Buying Bitcoin As A Company Doesn't Make You Bullet Proof

Hey Jessientreprenuers

Retail has long been the primary custodian of Bitcoin as the idea of the store of value took hold among early investors. Eventually, that idea reached the ears of those heading up corporations.

2020 and 2021 have been the year of corporations getting into Bitcoin, well rather in the public eye and by corporations, I mean non-crypto companies. The most high profile of those announcements has naturally been Tesla's purchase of $1.5 Billion in BTC.

The news really rallied the market, and Papa Musk sure does know how to get his adoring fans excited and his haters annoyed.

Elon is always making headlines, but one of the unknown quantities that have become a household name in the Bitcoin space has to be Micheal Saylor. The CEO of Microstrategy (MSTR) had become the official GigaChad of corporate Bitcoin Bitcoin holders when he converted his retained earnings of $500 million into BTC.

Since the reaction from the market and general public, it's only seen MSTR continue on its Bitcoin accumulation path. They then by issuing convertible debt and buying Bitcoin, and turning itself into a hybrid BTC ETF.

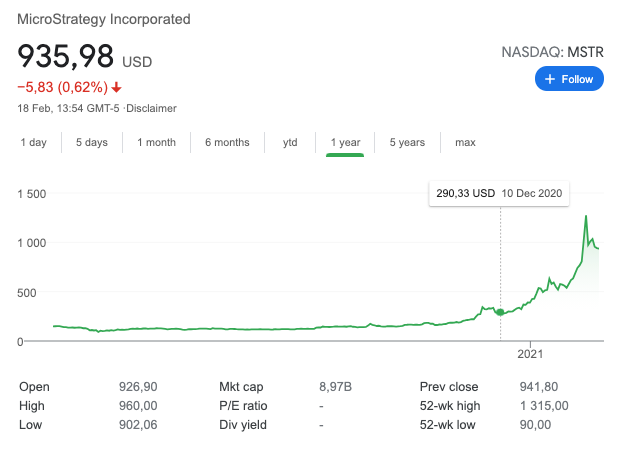

If we take a look at MSTR's share price since the Bitcoin news, you can see that it's pretty much 6x'd since its usual price range, and I don't need to tell you when they announced their BTC position.

Bitcoin is the new share buyback

In the last few years, we've seen company market cap valuations explode through the help of share buy backs. This is the process of companies taking their retained earnings or even debt they've financed for the year and using that to repurchase shares from the open market.

Naturally, that pushes up the company's value, attracts more investment, and the feedback loop continues. It allowed companies to do less to earn more. Instead of focusing on improving their product, instead of acquiring more customers, they could juice returns via these accounting tricks.

After a while, all accounting tricks tend to lose their shine, and we see diminishing returns or rather more capital needed to generate the same or better year on year returns.

Now that share buybacks have become commonplace; companies are looking at new ways to juice returns.

I am not saying MSTR is doing this exactly; I am saying if we look at what it's done to their share price, you can imagine other companies would want to emulate their playbook.

MSTR was in a position where they had retained earnings losing purchasing power, and turned it into BTC. Additionally, they've used that to attract new investors, but every decision comes at a cost.

Bitcoin doesn't mean companies are sound

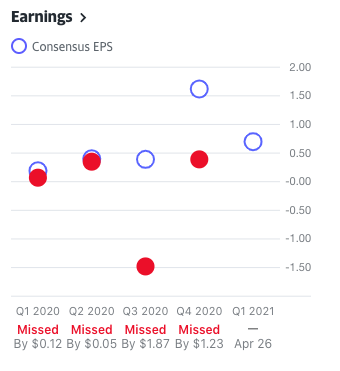

If we take a look at Yahoo Finance's data on MSTR we can see for the last 4 quarters; they've missed their projected earnings.

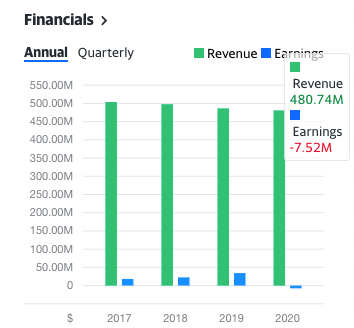

We can also see they posted a loss of $7.52 million in its last financial year, which isn't that concerning considering how well capitalised they are and that they were generating healthy returns in previous years, so they should have enough runway to weather several storms.

Why I bring this up is NOT to bash MSTR but to illustrate that putting BTC on your balance sheet doesn't translate to better business practices,

- improved earnings through productive means

- or that you have a competitive advantage,

- know how to deploy capital properly

- or you're not at risk of market tailwinds

All the dangers businesses face in general, are the same dangers you will face regardless of holding your retained earnings in Bitcoin.

To remain in business, you still need to go out there, improve the product, acquire customers, build cash flow and remain competitive in your niche.

Bitcoin balance sheets a potential bubble

I know this is an oversimplification because companies can finance themselves in various ways, but I'd like to play out this thought experiment.

As we cheer on the likes of Saylor and Musk, and the share prices continue to rise, more companies are going to try to replicate this strategy. Some of them will be zombie companies thinking they can use this model to buy themselves a few more months or years of runway.

If we have more zombie companies sitting with BTC on their balance sheet and they never become profitable, eventually, they'll need to liquidate their balance sheet.

Think of it like this if tomorrow I quit my job and decided to live on my BTC without ever working again, I'll blow through my BTC eventually.

While my selling each month to finance my life won't move the markets, think of companies that hold a lot of BTC that need to dump into the markets to cover expenses or generate runway.

Corporate accumulation could turn into corporate dumping

Dumping on this scale could drive massive market downturns, drive additional fear from weak hands in retail, and in bear markets, it could drive the price down as companies need cash to pay taxes, bills, loans, wages and other expenses.

While I am chuffed to see companies get into Bitcoin and realise the value it can provide, I do see the possible systemic risk if the tool is misused. Something corporations are pretty fond of doing when it comes to financial trickery.

Originally posted on The Bitcoin Manual

Have your say

What do you good people of HIVE think?

So have at it, my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem, and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta

That's a good point. The only thing that means is that the company actually has assets of value.

Could be a good thing. Could be a bad thing I guess...

But, I'm willing to bet there will be those who would buy it up, retail or otherwise, when it does happen.

Sure there will be buyers but we have yet to see a corporate liquidation of BTC yet, MT Gox would be the closest thing to it and at this scale and price levels who knows, could be nuts! Would be a great buying opportunity for retail for sure

What can I say, bitcoin is huge and all that money at s standpoint will make a firm looks valuable regardless of their playbook and lazy output. I guess it's just about looking good on on paper for orgs like MSTR

Posted Using LeoFinance Beta

I guess we won't know until we see how these companies run over the next few years! I don't think Michael was aiming to juice his books I think he really just wanted to secure his retained earnings and then realized the buying opportunities are still there and went for it

He could however become the Lewis Reneri who came up with the idea of the mortgage backed security which is a good idea and then the market took the idea and turned it into a time bomb that crashed the world economy

Well all I know is that eventually this will be proven by how far they aim to improve their servicing and product and also incur new ways to attract customers and deliver at a high level or consistency in the long run.

Posted Using LeoFinance Beta

Companies that buy significant amounts of bitcoin will make their stock price more volatile. The wild swings in the price of bitcoin will result in wild profits and losses on the quarterly report ... which will make evaluating the company harder for value investors.

As for stock buy backs. While this vehicle can be abused, I think that buy backs are a good way to distribute earnings. I think that companies should have a buy back policy in place to assure liquidity of the stock in the case of a market disruption.

I’m not against buy backs I just don’t think incentives line up all that well and boards are just milking companies cash flow for increased compensation and not reinvesting to remain competitive

Also what’s wrong with paying a dividend? I guess governments have made it less viable and this is the “logical” move to extract the most money for the least amount of work but eventually run way runs out

Bitcoin may help extend a company a second lifeline but if you’re a shit business that’s run shit you eventually only delaying the inevitable and wasting capital to do that

Posted Using LeoFinance Beta

I'm sure if they have to dump their corn, there will be plenty of buyers waiting in the wings! Even if MSTR has to liquidise, the chances that all other institutions will have to do the same thing at the same time and totally wipe out the market is slim I'd say. I guess we'll see what happens when the bubble pops towards the end of the year!

Yeah sure retail and companies will pick up the new coins but we’ve seen how prices fall when retail gets nervous imagine what it’s like if someone holding thousands gets nervous!

Driving the price down isn’t just that anymore, people have now got loans against it which means if the price falls below capital requirements they need to post more collateral or lose the loan

We now have futures and ETFs and all sorts of shit that if it goes out of wack makes the swings even more nuts

Not that I mind I’d pick BTC up all the same, I just want to state that corporations buying Bitcoin doesn’t exactly reduce risk or price volatility

Posted Using LeoFinance Beta

That's true although I'd say there's more strong hands this time round vs in 2017 bubble. Anything can happen though and we did see an institution state they were "in it for the long run" before selling at the first correction 2 weeks later lol!

I'll give it another market cycle before things become "less volatile" and getting loans isn't so much of a "risky" play. Getting a loan in a bull run during this bubble year like no other is some ballsy stuff!

Posted Using LeoFinance Beta

Another good article with really good insights

We need to be careful this time as we don’t want another bubble being burst and another financial crisis. That would be too bad this time.

Posted Using LeoFinance Beta

Lol I think we as humans love bubbles we will turn anything into a bubble! There is no perfect money when it's billions of imperfect people using it, that's why we must have boom and bust cycles to clear things out, that's how nature has always worked

Yo this is the write-up I've been waiting to show folk who aren't keen on Bitcoin! They're like :O companies investing in Bitcoin, companies getting more valuable! And it's like... yeah, on paper, maybe.

I guess that's the name of the game in a fiat money system get shit rich on paper that's all that matters!

The product, the market, the debt, the service, the quality that's irrelevant as long as you can make the share price go up

The longer we go on like this the fewer goods and services we produce, the higher inflation and we eat our tail until collapse

Corporations borrow money to buy bitcoin. Bitcoin price goes up and corporations have even more assets to secure loans with so they can buy even more bitcoin.

Sooner or later, the game will be up. But I think it is still early days yet with central banks not wanting to raise rates any time soon.

Lol sounds like another merry go round and ignore the underlying fundamentals for a little longer! Sad thing is a lot of zombie companies are going to jump on this trend.

I guess it doesn’t really matter because eventually they go bust! I just don’t like this blind cheering of buying Bitcoin by any company like it’s all great, some of it is shit

Yeah, if a company's only plan is to buy BTC, that's a major red flag right there.

Judging by the way the IPO/SPAC market is going and the fact that there's really a shrinking customer base for a lot of companies this tactic could prove popular

Also we have to take into account that they don't have actual profits yet till they sell their coins!

Posted Using LeoFinance Beta

That's if they want profits, how many companies are completely unprofitable and still continue to run? Profit is a tax liability so it's all about debt funding and rolling it over

Many of these big companies would implode should the interest on their debt actually normalise and are functionally insolvent even adding BTC on your balance sheet doesn’t erase your debt

Selling would be a last resort they will try to borrow against their balance sheet or Refinance as the price goes up.

In some cases it would even be wise for the company to lend out their BTC and generate an income that way

If we do get a correction I’m sure there will be companies that have to sell at losses to stay afloat.

ohh i haven't thought about it that way.

Imagine how much more they could earn by simply doing that

Posted Using LeoFinance Beta

Well if Tesla did it today they would earn more on their BTC lending then they would selling cars for the year lol but Elon doesn’t care about money he just wants to make cool stuff

!ENGAGE 20

ENGAGEtokens.I Wonder what happen when that big company with huge bitcoin bag decided to dump the market. I believe weak hand (like old me) or newbie who invest in the get quick rich investment will sell of their holding when they see huge price fall.

Posted Using LeoFinance Beta

Oh it's coming no doubt about it it's like most forgot about previous cycles and it's all about this current trend of it going up, eventually it reverts!

At what price range I don't know even if it's a super cycle it still reverts when buyers run out

There's only so many people who are going to get in this cycle