How would you invest $10,000? for the long term

Hello and welcome to this SPinvest post

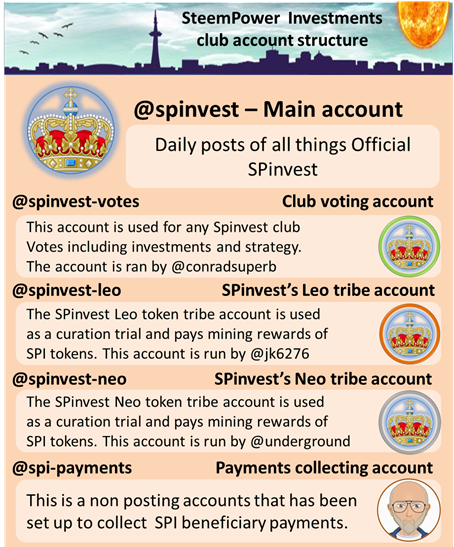

SPinvest is a tokenized investment fund/club for all users of social blockchains. Everyone is welcome! The concept of SPinvest is to get rich slowly by using time tested methods of earning, saving and compounding long term. This lets SPinvest offer an ROI of 20% per year on SPI tokens. We encourage long term investing on and off the blockchain. We hope someday everyone will HODL some SPI tokens that can be bought directly from @spinvest are through the steem-engine are dex.steemleo exchanges.

.

Let's spent some money

Ok, lets spend some money? Spinvest will have around $9500 in Tether (USDT) this time next week to put into other investments. I know how i would invest it for the club but i already know what i no but not what you know, so please share what you no and how you would invest $9.5k in the comment below, ya know?

I wanna see how others would invest the same money long term, are for passive income, are asset growth through compounding. Don't give half-assed answers like buying some ETH, gold, stocks and hold some stable token. Break it all down in more detail like $3000 ETH, $3000 gold, $1500 into stocks and keep $2000 in Tether. Think about what your suggestions as well. Think about.............

- Investments

Are they time tested?, how many complete market cycles have they been through?, is the investment liquid are not?, are they regulated and backed by government guarantee's, will they still be trading in 10 years? what risks are attached?

more than 99% of cryptos, master nodes, staking plans, whatever you wanna call it will not make our conditions. In general, the bigger the rewards, the more you lose. A lot of master nodes and staking pools are straight-up pyramid schemes weather set up purposely are not. Sorry for going on about this, i need to show a visual as a lot of people still think these are good investments. We are aiming for investments that can show growth over years, not boom and bust. Let's look at smart cash as an example.

The above is a business model - Offer staking rewards, everyone buys to HODL, FOMO kicks in, the price moons and the founders sell-off there all the tokens they got for basically free and get rich

Not saying this is what smartcash did but a pattern can be seen if you track masternodes for a few months. Very profitable for the first people to invest but you gotta get your money out just as fast and dump into people buying the FOMO. It's not an ethical way to make money.

With long term and low risk in mind

How would invest $9500?

.

SPinvest's content is contributed by @silverstackeruk, @underground, @no-advice, @metzli, @taskmaster4450 and

Today's post comes to you from @silverstackruk

I don't know at all and that's why I rely on the club.

I'll see you right :)

:-)

The last $10,000 I invested was a cash out from Bitcoin when it was $20,000 - I cashed out 2 and the reinvested $10 back into it when it went down to 7,

I initially purchased $2000 of Bitcoin when it was $400 a coin ,

So far I have been happy with this investment

#engageonhive

Thats the way to do it. Spinvest currently hold 1 BTC, we have it staking on celcuis learning 3-4% but our plan will be to sell when the next bull market pops in 18 months are so and then sit on the money for 2 years to rebuy back in for 30% of the next ATH.

Good strategy my friend :)

Maybe $3000 with Crypto.com and stake CRO, $3000 into bitcoin that will start to push higher, $3000 to $4000 in stablecoin like DAI and stake it for the interest.

I looked in crypto.com last week as it's been climbing marketcap ranks.

SPinvest has 1 BTC already which is enough for now.

What sort of ROI does DAI pay out? i would also assume its a daily payout?

Thanks for commenting man

The interest rate fluctuates, you can monitor the interest for the stablecoins on the following DeFi website.

https://loanscan.io/

Thanks for the link, checked it out. That's a good all in 1 comparison page.

We're currently using Nexo and getting a static 8% so we're ok

...never enough BTC

🐗

I just moved my personal coinbase hodling/trading account over there, last evening. The only thing I have found that I do not like (minor inconvenience) is that the application is not a full featured exchange. This is due to not being fully US Compliant, I am told.

I loves me some Crypto.com! 😍😍😍

With $10,000, I would spend it mostly off crypto.

I would get new windows in my condo, slap on a nice paint job, and do some minor upgrades - then refinance it to get rid of my PMI (private mortgage insurance).

This would cost around $8000, make my home more comfortable, raise its value and drip my mortgage by about $345 per month.

The other 2,000 I would invest in HIVES putting some aside for the new token SPINVEST is working on.

It it was club money, I would buy another bitcoin.

Ok, so you need $8k to save you $345 per month

You can have $8000 if you pay back $180 per month for 5 years :) :)

I'll need to visit first to do a quick appraisal, next Friday morning suit you? I think i know your condo, your still living beside your neighbour and there's a white car in your street? Yea, i know where i are.

Baaa-hahahaha

No plans to buy HIVE, im hoping selling off the last 2500 SPI will bring in 5000-7000 and I've been selling off LEO as well converting it into HIVE. I think everyone that owns tokens would like to see SPinvest hold 100K HIVE. We have our full BTC now so time i guess HIVE is the next mid term target.

My newest obsession is Tezos. XTZ. But to get the top "interest" you need to set up basically a "witness" and run it on a console. Tezos is overtaking EOS and has considerable interest from institutional investors. A more traditional approach, suitable for the Clubbers, would be the new and forthcoming ETH 2.0 but it is currently delayed. Was supposed to hit this month but is put off indefinitely. We'll see.