GREED is back, why should you care?

Hello HODLer,

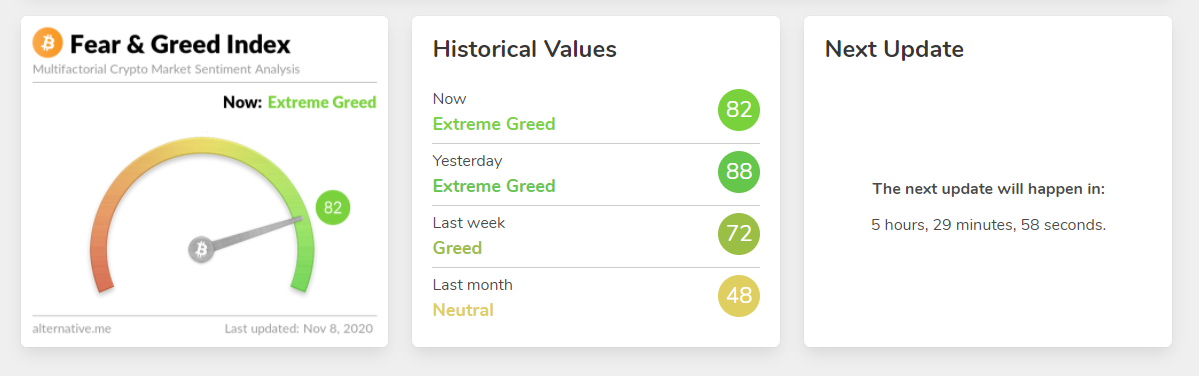

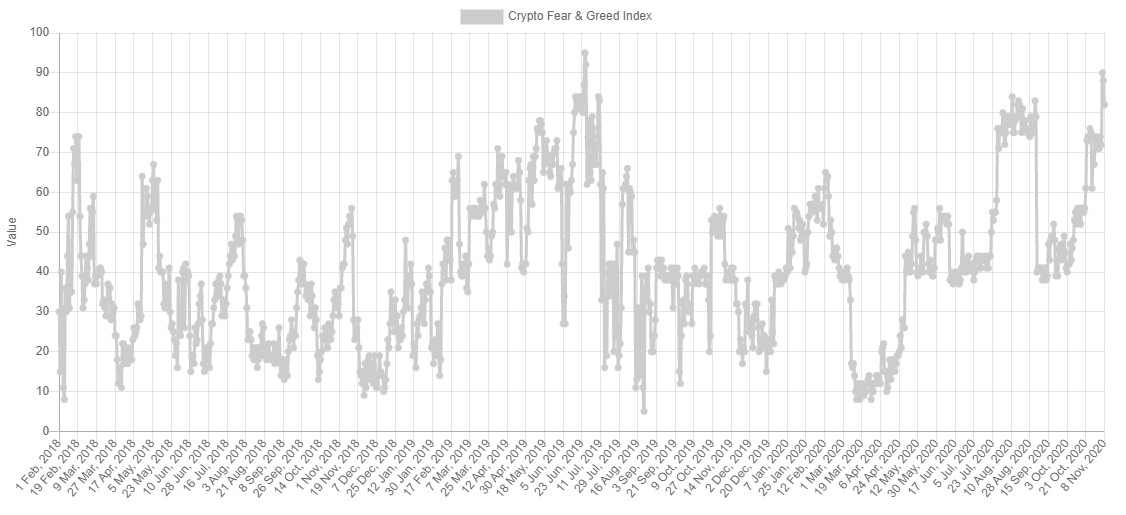

Just a quick message to express my thoughts about the current state of the market. The Fear & Greed indicator is one of the simplest but most useful to understant in which market's phase we are in.

It clearly feels we are in a Bull Market Phase, with elections stress going away and more and more bullish news (for Bitcoin mostly).

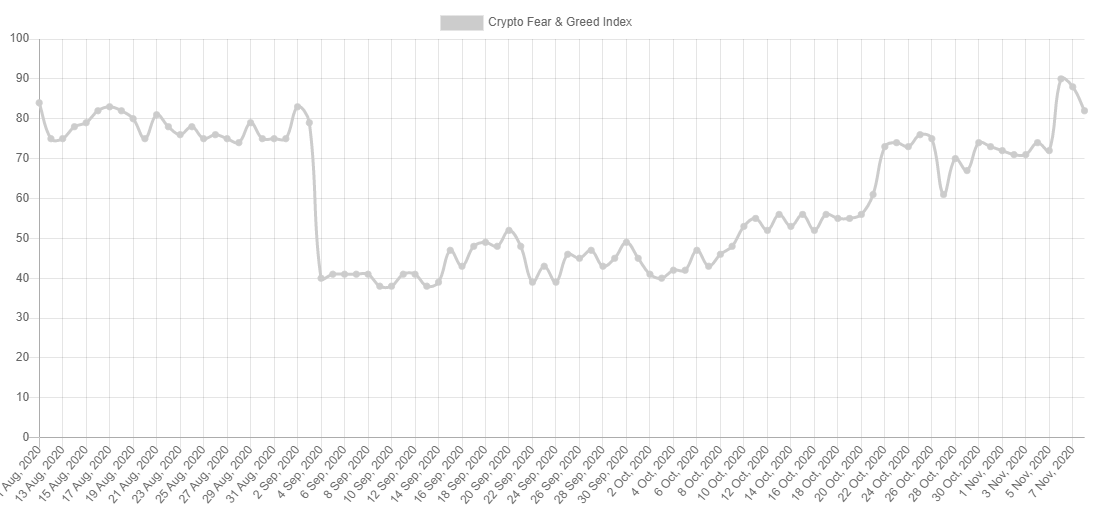

We touch a 90 score yesterday and are still very high compared to the past few months as you can see below.

I expect a small consildation before going up again.

I would also like to differentiate Bitcoin and Alts, Bitcoin going up is a no brainer for me. This is less the case for Alts are many of them do not have a clear narrative or value proposition (even if they can indeed moon).

We have an economic crisis, political crisis incoming in the US and a Health worldwide crisis so I expect the money printer to continue to print but risk-on assets to underperform and I put alts in this bucket.

To conclude, I am keeping my BTC Long but I am more neutrals on Alts at the moment.

I am looking still at some tasty ones !

Cheers, and be careful

➡️ Be paid daily to browse with Brave Internet Browser

➡️ A secure and easy wallet to use: Atomic Wallet

➡️ Invest and Trade on Binance and get a % of fees back

➡️ Youtube

➡️ Twitter

➡️ Hive

➡️ Publish0x

➡️ UpTrennd

➡️ Read.cash

➡️ LBRY

➡️ Check out my video on Unstoppable Domains and get 10$ off a 40$ domain purchase

➡️ Get 50$ free by ordering a free Visa Card on Crypto.com using this link or using this code qs4ha45pvh

Helps us by delegating to @hodlcommunity

Make a good APR Curation by following our HIVE trail here

Posted Using LeoFinance Beta

https://twitter.com/VinnieLemon/status/1325510809825501186

@vlemon, Game changing Creators wait for the Crisis to build new Economy from scratch. Stay blessed.

"Be greedy when everyone is fearful; be fearful when everyone is greedy" 😅 Well, even though Warren Buffet is a pioneer for investors, this time I do not think it is best time to be fearful. Governments are non-stop printing money and the amount of money flowing through crypto market is increasing excessively. However, it is absolutely right time to be more cautious about the price actions of altcoins as sharp moves may result in irretrievable loses...

Posted Using LeoFinance Beta

Indeed ! But I do not see Crypto people fearful right now (as we shouldn’t be hehe 😉). Maybe I will FOMO later 😂😂😂

It is an amazing time for daily trading and scalping, volatility is high as well.

I can only imagine but I do not do that hehe

Posted Using LeoFinance Beta

I know you only HODL ;-)

What tasty alts are on your scoop?

Posted Using LeoFinance Beta

ETH mainly. RUNE, AVA, AAVE as all the shillers there hehe !

I have AVA as well and I see RUNE so shilled these days. Maybe I'll buy some.

Posted Using LeoFinance Beta

It only took 3 years...but better late than never.

Full greed ahead!

Posted Using LeoFinance Beta

Yiiiiiiiiiiha !

Posted Using LeoFinance Beta

It would be amazing for Bitcoin to hit US$20K again like 2017. It looks a lot like the golden age of Bitcoin is back again.

Patience my dear ! Patience :D But we are getting there !

What is the data behind that particular index?

Posted Using LeoFinance Beta

Hello there, sorry for the late reply. Below is the full description of their scoring methodology.

https://alternative.me/crypto/fear-and-greed-index/

Data Sources

We are gathering data from the five following sources. Each data point is valued the same as the day before in order to visualize a meaningful progress in sentiment change of the crypto market.

First of all, the current index is for bitcoin only (we offer separate indices for large alt coins soon), because a big part of it is the volatility of the coin price.

But let’s list all the different factors we’re including in the current index:

Volatility (25 %)

We’re measuring the current volatility and max. drawdowns of bitcoin and compare it with the corresponding average values of the last 30 days and 90 days. We argue that an unusual rise in volatility is a sign of a fearful market.

Market Momentum/Volume (25%)

Also, we’re measuring the current volume and market momentum (again in comparison with the last 30/90 day average values) and put those two values together. Generally, when we see high buying volumes in a positive market on a daily basis, we conclude that the market acts overly greedy / too bullish.

Social Media (15%)

While our reddit sentiment analysis is still not in the live index (we’re still experimenting some market-related key words in the text processing algorithm), our twitter analysis is running. There, we gather and count posts on various hashtags for each coin (publicly, we show only those for Bitcoin) and check how fast and how many interactions they receive in certain time frames). A unusual high interaction rate results in a grown public interest in the coin and in our eyes, corresponds to a greedy market behaviour.

Surveys (15%) currently paused

Together with strawpoll.com (disclaimer: we own this site, too), quite a large public polling platform, we’re conducting weekly crypto polls and ask people how they see the market. Usually, we’re seeing 2,000 - 3,000 votes on each poll, so we do get a picture of the sentiment of a group of crypto investors. We don’t give those results too much attention, but it was quite useful in the beginning of our studies. You can see some recent results here.

Dominance (10%)

The dominance of a coin resembles the market cap share of the whole crypto market. Especially for Bitcoin, we think that a rise in Bitcoin dominance is caused by a fear of (and thus a reduction of) too speculative alt-coin investments, since Bitcoin is becoming more and more the safe haven of crypto. On the other side, when Bitcoin dominance shrinks, people are getting more greedy by investing in more risky alt-coins, dreaming of their chance in next big bull run. Anyhow, analyzing the dominance for a coin other than Bitcoin, you could argue the other way round, since more interest in an alt-coin may conclude a bullish/greedy behaviour for that specific coin.

Trends (10%)

We pull Google Trends data for various Bitcoin related search queries and crunch those numbers, especially the change of search volumes as well as recommended other currently popular searches. For example, if you check Google Trends for "Bitcoin", you can’t get much information from the search volume. But currently, you can see that there is currently a +1,550% rise of the query „bitcoin price manipulation“ in the box of related search queries (as of 05/29/2018). This is clearly a sign of fear in the market, and we use that for our index.

I am not sure I like this bull.

Will People join Bitcoin because the Product or the price...

Sure it is a way to get more intresting But that is (in My country) Only nerds and financial People. Common People (that btc is Most positive for) dont care

At the moment, normies have not been attracted by the price of Bitcoin yet. SO we have professional and qualified invetors / users only.

Posted Using LeoFinance Beta

So basically, take tiny profits from alts when they come. Maybe do a 50:50 split between shorting and longing?

Posted Using LeoFinance Beta

That is what I would do, shorting is very hard so you should not do it if you are not an experienced trader. But you could take profits, buy BTC and wait for the Alts you sold to buy them lower.

Who knows :D

Posted Using LeoFinance Beta