🗞 Daily Crypto News, May, 15th💰

Welcome to the Daily Crypto News: A complete News Review, Coin Calendar and Analysis. Enjoy!

🗞 Market Wrap: It’s ‘Doge Day Afternoon’ as Memecoin Jumps 47%; Ether and Bitcoin Rise

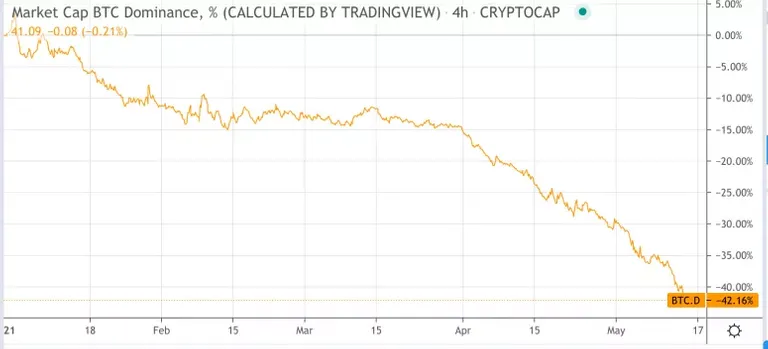

Dogecoin soared on Friday but the cryptocurrency’s circulation ownership raises questions. Ether pops as its futures market hits a record. Bitcoin faces pressures from its options market and a downward trending dominance percentage.

- Dogecoin’s 24-hour range: $0.39-$0.58 (CoinDesk 20)

- Bitcoin’s 24-hour range: $49,009-$51,502 (CoinDesk 20)

- Ether’s 24-hour range: $3,641-$4,165 (CoinDesk 20)

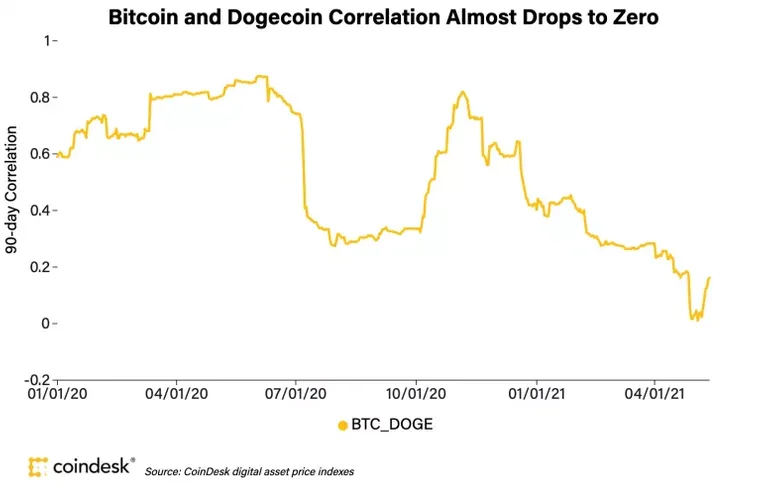

Dogecoin correlation to BTC near zero as asset pumps

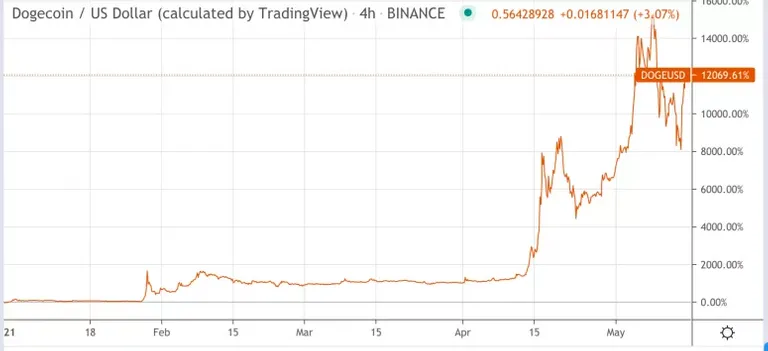

Meme-friendly cryptocurrency dogecoin bounced back in a big way Friday, up 47% as of press time. The expectation that Coinbase would list and begin trading the asset in the near future was likely one culprit for the FOMO. So far in 2021, dogecoin is up over 12,000% on Binance, according to data provided by charting software provider TradingView.

Interesting to note from Kugelberg is the sheer concentration of wealth in the dogecoin ecosystem. According to blockchain data from Bitinfocharts, one person owns 28.8% of all doge in circulation, and just 102 wallet holders own another 38.5%. So 67% of all dogecoin is effectively controlled via 103 wallets.

Ether futures explosion

Bitcoin options market, dominance in the dumps

*“It’s market and trader segments that have settled into three different types of crypto investors,” Lau told CoinDesk. “There is the longer-term store of value, which is BTC. Then there is the ecosystem, application-driven, which is ETH. Then you have the meme and momentum-driven, which is DOGE.”

🗞 A 'War on Rugs' Has Been Declared Against Ethereum Creator Over SHIB Transfer

- Ethereum co-founder Vitalik Buterin incensed Shiba Inu token holders by getting rid of his holdings.

- The market for SHIB collapsed.

- Now, one group wants to collapse the market for ETH.

The Telegram group War on Rugs hates rug pulls. So, naturally, it's...trying to pull the rug out on Ethereum.

The watchdog group, which says it's composed of developers and auditors, has created the Rug Ethereum (RETH) token in retaliation for Ethereum co-founder Vitalik Buterin's decision to transfer millions in Shiba Inu (SHIB) to charity while simultaneously crashing the market for the token.

Binance CEO Changpeng Zhao, who agreed to list the token on Binance's "Innovation Zone," has called SHIB "super high risk." And War on Rugs, which looked at the smart contract, noted earlier this year that Buterin had a very large stake in the token, which meant it could be vulnerable.

Theoretically. On Wednesday, Buterin did just that, removing the tokens from a liquidity pool in Uniswap and contributing to a crash in token price. As recently as Tuesday, the price of SHIB was $0.00003394. By Thursday, it had fallen by more than half, to $0.00001563.

🗞 Ransomware Attacks Top $81 Million in Stolen Crypto This Year: Chainalysis

- At least $81 million in cryptocurrency has been stolen through ransomware attacks this year, per Chainalysis.

- Chainalysis tends to underestimate in their crime reports—the real number, for the first months of 2021, is likely higher.

Ransomware attacks were responsible for at least $81 million in stolen crypto this year, according to the blockchain data company Chainalysis.

That number is likely to rise, since Chainalysis tends to discover new criminal activity retroactively (the company previously said ransomware attackers stole at least $350 million in 2020—now it says that number is over $406 million).

🗞 Spanish Regulator Green-lights Institutional Crypto Investment

Spain’s market regulator has announced that it will allow firms operating funds to make crypto investments – but only under certain conditions.

Per El Economista, the National Securities Market Commission (known locally as the CNMV) has published a new set of guidelines for institutional investors. The guidelines show that the CNMV is now happy to allow investment fund operators, collective investment institutions (known as IICs in Spain) and variable-capital collective investment programs investment companies (known in continental Europe as sicavs) to invest in cryptoassets. However, the regulator specified a number of provisos.

Firstly, funds will only be allowed to offer crypto products in cases where “market prices are determined from purchase and sales operations carried out by third parties.”

Furthermore, fund managers will be obliged to warn their clients that cryptoassets constitute a “high-risk investment” that “involve a highly speculative element.”

And finally, institutional investors and fund operators will be prevented from making investments in certain types of crypto derivatives and securities underpinned by cryptoassets, including crypto-powered exchange-traded commodities (ETCs) or exchange-traded notes (ETNs) – which could be used to track an underlying index of tokens.

🗞 Daily Crypto Calendar, May, 15th💰

- Student Coin (STC)

"STC Will Be Listed on ProBit Exchange for Trading on May 15. Trading Pairs: STC/USDT."

- Minter (BIP)

"Minter will burn around 300 million BIP (or $6,300,000 at current prices) to strengthen the network's economy."

- SmartKey (SKEY)

"Testnet is the step forward to create dedicated #SmartKey blockchain connecting Blockchain of Things technology with 2nd Generation Oracle"

- Bitcoin Cash (BCH)

"The next Bitcoin Cash May 15th upgrade will bring many improvements to users and merchants."

- Venus (XVS), Venus XVS (VXVS)

"The Venus $VRT Airdrop as part of the v2 upgrade will be on May 15th."

- 🗞 Daily Crypto News, May, 14th💰

- 🗞 Daily Crypto News, May, 13th💰

- 🗞 Daily Crypto News, May, 12th💰

- 🗞 Daily Crypto News, May, 11th💰

- 🗞 Daily Crypto News, May, 10th💰

- 🗞 Daily Crypto News, May, 9th💰

- 🗞 Daily Crypto News, May, 8th💰

- 🗞 Daily Crypto News, May, 6th💰

- 🗞 Daily Crypto News, May, 5th💰

- 🗞 Daily Crypto News, May, 4th💰

- 🗞 Daily Crypto News, May, 3rd💰

- 🗞 Daily Crypto News, May, 2nd💰

➡️ Leofinance

➡️ Youtube

➡️ LBRY

➡️ Twitter

➡️ Publish0x

➡️ Den.Social

➡️ Torum

➡️Minds

➡️ Spotify

➡️ Be paid daily to browse with Brave Internet Browser

➡️ Invest and Trade on Binance and get a % of fees back

Posted Using LeoFinance Beta