High Value NFT Collectibles Collateralized by ETH Are Here With Decentralized Curation | Unique Directory Introduction

Unique Directory has to be the best NFT markets I have seen so far. The idea is like a oasis in the Tulip Bubble-esque madness that is going on in the NFT space that is going to make a lot of people rich and lot of people burned. I found out about Unique Directory thanks @kazirma and there is a real effort made to create something long term and sustainable rather than a random trend that is going to be a quick cash(crypto) grab.

A Quick Introduction from Co-Founder

The first thing I thought of after coming across the project was Dark Energy Crystals (which I have extensively written about in the past). @splinterlands have had NFTs without even having to utilize smart contracts and it is growing up to be an amazing NFT ecosystem. These NFTs have real value through real utility of being usable in a well designed game.

That doesn't mean the prices will hold up well. I remember some of the cards like Vampire and Rusty Android prices went below 1 cent per BCX. When Dark Energy Crystals were introduced and made it possible to burn these cards for specific amounts of DEC based on rarity, some of the lowest value cards went up by over 50% immediately.

A Very Early Stage Project

The project is set to be released in five phases.

- Proof of Concept

- Testnet

- Limited Mainnet

- Community Governance

- Public Launch

Currently it is still in the Testnet phase. The good news is that you are hearing about this very early and has the chance to join right from Day 1 when the Mainnet goes live.

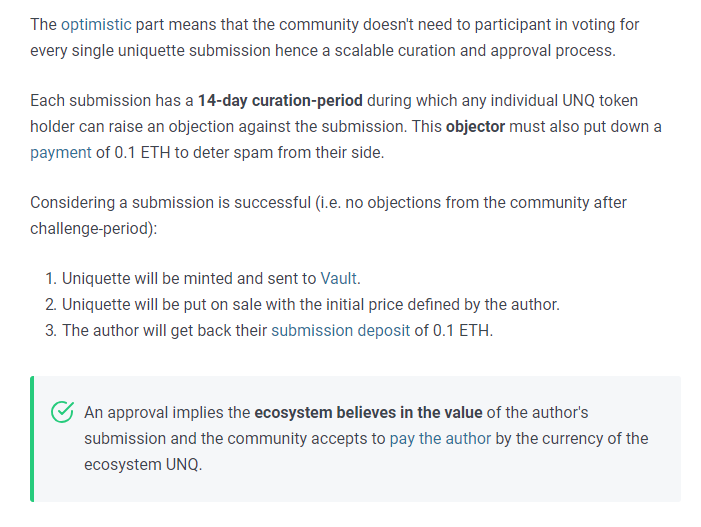

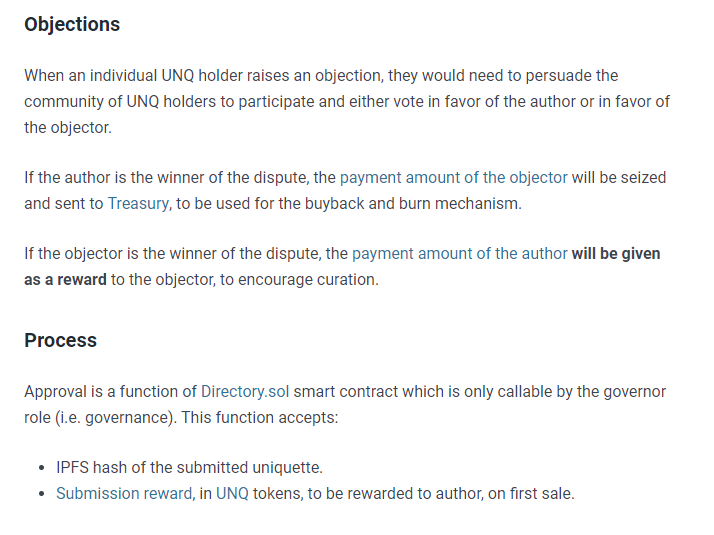

Decentralized Curation

Anti-Speculation Measures

You can only increase take a quick profit of 10% without increasing the "collateral". The idea is that the initial amount of ETH that is used to purchase the NFT gets locked. (There is a 5% protocol fee).

If you want to see for massive gains, you have to lock up a significant amount of ETH as additional collateral. Let's see an example:

- You spend 5.25 ETH for an NFT

- 5 ETH goes to vault and 0.25 ETH is protocol fee

- You can immediately sell for 5.5 ETH or less

- If you add 3 ETH collateral, you can sell for 8.8 ETH

- If you add 4 ETH collateral, you can sell for 9.9 ETH

- If you add 5 ETH collateral, you can sell for 11 ETH

- If B buys for 11 ETH, B can sell for 12.1 ETH

- If C buys for 12.1 ETH, C can sell for 13.31 ETH

- If C wants immediate liquidity, C can get 5 ETH from the vault

At least that is what I can understand from the documentation. Full documentation can be accessed at https://docs.unique.directory

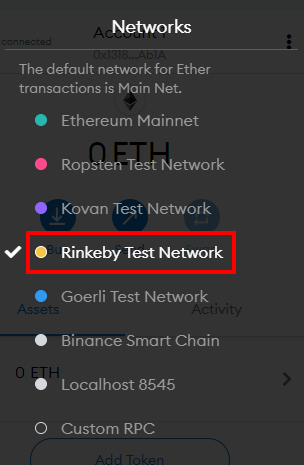

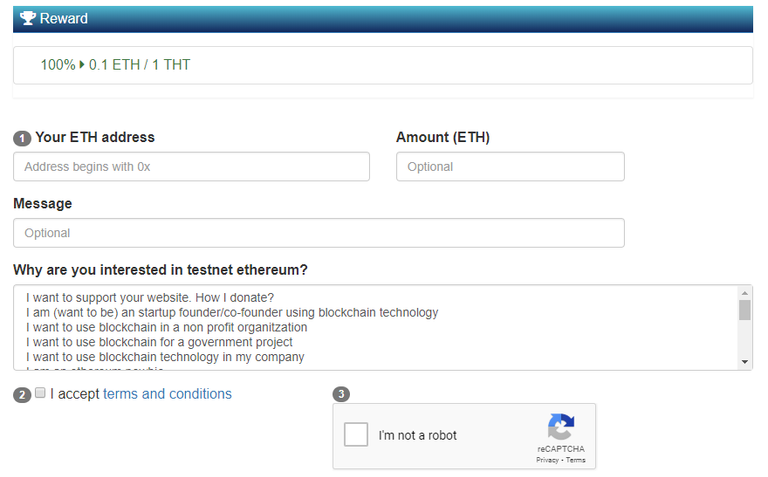

Try The DAPP on Rinkeby Test Network

Go to https://app.unique.directory and you will be able to witness real art and how the DAPP would work when it is launched. There is nothing to worry about the fancy Testnet names. You should have MetaMask by now.Click on the drop down menu and you are ready to go.

You can try https://testnet.help/en/ethfaucet/rinkeby for a faucet. You can claim up to 0.1 ETH every 24 hours.

Happy Investing!

Posted Using LeoFinance Beta