Semiconductors Rise As Intel (INTC) Likely To Sell Out Of NAND

News of potentially even more consolidation within the memory space has sent semiconductor stocks on the rise today. Most notably, Western Digital (WDC) saw a meaningful boost as the company's struggles in NAND flash may improve in a tighter supply market.

https://www.investors.com/news/technology/intel-stock-rises-memory-chip-unit-sale-report/?src=A00220

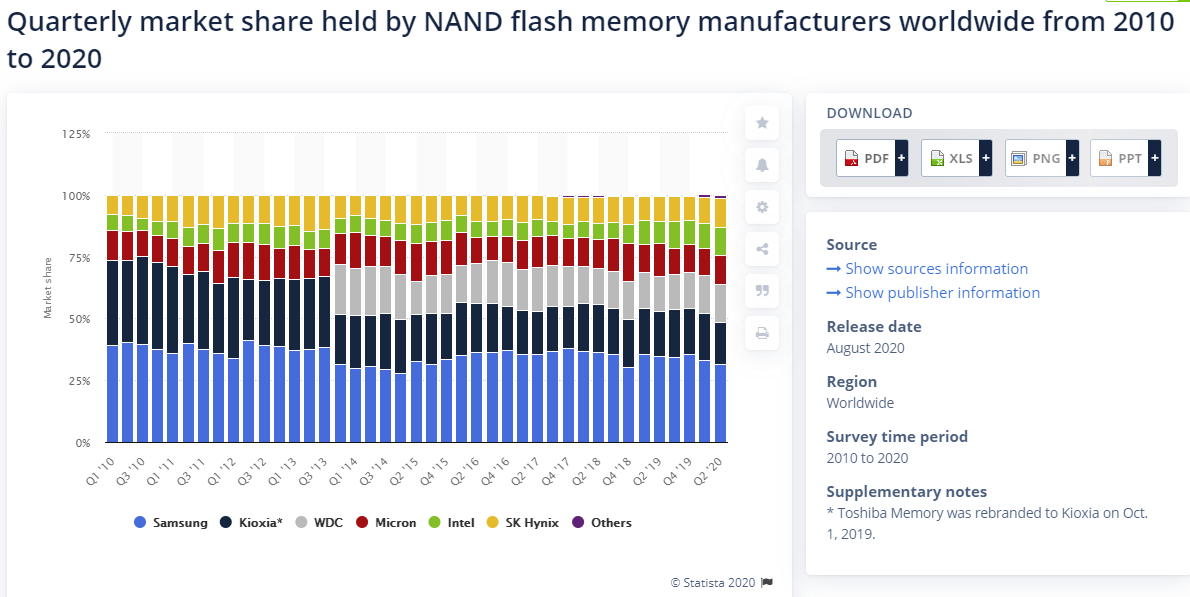

There are 6 major manufacturers in NAND, so bidding farewell to Intel moves the industry one step closer to yet another oligarchy in the making. Recall that several of the key players here are also dominant players in the adjacent DRAM industry, which serves as a fundamental backbone when it comes to processing speed.

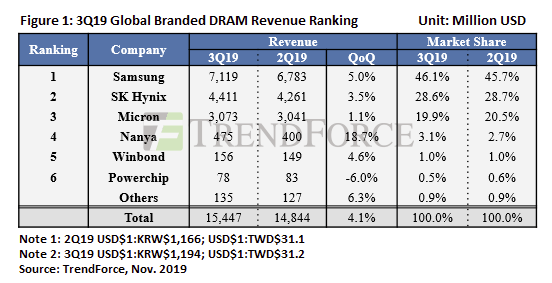

In particular, Samsung, Micron (MU), & SK Hynix make up the lion's share of that market in what has essentially become a defacto oligarchy.

Personally, I believe this bodes well the best for Samsung (SMSN.il) and SK HYNIX as the industry continues to migrate into a sector essentially dominated by Korea. Nevertheless Micron remains the most versatile American winner in this potential event. Western Digital might have gotten a meaningful jolt, but the company's financials are far less pristine compared to that of Micron's.

Posted Using LeoFinance Beta