US Banks shut down Credit lines

This is the END

Yo, something weird happens in the last weeks. Some banks like Fargo shutting down all personal lines of credit.

It is weird because this includes Home equity lines too.

I hear some rumor other will follow. This will decrease the liquidity in the market + it devalues homes and assets.

It could have 2 reasons for killing credit lines. The first is to sell more expensive loans the other is to reduce risk.

I think it will be the reduce risk part. the paradox is, if inflation is high, banks should want to give out loans on mass to don't lose on inflation. Sure it would be smarter to buy assets with it, but it is not allowed for average banks by law :)

Reduce risk means, banks don't trust the client to pay back the loan. With covid and supply chain issues + high longterm inflation possibility, it looks like the first signs of a market crash.

Also the Commercial Mortgage-Backed Securities horse "problem" doesn't have left the bar.

More about this here:

Commercial Mortgage-Backed Securities 2008 is repeating

Fud or a real problem?

To be honest, I wish it will be FUD. Because I expect if the first bubble bust, we see a chain reaction over all asset classes.

Housing, stocks, bonds, and everything the government can take from you.

Special if an inflation mill starts to rotate. I don't expect hyper Inflation. But I expect it will be enough to slow down everything and bring the economy to stagnate worldwide.

Some countries in South America and Africa already have inflation on food up to 200%. Sucks right?

No financial advice, but I think it will be good for crypto and good for hive.

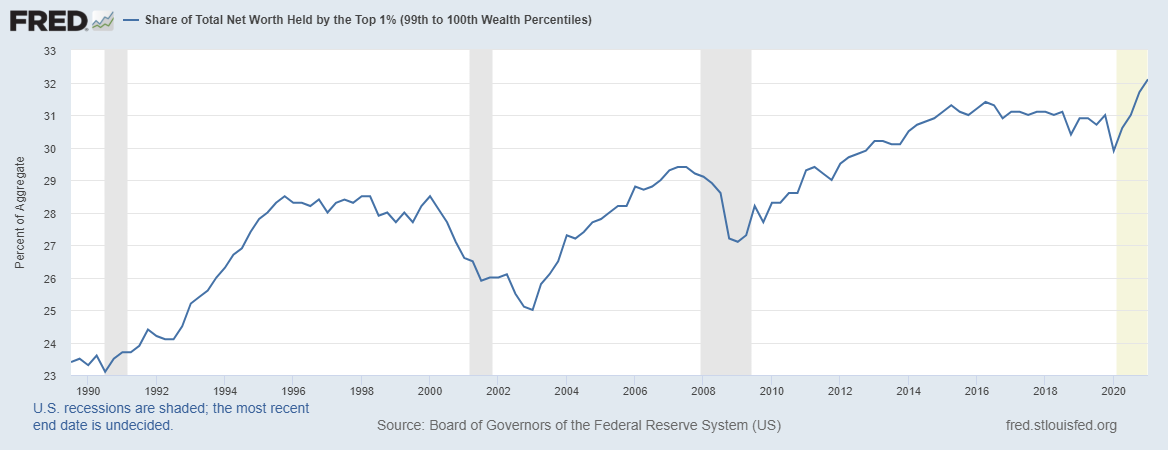

And we see a new ATH on "Total Net Worth Held by the Top 1%"

1% that holds 32% of all wealth is really high. Special if we think about the problem " normal people" will be not to be able to take a loan...

Sidenote:

Hive should promote besides the social thing, keychain mobile as a payment app.

Simple because send and receive money is a really strong use case :)

Posted Using LeoFinance Beta

https://twitter.com/PowerGames8/status/1414718616042409987

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Right before the financial crisis of 2008 we had banks reduce all their credit lines.

Posted Using LeoFinance Beta

I have the feeling too we will become a new 2008 :)

Actually I was looking into it but one of the people I followed (a big bond bull) said that Wells Fargo is in the black box and doesn't need a bunch of mortgaged back securities. If the Fed puts them back in order, he said they would probably be accepting credit lines again.

Posted Using LeoFinance Beta

the commercial mortgaged back securities market is pretty fucked since covid. So i would not wonder if we see a crash in the next 12 months :)

Posted Using LeoFinance Beta