The Reversal Is Coming

Remember when Lumber was the poster child for the inflationists argument for massive inflation. We were warned that hyper-inflation is coming.

It seems that the likes of Peter Schiff and Jim Rickards were wrong once again.

While the commodity did have a massive run up, it has collapsed the past 45 days. It is amazing how much can change in a couple of months. Keep this in mind when looking at the situation going forward.

The price of Lumber peaked at just shy $1,700 and now is under $500. That is more than a 70% drop.

Obviously, one commodity does not tell the entire story. However, when it is put up as the epitome of inflation, when it reverse, isn't that deflationary?

To further the situation with Lumber, we are seeing the prices moving back into range they were before. Looking at a long chart, we see that the price is now below the high in 2018, which was the previous all-time high before this recent run.

Oil As A Barometer

Another commodity that went on a run and is creating a great deal of chaos is oil. We are seeing a heated situation within OPEC as whether to pump more oil or not. Either way, the global prices are on the upswing.

The challenge with this commodity is that oil affects everything. We see it add to transportation costs of food and other products. It goes into our plastics as well as an assortment of fuels.

When we see large runups in oil, there is a threat to the global economy. In this situation, we are looking at weakness to start with. Having high oil prices for a sustained period will only further the economic weakness.

Nevertheless, the run does not appear without resistance.

This week we saw a pullback in oil prices. What is notable about this is the fact that the $75 level has served as a barrier in the past. We last reached these levels in 2018 only to have them rejected. There is a chance that we see the situation repeat itself.

We see the move higher based upon the idea that demand is on the rise. Since the lows during the lockdown, that is true. However, when we look at things in regards to overall consumption, this is a hard case to make. Looking at the traffic patterns of major cities as well as commercial real estate occupancy, it is evident that people simply are not commuting like in the past.

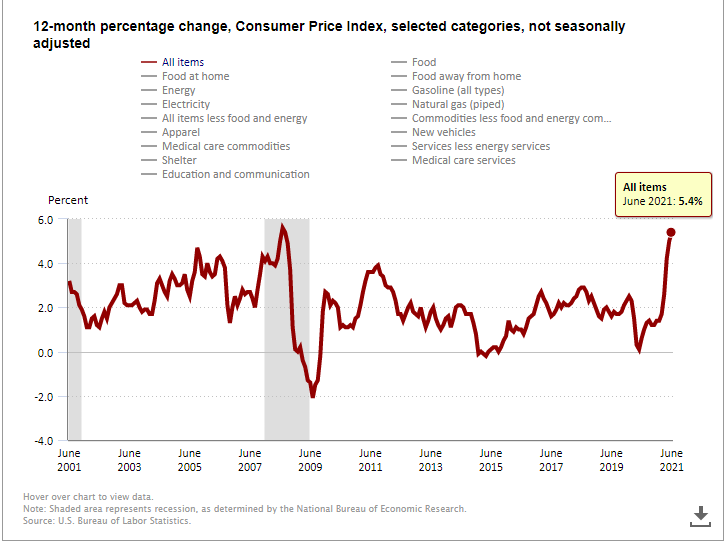

Consumer Price Index

This week, we got the print on the CPI for the United States. It was awful setting a number not seen since the Great Recession.

Of course, this is what all those beating the inflation drum are pointing to.

Source

The challenge with this is that, as the Fed stated, this is a lagging indicator of economic activity. This typically means rough times are head. So we can expect the next 12-18 months to see pullbacks from the level of economic progress that is being made.

As is the case with oil, we can expect this to reverse course starting in the next month or two. When it reverses, we can expect it to be fierce.

Cheap Goods

The other point that is overlooked is the fact the global economy was shut down meaning that products were not shipped. This kept low cost producers from being able to move their wares for much of 2020. Even now, we are still dealing with a container shortage meaning products are not moving at the pace they could.

What this allowed was for high cost producers to hold their prices up. Without the foreign competition, margins were held and profits were realized. This is not going to carry on forever.

The shipping of global products is already underway. For the next quarter or so, we could see prices remain high as these producers re-enter the market. When they do, the incumbents who gained market share, are going to have to get competitive with their pricing.

With the reopening of supply chains, we are going to see the deflation from countries like China and Vietnam exported to the developed countries.

Economic Slowdown

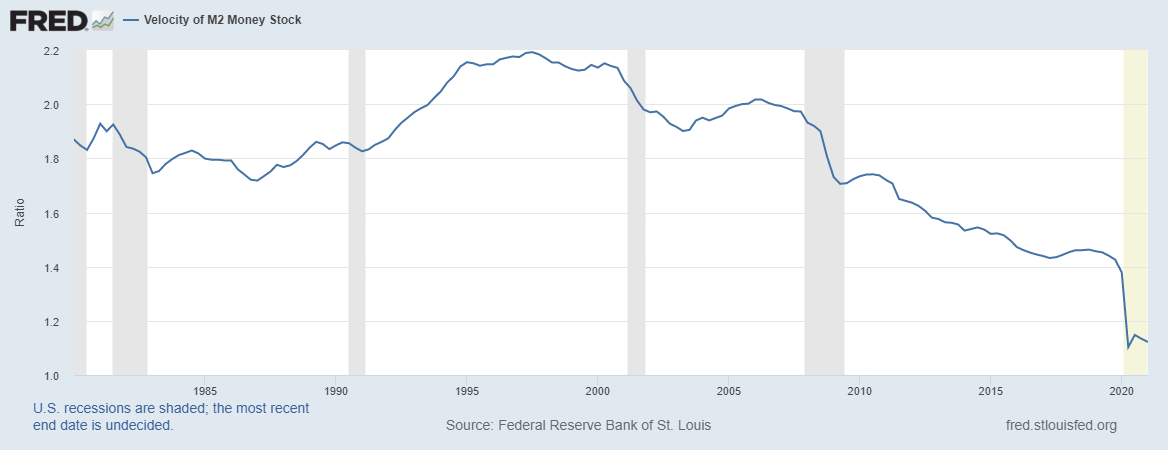

The banking system is awash with cash. So is the financial system. The problem with this is the money is not making it into the general economy. Without enough cash to in the system, higher prices get rejected. They simply cannot be sustained.

In a week and a half, we get the Velocity of Money reading for the last quarter. This will be very telling as to what the economy is doing.

Unlike many other economic indicators, the VoM has not rebounded. While there was a bounce back from the second quarter, the last two saw negative readings. In other words, the pace which money is flowing through the system is slowing down.

This is not an inflationary characteristic. Economies cannot expand a great deal when the VoM is slowing down, especially since we are already at historic lows.

We are likely to see another negative reading simply due to the fact that there is so much cash locked in the banking system. This is compounded by the fact that lending is tightening, as evidenced by Wells Fargo's elimination of credit lines earlier this week.

For all these reasons, do not buy what the mainstream media is selling. We are not seeing an economic expansion nor is inflation going to be a problem going forward. Instead, we are going to see more weakness in the months ahead. This simply cannot be avoided. All the indicators are telling us that we could be in for a sub 2% growth rate by the end of 2022.

Companies will have to enjoy this economic thrust forward. It will not last long for most of them.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

https://twitter.com/taskmaster4450/status/1415842605166997504

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Peter Schiff was wrong? OMG.

lol, never before have we decided to stop a global economy and then decide to see if we can start it back up.

I think there will be a snowball effect, but it's a ways out.

Property Managers that I know are just feeling the impacts, and once housing and other sectors start to fall..

Who knows what happens next.

1 really interesting point you made is that the supply of many good were also suppressed.

Interesting roads ahead.

Posted Using LeoFinance Beta

I know, an insane idea but I am going with it.

Yep these nitwits think it is like turning on a switch. It is not that way. They have no concept about how an economy works. The entire inflation/deflation debate is so misunderstood that it is laughable.

I do. A slow economic deterioration across the world. It is already showing signs of appearing in the EU which will cause it to spread to the US. Growth rates will go down from this point causing less employment and tighter margins for companies.

We can expect more easing that will push more money into the banking and financial system, just growing the existing problem. The global economy will keep suffering for a lack of liquidity as the central banks keep themselves locked in the same corner.

Posted Using LeoFinance Beta

Very curious to see the velocity of money here in a week and a half. Feels like we are in for a few more months of some higher prices on a few things but overall it seems like everything has caught back up again with demand. The demand of things seems much lower as I believe many people and companies got a reality check as to what's really important or do I need this thing.

Posted Using LeoFinance Beta

My view is that the future demand is being over estimated.

We will have to watch inventory levels. The shortage caused a lot of ordering to "fill shelves" yet I think companies are going to, at some point, start cancelling as they realize the demand is not there.

Posted Using LeoFinance Beta

Well lumber prices tend to be correlated more to the housing prices/sales. Recently I think it has started slowing down due to the top level buyers have probably already bought the houses. The rest are probably sitting and looking for better prices and I have heard some bad stories about builders charging people more after the fact due to the higher prices of lumber a few months ago.

Posted Using LeoFinance Beta

In this instance, the saw mills were down which affected supply. There is also tariff issues and a disease in Canada that wiped out a bunch of trees. So there are legitimate reasons for the price of lumber to go up.

However, the market it took it way to far. The proverbial Greenspan irrational exuberance comes to mind.

It was bound to collapse.

Posted Using LeoFinance Beta

We've got a timber shortage in Australia. This whole pandemic is a nightmare. I've lost just over $100k in building delays, interest, rent, extra price hikes and it isn't stopping anytime soon.

Posted Using LeoFinance Beta

And I am going to surmise that is money you are not going to make up. Hence, you are out that money, which will not be recouped anytime soon.

That has an overall impact upon the economic situation.

Posted Using LeoFinance Beta

Nope, infact it will probably be an even bigger loss. Once everything gets back to normal prices will reduce.

Unfortunately, we sold the property we owned to start building which ment we needed to start renting. Rent is quite pricey at $2000 per month. So each month passed October will be a loss, not to mention rent will increase by then too.

I had delays in building due to COVID and each snap lock down that goes for 5 days is roughly $500 lost. I'm already 5 months behind schedule so that's another $10,000 loss.

I'm hearing there is also a shortage of nuts, bolts and nails too.

I'm in an okish position at current. But there are many that will start faulting on their loans and many will lose their homes. There is already discussion in community groups of people unable to cover the cost increases.

Posted Using LeoFinance Beta

!PIZZA

Posted Using LeoFinance Beta

@taskmaster4450le! I sent you a slice of $PIZZA on behalf of @eirik.

Learn more about $PIZZA Token at hive.pizza (2/20)

That is what we call a fake reversal, a deceptive reversal.

Posted Using LeoFinance Beta

How so?

Posted Using LeoFinance Beta

No no no listen you wrong again. I was considered a wallstreet hotshot to the wallstreet hotshots. Let me explain what's going on. Peter is not wrong but here's the situation. So what happens and this has happened twice before already to my recollection.

In the 80's there was a lumber to gold run up that proceeded an inflationary run up and then it happened right before the housing collapse of 2009. So these are intial indicators. Means it follows that pattern which suggest a bull market, however lumber then corrects shortly after . .

Evenso.. gold to lumber is still somewhat considered a pseudo science. The commodity group that was under peer review with several academic studies to give indicators on this was gold to platinum division.. or the price of gold divided by platinum.

The real situation though is in monetary government policy. What Peter is saying we're dumping money because the fed has a very bearish view of the economy same as many economist. So now what you have over the next several months is alot of money chasing not enough goods and services which is causing the inflation.

My family owns one of the biggest construction companies in the city. I work day to day with them. Let me ask you this question? Do you think we're charging less for services or more? I'll let you answer that.

You should also be aware that what will drive this inflation higher is we now have the covid delta variant. They got all these poor sick children with it. The same disease many of you all don't believe exist. You also don't believe the earth is round. That they faking up in space on a sound stage and elon musk and richard branson nothing more than trained actors, lol.

Well states are once again closing up. Only have the populace has been vaccinated. So you know what that means right? Means this is happening all over again almost like we been hit by a 4th wave.

I have done everything i have tried everything to educate " you people". People like whatsapp and marky mark over in the pulse room going to take you all to the bowels of hell". they going to take you all to the abyss of hell.

I have tried to save this chain. Have brought my knowledge my talents free of charge. Haven't asked for a dime but you all are reprobate" for those of you not sure about this word in your lexicon means predestined to damnation.

I may have to turn to another community .. another chain to save. Anyway let me continue on with these market corelations, please excuse the tangents lol. So here's what many economist feel will likely happen who will take a big hit. Obviously Peter Schiff is a gold bug. So that means his predictions are always going to point more to a hyperinflated outcome because he wants you to put your money in gold. He sells gold so his predictions have to follow a good reason to sell it. Gold we've seen what it's done price wise. Thats an indicator of inflation, you're trying to protect your assets against inflation.

So here's the kicker many don't understand. They erroneously believe that crypto will perform good in these cases. Unfortunately most economist disagree. They believe that leveraged assets .. highly speculative asset classes like cryptocurrencies will suffer the most as they generally do. That is because in the idea that cryptos are deflationary what is actually happening is that we are creating thousands of crypto at a number we probably won't be able to number in the future. All this defi . and nft crap. What is happening the crypto space is not really deflationary. This is why bitcoin maximalist go crazy because they don't want the high levels of inflation coming into crypto in which most projects are crap. Most aren't used and create no new money. So that's why they so upset.

So because of this economist have predicted when everything hits the fan. So will cryptocurrency. Now of course crypto people don't believe that. They are hopeful and not rational most of the time .. Especially under the economic conditions we're in because they don't know what else to do.

I mean i get it. I get that you all want to take your power back. That you tired. The thing is in any resistance or revolution you have to learn from your enemies those you impose. You can't just get out here trying to fight and try to know things you don't know. I worked on wallstreet most of my life. These economist who got nobel prizes and went to school they weren't just like doing nothing there. They were actually doing something related to this stuff lol. So you gotta know how to fight your enemy not just fight your enemy blindly.

I know you all going to have a problem because i already clearly see how you all manuever and function. I can only pray for you all now.

Marky mark and whatsapp dont know what they talking about. Stop listening to them. They going to be the undoing of this place. That's my last warning lol.

Posted Using LeoFinance Beta

Lumber was artificially inflated as home owners decided to take stimi / extra money towards home increasing demand for lumber. That has no subsided as Lumber yards were stock piling out of greed. I was talking to a machinist next door to me and he said he cannot find workers because they are still milking the benefits from government.

There are demand for jobs but many are just sitting at home keeping the stimulus checks.

Posted Using LeoFinance Beta

Curation and Education Project for LeoFinance

@erarium

This post has been voted on by Erarium's Curation Team Our goal is to reward financial content within the Spanish and English community for LeoFinance. We have liked the content you have expressed in this article and we would like to invite you to continue developing material of this type, and to use the #Leofinance tag in order to make the community grow.We invite you to join the LeoFinance Discord so that we can interact and continue to grow.

Erarium Discord

Posted Using LeoFinance Beta

That sure put my renovations on hold.

Posted Using LeoFinance Beta