The Fed Is Now Tightening Showing How They Lost The Economy

Have no fear, the Fed has things under control.

Well actually they do not. But this should not come as much of a surprise to anyone, other than maybe the Fed itself.

While everyone is complaining about the money printing, the Fed starts to tighten, believing their own Keynesian fantasies. They actually believe they have the ability to stamp out the inflation that is showing up. Since they naively believe they caused it, they also think they can fix it.

Source

Make no mistake about it, the inflation we are seeing is due to shortages in the supply chain. This is what happens when the global economy is shut down. Everything from electronics to food is in short supply. This is causing prices to accelerate.

The Keynesian model mistakenly believes that money printing will push up prices causing too much money to chase too few goods and services. The problem with this is that it isn't the case. In fact, money has nothing to do with this. Shortages mean higher prices. Period. It is simply supply and demand.

This is exactly why the Great Reset was doomed to fail. These people simply do not know what they are doing. The idea of tearing down and building back better is asinine. These people have no idea what it takes to build and grow an economy. It is not something that can be modeled out in a think tank or an elite University classroom.

We are now seeing the Fed conducting what amounts to Reverse Repos. They are trying to suck money out of the system, falsely believe that is going to stem the inflation problem. How is taking money out of the system going to help supply? Will there suddenly be more lumber since the Fed is selling $350 billion worth of securities? How about the cows and chickens that were slaughtered before making it to market? Will then suddenly end up in supermarkets? Do we see the crops that were plowed over last year suddenly find their way to people's plates at the dinner table?

As I stated on a number of occasions, the economy is very weak. The growth rate only looks good when comparing it YoY since last year saw such a shutdown. The reality is we are still not back to where we were pre-COVID, which was pretty anemic to begin with.

.png)

Then we have the President pushing through an agenda of tax increases. Tax the rich is just political rhetoric and it is time people realized that. This is not going to affect people like Gates, Bezos, or even Musk. They have their wealth socked away in trusts and other tax-shelters. This protects them from having to pay the increase.

So who gets hit? Small businesses end up bearing the brunt of it, including farmers. This have the net effect of reducing the food supply even more.

The last time the Fed tried to tighten it blew up in their face. When they reversed course a few years ago and tried to sell off some of their balance sheet, the market tanked. It is likely we will see something similar again. The Fed will push this line of thinking believing they are in control, until the market suffers enough of a pullback.

At that point in time, they will reverse course again since a market collapse is the last thing they can afford.

Commodities stand a good chance of going on a multi-year run. As stated a number of times, we are likely to see this last through 2023 and into 2024. It took more than a year to soak up the glut of oil that existed and it will take perhaps double that to make up for these shortages.

In fact, Intel came out and openly stated the semiconductor shortage is probably going to last a couple of years.

This is what happens when the supply chain is so vastly affected.

Source

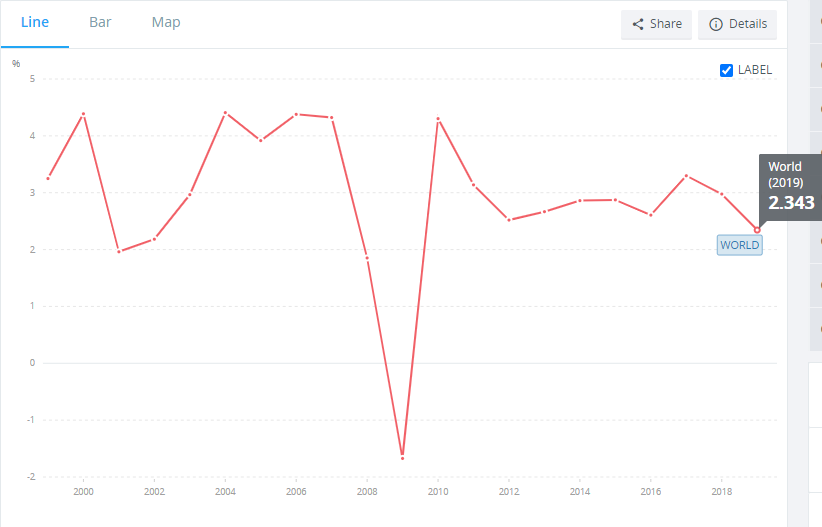

Also kiss the global economy goodbye. It is in rough shape right now and will only get worse. The only thing keeping it propped up is the stimulus. Now that the Fed decided to end that, if it is a long-term thing, we will see a further push down.

As we can see, the downward slide was in place long before COVID. In fact, since 2010, which saw a massive push higher as a result of the Great Recession, we only hit 3% global growth twice. The last being 2017.

We will likely have a 5% growth rate coming off a negative 2020 before resuming the downward trend we were on.

And the Fed believes that is had a hand in all this and they can control it? It is almost laughable how backwards they truly are.

Hopefully their tightening can magically produce some semiconductors because the global economy can really use them. If not, I am not sure how much positive news we will see.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

.

Not likely. In fact it will be surprising if you get back to the levels reached earlier last decade.

To get hyperinflation you need an acceleration in three areas:

Wages havent gone up in 20 years and will not likely in spite of the push to raise minimum wages. Automation is going to keep the cap on that.

Velocity of money is at an all time low and not going back to the 1980s level of 3.75. With it barely above 1, we will be lucky to see it get to 2 again.

Commodities will be on a run but that will cease after a couple years.

So, no the hyperinflation idea is actually getting more absurd as time goes by.

Posted Using LeoFinance Beta

.

Thank you for making this post!

If the Fed tightens, the crypto space will suffer tremendously. I've got everything except what I've got on Hive in fiat right now. I've been thinking about making a position in crypto again. But if the Fed is going to tighten, the stock market and tech stocks will be crushed. Institutions will pull out of crypto until the Fed starts expanding its balance sheet again when it notices that the economy is being destroyed.

Posted Using LeoFinance Beta

Hard to tell what will happen to crypto. Yes there has been the correlation to the stock market but do not believe the Fed really has a ton of control over the either. We might see a pullback but the Fed will not be at it for long.

Too much liquidity is NOT the cause of inflation now; it is a supply issue. All the Fed is going to do is to push the economy down even more and perhaps give the market a pullback.

Posted Using LeoFinance Beta

It's mostly about perceptions.

I fully agree that the liquidity is not pushing up consumer prices. However, the financial markets depend very much on the liquidity provided by the Fed.

Posted Using LeoFinance Beta

The economy is hard to control because it just has way too much factors. So I would say tightening needed to happen a long while ago. It should of happened when the economy was stronger but doing it now is just suicide. I don't predict anything really going well.

Posted Using LeoFinance Beta

To be fair to the Fed, they couldnt tighten. The economy has been weak since the Great Recession. In spite of Trump's chest pounding and talks of the best economy ever, it was still very weak.

Posted Using LeoFinance Beta

Its like we have the insane running the asylum, taxing the rich never works they just past it on the employees and consumers.

I don't think many actually realise just how devastated the world economy has been and with shortages starting to appear it ain't going to matter one bit how much the Fed prints.

Printing excess fiat does no good for the economy and in turn no good for the consumers.

We are headed for a rough period over the next few years.

Yep. That is a good summary of what I wrote. You summed it up in a few sentences.

Posted Using LeoFinance Beta

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 25000 replies.

Your next target is to reach 160000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

I saw a really awesome graphic the other day that I wanted to share with you, but I can't seem to place it now. It was all of these facts and figures about a token and the supply and the tokenomics of it and how horrible it was and then at the end it says no really, this is the US dollar. It was pretty interesting. Sorry I can't locate it now. I knew I should have screenshotted it.

Posted Using LeoFinance Beta

Don't buy into that stuff about the USD @bozz. A lot of it is total bullshit.

The USD has 60% of its physical dollars outside the US. This means that it is global in its distribution. Also, there is $200 trillion worth of debt out there, much of it written in dollars. That means all payment streams are in USD. There is a lot of 30 year bonds out there (If I was at the Fed, I would start issuing out 50 and 100 year bonds).

One thing that people overlook about an overly financialized economy, which the US has, is that it protects the currency.

Posted Using LeoFinance Beta

Okay, good to know. Thanks!

Posted Using LeoFinance Beta

That's what @bozz means... do you now see the longterm Revolution of defi?

These scam coins are getting crazy. One someone just shilled me:

jk that’s the US dollar

https://twitter.com/joinryze/status/1394374934936293380

Posted Using LeoFinance Beta

This bodes well with the cancel culture we also live in. Destroy, delete, cancel, remove, before you have something at least of equal value to put in its place. And usually without an undo function. Who needs that, right?

Posted Using LeoFinance Beta

Just a bunch of controlled agents is what they are. Not surprising considering who their parents were.

The cancel culture will become less important when a lot of them are starving and sitting in their apartments without heat.

Posted Using LeoFinance Beta

Cancel culture will likely become more important as part of social control and manipulation, mainly as a tool to crush dissent and entertain the increasingly impoverished and unhappy masses through "bread and circuses" policies.

Posted Using LeoFinance Beta

So much doom and gloom these days, we need some uplifting news around here

Posted Using LeoFinance Beta

I think the FED knows perfectly well that their strategy is driving inflation, they simply do not care to work to correct this trend, in fact they recognize the increase in the consumer price index, however they assume that this will be temporary, that it will not be necessary to raise interest rates given the need of the rest of the world to use American money to mobilize their own economies.

The time will come when this house of cards they call the fiat system will totally collapse, they know it and that is why they will not try to stop the fall, for the simple reason that they already have a plan B designed and waiting to be implemented. The era of digital fiat money is imminent, it will not solve anything, but it will generate changes that will be seen as 'revolutionary' in the eyes of the unwary. For now, people are blind drunk on incentives, but at some point the bottle will run out and the hangover will come.

Posted Using LeoFinance Beta