Commercial Real State Is Taking A Big Hit

Over the past year, the crisis in commercial real estate is becoming more exposed.

Due to the lockdowns, the already suffering shopping mall market took a bigger hit. This was joined by office space getting hit as companies moved towards the "work-from-home" model. At present, there is debate about how permanent this concept is.

Nevertheless, in the meantime, we are dealing with a growing problem.

Banks are about to become minority holders in two of the biggest malls in the United States.

Bankers are reportedly set to take a minority stake in the two largest malls in North America after their owner defaulted on its massive, 3.3 million-sq.-ft. retail and entertainment development in New Jersey.

The debt loads on these properties is really crushing them.

J.P. Morgan Chase, Goldman Sachs and a group of real estate investors are set to take a 49% equity stake in Triple Five Group’s Mall of America and West Edmonton Mall, reported Women’s Wear Daily. (The Financial Times reported the news earlier.) The developer had put up 49% stakes in the two huge malls as collateral to secure a $1.2 billion construction loan for American Dream, which is located in East Rutherford, N.J.

It is no secret that the shift towards online shopping has really had an impact in the sales for the physical stores. Each year we see this increasing, with no expectation of it slowing. We are seeing larger ticket items like cars being sold online.

Source

As department stores and other chains come under pressure, they turned to the landlords to make concessions on the rent. Some even took the step of not sending in the rent checks, simply claiming that they couldn't afford it during the lockdown.

Of course, this put pressure on the mall owners as the holders of the debt wanted to get paid. The banks are obviously getting a bit tired of waiting around. By taking a piece of the malls, the banks are hoping to recoup the money they laid out.

Ultimately, we can expect to see stories like this in the future.

The situation is not much better for office real estate, especially in the major cities. The Big Apple is known to be suffering and there is no end in sight to the pain that commercial real estate holders are facing.

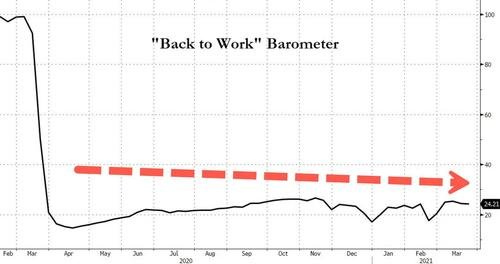

This sector is being hit hard by the work from home movement. In Manhattan, it is estimated that less than 25% of the employees are working in the office. That means 75% of the city is still working from home. How much of this becomes permanent is the major question? If it is a significant portion, we might see the office real estate market completely obliterated.

Presently, the availability rate in that area hit a 30 year high. It is now at more than 17%.

Savills said the amount of office space available in Manhattan is at a three-decade high. The report, released on Thursday, said the availability rate soared to 17.2% in the first quarter. The rise in the rate was primarily due to a massive surge in sublease space, which now stands at 22 million square feet, or 62% higher than 2019 levels.

This is causing agents to do whatever they can to incentivize companies to sign leases.

Savills said rents fell for the fifth consecutive quarter to around $76.27 a square foot, down 9% from a year earlier. These cheaper rents are creating a massive opportunity for companies who want to enter the city.

Desperate landlords were offering generous concessions for long-term leases at newly constructed buildings: "Average tenant improvement allowances jumped 16% and free rent surged 17% to an average of 13.5 months. The tenant-friendly market is expected to last for at least the next 12 to 18 months," Savills said.

This chart shows how few people have returned to the office in Manhattan. The trend is telling a very dark story for landlords.

Source

What is being discussed is a hybrid situation that companies adopt. Under this scenario, a portion of the staff returns to the office while others remain home. We also could see alternate days where a portion of the employees come in on one day while other parts come in a day or two later.

All of this means that less office space will be required by the companies. This, of course, is a major cost savings for these entities. It doesn't take a genius to figure out that they will opt for this is they can make it work.

Technology is making all of this possible. According to Gartner, IT spending is set to increase 6% over the 2020 number. A lot of this is going to enterprise software which enables more streamlined workflow increasing the ability for companies to move in this direction.

Many are wondering if the commercial real estate markets in some of these cities is ever going to come back. Naturally, the idea is that it will since it always did before.

However, with technology advancing so rapidly, we might find that something is truly different from the past. If the work from home (read work from anywhere), people can achieve the same end by being in an area with a much lower cost of living.

We are now a year since this all started. The reason this is important is because commercial real estate leases tend to be 5 year terms. Thus, we already see 20% are already up. Throughout the next 12 months, we will see another 20% coming up for renewal.

What will companies opt to do when their leases come due? We will have to wait and see. However, the longer all this goes on, the worse the situation becomes for landlords.

If it goes on long enough, this trend might be permanent.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

https://twitter.com/taskmaster4450/status/1378508047799181312

This actually happens because most people have not turned to cryptocurrencies to invest

On the ground, they invest in the real estate, as something guaranteed over the years and made steady progress.

Posted Using LeoFinance Beta

Yes well is real estate guaranteed in the coming years?

This is something that people are going to be confronted with.

Posted Using LeoFinance Beta

Wow muy buen post, es muy instructivo lo explayado, gracias por compartir.

Congratulations @taskmaster4450le! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 28000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Great post mate. I really do hope we change to a work from home model there will be a transitional slump but you will find more retail would open up in the burbs as well as increased local economies and a massive reduction in greenhouse gas emissions.

Why drive in a massive car park when you can walk 5mins down the road?

It will also cause a wealth redistribution away from cities and provide more booming businesses as there won't be this massive funnel of wealth in the city.

The city will be more botequ but the outter suburbs will be the rise of many.

Posted Using LeoFinance Beta

Do you think that physical shopping is going to relocate?

I have a feeling that online/virtual will continue to eat up a greater market share, thus ending the run of most physical stores.

Posted Using LeoFinance Beta

I'm one of the ones that has ditched physical shopping, I still do it occasionally as I take the lil one out to learn but often the big shops will be online.

They also provide incentives by giving shoppers free stuff if you purchasing online. It saves having to wait in the checkout line and carry bags, load up a car with screeming kids!

That will be gone soon, I do like the auto scan and buy option. But that will cost jobs.

Posted Using LeoFinance Beta

Seems to me the whole retail meltdown was already in the writing on the wall... the USA is horribly over-retailed to begin with. Depending on what you compare to, we have between five to ten times the retail space per capita compared to most industrialized nations. Not only don't we need that much space we don't need to buy that much stuff.

Indeed, I'd agree that Covid served as a catalyst in that sense, in that people spent a lot more time at home and potentially realized that they don't even need all the stuff they had been buying. I see a potential growth sector being on the "online aftermarket" industry... peer-to-peer marketplaces where people try to re-house all their stuff to someone who needs it more.

Conventional economics and economists need to WAKE UP to the fact that there is no "normal" we're ever going to get "back" to... we have to start where we are now, and build on that. Turn those malls into affordable apartments and "extended stay" accommodations for business workers who travel.

As for the office space? Better be looking around for something besides offices as the highest and best use!

=^..^=

Posted Using LeoFinance Beta

This is certainly a fact that cant be disputed. COVID simply sped up what was already in place. Shopping malls were not suddenly hit due to the lockdowns, they were suffering for years.

What took place the last year only accelerated the demise of an already faltering sector.

It will be interesting to see if they can repurpose the retail and office space into something more useful. How to do that and maintain the value though?

Obviously, industrial space is likely to keep growing but that is not typically the highest and best use case, at least from a financial perpsective.

Posted Using LeoFinance Beta

yeah, working out of the office is likely to become a cost effective way to work for both employers and employees.

I'm with you on this one. I don't see retail coming back to brick and mortar. If they do they really need to change things up and make it worth going to the store instead of shopping online but not sure how they are going to pull that off. Plus all of that wasted time driving into work, the money renting out the place for those people to work. When working from home is seriously a win/win for the company and the person working at least to me. I'd never work another job again where I have to actually drive too it.

Retail is also going to suffer from the virtualization movement when that starts to hit.

Who is going to head to a physical location when all of that can be found in 3D via VR devices?

Posted Using LeoFinance Beta

I don't know for sure since there is so much conflicting data. REITs look like they are prime for another pump last time I checked in the stock market and Google doesn't seem to want their employees to work from home. Then again Google has their own space and isn't exactly renting it off someone else.

My guts tell me that real estate should tank given that businesses want to cut costs and doing things online seems right. Also 3D printing show decrease the cost of building houses but I fully expect those environmentalists to start doing their work soon enough.

Posted Using LeoFinance Beta

Google and companies like that get headlines but we need to look at all the small businesses that were crushed and the real estate they put on the market. At the same time, for every Google, there are a ton of other companies that are opting for something different.

I spoke to a buddy yesterday who is now completely working from home. If he heads into the office, they wonder what he is doing there.

Posted Using LeoFinance Beta

It's so bad that right now. In my country even the investors do not have the money to spend. The market is almost dead for now and there are no signs of recovering. Real estate as a scarce resource will pick up anytime. Demand will rise soon hopefully.

Posted Using LeoFinance Beta

As far as I know residential real estate ( as oppose to commercial) has gone up in the States because people are moving in the suburbs, same is true in other countries as well

Posted Using LeoFinance Beta

There are a few reasons but you did hit one on the head. People are moving, at least now, from the urban to the burbs. A lot of this is driven by central bank policy and low interest rates.

That is helping to feed into the push higher in residential real estate prices.

Posted Using LeoFinance Beta

I didn't know the banks were in on the action

Posted Using LeoFinance Beta

Well when it comes to residential real estate, interest rates have a big impact. The fact the Fed is keeping rate very low makes the real estate market hum since people can "afford" higher prices since they are only concerned with the payment.

Posted Using LeoFinance Beta

Working remotely removes the necessity of commercial offices, so I understand how that is affected. I think people in this space need to be more creative and use those as shared offices, part time office or other new ways of offering business spaces to companies and individuals, but without a long term commitment.

Posted Using LeoFinance Beta

There is debate right now if it is temporary or will it become permanent.

We also face a demographic shift with the population. As companies are run by younger people, their viewpoint is different.

Posted Using LeoFinance Beta

https://twitter.com/sharkthelion/status/1378726814630166531