Ethereum bulls maintain control ahead of expiry this Friday

It's me SilverGoldHunter here again

Today I will be talking about the analysis of Ethereum

Ethereum or ETH had initiated a rally on the 25th of April which had gained a massive 90% increase which had pushed the price of Ethereum to an ATH of $4,200.

But why did it increase this high and breaking new records?

Well, this is due to an incredible increase in decentralized finance (DeFi) applications where the net locked value has surpassed a total of $74 billion, a 51% increase in eighteen days.

This is a positive momentum that has been decimating the neutral-to-bearish which is giving the bulls even more incentives to continue the rally.

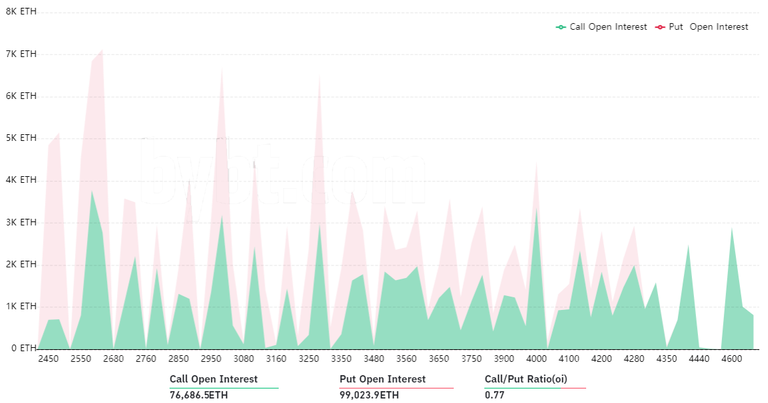

And remember tomorrow on the date of Friday, May 14 the total of $730 million Ether options are set to expire, and bulls have complete control as the call (buy) options are in the majority.

This will be interesting for us to see what will happens next.

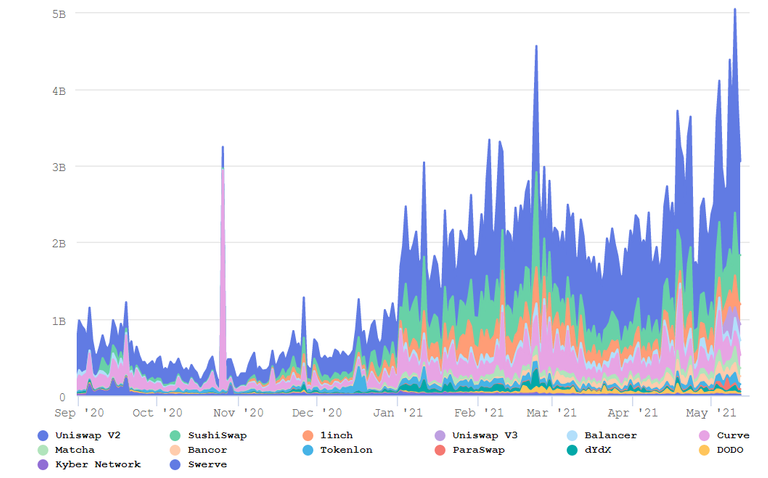

And if we look at the DEX volume we can see that most of the majority has come from Uniswap v2 which had spiked across $5 Billion

First Glance

As we can see that it has been coming down as May 14, looms

** Will it be a bear or a bull?**

If somehow the bears somehow manage to push the price below $3,500 on Friday at 8am UTC Time, this would reduce their disadvantage by $86 million. Thus, they have incentives to suppress the price, at least for Friday's expiry.

As for a long-term view, unless there's pressure coming from the United States, the path for $5,000 Ether is still a clear target for bulls.

So everyone please keep an eye out for Friday, May 14 @ 8 AM UTC as it could change the complexity of the price of Ethereum as the Defi contracts expire.

Source

Have a good day and I will catch you on the next blog

PEACE OUT EVERYBODY

SilverGoldHunter

Posted Using LeoFinance Beta