PayPal Offers Crypto Checkout Service

U.S. customers are now allowed to use their cryptocurrency assets to pay at PayPal's online merchants.

The fintech giant started providing its customers with the ability to buy, hold and sell crypto assets in 2020, and is now pushing for further crypto adoption, as it is encouraging the use of crypto as a means of payment across the 29 million merchants connected to its network. It appears that the crypto industry is being endorsed by a growing number of payment giants as the months go by, with 2021 already proving to be a spectacular year for the space.

PayPal’s Checkout will allow bitcoin (BTC), ether (ETH), bitcoin cash (BCH) and litecoin (LTC) to be seamlessly converted into U.S. dollars or other fiat currencies when making purchases, the same as credit card or a debit card would work inside a PayPal wallet, said PayPal – meaning merchants will not actually be the recipients of cryptocurrencies.

Source: coindesk.com

In other words, PayPal sees huge potential in crypto and is looking to grab as much as possible, to the point that it will be providing the consumer with a 1099 tax form and reporting to the IRS in order to tackle tax problems. The checkout service will certainly act as a catalyst for mainstream adoption of cryptocurrencies, but I don't think PayPal is doing this all due to its sincere interest in the ways in which the blockchain technology can revolutionize the way we perform transactions on a global scale.

“We think it is a transitional point where cryptocurrencies move from being predominantly an asset class that you buy, hold and or sell to now becoming a legitimate funding source to make transactions in the real world at millions of merchants.”

-PayPal President and CEO Dan Schulman

Source: reuters.com

In my humble opinion, all of these powerful players are not just entering the fray out of curiosity, nor are they dreaming of a decentralized world. They are just starting to realize there are huge profits to be made in the space, as it has been attracting major attention lately, with influential individuals, celebrities, corporations and central banks getting involved and making positive public statements.

They are just looking to grab a piece of the pie.

And that's good news. Being endorsed by the guys running the show gives you a great chance of succeeding, so those of us who have been around for quite some time now do enjoy witnessing all this money flowing into the space. The best part is that institutional interest serves as a guarantee that mass adoption is just a matter of time, regardless of what governments think of crypto. They themselves have owners too, and their owners are probably already holding Bitcoin. Checkmate.

One thing should be clear though: do not sell your crypto unless it's necessary or you have already made it. I'm certainly not against taking sweet profits, but if the amounts are not life-changing and you do have alternative income sources, I think it's best to hold on to your crypto assets for a couple more years. Personally, I've regretted selling every single token I've sold so far. Hell, even Dogecoin skyrocketed and made me regret having dumped.

Panic holding.

This is why I've decided not to sell anything at all before 2025, and I will only break this promise if selling can completely transform my life, as I'm still far from making it and being able to cover my life expenses without having to sell my time. There are many reasons as to why I believe the crypto space is still in its infancy stage, and if you hit the road asking random strangers whether they know anything about crypto, I'm sure you will agree with me.

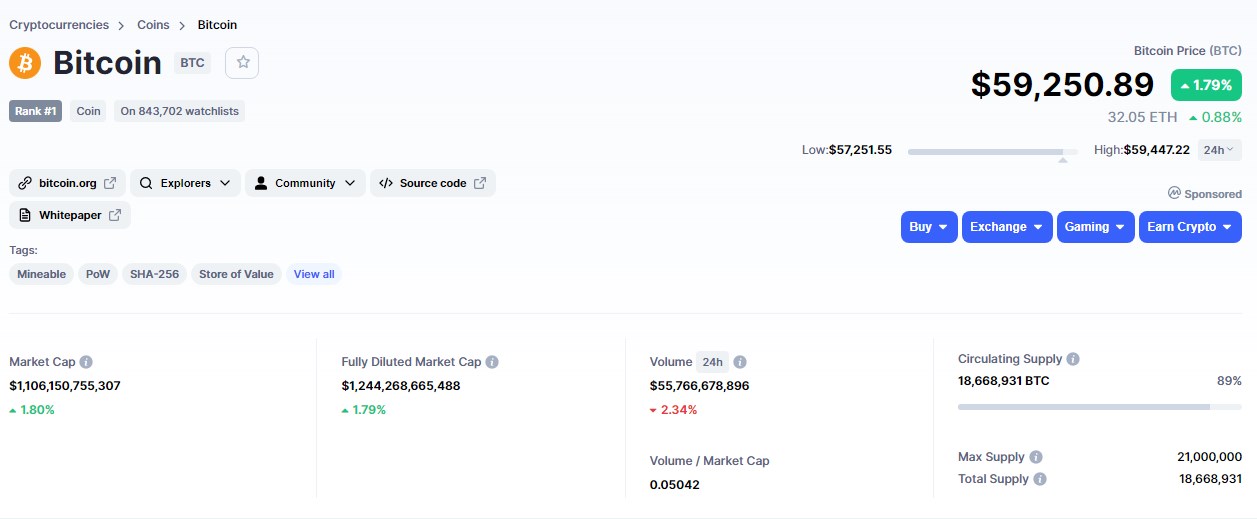

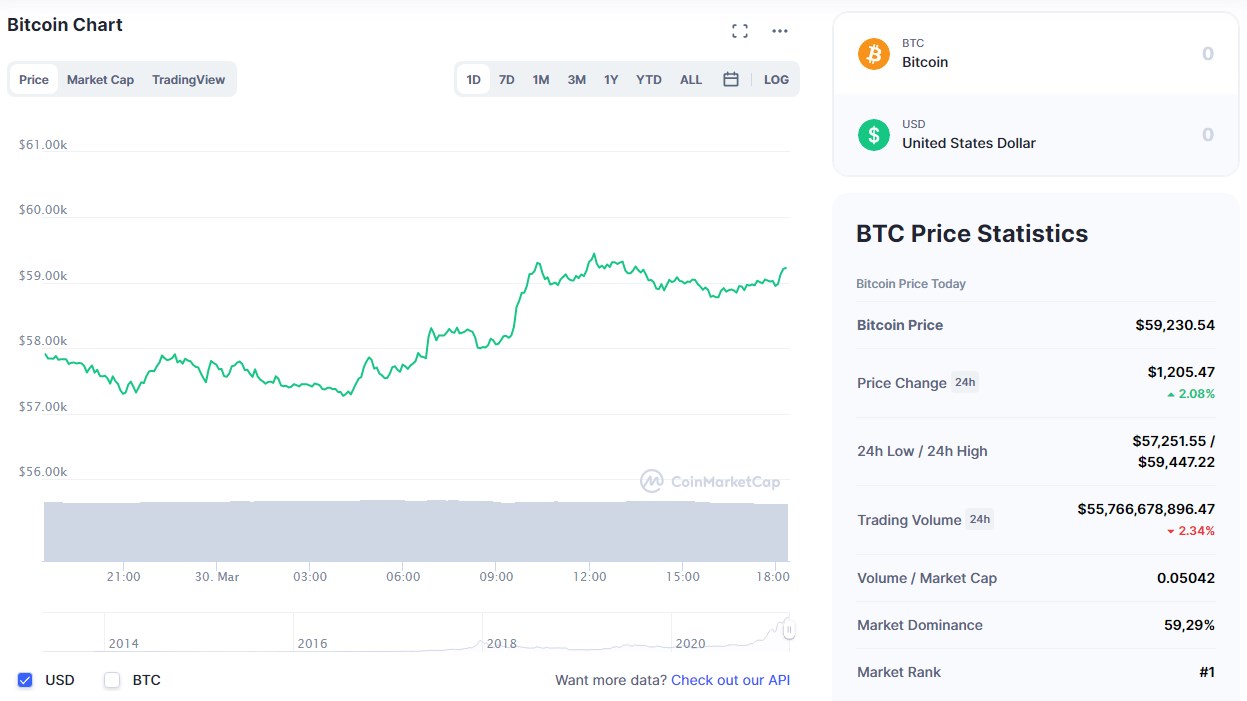

Bitcoin is currently swinging around the $59k mark, an increase of roughly 2% over the last 24 hours, with trading volumes of approximately $56 billion. BTC almost hit the $60k mark again following PayPal's announcement, with ETH, BCH and LTC showing signs of growth as well. Now, some of you may think that this is not really a big deal, but as @edicted pointed out in a recent post, Q1 is supposed to be bad, and quarterly reports are a thing.

Corporate money is supposed to be flowing out of the space as we speak, and soon it will be coming back for more. The fact that Q1 2021 ends tomorrow but there's no blood in the streets is a very bullish sign as far as I'm concerned, but you know, always DYOR and stuff. I'm just speaking my mind here and that's it. But if you ask me, then yeah, I see a massive run towards the beginning of Q3 2021 for similar reasons.

Only time will tell, but I think it's now more than obvious that the cryptocurrency industry is only getting bigger with time. It's a movement they can't stop, and it has already changed the lives of millions of people for the better, offering numerous ways to generate income from home. And that's just for starters, as the technology behind it all has the potential to transform the world by providing us with the weapons needed to fight corruption.

Thank you for your attention.

Alright guys, that's it for now. Thank you for taking the time to read these lines.

Just my two cents. This is by no means financial advice. Just sharing my personal views and experiences. Please do not take my word for your investment choices, and always do your own research.

Stay safe and have a good one,

@lordneroo

Posted Using LeoFinance Beta

I feel like it's weird to say that Paypal is allowing their users to spend crypto, considering you can't deposit or withdraw crypto from the platform. Even if they quote "didn't allow that" it would just require one extra step of selling the crypto for fiat first. In fact, this is actually what's happening in the background: PayPal is just doing it for us behind the scenes and eliminating that step for the frontend-user.

It kinda just seems like a marketing ploy to keep PayPal relevant.

Tell people you can spend crypto now to draw capital to the platform.

But I guess that's just how capitalism works.

@edicted you have said it all sir...

Posted Using LeoFinance Beta

Couldn't agree more, they are obviously just trying to grab a piece of the pie. At first I thought they were either trying to get their hands on some ''cheap'' crypto by ripping their customers off with fees, which would translate into moar crypto for them than what they paid for, or this was just a publicity stunt on their behalf. Or both.

This is a very bizarre way of offering crypto services, isn't it?

That's the worst part. This makes it more than obvious that it's just a marketing ploy. Some would argue they are doing it to tackle any tax problems that may arise due to different legal approaches from country to country, but the service is only available in the U.S. for now. So I don't really get it.

As you said, it's all about profit.

Posted Using LeoFinance Beta

!WINE

Posted Using LeoFinance Beta

Congratulations, @filotasriza3 You Successfully Shared 0.100 WINE With @lordneroo.

You Earned 0.100 WINE As Curation Reward.

You Utilized 1/3 Successful Calls.

Total Purchase : 24816.918 WINE & Last Price : 0.290 HIVE

HURRY UP & GET YOUR SPOT IN WINE INITIAL TOKEN OFFERING -ITO-

WINE Current Market Price : 0.270 HIVE

!LUV

Thanks for the wine!

Posted Using LeoFinance Beta

Command accepted!

Hey @filotasriza3, you were just shared some LUV. With at least 5 LUV in your wallet, you can give 3 LUV per day, for free. See the LUV tokens in your wallet at https://hive-engine.com or learn about LUV at https://hive.blog/@luvshares

Now millions of people have to check and use bitcoin in paypal

but as you said people still afraid of hodling btc and may will change it to fiat Quickly

Posted Using LeoFinance Beta

It definitely helps in getting the word out about crypto, so it's a win in my book.

Posted Using LeoFinance Beta

Congratulations @lordneroo!

You raised your level and are now a Minnow!

Check out the last post from @hivebuzz: