Introducing CUB Kingdoms | Cross-Platform Autocompounding Yield Vaults

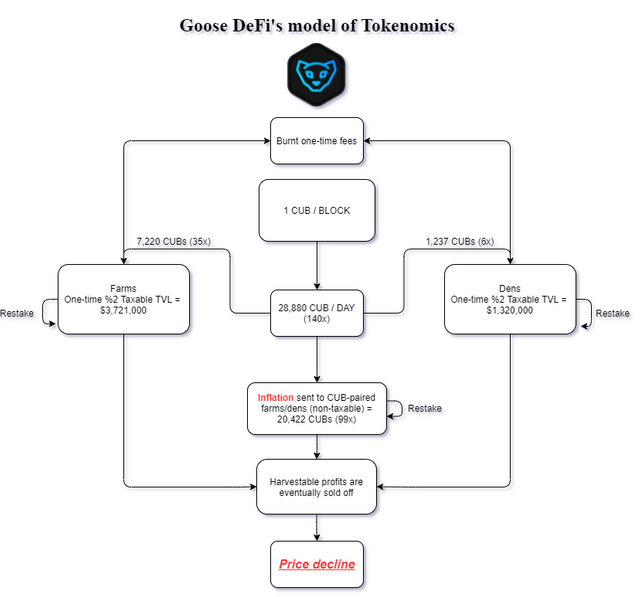

Cub started out as a fork of the popular GooseDeFi project on the Binance Smart Chain. Goose was one of the first yield applications to gain traction on BSC and showed the way for many other platforms to launch a simple yield app.

For us, we saw it as an opportunity to launch a base layer yield app. A basic application and token to gain distribution and traction on the Binance Smart Chain. We launched bLEO on top of the CubDeFi app which allowed the LEO token economy to expand alongside the new CUB token economy.

This original idea for yield apps came with a particular type of yield vault: one-time deposit fees and single-platform yield farming.

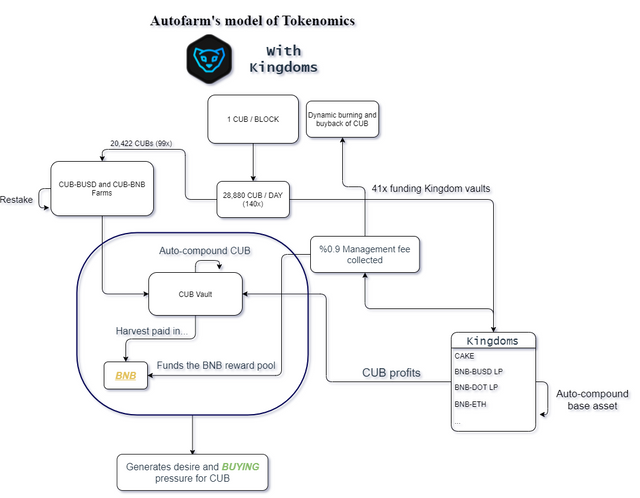

Other platforms like Autofarm have gained far more popularity and have shown that sustainability for the platform's native token price comes primarily through 5 characteristics:

- Ongoing management fees

- Cross-platform composability

- Collaboration

- Low inflation toward non-native farms

- High inflation toward native token farms (i.e. CUB, CUB-BNB, CUB-BUSD)

Introducing CUB Kingdoms

Kingdoms have been in development for a long time. Just a few weeks after the Cub launch, we decided to scope out some really big ideas for the future of Cub Finance. Ambitions are high for our DeFi platform and it was important to us to figure out a way to build something that lasts and continually grows in the long run.

While we could chase after small potatoes - as many other platforms have done - the end result would have been the same: a slow and steady decline into nothingness.

Instead, we took the approach of designing and chasing after the largest possible ideas. While other platforms would've likely dropped the old model and just moved to a new model, we didn't want to leave behind a poorly built platform to grind into dust.

Our approach is to continually build new applications, use cases and features for our tokens and platforms. If you've been on LeoFinance for a while, then you may remember when LEO was worth a fraction of a penny.

Through consistent development, vision for the long-term and community building, we managed to build LEO up to $1 at the height of this bull cycle in the crypto market. A truly amazing feat.

LEO still hovers around $0.30 these days even after the recent correction and a slow downtrend. Our approach for LEO is being applied to CUB just the same: slow but steady and relentless development. We've been continually adding new things to CUB whether it's a small UI update here or a bug fix there. It's been a lot of work.

The real work comes with the migration of our platform. This is where Kingdoms come into play.

The 5 characteristics that platforms like Autofarm feature are the characteristics that we're building into CUB via Kingdoms.

What is a Kingdom?

Kingdoms are cross-compatible, autocompounding yield farming vaults. The main difference between a "Farm" (the old vault contracts we forked from Goose) and a "Kingdom" is that farms offer rewards only in the form of CUB inflation.

That means that if ETH-BNB is paying out a 30% APR, that entire 30% APR is being paid via CUB inflation. Obviously, if most people who deposit ETH-BNB turn around and sell their CUB rewards, the price will steadily decline over time.

To offset this, Goose introduced one-time deposit fees which we also mirrored. The problem with one-time deposit fees is that you only collect a fee one-time. This means that capital can flow into farms/dens, pay a 2% deposit fee up front and then farm CUB and sell it with no cost whatsoever.

Our goal with CUB is to build a multi-pronged DeFi platform that is around for the years to come. A place for our community to engage with DeFi and not feel the risk of a rug pull or some other nonsense that you see with these anonymous yield farms that pop up from every which direction.

To accomplish this mission, we need to build sustainability and growth into every aspect of the platform. That's why we set out on this journey of building Kingdoms into the CUB platform.

So what are the key differences between a "Farm" and a "Kingdom"?

- Cross-Compatible Yield Farming (Earn 2 Tokens Simultaneously)

- Autocompounding

- Ongoing Management Fees

Cross-Compatible Yield Farming:

Kingdoms are no ordinary farming vault. The smart contract governing a Kingdom vault pools your assets on another platform (i.e. PancakeSwap) and earns their farming token in addition to the CUB rewards we direct to the vault.

Current Farms only earn CUB inflation. Kingdoms earn a small portion of CUB inflation, but also earn the inflation from another platform (i.e. earn CAKE from PCS).

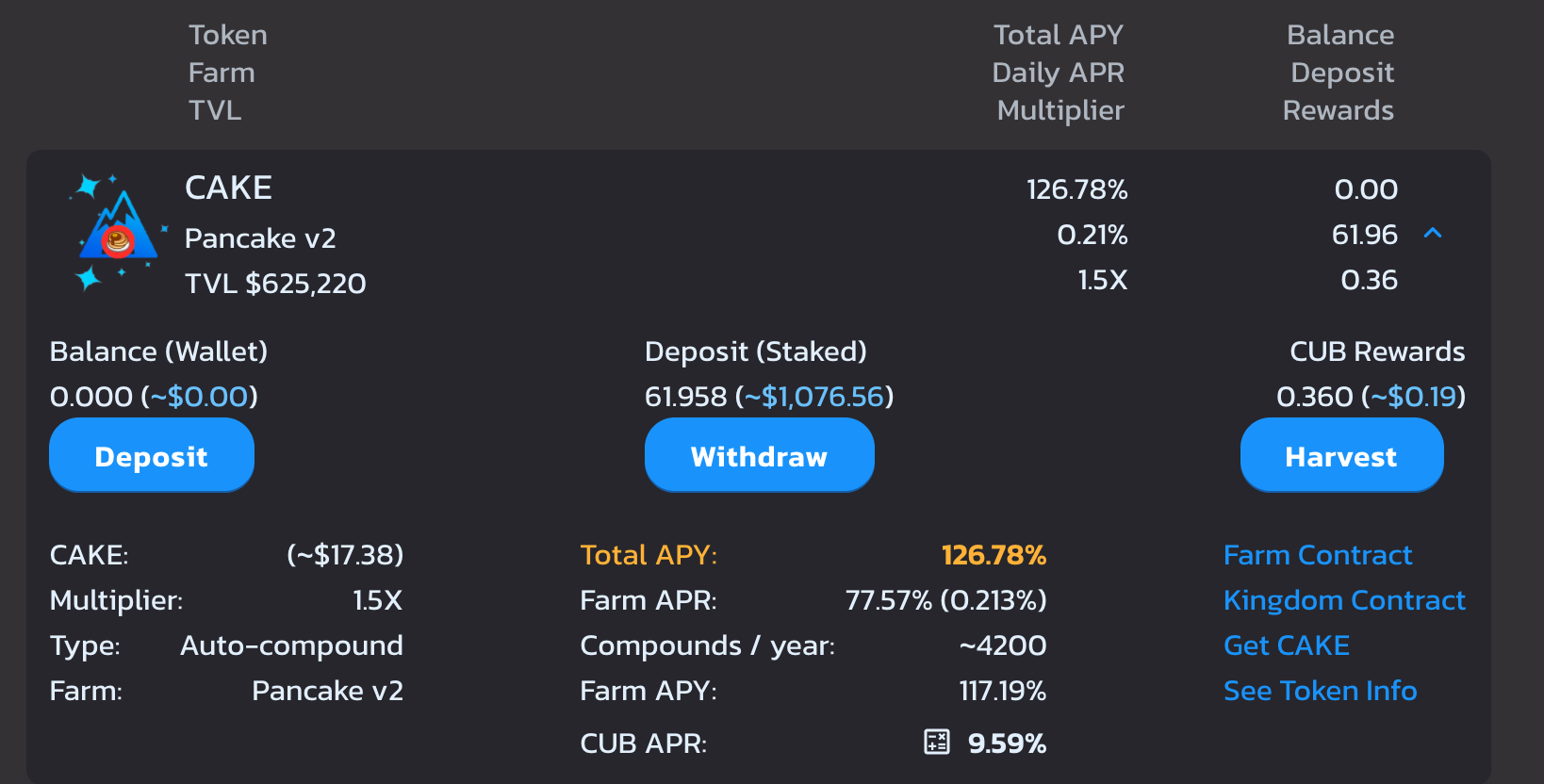

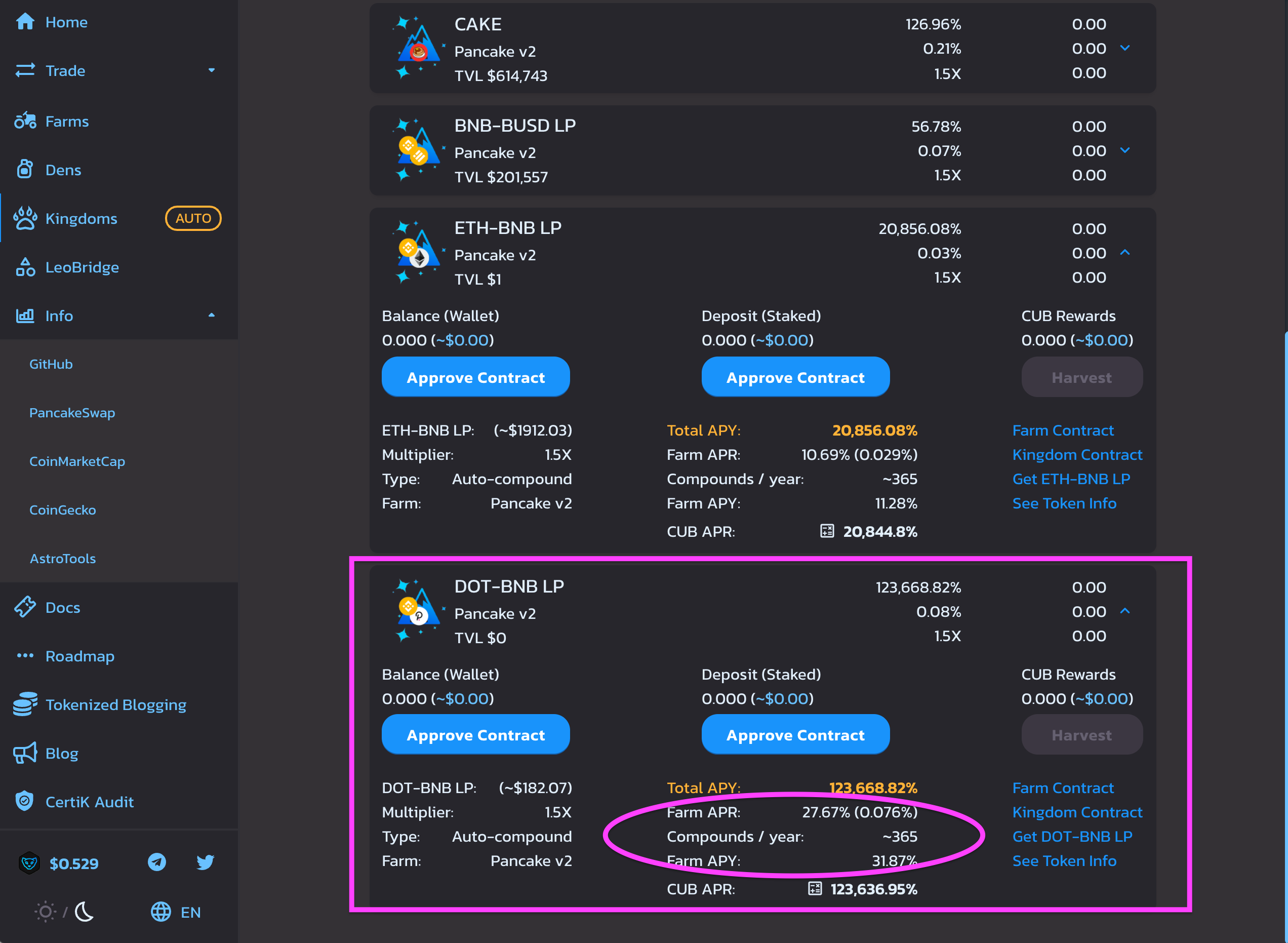

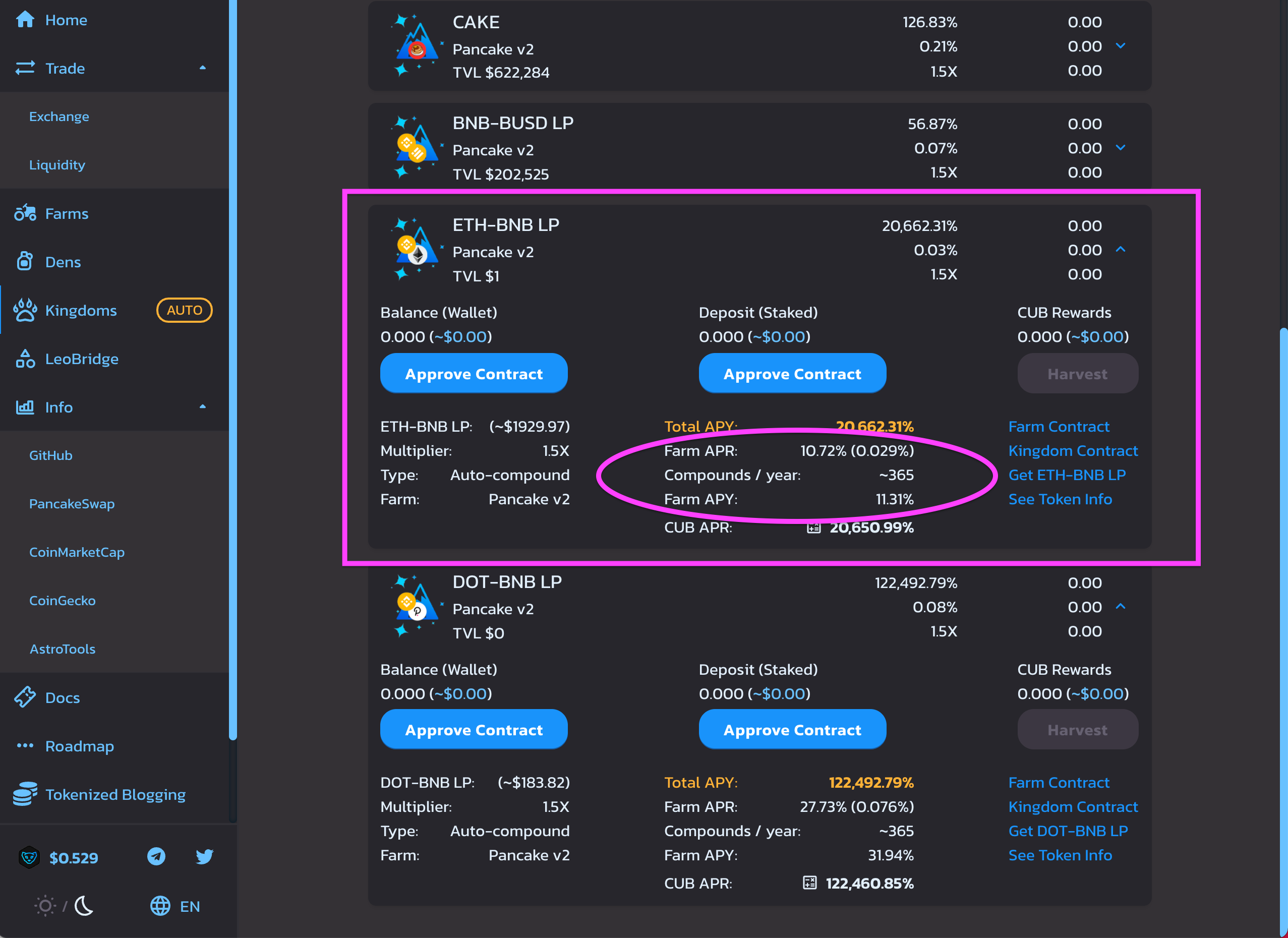

This means that less inflation is necessary from the CUB rewards pool as compared to a standard farm. We can still carry high APYs without needing to allocate large amounts of CUB rewards. This is illustrated perfectly with the first Kingdom we launched: CAKE

With $625k in TVL, CAKE is earning a total APY of 126.78% (0.21% per day). The breakdown of this APY:

- 77.57% APR from CAKE inflation on PCS (autocompounded by the Kingdom contract, this comes out to 117.19% APY)

- 9.59% APR from CUB inflation on Cub Finance (this is the allocation we've given to the pool and fluctuates based on total capital in the pool and the CUB token price)

The beauty of Kingdoms are illustrated right here in the CAKE Kingdom. Our users can deposit CAKE and earn 126% APY without being a burden on the CUB inflation. In fact, if we were to try and offer this level of yield with a standard CUB Farm/Den, we'd need to 10x the amount of CUB inflation allocated to it as compared to the amount allocated here in the Kingdom.

With Kingdoms, CUB can offer higher APYs than the majority of platforms on Binance Smart Chain without raising inflation to crazy amounts.

The other amazing thing about being cross-platform compatible is management fees. Ongoing management fees are paid to the CUB treasury and CUB Staking Kingdom in the form of CAKE. This means that we're essentially pulling value from CAKE (and eventually, the other platform tokens we offer pooling with on Kingdoms) and relaying it to the CUB value via buybacks/burns and Staking Rewards for the CUB Kingdom.

Autocompounding:

When you pool assets in a Kingdom, the rewards from the base layer platform (i.e. Pancakeswap on the currently live Kingdoms), you're autocompounding your base LP position.

Since the soft launch of our first two Kingdoms contracts, a few users have jumped in the CUB Telegram and LeoFinance discord asking questions about where their Pancakeswap rewards go from the Kingdoms.

When you pool in a Pancakeswap-based Kingdom (for example), you're earning CAKE rewards from PCS. These CAKE rewards are automatically paid out from PCS to the Kingdoms contract. The Kingdoms contract autonomously sells these CAKE rewards for the base assets that you pooled with and deposits them into your position.

If you're familiar with automatic dividend reinvestment with stocks, this is the same concept. You're earning rewards from Pancakeswap (CAKE) and those rewards are being converted into the assets you originally deposited and compound your position.

Since CAKE is CAKE, our CAKE Kingdom strategy contract doesn't sell the CAKE rewards, It just re-deposits them into the base position.

The BNB-BUSD Kingdom, however, illustrates the concept of earning CAKE rewards and converting them back into the base asset pair.

If you've deposited to the BNB-BUSD Kingdom, you've seen this in action every single day. When you deposit BNB-BUSD and come back a day later, you'll notice that your LP Token Deposit amount has increased.

Every compounding period, the Kingdoms contract harvests the total CAKE rewards from our BNB-BUSD Kingdom on Pancakeswap. It then takes those CAKE rewards and sells them into BNB and BUSD and repools it for the entire Kingdom and our users see their balance increase.

The remaining Kingdoms that are yet to be launched will utilize a number of different BSC platforms. In time, we'll release a concept dubbed "Yolo Kingdoms" which will also carry some interesting risk/reward trade-offs.

Since Kingdoms utilize other BSC platforms as well as CUB, we must evaluate the risk of those underlying platforms. The initial 8+ Kingdoms will all utilize extremely safe platforms (i.e. Pancakeswap).

Ongoing Management Fees

This is an extremely important concept. Goose and all Goose forks have shown that one-time deposit or withdrawal fees are simply not sustainable for the long-term health of a DeFi yield platform.

Instead, the platform needs to find a balance between ongoing management fee burns and even fee redistribution.

With Kingdoms, a management fee is autonomously taken from each harvest of the base layer rewards during each compounding period. For example, if the BNB-BUSD PCS Kingdom compounds 2x per day and earns 100 CAKE in each harvest, then a management fee is taken off the top of that 100 CAKE harvest.

The management fee is then split between the CUB Burn Treasury and CUB Staking Rewards.

This means that a % of the CAKE earned is going toward buying/burning CUB and another % of that CAKE is being sold into BNB and then distributed to users who deposit CUB in the Staking Kingdom as an additional reward for buying and staking CUB.

Long-Term Vision for Cub

The long-term vision that we've laid out for CUB is slowly coming together. Great things take time and we believe that migrating all of our farms/dens into Kingdoms is the key to a successful platform in the long-run.

As we keep reiterating: our goal with CUB is to build a DeFi platform that offers endless opportunities to participate and grow in the world of Decentralized Finance.

CUB 1.0 was a Goose Farm Fork.

CUB 2.0 is an Autofarm clone with some additional unique features.

We believe that when all of the remaining vaults are converted into Kingdoms, there will be a drastic change in the long-term curve of the CUB price.

There will be far less inflation (fractions of the current amount) going toward non-CUB pools.

There will be far more rewards for staking CUB in the new CUB Staking Kingdom (via the redirection of inflation from non-CUB pools + the introduction of BNB staking rewards from Kingdom management fees).

The future of CUB is bright, it just requires relentless repositioning and development which is what we've been working on the past few months with LeoBridge, Kingdoms and our new Polygon application.

LeoBridge, Polygon, Kingdoms and Marketing

LeoBridge has also slowly begun gaining traction. Now that we've resolved the major issues that we caught during our soft launch of the bridge, we can continue to encourage LPs to deposit to WLEO-ETH and bLEO-BNB so that we can deepen our liquidity pools and make swapping between ERC20s and BEP20s more seamless.

The goal of LeoBridge is partly to collect Bridge TX Fees (0.25% on each Bridge swap) which burn CUB / LEO but it is primarily to drive Trading Volume on the bLEO and wLEO pairs.

By driving trading volume on these two pairs, LPs earn an additional swap fee from the natural pool tokenomics. More trading volume will drive more liquidity since the APY for providing liquidity will increase drastically.

As this APY increases and more liquidity gets added, it will make it cheaper to swap across the LeoBridge which means that trading volume and APY will increase further. It is a virtuous cycle and it continually markets the Cub platform, earns LeoBridge TX fees for burns and increases the incentive to buy/stake LEO in one of our Liquidity Pools. Read Khal's Post About Liquidity Black Hole Theory

Polygon (MATIC) is an incredible project that has gained a lot of traction in recent weeks. We decided several weeks back that we would build a bridge to Matic via LeoBridge and Cub Finance. The design changed a few times but wee've finally landed on an interesting model for creating incredible value both for CUB and for LEO. Just a few days ago, we entered closed testnet for our Polygon app.

Rather than announce any details about these plans and the pending Polygon airdrop to CUB hodlers, we'll wait until just before the platform launches to release a massive post with everything you need to know about our expansion to the Polygon blockchain.

2 New Kingdoms Are Now Live!

We've officially migrated two new Kingdoms vaults. It's much more difficult to carry out this development and migration than expected. Our timelines are always optimistic to encourage faster development, but in the end, the product is better than we even planned it to be and the wait is well worth it.

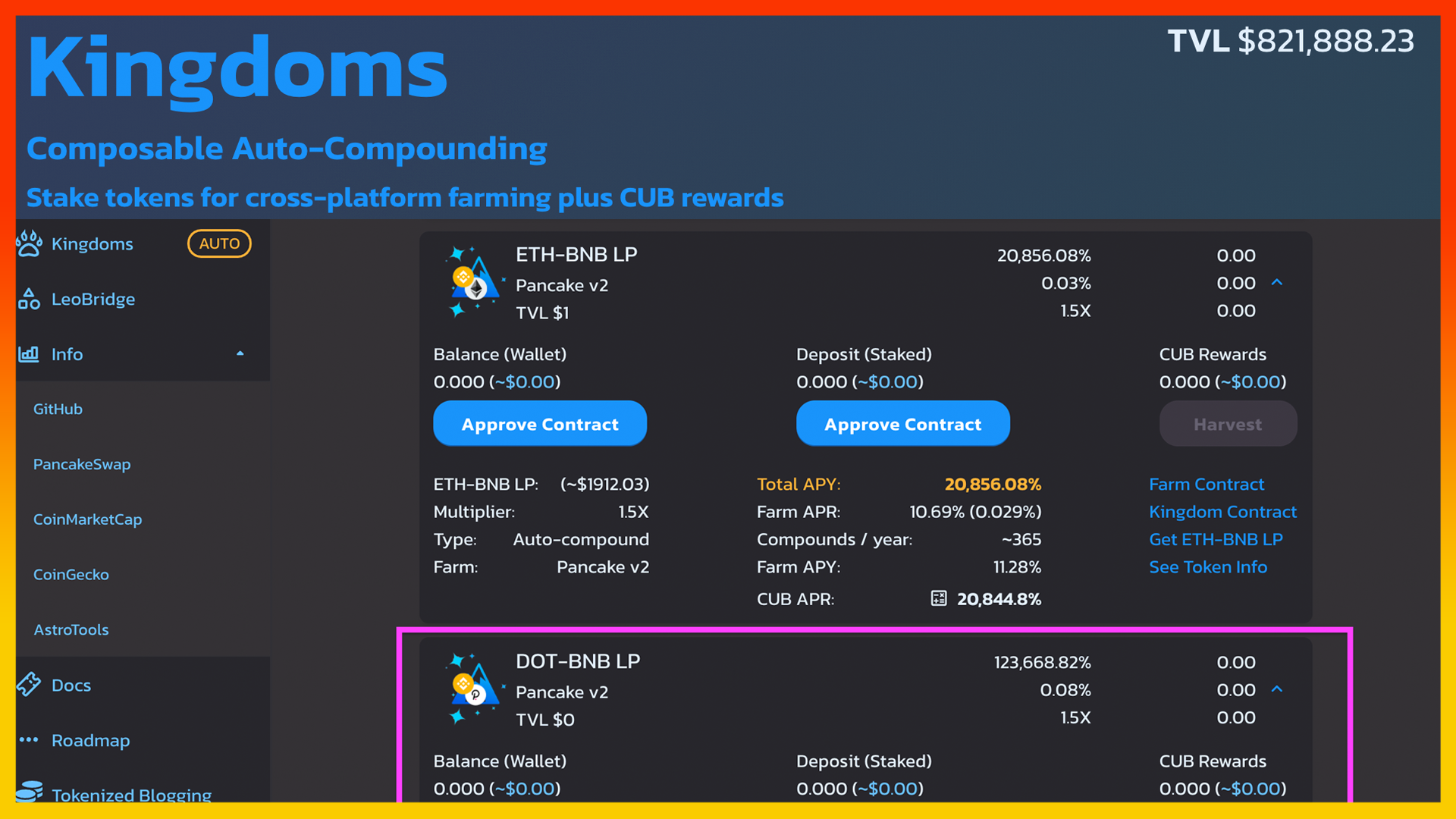

DOT-BNB

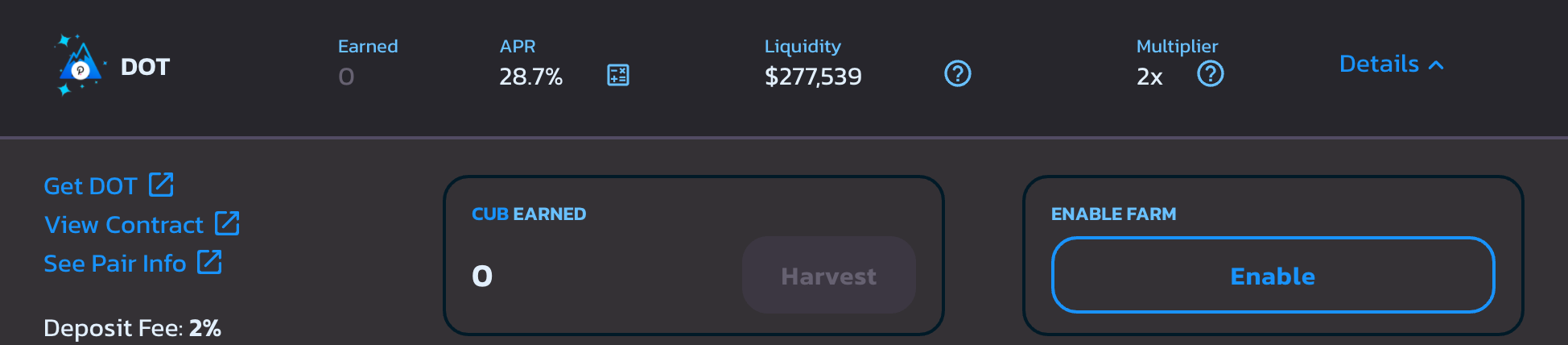

Currently, there is a DOT Den which allows you to earn a 28.7% APR paid entirely in CUB rewards for depositing your DOT. There is $277k in DOT here in the Den.

This den is being deprecated for the DOT-BNB Kingdom.

In the DOT-BNB Kingdom, the current Farm APR (the rewards paid out in CAKE from PCS) is 27.67%.

That means that we could direct 0% CUB inflation to the DOT-BNB Kingdom and it would still nearly outperform the DOT Den where we pay 100% of the rewards.

Since Kingdoms also autonomously autocompounds your CAKE rewards back into DOT-BNB, the DOT-BNB APY comes out to 31.87% before any CUB rewards are even paid out.

Obviously the CUB APR displayed right now is outrageously high. This APR will quickly drop as the TVL (and thus, competition) in the Kingdom increases.

IMPORTANT NOTE if you are in the DOT den, you will need to migrate to the DOT-BNB Kingdom. We decided to launch a DOT-BNB LP instead of a DOT single asset pool for the time being. We may re-introduce a DOT single asset pool in the near future after the full Kingdoms migration is complete.

24 hours from when this post goes live, the DOT Den will have all of it's inflation removed. You can remove your DOT now and pool it in the Kingdom with BNB or you can remove your DOT tomorrow when the inflation is removed by visiting /dens and the "Inactive" tab.

Note #2 This Kingdom utilizes Pancakeswap V2 (PCSv2) LP Tokens. You must use the PCS UI to deposit DOT-BNB into a liquidity pool and add those LP tokens to the Kingdom vault. There is a link to "Get DOT-BNB LP".

ETH-BNB

ETH-BNB is an existing farm so the migration is very simple:

- Remove your ETH-BNB from the ETH-BNB Farm

- Visit the CubDeFi AMM Page (https://exchange.cubdefi.com/#/pool)

- Click ETH-BNB

- Approve ETH-BNB LP Tokens

- Unstake from the ETH-BNB PCSv1 Liquidity Pool

Once you've removed those LP tokens from PCSv1, you can deposit them into the ETH-BNB Kingdom:

- Get ETH-BNB PCSv2 LP Tokens by visiting the "Get ETH-BNB LP"(https://exchange.pancakeswap.finance/#/add/BNB/0x2170ed0880ac9a755fd29b2688956bd959f933f8)

- Go to the Kingdoms page (https://cubdefi.com/kingdoms)

- Approve the ETH-BNB Kingdom

- Click Deposit

- Sit back and watch your ETH-BNB autocompound + earn some CUB harvests

The ETH-BNB farm on Pancakeswap earns less rewards than the DOT-BNB farm because there is far more TVL and competition for the CAKE rewards.

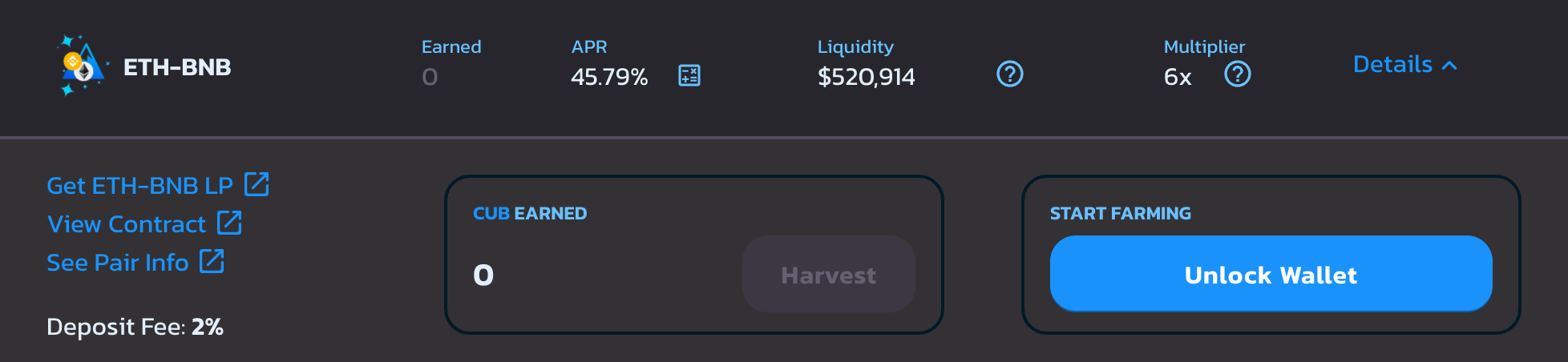

Let's compare this APR to the current ETH-BNB Farm on Cub Finance:

45.79% APR being paid out entirely from CUB inflation. With $520k in liquidity, this is a signficant amount of inflation being pulled from the ecosystem and paid to ETH-BNB stakers who only paid a one-time deposit fee of 2% and have no cost now to farm CUB.

The ETH-BNB Kingdom is currently paying out 11.31% APY (Autocompounded) from the CAKE rewards on PCS. This is signifcantly less than the current ETH-BNB farm, but it is sustainable for our platform since we pay 0% of that 11.31% in rewards.

The CUB APR display for ETH-BNB is obviously a lot higher right now since the TVL is low. If the entirety of this $520k in liquidity migrates from the Farm to the Kingdom, the expected CUB APR will be ~12-15%.

Total APY on ETH-BNB will be right around 23-26%. While this is a step down from the farm APR currently, it is still on par (and even higher in many cases) as compared to other BSC platforms. Sustainble yield farming on one of the largest digital assets on the entire industry.

We may also introduce some more "Fringe" ETH-BNB pooling opportunities (and the ETH Single Asset Pool) in the future. These will offer much higher APRs with a bit more platform risk (since they're not utilizing Pancakeswap and will utilize other platforms with less TVL and perceived security).

IMPORTANT NOTE if you are in the ETH-BNB Farm, you will need to migrate to the ETH-BNB Kingdom.

24 hours from when this post goes live, the ETH-BNB Farm will have all of it's inflation removed. You can remove your ETH-BNB (PCSv1) now and pool it in the Kingdom (as PCSv2) or you can remove your ETH-BNB tomorrow when the inflation is removed by visiting /farms and the "Inactive" tab.

Note #2 This Kingdom utilizes Pancakeswap V2 (PCSv2) LP Tokens. You must use the PCS UI to deposit ETH-BNB into a liquidity pool and add those LP tokens to the Kingdom vault. There is a link to "Get ETH-BNB LP".

Next Up in the Kingdoms Migration:

The next Kingdom to be released is our highly anticipated CUB Staking Kingdom.

In Last Week's AMA, @onealfa asked a great question: will the CUB Den remain alongside the CUB Kingdom.

At the time, it was not planned but since then the updated CUB Staking Kingdom will work alongside the CUB Den.

Basically, the CUB Staking Kingdom contract will pool CUB assets into the original CUB Den - essentially treating the CUB Den as the base platform (in the same way that the ETH-BNB Kingdom utilizes PCS and CAKE rewards as the base platform).

The CUB Kingdom will then autonomously harvest the CUB rewards from the CUB Den and compound them in your base CUB position.

If, for some reason, you don't want your CUB Autocompounded in your base position, you will be able to keep your CUB staked in the original Den.

Note: this has no impact on inflation. Since the Kingdom pulls CUB rewards from the original Den, the CUB inflation directed at the Den doesn't need to change (it will actually be increased after the full Kingdoms migration is complete and we've freed up the majority of outstanding multipliers from non-CUB vaults).

Key Differences Between CUB Staking Kingdom and CUB Den:

- Autocompound your CUB Rewards in the CUB Kingdom and earn a higher APY

- Earn a % of the total Kingdoms management fees paid out in BNB (feature will launch shortly after the Kingdom is introduced)

p.s. CAKE actually has a very similar setup. If you go to PCS, you can stake your CAKE in their original non-compounding CAKE pool or you can stake it in their autocompounding CAKE pool.

BTC - the most highly requested Kingdoms are BTCB (single asset) and BTCB-BNB (LP). We decided not to utilize PCS as the base platform for these two Kingdoms (since the BTC APR on PCS is so low).

Instead, we're utilizing BeltBTC for the single asset BTCB Kingdom (10% base APY and over $1b in TVL on Belt) and we're using Bakeryswap for the BTCB-BNB LP (44% base APY and over $283m in TVL on Bakeryswap).

Barring any last minute changes in the order of migration, these two vaults will be our next to go live.

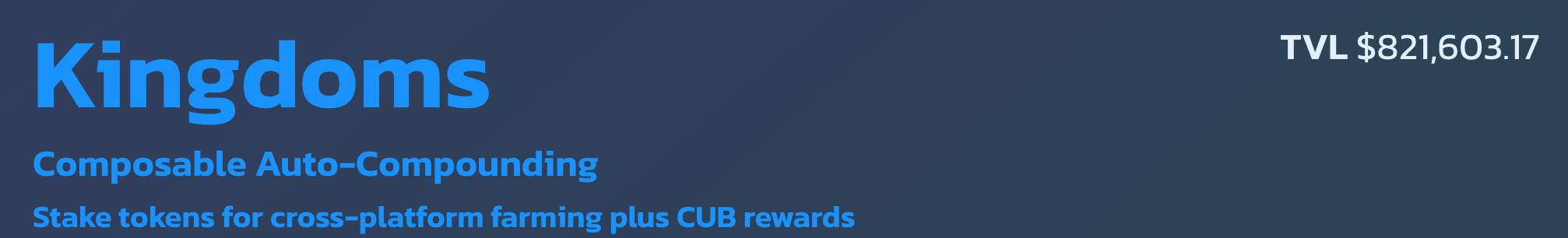

Approaching $1m In Kingdoms TVL:

It's pretty incredible that we're closing in on $1m in TVL with only 2 Kingdoms live (CAKE and BNB-BUSD) and very little announcements (purposefully done early on in this migration process).

TVL now has even more impact on the value of CUB in the long-run. Since CUB is now taking a % of rewards earned from pooled capital (ongoing management fees), TVL now has a direct correlation to the growth of the CUB treasury and the soon-to-be-released CUB Staking rewards that will get paid out as BNB to CUB Kingdom Stake.

A new LeoFinance user - @leonordomonol - was onboarded by @trumpman and wrote a great post about the migration of CUB Tokenomics from the Goose model to the Autofarm model. Check it out here and also give these infographics a look:

The plan is coming together as the development we've been doing for so many weeks reaches production release. Slowly... but Surely.

LeoFinance is a blockchain-based social media community that builds innovative applications on the Hive, BSC and ETH blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

| DeFi Platform | Tokenized Blogging | Track Hive Data |

|---|---|---|

| Cub Finance | LeoFinance Beta | Hivestats |

|  |  |

| Native DEX | Wrapped LEO (ETH) | Hive Node |

|---|---|---|

| LeoDex | wLEO On Uniswap | Witness Vote |

|  |  |

Posted Using LeoFinance Beta

Wow... i love this idea.... honestly we arr really advancing

I'm still confused about moving the CUB den to kingdoms.

My understanding is that this wouldn't be that useful because there are no other farms on BSC that reward users for staking cub. Same would go for CUB/BNB and CUB/BUSD. The only advantage is auto-compounding... unless I'm mistaken.

The CUB Den will not exactly be migrated. It’s going to continue existing

The CUB Kingdom will be introduced as an entirely new vault. There is no increase to inflation because the CUB Kingdom contract actually pools CUB within the old CUB Den and pulls inflation from that (and autocompounds it).

The benefit is autocompounding. If you want to stake CUB and harvest manually, you can stay in the old Cub den.

If you want your rewards autocompounded, stake in the CUB Kingdom.

We can also do the same for CUB-BNB and CUB-BUSD. If we did though, it would auto sell 50% of the CUB rewards into BUSD (or BNB) and repool it for you.

Instead of doing this, we’re reaching out to different BSC yield platforms and seeing if we can get a CUB listing in exchange for listing their token. That way we could actually introduce a new Kingdom with external rewards for a CUB pairing

Posted Using LeoFinance Beta

Does Auto Compounding will save my transaction fees too? (beside manual effort)

Posted Using LeoFinance Beta

Yes. And this is kind of great. We get a better APY and no fees. Good for non millionaires hehe :D

Posted Using LeoFinance Beta

baller

Very clear, thanks !

It must be difficult to find partners to work with I guess.

Posted Using LeoFinance Beta

For now, but I think the theory is the BNB reward that will be attached will compensate for the lack of that external reward - which in itself is technically an external reward in that roundabout way given that they're external fees from the other kingdoms.

Additionally, auto compounding probably works a lot better than your ability to harvest/compound manually - especially given your constraints as a human w/ limited time & the cost associated w/ the tx.

Posted Using LeoFinance Beta

Your post was promoted by @finguru

Awesome guys. I have been waiting for this!!!

Posted Using LeoFinance Beta

Happy to hear the CUB Kingdom is next in line. However, since it now seems the den will co-exist with the Kingdom for CUB, I don't quite understand how the APR will be impacted. Isn't it better having only one CUB vault exist and piling the APR benefits of shifting to Kindoms?

I am an ape. Be kind.

Posted using Dapplr

I explained it a bit more in my comment to @edicted if you want the lengthier answer:

In short, the rewards for staking CUB will still flow to the CUB den like normal. Users will now also have the option to stake in the CUB Kingdom. The CUB kingdom will actually take the stake and pool it in the CUB den but then autonomously compound the CUB harvests it earns.

So no new additional inflation is necessary since all the rewards are still being paid to the CUB den. The difference is that the Kingdom will manage those rewards for you

Posted Using LeoFinance Beta

If I am getting you, assuming I go all in on the CUB Kingdom, will the CUB generated from that vault get auto-compounded in the Kingdom vault or is it sent to the CUB Den??

That is not coming out quite clearly.

Posted using Dapplr

How I understand it is that he $CUB Kingdom at the moment will just be an autocompouding $CUB Den.

They probably aim in the future to partner with another platform to make it a "real kingdom" and earn another asset in the process.

This is just my understanding so do not take my full word for it.

Posted Using LeoFinance Beta

I believe the post mentioned that.

That would be very interesting. The idea of BNB rewards for staking in the Kingdoms would probably see me shift from the Den. No more swapping for BNB and just auto-compounding everything without fees chewing into my BNB holdings.

Posted Using LeoFinance Beta

Genial, lo que conviene prevalecerá,estoy convencida de eso. Gracias.

Quick question:

I created some DOT-BNB pool tokens

However, when I want to deposit them in the Kingdom, they are not recognised!

What did I miss?

CUB’s AMM is currently using V1 (we’ll upgrade it after the full kingdoms migration). See the details from the post above:

Posted Using LeoFinance Beta

This is more than annoying. Now I have to unstake and pay all the fees again? Thanks.

The post included details about the migration to PCSv2.

All of BSC will be migrated eventually (most already have). Better to get it out of the way now

If you have all your cub staked in a farm, i.e CUB/BUSD does that still count as hodling and being eligible for any airdrop?

I already migrated my funds. I expect higher APY when this stabilizes!

Posted Using LeoFinance Beta

To confusing for me right now.

@leofinance! This post has been manually curated by the $PIZZA Token team!

Learn more about $PIZZA Token at hive.pizza. Enjoy a slice of $PIZZA on us!

Thanks for sharing this, looking forward to use leoKingdoms since it deals autocompounding

The APR does make sense since we have noticed how most Defi project's price drops over time. Is the APR for the CUB kingdom going to be better than the CUB Den? Are we getting some extra percentage on top of the Den's APR?

Posted Using LeoFinance Beta

It will be a better APY (APR will be the same) but as you are human and not a billionaire you cannot "optimize" your $CUB reinvestments. By making it a Kingdom, Cubdefi will do it for you. Therfore your APY in the Kingdom will be higher than the APY you currently have in the Den.

Also, they are working to make a partnership with another DeFi platform, so I guess in the DEN Kingdom we might earn another asset soon (boosting the kingdom APR then !)

I might not have been clear. Sorry if it the case.

Posted Using LeoFinance Beta

I don't want to say it... but the CUB chart is going to have a serious rebound once kingdoms are all in place. Cheap CUB now, but for how much longer? I cannot wait to get some stake over on the Polygon platform.

Posted Using LeoFinance Beta

Quite a long read. Will take sometime to assimilate all this. However great one from you guys. Decent APR right there.

So, if I stake Cake on Cub Kingdoms, I will earn the Cake and the Cub tokens?

Or only Cub Token?

Do you have a calculator for the ROI for Cake staked?

You autocompound CAKE and earn CUB at 1.5x multiplier. There are just percentages in the kingdom details, farm APY currently 117%, CUB APR 9%, total APY 126%. There is a calculator for CUB earnings, but you just need to watch the CAKE grow. I am really impressed with my results.

Posted Using LeoFinance Beta

Thanks for the update guys.

Looking forward to the CUB Kingdom coming online.

Posted Using LeoFinance Beta

The team is working very hard on this, and what you showed here sounds sustainable and profitable in the long term, congratulations.

Posted Using LeoFinance Beta

We love Kingdoms! Auto compounding is the way to go. Sharing this with our audience at https://coin-logic.com

Posted Using LeoFinance Beta

My only issue is that for time sensetive people who like what you're doing and have put a bit of cash to work, this is hard to fathom whether I should be doing anything.

I only have two positions left:

Am I right there's nothing for me to do yet? But there will be?

Posted Using LeoFinance Beta

Is not possible to connect trough hive

why is not a part of he ecosystem?