Will Ehereum 2.0 Cause ETH Price Pump?

Beacon chain in phase 0 of Ethereum serenity have been launched. The next phase is phase 1 and 2. In the phase 2, the proof of work network will be shutdown. Minting new ETH is only from one channel that is via staking reward. That cause of reducing inflation rate.

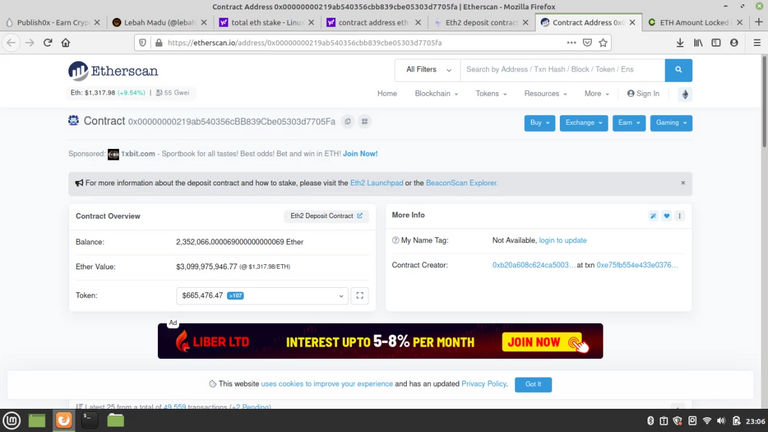

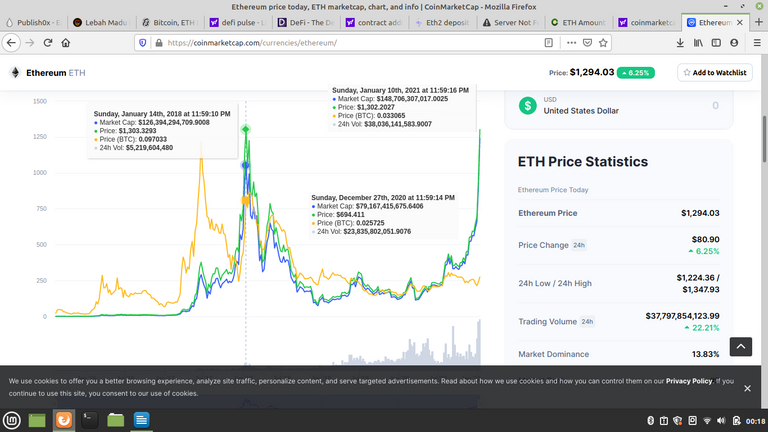

Eth staking surpasses 2,3 million eth. Current report from deposit smart contract , the staked eth has reached more than 2.3 eth locked. Total staked eth is more than 2,3 million. The value is about 3,09 billion USD at the current price 1,300 USD. The price of ethereum is bullish from $500 few months ago to $1,300. Staking eth to smart contract influence the demand of eth in the market so the price increases too. Minimum staking is 32 ETH. Current staked has passed the minimum requirement of 524,288 ETH to launch the beacon chain.

ETHEREUM 2.0 AND ETH PRICE

The law supply and demand works on eth recently. Supply eth in the market decreases because more people participate in staking ethereum. Other reasons that ethereum holders seems to keep their asset and wait for the eth bull run.

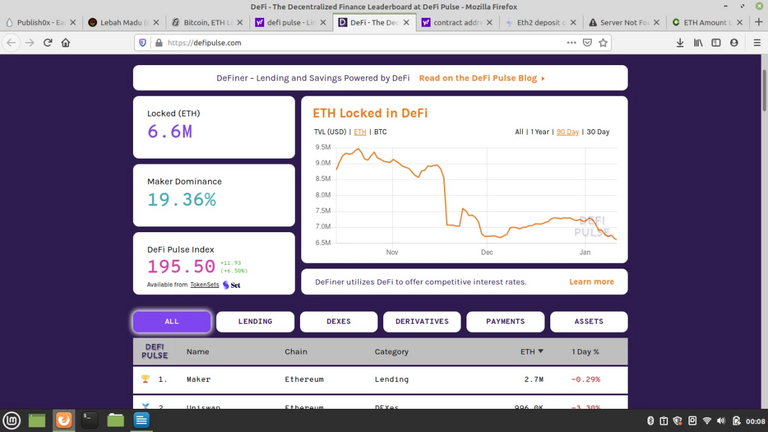

Ethereum Locked in Defi projects

Ethereum staking on Ethereum 2.0 contract address is a reason for ethereum price bullish. Other reason is Eth locked in defi projects. There are tens to hundreds of defi projects that use Eth as the liquid asset or collateral asset. Uniswap use eth as one of the liquid asset to ethereum defi tokens. Most defi projects are ethereum based network so the need of Eth increase for liquid asset in defi.

The end of 2020 was the party of defis. In the early 2021, the party continues. Most new crypto projects include defi beside the main project. Developers see that defi increase the interest of investors because they will not only get rebase from the rise of the native token projects but also earn reward from providing eth as liquidity asset.

Total Eth locked in defi decrease from December 2020. Currently the eth locked in defi protocols reached 6.6 Million. Eth locked in defi plus in Ethereum 2.0 smart contract 6.6 plus 2.35 equals to 8.95 million. Eth locked in coming months will increase since more defi projects and more staking in Ethereum 2.0 smart contract. Though, the trend of Eth locked in defi protocols decreases, in the near future, eth locked in defi will climb up.

Ethereum 2.0 is the answer to gas fee matters. The biggest problem of ethereum in defi project is the gas fee. In Ethereum 2.0 the gas fee will be reduced sharply because the network is based on Proof of Stake. The trasaction is also faster and can handle heavy load traffics. ETH will be value asset like bitcoin. It is not only as the crypto money but it can be digital silver as bitcoin the digital gold.

Posted Using LeoFinance Beta

https://twitter.com/ahmadfz1/status/1349608208822726656