What is Wrapped Bitcoin (wBTC)?

Wrapped Bitcoin (wBTC) is an Ethereum-based token that represents 1 Bitcoin. The price of 1 wBTC is pegged to the price of 1 BTC. If Bitcoin is trading for $9,200 - for example - then wBTC is also trading for around $9,200.

The https://wbtc.network/ brings the promise of bridging the power & scope of Bitcoin with the flexibility of the Ethereum network.

We archived this guide on LeoPedia: https://leopedia.io/what-is-wrapped-bitcoin-wbtc

Bitcoin is the largest, most robust and decentralized computing network in the world. It’s also the highest market cap cryptocurrency by a large margin. There is no question that having access to that kind of value could be incredibly fruitful for DeFi and other crypto projects.

Ethereum has the largest pool of developers and projects on the bleeding edge of Decentralized Finance and other initiatives aimed at bringing real products & use cases into the hands of the masses.

Following that logic, it makes perfect sense to bridge these two blockchains together. To bring the power and market cap of Bitcoin into the flexibility and protocols of Ethereum.

Who Invented wBTC?

Wrapped Bitcoin was launched in January 2019 as a joint effort between crypto projects Kyber, Ren, and BitGo.

Since then, a DAO (decentralized autonomous organization) has been established to manage the wBTC project. Many other Ethereum-based projects have taken up the initiative and backed the project in various ways.

How it Works

Management of the DAO works in an interesting way. There are 3 different types of “Partners” involved in the wBTC Organization:

- Wrapped Tokens DAO

- Merchants

- Custodians

The Wrapped Tokens DAO represents institutions who hold keys to the multi-signature contract that approves and removes merchants and custodians.

The Merchants are responsible for minting new wBTC and burning wrapped tokens.

The Custodians secure the Bitcoin and provide “institutional-grade security” for the wBTC protocol.

There are now dozens of partners who fall into these 3 categories. If you are active in the crypto/ethereum space, then you will recognize many of these names. Head over to https://wbtc.network/dashboard/partners to see the current list of partners and which category they belong to.

How Safe is wBTC

Safety is obviously a #1 concern when using something like a wrapped or “pegged” asset. If the asset is not secure, then there is no point in leveraging it.

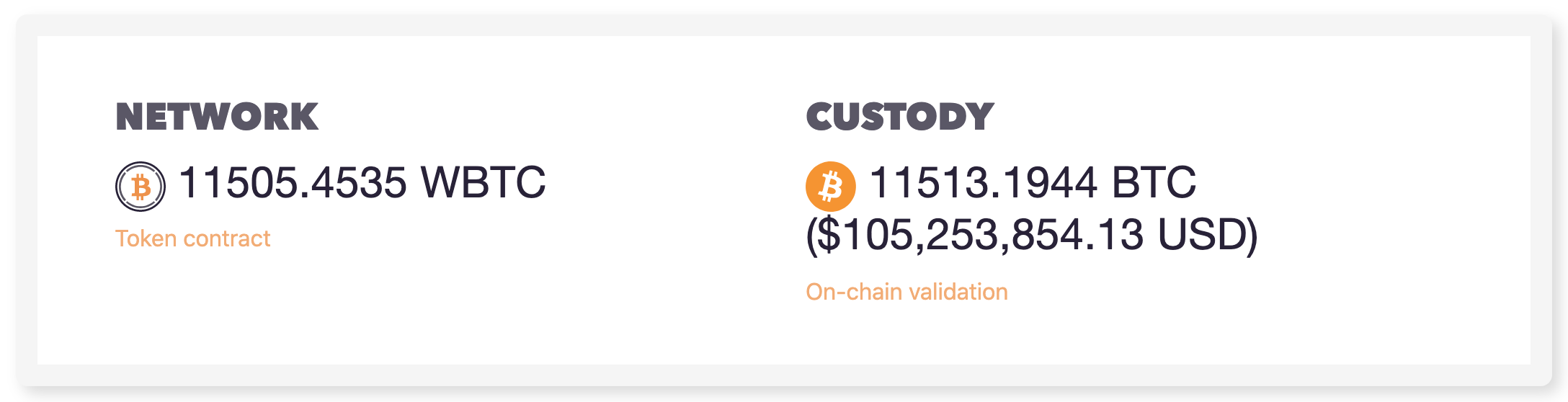

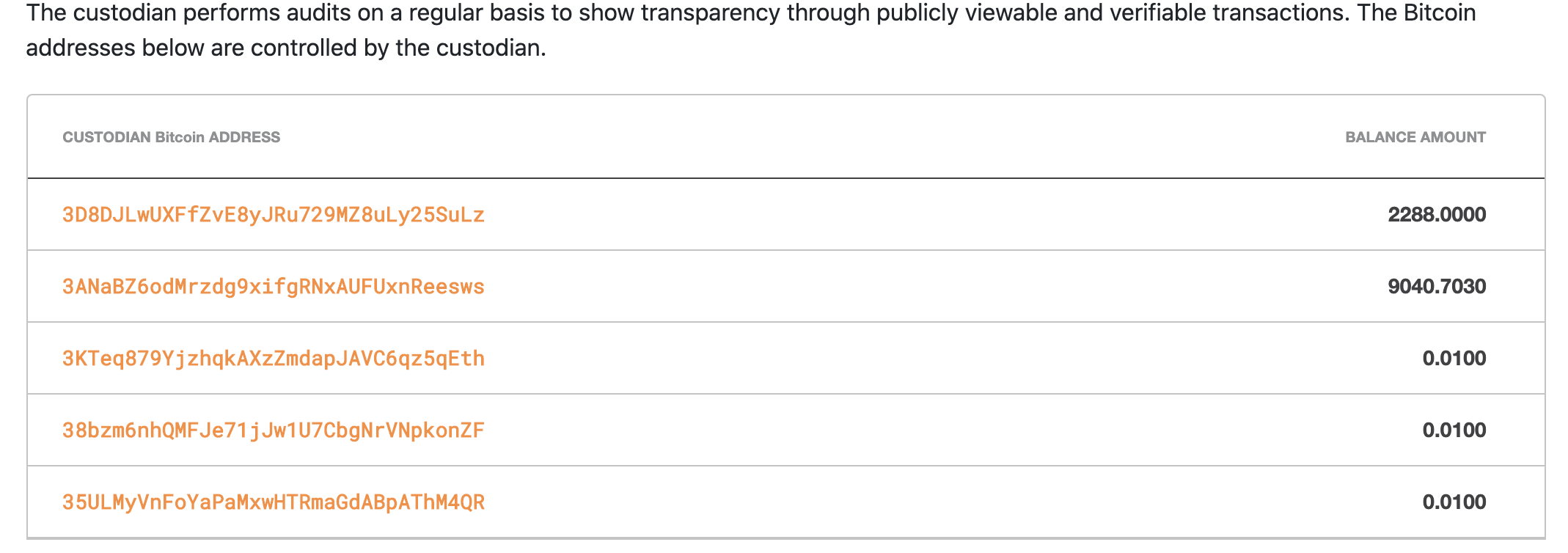

Using “proof of reserve”, the receipt, custody and ongoing issuance of wBTC and the BTC that backs it is all verifiable on-chain. You can see the actual Bitcoin that is held in custody on the audit page: https://wbtc.network/dashboard/audit

On this page, you’ll see the Bitcoin addresses of the custodians who securely store the BTC that backs each issued wBTC at a 1:1 ratio.

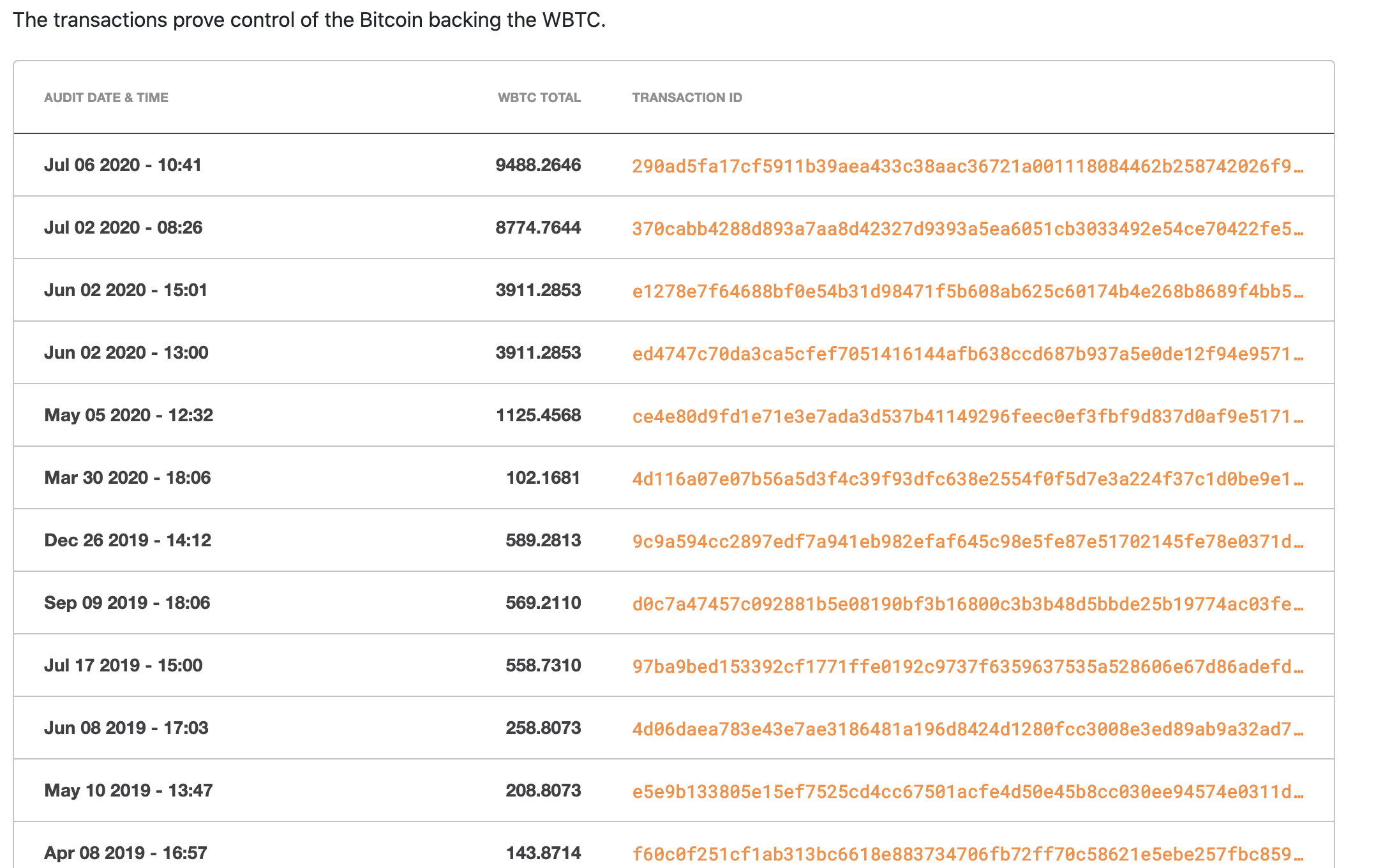

Just below that, you can see an even more detailed breakdown of the BTC in custody via a transaction history report:

As far as security is concerned, I think wBTC is one of the more mature protocols in terms of transparency and provably showing a 1:1 relationship between the pegged token (wBTC) and the token held in custody (BTC).

With that said, there is still a great degree of risk with any protocol - whether it’s on the Bitcoin network, Ethereum network or anywhere else. We’ve seen protocols blow up in the past and we’ve seen hacks varying in any way that seems imaginable.

Personally, I wouldn’t hold a large % of my wealth in any one protocol.. but I would still leverage these technologies and tools to improve my investments and more importantly my experience within crypto.

A wBTC use case that I am eying for my personal portfolio is leveraging the MakerDAO protocol (which just recently added wBTC as a collateral type). I can now take some of my Bitcoin, go to a participating merchant, wrap my BTC and then send that wBTC to a MakerDAO CDP vault and take out a crypto loan against it in the DAI stable coin.

LeoFinance is an online community for crypto & finance. We run several projects that are powered by Hive and the LEO token economy:

| Track Hive Data | Blog & Earn LEO | LEO FAQ |

|---|---|---|

| Hivestats | LeoFinance | Learn More |

|  |  |

| Trade Hive Tokens | Learn & Contribute | Hive Witness |

|---|---|---|

| LeoDex | LeoPedia | Vote |

|  |  |

Archived on LeoPedia

Posted Using LeoFinance

Oh ... wasnt awere that wBTC is on Maker now .... that is an intersting :)

It is quite the game changer. Im going to wrap some BTC soon and collateralize it. Will report back with my experience

Posted Using LeoFinance

By the way, we can also "mint" our hive version of the BTC on hive-engine but probably because of the 1% deposit/withdraw fee almost no one uses it. Do you think it have an use case on Hive? Maybe if we could borrow BTC with Hive (and the other way around) with over collateralized loans it would be more useful. But then it a service that would run this would be still a centralized one... maybe multi-sig can help here? Just some thoughts :)

Are you talking about the BTCP on HE? If so, I think it’s unused because of two main reasons: it’s not really backed with bitcoin (AFAIK) and also because the trading is inefficient.

I have been playing around with various collateralized loan products and creating models that could work on hive. We could likely have a multi-sig of some sort, although I wonder what kind of flaws it would expose.

Alternatively, a multi-Level custodial option is more interesting to me. Again, such a system isn’t perfect but if it works for wBTC, then it would work for hive imo

Posted Using LeoFinance

Hope you'll write something about it soon :) How it could be applied on Hive.

Check this @cardboard.

https://peakd.com/hbd/@edicted/hbd-the-ultimate-stable-coin

@edicted thought about a system like MakerDao to leverage our HBD.

If you didn't checked, it's worth a read. It would be awesome to have something like this on HIVE.

Posted Using LeoFinance

Thanks! I've seen it but it's good to remind myself about the idea :) Still, this would require changing the blockchain code and I was thinking about a dapp that can work without hardforks etc.

I just read what you did with reward.app, definitively we need more devs like you.

I also saw the tip which you sent to me! wow, it caught me by surprise! I wanted to say thank you & to give back half of the tip. There's others who need it much more than me.

Thank you!

I think things like LBTC and WBTC are what make the crypto market so cool, BTC is not going to change shit, it does what it does. Eth is more like a sandbox for experimentation, BTC provides the collateral and they can build various de-fi options and experiment.

The best ideas I feel will eventually be absorbed into things like Liquid and Lightning network. While LN continues to grow as more nodes come online focusing on just payments for now, ETH will provide use cases to improve it once is fully operational.