FUT - Fear, Uncertainty & Tether

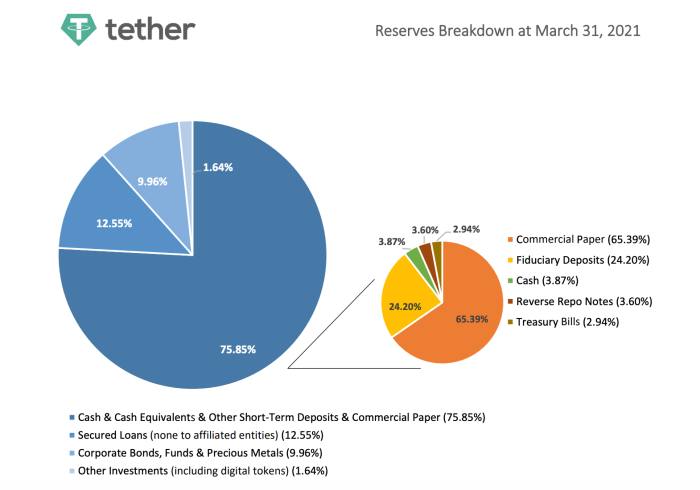

Tether FUD is spreading again among some crypto groups as usual. Even though the company could support their claims and eliminated the previous speculations, it looks like people are not satisfied with the division of the reseverves by the company.

While people hold stable coins to minimize risk that is being taken by holding their money in crypto, to what extent are we secure with the stable coins? This is the question that pushes us to re-consider our decisions...

People speculate about the possible side-effects of Tether cases. While there are softs and bearable ones, the majority of scenarios are terrible for crypto ecosystem. The most terrifying projection being made is that Tether has been dominating the market with a limited amount of liquid USD, any FUD case may push individuals to withdraw their USD from the exchanges but the existing amount of USDT would never be enough for payments. Thus, a systematic problem is likely to be triggered.

The unadequate amount of "liquid" Tether-backed USD may give birth to suspension of withdrawals; the Tether FUD may end up with a fear of central exchanges and the blockchains, which are going to be used to take the risky money from exchanges, may reach ATH transactions with incredibly high fees. Such a case will be devastating for the crypto ecosystem. Relying on Tether as the major stable coin is risky when we check the collaterals published by the company.

Stabilizing the risk

To cope with the risks that are likely to happen again again, I mostly use other stable coins. In terms of stablecoins, the policy makers are more welcoming compared to crypto assets. Thus, I do not find highly risky to have a portion of centralized stable coins as a part of my portfolio.

USDC by Circle is one of the most appreciated stablecoin among the counterparties. As the associations of Circle is strong enough to gain popularity, the coin is seen the most suitable one to be fully regulated. Even it would not be surprising to see that the coin would go beyond the limits of crypto ecosystem by developing new products for real-life use cases. If I'm supposed to use a centralized stable coin, I'm up for USDC.

DAI as the most popular Decentralized Option

When it comes to decentralized options, DAI as a well-collateralized shines bright enough to grab our attention. Since DAI is mostly preferred by crypto enthusiasts who again totally again any centralized solutions, it is by far the most valued decentralized stable coin. The minor problems with DAI are directly related to the transaction fees to be paid and the collateral liquidation thresholds for DAI minters. Apart from these tiny details, DAI is precious 🤩

USDN through Waves Blockchain

One last option that I adore using is USDN by Waves. It's fully backed by Waves coin and the perfect algorithm behind it. To be able to mint/create USDN, you are locking your Waves coins according to a specific ratio that is served by DAO. As the transactions in Waves ecosystem is always 0.003, USDN is a nice option for those who want to use Waves blockchain.

If you decide to explore Waves ecosystem, I can suggest you to check the way USDN, NSBT and Waves staking works as a mini ecosystem. The way the elements of Waves ecosystem feeds one another can be inspiring for you 😎

Here is an interesting video on Twitter and the flood in replies.

https://twitter.com/AshxBanterCity/status/1407928990560567297

As the adoption of crypto into our lives accelerates, the risks of unfriendly policies become more likely. As an investor, I'm not willing to play the game in a high risk in all branches. Especially when I go stable, I want to take the least risks to have a clearer vision for future investment strategies. In that sense, Tether has an unorthodox role among the others. So that I can feel safer, I try to put my money on a bit safer options. At that point, USDC as a central option and DAI & USDN (Waves ecosystem) are the options that I rely on. I'm tired of feeling tense whenever I read FUD news related to Tether. This is the major reason that pushes me to find other options that make me feel securer.

What about you?

Do you go for Tether or is there any other option that you count on?

Posted Using LeoFinance Beta

I mostly only use Tether when it comes to transactions, I like DAI but most of my stables are HBD lol then a little in BUSD...

Posted Using LeoFinance Beta

Btw I forget about BUSD... Mate it might be high time to move to other options 😌

Hopefully the upcoming hardfork fixes the HBD peg to a better extent then I might just stay but if it doesn’t then we move

Posted Using LeoFinance Beta