How you can Use Smart Contracts For Revenue Sharing

What is revenue sharing and how its plan of action functions?

It's practically similar to sharing your compensation with your family toward the month's end.

Revenue sharing is a dispersion of benefit (and misfortunes) in the midst of the partners, business collusions or even the workers of an association.

Despite the fact that it was promoted as of late on the web as a feature of offshoot showcasing and publicizing programs, revenue sharing has been around for long. It is utilized in pretty much every industry including government, innovation, media, sports, energy, speculations, diversion, neighborliness, and so on

With the idea of sharing economy tipped to be our future, revenue sharing is getting more openness.

How one can really apply it?

Choices are monstrous.

In government, for example, one of the uses of revenue sharing is found in charge income sharing among various units of government. For instance, states or provinces sharing assessment revenue with nearby governments or national governments.

In diversion, one of the uses of revenue sharing is found in how music administrations, like Spotify for example, share the revenue they produce from their music real time features with specialists.

In sports, classes overseeing bodies and the groups in the alliance share revenue created from neighborhood and public TV rights.

In contributing, revenue sharing is utilized to remunerate financial backers as profits or benefit sharing.

Are there any difficulties in this plan of action?

Straightforwardness, security and speed.

It is hard to list the current difficulties of the revenue sharing plan of action, as every industry has its own, mostly in light of the fact that the fundamental organizations are diverse in arrangement. For example, music-real time features that group tunes into one contribution experience the issue of how to designate the revenue to every melody in the pack. In sports, inventive bookkeeping can be utilized make an unevenness in revenue sharing because of such a large number of gatherings associated with the approval interaction.

Nonetheless, glancing through every one of the grumblings in regards to revenue sharing across enterprises, it's not difficult to sum up the difficulties they face under these subjects: straightforwardness, speed and security (i.e., confirmation of installment).

Blockchain innovation has a cure to the difficulties inborn in the revenue sharing plan of action: smart contracts.

How could smart contracts help?

Smart contracts guarantee exact revenue sharing progressively.

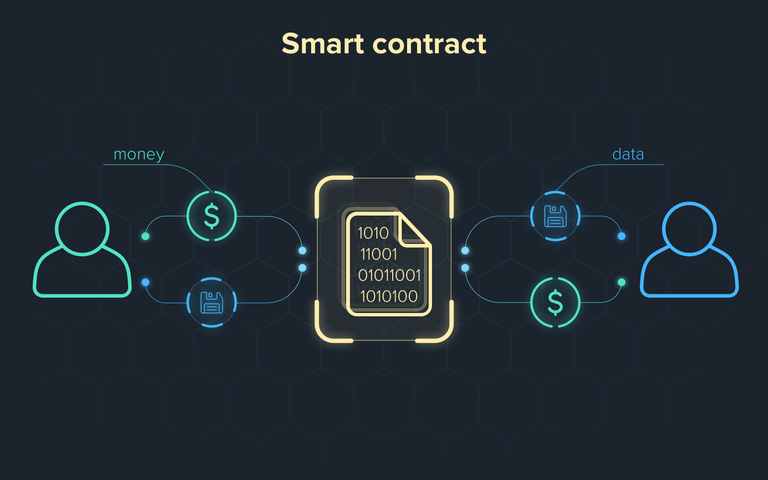

As a brisk update, a smart agreement is an arrangement, fueled by Blockchain innovation, put out as a PC program and executed once all pre-decided and customized terms and conditions are fulfilled. At its center, the smart agreement convention expects to make contracts safer, disintermediated, executed continuously and more straightforward, which are the specific difficulties with the revenue sharing plan of action.

Furthermore, shouldn't something be said about straightforwardness in revenue sharing?

That's right, this as well.

Consider a speculation opportunity where you contribute, say, 10 BTC esteemed at about $140,000 for a 10 percent possession in the endeavor. This chance additionally gives you the privilege to 10 percent of the revenue or $0.10 on the dollar. Prior to now, you put away your cash and expectation/believe that the business will respect the details of the agreement.

Nonetheless, with a smart agreement, you can be certain that you will get your right portion of the revenue. Everything necessary is to embed these terms into a smart agreement. When the revenue streams in, the smart agreement will be executed, promptly moving 10% of the revenue to your wallet. Xwin, a Blockchain-controlled games wagering startup, is one of the organizations intending to utilize smart agreement to improve revenue sharing straightforwardness.

Can smart contracts make revenue sharing secure?

How about we see.

Since smart contracts depend on Blockchain innovation, which is a public record that is kept up by various gatherings all the while, smart contracts can't be changed. Consequently, up to a smart agreement is started, no single gathering can choose to modify it. A smart agreement must be suspended or adjusted if all gatherings concur. Strangely, this degree of safety is accomplished without the requirement for a delegate, which has its own expense.

Furthermore, speed of execution, any enhancements there?

All things considered, we've referenced the continuous cycle.

However, that is not all. One other speed advantage is that with smart agreement, you could have faster admittance to yield's from your speculation, perhaps on week after week or even month to month premise, as long as the smart agreement contains such statement. It is exorbitant for this level adaptability to exist with conventional revenue sharing model since it would require non-center managerial exercises time and again.

Posted Using LeoFinance Beta