Should I? Shouldn't I?

The rise in defi adoption (or rather the locked funds in their smart contracts) is probably the greatest thing that happened to crypto sphere in 2020, and it's continuing this year as well.

Leading in the world of defi are platforms built on Ethereum smart contracts. But since nothing is perfect, gas fees make usage of these platforms prohibitive to most people.

Where there's a problem, there is at least a solution. Most of the times anyway! So other blockchains come from behind with lower fees.

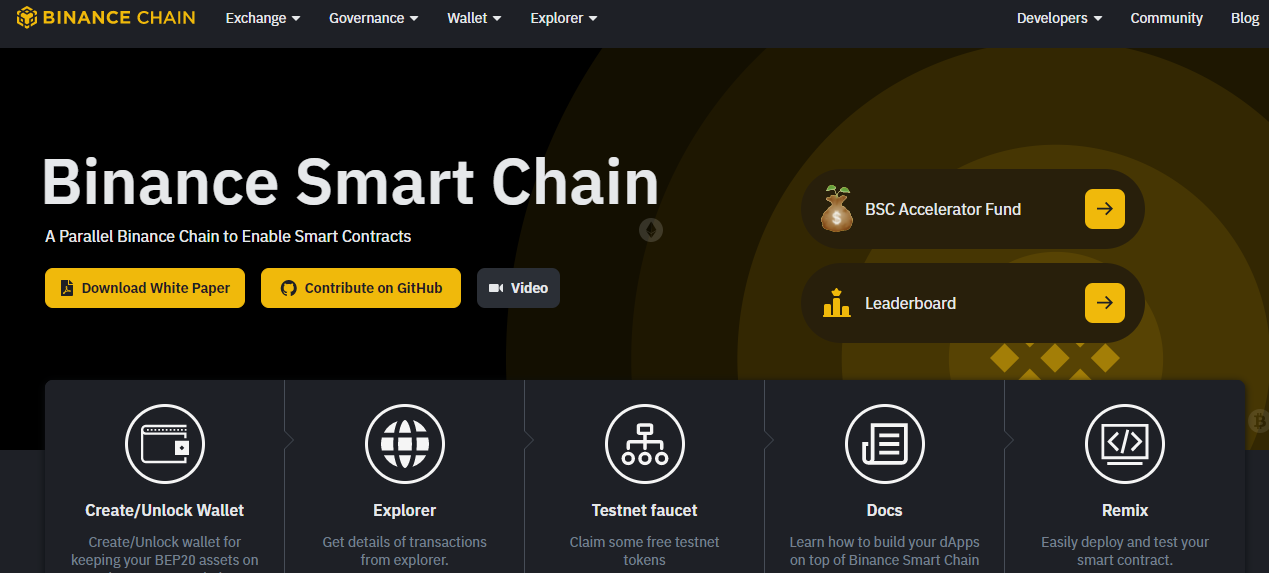

From what I read recently, the fees on Binance Smart Chain (BSC) are about x10 less than on Ethereum, if not more at times. The drawback: BSC is centralized.

If you can live with that (or simply out of alternatives), BSC may be a solution to access defi-like platforms offering impressive, maybe even outrageus returns.

With its risks, of course. I believe everyone who has taken at least a marginal interest in defi knows by now about the risk of smart contract code bugs, as well as impermanent loss. And if you are interested in defi for its decentralized aspect, then BSC comes with its own risk here: it's only theoretically decentralized.

But that's why there is such a thing as a risk-reward factor: the higher the risk, the better the reward.

Personally I haven't used defi platforms on Ethereum because I found gas fees unnacceptable high. For my budget at least.

With BSC, there's a different story. The fees aren't so high, even for my budget.

With that issue out of the way, should I or shouldn't I plundge into a platform that runs on BSC?

That is a question I keep asking myself.

There is also the risk-reward factor. Am I ok to seriously elevate the risk for a significant portion of my portfolio to access those insane rewards? At the moment I'm leaning towards no.

I hear Leo will very soon come to BSC as bLeo. That may play a role in my final decision or not.

Soon there will also be LeoFi, where some of my staked LEO can be put to work. And at zero fees, probably.

The physical world has been on the verge of collapse for a while now and keeps getting cosmetized until that won't work anymore. I don't feel like taking more risks under these circumstances. But that's just me and my risk tolerance. And everyone has their own apetite for risk.

Posted Using LeoFinance Beta

I do not want to participate in the Binance Smart Chain - one fine moment you will not be able to withdraw funds, and when this is possible it will no longer make sense - I do not believe in centralized services and I do not recommend you!

Posted Using LeoFinance Beta

Well, if we only remember the Binance - Steem - JS episode, that gives you every reason to think like that.

Defi became a buzz word and is often used where cefi should be used.

Posted Using LeoFinance Beta

I truly can relate with you view point, I so much feel like partaking on the DeFi projects on Ethereum but the gas fees are just way too much for me. As for BSC I am unsure of that.

Posted Using LeoFinance Beta

Yeah, Ethereum defi feels like an exclusive game. At least before Ethereum switches completely to PoS, but by then it probably won't matter because everyone will have defi and likely there will be blockchain interoperability.

Posted Using LeoFinance Beta

If LEO gets to Binance expect a $10 LEO pretty soon. Interesting to see how Leofi will be. I haven't yet provided liquidity for any pool. I am invested in UNI though. So far it has never been down for one second.

Posted Using LeoFinance Beta

Well, Khal said that code for bLeo is ready and asked for advice about what platform he should list bLeo on. :)

When I saw the move you made for UNI I thought it was a bit extreme considering the percent, but turned out great so far for you.

Posted Using LeoFinance Beta

UNI is a great investment imo. From all the DEXs seems to have been the most reliable ones so far.

Posted Using LeoFinance Beta

Yeah, I missed that train. Should have invested some in it as well. Although it still has potential to grow.

Posted Using LeoFinance Beta

There are many Ethereum alternatives out there which aren't as centralized. I'm going to try out Solana, which is developing new scaling technology rather than copying a 6 year old concept. Meanwhile, not being able to touch my pools and deposits on Ethereum helps me to hodl.

Thanks for the pointers! I was looking at BSC because I have some BNB and others before me presented several options on BSC. I'd like to move to more decentralized options, but I discover by the day that I'm not such an early investor. Not as I used to be anyway. These days I'd rather protect my investment than take risks for much higher returns. Time will come for me to take the plunge!

I've gone in with 5% of my crypto assets - which is precisely what I did with FIAT to crypto in 2017.

Just in case it all goes 'pop'!

One has to remember there are risks!

Posted Using LeoFinance Beta

That's smart! 5% of my crypto assets wouldn't amount to much. The liquid ones at least. That's one of the main reasons I can't balance risk-reward as I want to.

EDIT: And I don't want to sell the little BTC and ETH I have.

Posted Using LeoFinance Beta