Data shows: The liquidity that SushiSwap grabs actually makes Uniswap stronger

It is generally believed that SushiSwap has drawn liquidity from Uniswap, but new data from Flipside Crypto, an analytical resource on the cryptocurrency chain, shows that the launch mechanism of the decentralized exchange actually benefits Uniswap because it injects new funds into its liquidity Pool.

On August 28, SushiSwap declared that it'd launch its own decentralized exchange. Many in the DeFi community called the project a "vampire mining attack." After forking from Uniswap (the most popular decentralized exchange in the field), SushiSwap has created an incentive structure that allows users to switch to their protocol by issuing SUSHI tokens as rewards.

In order to facilitate transactions, if users who provide liquidity to certain Uniswap pools choose to migrate to the platform on September 8, they will receive SUSHI as a reward.

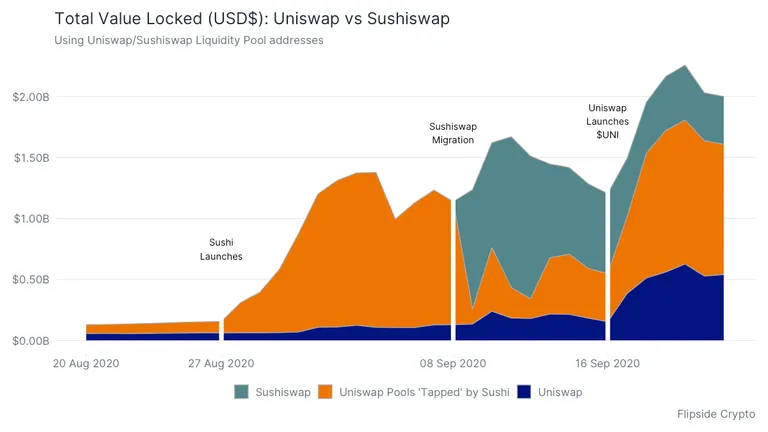

As of September 9, more than $800 million in liquidity has been transferred to SushiSwap, and the total value locked by Uniswap is more than $400 million.

SushiSwap helped Uniswap inadvertently

Although SushiSwap has a bad reputation due to its launch strategy and other incidents, such as its chief developer Chef Nomi, which sold $14 million worth of SUSHI tokens on the spot market, this project seems to actually be beneficial to Uniswap .

The split between the two exchanges eventually brought new liquidity and forced the project to launch its own token to remain competitive.

According to Flipside Crypto, most of the liquidity that entered Uniswap during the launch of SushiSwap appeared to come from new users and additional funds deposited into the liquidity pool for SUSHI rewards.

Initially, liquidity providers who chose to migrate may be impressed by the strong performance of SUSHI tokens, but Chef Nomi unexpectedly negatively affected the price. A few weeks later, Uniswap's UNI token was launched, and the exchange gained all this new liquidity.

Locked total value (USD): Uniswap and SushiSwap Source: Flipside Crypto

Locked total value (USD): Uniswap and SushiSwap Source: Flipside Crypto

Since the launch of UNI on September 16, Uniswap's liquidity has increased significantly. According to Defipulse's data, the total value of lock-in soared from US$786 million to US$2.09 billion, an increase of 165%. At the same time, the total value locked by SushiSwap fell 46%, from US$754 million to US$402 million.

The way UNI is launched may also lead to an increase in capital inflows into its liquidity pool. Uniswap unexpectedly distributed 400 UNI tokens to users who provided liquidity before September 1. Most recipients may exchange UNI tokens for Ethereum, or use these funds for other asset pools listed for Uniswap Provide liquidity.

SushiSwap may be a bit sluggish

Despite the controversy, SushiSwap achieved short-term success. However, the red flags mentioned above seem to undermine the confidence of the DeFi community in the project.

Although Chef Nomi returned $14 million in Ethereum, and the project was taken over by Bankman-Fried, CEO of FTX Exchange, DEX trading volume continued to decline.

These problems, combined with the current sluggish altcoin market, caused the price of SUSHI to fall from its historical high of $9.85 on September 1 to $1.24 a month after its launch. At the same time, UNI's transaction price is approximately US$4.34, which has fallen by approximately 76% from its all-time high of US$7.66.

Given that governance tokens are not used to add value, and the tokens have limited use cases beyond liquidity mining and providing voting rights to certain holders, it is not clear whether they will follow the steps of their vampire cloning.

Source

There is reasonable evidence that this article has been spun, rewritten, or reworded. Posting such content is considered plagiarism and/or fraud.

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.