A Look At Polygon/Matic Data | Number of wallets, transactions, fees, contracts

Polygon (Previously Matic), has been the second Ethereum compatible chain after BSC that has taken off in the last period. Its grow has been quite notable in the last few months.

Since recently they have made the block explorer compatible to etherscan as well pushing the standard in this direction. https://polygonscan.com,

Let’s take a look at the data on the Polygon network and see what has been happening in the last period.

The data presented here is mainly from etherscan charts.

We will be looking at:

- Number of Addresses

- Active Addresses

- Daily Transactions

- Fees

- Contracts

The period that we are looking into is from the beginning of 2021, with a close lookup on the last months.

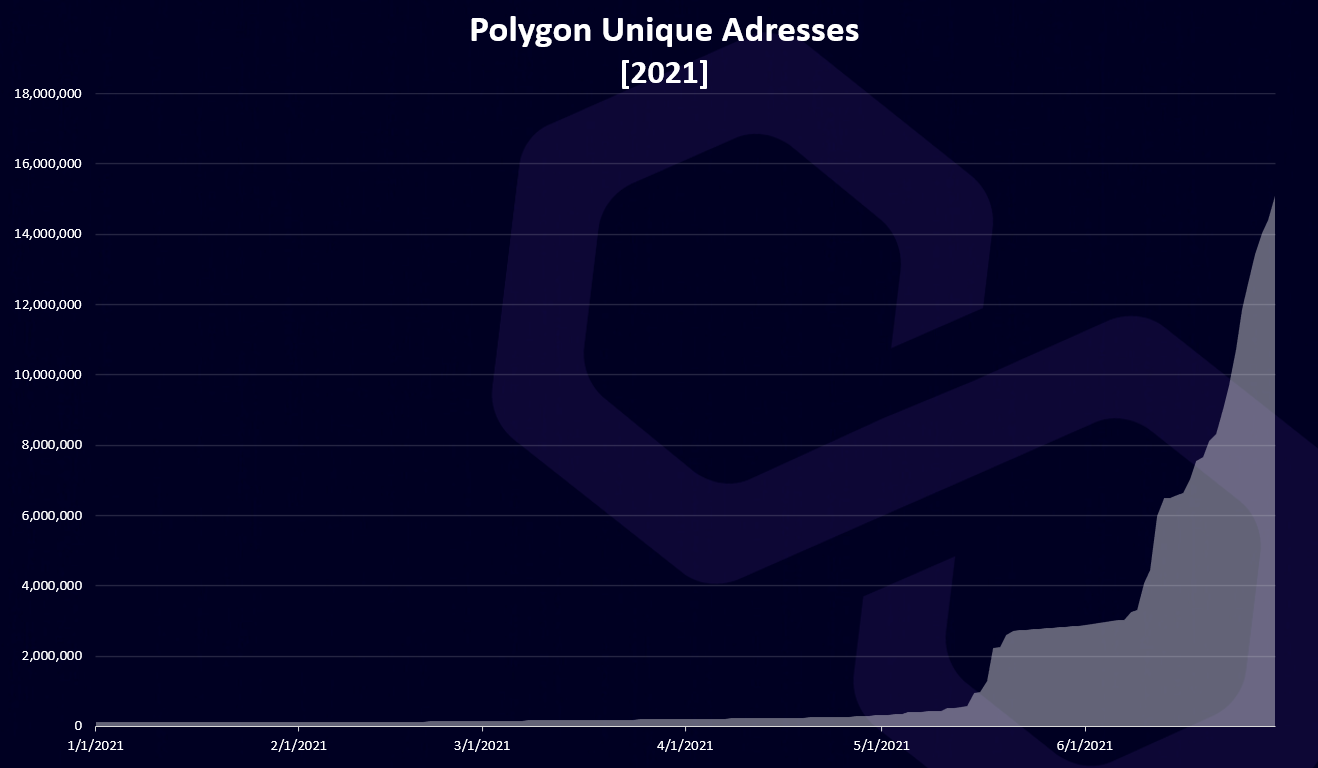

Number Of Addresses

One of the key metrics for crypto projects is the number of wallets.

First the overall number of wallets.

As we see from the chart the number of addresses increased a lot in the last two months, May and June. It has gone a lot in June especially. This is quite interesting since these two months has not very good in terms of crypto prices. Once when the market turns the growth can be even larger.

At the end of June Polygon has 15M wallets. For comparison Ethereum has more than 160M, and Bitcoin is around 74M.

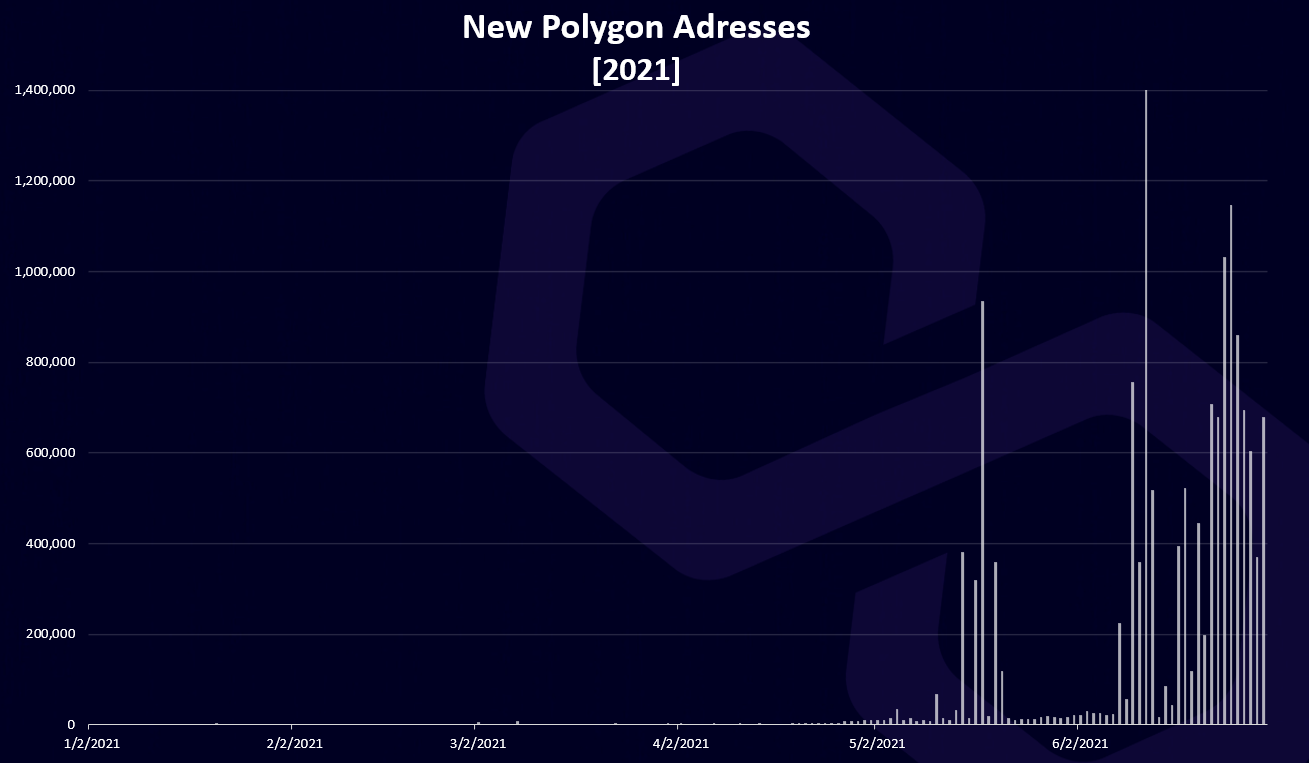

If we take a look at the new daily wallets we get this.

A similar pattern as the overall numbers of wallets, since most of it was created in May and June. A lot of spikes here, so can not determine some regular pattern.

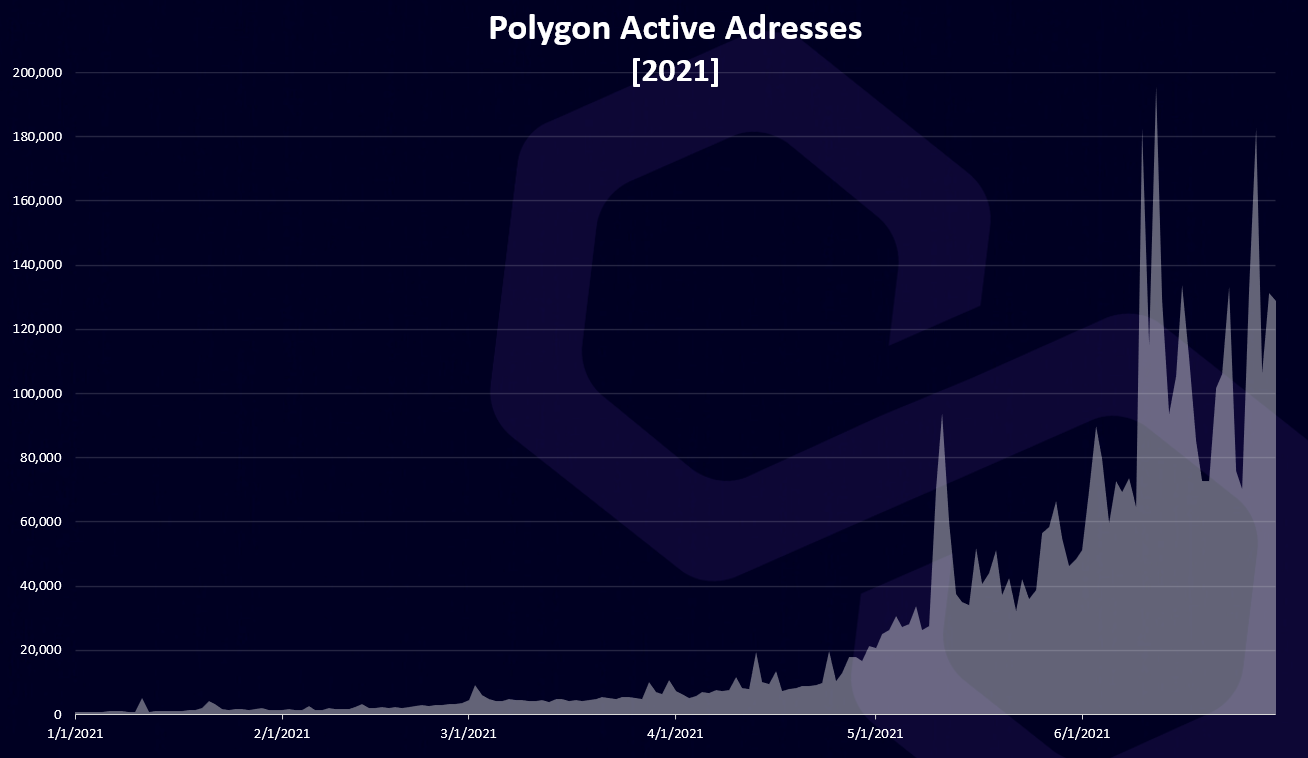

Active Addresses

What’s more interesting in times like this is how many wallets are transacting. Volatility should increase the numbers of active wallets. How many of those 15M addresses are actually active?

A steady growth in the number of active wallets here. At the end of June there is around 120k active wallets per day although this number has been up to 180k.

ThIn the same period Ethereum has been around 500k active daily wallets.

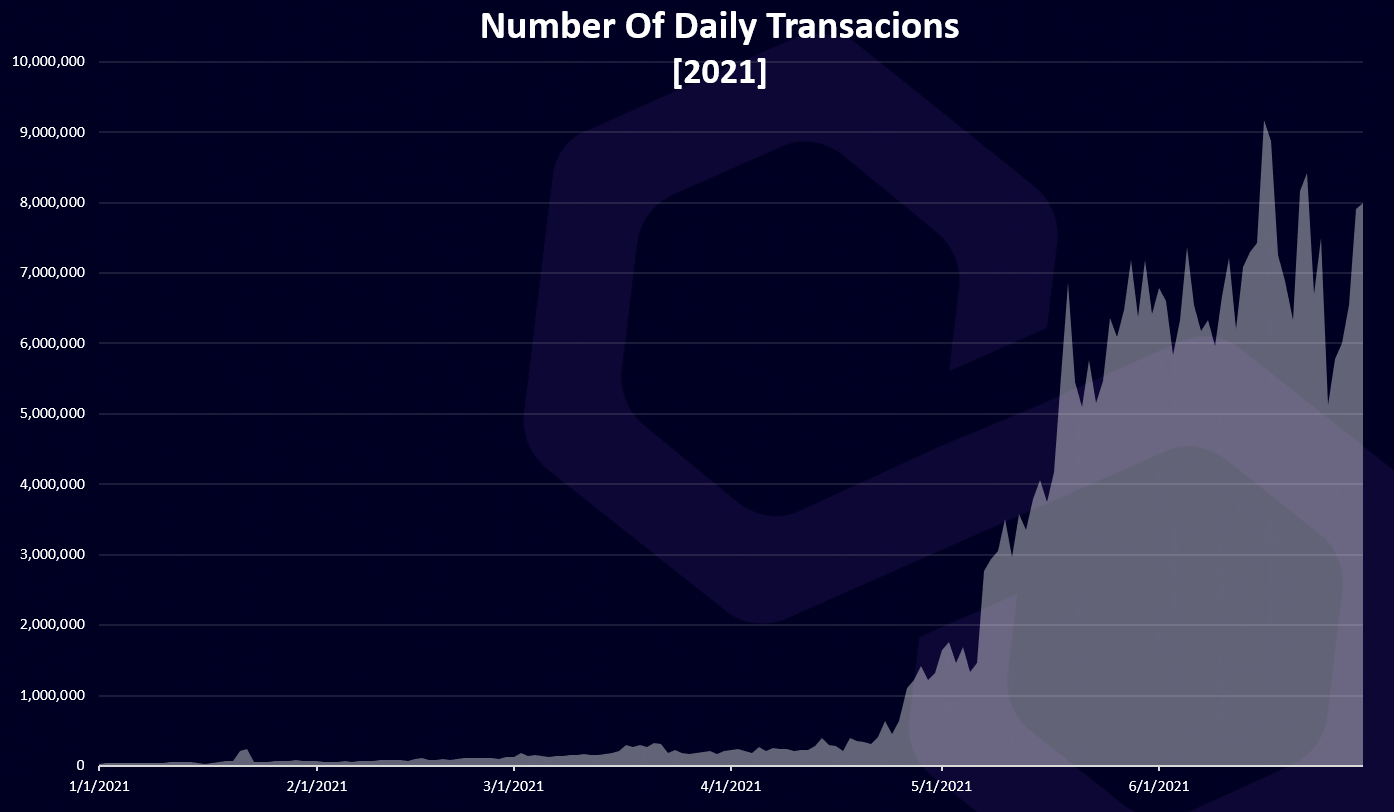

Daily Transactions

The activity on the network is mostly represented by the number of daily transactions.

A nice growth here and then a sort of peak and flattening out, although its to early.

The ATH in the number of daily transaction has been 9M and then going back to the range of 7M to 8M. Again for comparison, ETH has been around 1.2M in the period.

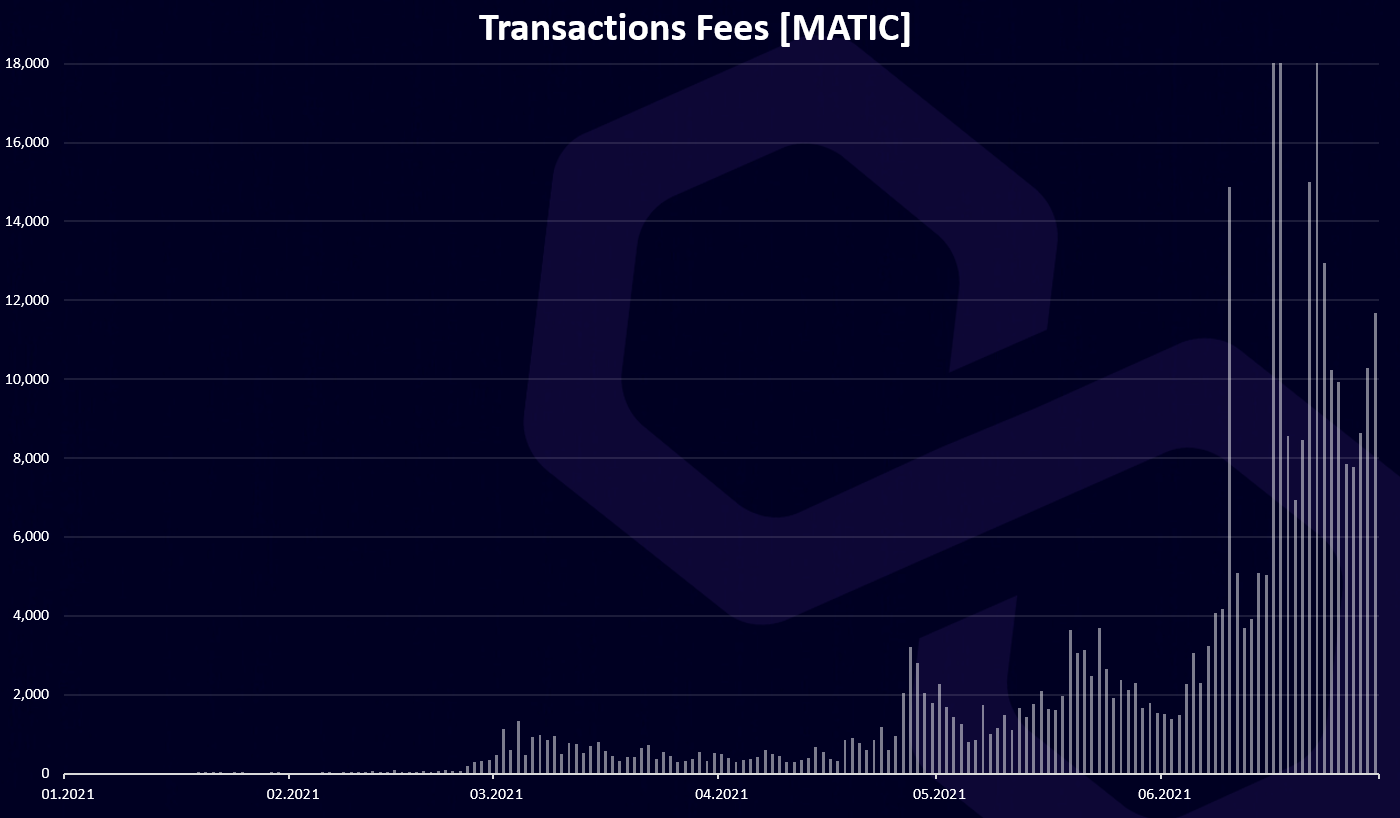

Fees

Polygon is know for its very low fees, that has been the lowest in the industry to under one cent, lower then BSC. Here is the chart.

The above are the total daily fees in MATIC. As we can see that in the last period the fees has been in the range of 10k to 20k MATIC per day, that when converted to USD is around the same amount or a bit more for a MATIC at 1$. For comparison ETH has a total of daily fees in millions of dollars for a smaller number of transactions.

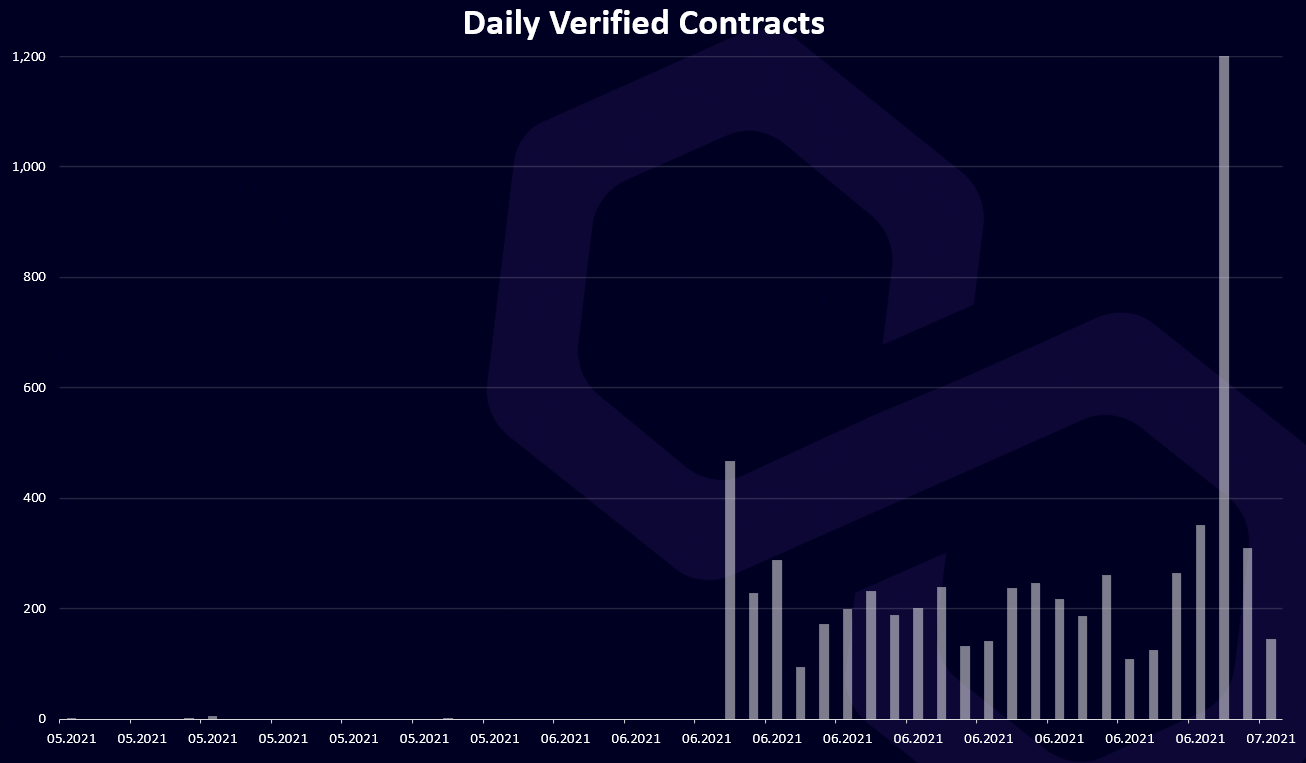

Contracts

Polygon as Ethereum is a smart contract platform so here is the chart for verified contracts per day.

There seems to be missing some data in the block explorer for the contracts, but we can see that there was around 200 verified contracts per day, with a huge spike at the beginning of June, and then back to the few hundreds verified contracts per day.

Overall, we can see an explosive growth for Polygon in terms of active wallets and transactions in the last period. A lot of Ethereum and BSC dapps have made or are in the process of making a Polygon compatible version of their app. Polygon has been a new land for growth and expand for a lot of apps, and some ETH only projects have made their version on it, like Aave and Curve.

There are more apps that are in the process of building and will be releasing their version soon. The fees on Polygon have been extremely low and the compatibility with ETH and the usage of Metamask has done its thing.

One thing to think about is the level of centralization of Polygon since it is a PoS chain. Some are suggesting that it is even more centralized then BSC, but that is a topic for another post. Also usually it is hard to allocate who own the coins.

All the best

@dalz

Posted Using LeoFinance Beta

https://twitter.com/Dalz19631657/status/1410952576326111234

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken.

I wonder how would ETH2.0 effect those chains that are supposed to cut on Ethereum fees.

I much rather develop on Ethereum, even though it is more expensive, because things work more intuitively.

The only reason I have discussed the possibility of deploying something on Matic was when considering the fees, but we kept with Ethereum because of the ecosystem (bridges are bridges, native is always better)

I was thinking about this as well, but as we can see now eth fees are a bit lower, and polygon and bsc still keep their momentum ... Overall I think we are very early in the game and their will be enough space to grow for a lot of chains.

If those other chains adopt sharding and those strategies Ethereum will adopt it will be mind blowing! I know I may be dreaming too much, but using those chains would eventually become almost free! The future looks awesome

PS: would be great if Hive devs also took a look about how could Hive escale that much too and what could we learn from them.

I am a dev but I only code applications (mostly in Javascript), never worked on a protocol/infrastructure level, so I am a bit lost trying to figure out how can I help over here

How about developing on the Steem/Hive blockchain? There are no transaction fees on these blockchains, although I do not know how intuitively the things works, compared to Ethereum.

I am trying to learn how hive-engine works but so far it seems:

Read the Solidity Vs hive-engine documentation and you will see that Solidity goes in depth with many many examples and details for each and every function or variable in regards to what it does, how it does, what it receives, what it spells or behaves etc, everything is very well documented on Ethereum… It even gets repetitive after years reviewing the documentation.

Now we do check the hive-engine docs and it has half a page of an overview about the system and the contracts…

I am an app developer, not as infrastructure/protocol dev (I would like to work on infra and protocols, but need someone to “adopt” and teach me, please!), so I need documentation and software to work and to explain what why and how it works so I just assemble it (and turing complete, for that matter), it is hard to work when things are not clear.

That said, if you or someone reading this knows about Hive-Engine, or any other smart contract on Hive or at least deeply understood the docs and is willling to share, I thank you very very much, please, do help.

The path to follow to get started is unclear thus some tips, links and guidance would be very very welcome!

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 100000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Amazing growth. I guess that's what happens when you lower the barrier to entry.

Posted Using LeoFinance Beta

Yep, I just wonder, why it didnt happen earlier ... was bsc like a proof of concept or something

Posted Using LeoFinance Beta

Yeah there's definitely a chicken and egg thing going on. These EVMs need users to attract platforms to attract capital to attract users....

Posted Using LeoFinance Beta