A Look At FEI | The New Innovative DeFi Stablecoin With Billions In Liquidity

I have posted about stablecoins before in terms of their growth and how they work:

Stablecoins are a very interesting and important topic in the crypto world. Having a token pegged to the USD (usually) give it all the functionality that crypto has to offer and the stability and the convenience of the dollar.

In the past, these USD pegged tokens were mainly used for trading. Now with the growth of DeFi their use case has even wider spectrum, like farming with stablecoins. A specialized stablecoins defi platforms have already emerged like curve.finance on Ethereum and ellipsis.finance on BSC with billions in TVL.

At the moment stablecoins have a market cap of more than 60B now.

Stablecoins can be categorized as:

- Collateralized

- Non-collateralized stablecoins.

The most popular collateralized stablecoins are USDT, USDC, DAI, BUSD.

USDT, USDC, BUSD are centrally controlled and issued tokens, pegged to the dollar with an equal amount in dollars in the bank. It’s a 1:1 ratio. These types of token are fiat collateralized.

DAI is different as it uses crypto assets as collateral (crypto collateralized), and because crypto is volatile it has more than 1:1 ratio in collateral, usually somewhere around 3:1. It is also a decentralized protocol for creating stablecoins, and everyone can go on the ETH network and mint DAI by depositing crypto asset.

The non-collateralized stablecoins or algorithmic stablecoins use algorithms to control the supply and the demand, and maintain the peg in this way, similar to central banks. These tokens usually have elastic/changing supply and a multi token economy with shares and bonds. They literally change the amount of tokens you hold in your wallet. In most cases these tokens are known as Seigniorage tokens. An example is Basis, bDollar etc. Until now they haven’t reached a wide adoption in crypto yet.

Enter FEI

At the moment of writing this FEI has 1.7 billions in market cap and a 2 billions liquidity pool on Uniswap. The FEI-ETH pair is the number one pair on Uniswap at the moment.

The elegance of DeFi is the ability to offer the best possible financial solution in every category. But users today are forced to choose between frustrating options when looking for a decentralized stablecoin. On one side, there are bloated, debt-fueled overcollateralized stablecoins that cannot scale to meet demand. On the other are algorithmic stablecoins that fuel volatility and continuously centralize rewards in the hands of the earliest holders. To truly build DeFi’s vision of global interoperable financial access, there needs to be a decentralized, fair, liquid, and scalable stablecoin that exhibits a high fidelity peg.

FEI claims that stablecoins have a lot of room for improvement. On one side we have the fiat-collateralized, centrally controlled tokens, that have inherent risk of single point of failure and regulatory risks as well.

The decentralized crypto options DAI is capital inefficient, locking a lot of capital in, and just a fraction of it being used. The algorithmic stablecoins like BDO, are volatile and in favor of the earliest adopters.

Ultimately a stablecoin needs a lot of liquidity at the 1$, buying and selling orders. Its just a question how to achieve this.

To achieve this the FEI protocol uses something called direct incentives.

Upper price limit

The way that FEI limit the price on the upside to 1$ is by constantly selling the FEI token for a 1$ price by its contract. What this means there is unlimited supply of the FEI token for a 1$ price. Whenever someone want to but at 1$ they can do it from the house.

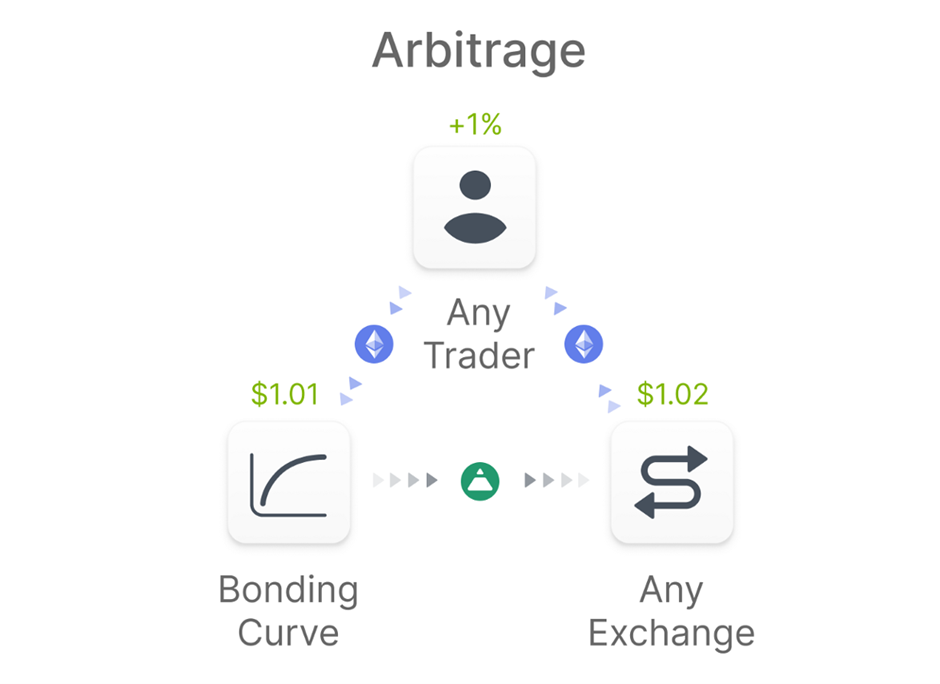

What this means that if on some exchange/market, the price of FEI is above 1$, this is an opportunity for traders, to buy from the house and sell on that market, bringing the price down to 1$.

The FEI protocol has this bonding curve, for tokens sales. What this means is when the token starts, there is a period where the token can be bought under 1$ in order to boost liquidity. I think for the ETH bonding curve this limit was 250M tokens. After this the token reaches the 1$ and the sale price is close to the dollar.

At the moment only ETH is accepted for buying the token for the house and there is only one bonding curve.

Users that have bought tokens, can’t sell them at the price of the bonding curve, but at the market price. We will go in this bellow.

For now, this part seems easy. Having an unlimited supply at the one dollar price. As long as there is demand new tokens will be minted and sold by the protocol at the fixed price of one dollar.

The tricky part comes how to maintain the one dollar price. What prevents users from selling lower than one dollar? Especially the ones that bough in very early under the dollar mark?

Low price limit

Here comes the direct incentives method:

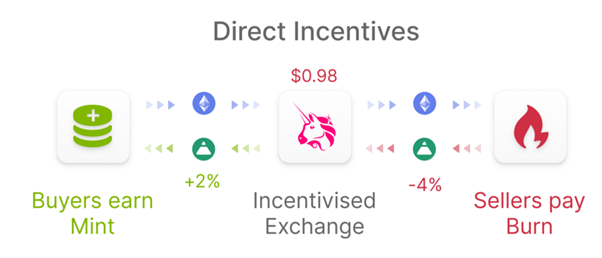

A direct incentive stablecoin is one in which both the trading activity and usage of the stablecoin are incentivized, where rewards and penalties drive the price towards the peg. In general this would include at least one incentivized exchange acting as a hub. All other exchanges and secondary markets can arbitrage with the incentivized exchanges. This helps maintain the peg throughout the ecosystem. Fei Protocol achieves this goal by incentivizing Uniswap trading volume with mints and burns.

The protocol uses penalty and rewards to incentivize the trading on Uniswap at the one dollar mark. What this means if the price of the token is under one dollar, when someone sells they will penalized and will receive smaller amounts for the sale. A share of the tokens is being burnt in the process.

For example, if the price of the token is 0.8$, if you sell you will get ETH for the value of the token at 0.6$. These are not exact number just example. If the price of the tokens drop very low, the penalty can be as high as 100%, basically making your tokens worthless and unable to sell.

At the same time if you buy when the value of the token is under one dollar you will be rewarded. Like if the price of the token is 0.8$ and you buy in, you will get more tokens on you buy. This extra amount of tokens is minted from the protocol.

A sort of carrot and a stick approach 😊.

Protocol Controlled Value

To achieve the direct incentives mentioned above the FEI protocol uses something called protocol controlled value PCV in short. It is their replacement of the Total Locked Value TVL.

You might be wondering where all the ETH from selling FEI goes? Remember there is unlimited supply of FEI at the one dollar mark, and there is already 1.7 billions worth of FEI.

The answer, where all the ETH from selling FEI goes, is the PCV.

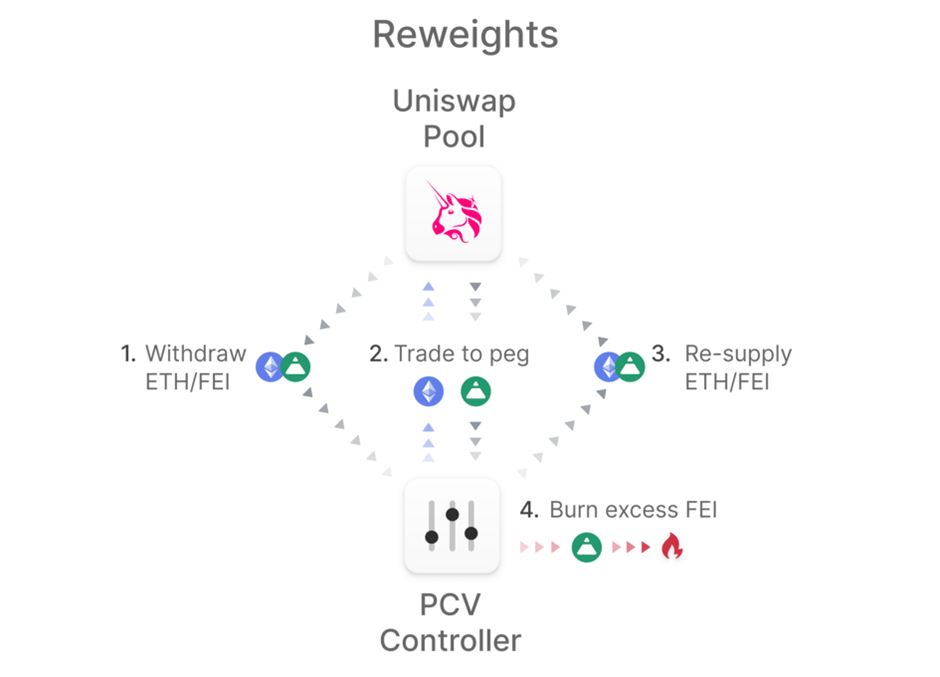

The way that the FEI protocol works is when the ETH is received from selling FEI, it mints the matching amount of FEI and instantly provides liquidity on the Uniswap pool. What this means is that for every FEI token sold, another is minted and added in the pool, basically doubling the supply.

Also unlike DAI, where users can return the debt and unlock the collateral, basically give the DAI back, once FEI is minted there is no way to give it back to the protocol, meaning the protocol keeps growing its PCV. The only way for a user to get rid of FEI is by selling it on the market, not by removing it from circulation.

Except for the providing liquidity, the PCV is used to incentivize the Uniswap pool with the burns and mints for the buying and selling under the dollar peg.

Here is how it work.

It basically adds and removes ETH/FEI liquidity based on the trading activity. In ideal situation (1:1), example 2 on the image, it trades directly from Uniswap to the PCV controller.

Governance Token TRIBE

The FEI protocol has a governance token called TRIBE. It is similar as the MAKER token for the DAI. It will control some aspects of the protocol as adding new tokens with which FEI can be bought, set the direct incentives, adjust PCV allocation, staking rewards etc.

You can stake a FEI-TRIBE liquidity to earn the TRIBE token.

Troubles in paradise?

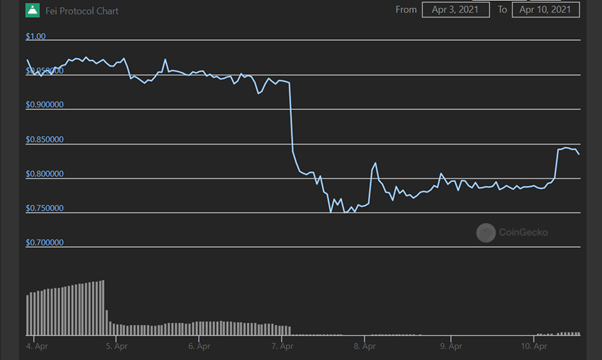

If you check the FEI-ETH pair on Uniswap you can notice that at the moment FEI is being traded around 0.8$. Not exactly the 1$ peg. When started the FEI price has dropped even lower, going under 0.7$ for a brief moment.

My guess is that this happened mostly because of the lower token sale for the first 250M tokens. The ones that bough for 0.5 for example, are happy to sell for 0.7$$. I’m not sure how exactly the bonding curve worked, and what were the price at start, as they have been bought very fast, I guess.

Having a lower price at start is a double-edged sword, as it serves to boost liquidity fast, but then at the same time attracts users who are for the quick profit and can bring a bad light for the project.

Also, we should be aware that this is a totally new and experimenting project for a new type of stablecoin. Trying out new stuff always brings risks.

Looks like the price have reached some stability now and its slowly claiming to the peg. Will be interesting will the direct incentives coupled with the PCV reach their goal and bring the price to a one dollar.

The basic function of FEI seems to be to provide a capital efficient decentralized stablecoin. It is on a rough start, but we will see how thing will evolve going forward.

Great to see new and innovating things. And again, they are on ETH. Will wait a bit for something like this to come on BSC and get some of the action 😊.

A HIVE-HBD lesson. It is great to see this type of experiments. We can see how much value there is just in providing a capital efficient and reliable stablecoin. If HIVE manages to create a reliable stablecoin with HBD, HIVE will be acting as a governance token for the HBD and will gain a ton of value just from that function.

The DHF/DAO in the case of HIVE can act as a PCV controller, and the internal DEX on chain, HIVE-HBD as an incentivized market. The DHF on Hive will continue to grow and at some point it will have enough firepower to maintain the HBD peg.

Not sure how many of the Hivers are aware about the internal DEX and the fact that HIVE has one for five years. Long before Uniswap and everyone. Its just not been incentivized in a proper way.

We need to put incentives for all the HIVE users on DEX, and engage everyone, not just the DHF in maintaining the HBD price. But this is a topic for another post.

All the best

@dalz

Important FEI links and image sources:

Posted Using LeoFinance Beta

Nice post

Nice spam

:)

https://twitter.com/Dalz19631657/status/1380856322258788352

What do you think of RAI?

Posted Using LeoFinance Beta

Give me a link :)

https://reflexer.finance/

Posted Using LeoFinance Beta

I love the use of smart contracts and incentives. It's bold but it makes sense. There's no capital inefficiency of being over collateralized. I really love FEI & want it to succeed. Hope the future will be kinder to the $1 peg :)

Posted Using LeoFinance Beta

I wonder why a industry developed on the idea to overcome the $ is so much focused on building something that is 1:1 pegged to it. Major hypothesis (still) is that the central bank system and the inherent control of value should be given back to the people. What is achieved if a major fraction of ETH is staked in a system linking it to the value of the $? Mass adoption! Ok! But we may see times when the volatility is coming much more from the $ side. Will it put (negative) pressure on ETH than? I am just wondering...

I belive a time will come when the measuring stick will be bitcoin or sats. But nothing happens over night and it needs time ..till then we will have these things.

I couldn’t agree more

Have a Glas of !WINE for a (locked down) Saturday night 😉

we are now going from a Dollar to a CryptoDollar which is step one.

I guess the next step will be a basket of currencies like Libra proposed.

Third step is to include BTC in that basket

4th step is to take out the fiat and stay with BTC

Posted Using LeoFinance Beta

Sounds like a good plan... hope it will not freeze at the cryptoDollar stage.

I took part in this genesis with a few ETH. I like the project but it got to successfull and to many people thought they could make a quick buck.

the ohter thing is that in the beginning people were selling FEI on Uniswap but that did not take into account the penalties as they were not showing.

people lost a lot of money that way

I am just holding my tribe and my fei to see how it works out

Posted Using LeoFinance Beta

Will be easy if converting works the other way.

Convert hive to HBD sell on market get more hive, repeat. Would be work super nice in an automated pool, people can buy-in. So it would run automatically and every time is over 1$ people earn a nice ROI.

Supply on demand backed by community :)

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 78000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!

Thanks for the description of FEI.

I saw the FEI-ETH pair on Uniswap at the top, saw it was a stablecoin, but that's as far as I dug at that point.

It's a different approach, and with every new experiment/innovation more is learned and can be used going forward.

Posted Using LeoFinance Beta