REIT - Whether to Invest or not

I was looking to diversify some of my investment and then REIT came in search. REIT stands for Real Estate Investment Trust, which actually is a company which owns real estate properties and its income is distributed among its shareholders. These companies manage the portfolios of real estate properties where they lease out the properties and the collected rent is distributed among the shareholders as dividends.

PC: Pixabay.com

As a small investor, I actually do not go for real estates because sometimes to get a good property you have to have good capital and thus the liquidity of the real estate seems to be the worst among the investments. So, the only option to have an exposure in real estate is using the REIT companies. I know the investment might not be great as per owning your own properties but still, it's better than not having anything exposed to that front.

What I like about REIT companies is that they have to pay at least 90% of the taxable income as a dividend that means if the company is generating good profit there is a chance of getting good dividends too. Also, these companies have to have a minimum of 75% of investment in real estate (thus the investors will be exposed to real estate) and a minimum of 95% of total income should be invested that means no money is wasted sitting idle.

There can be a variety of REITs like Equity, Mortgage, Hybrid (Equity + Mortgage) etc. In which the equity REIT is the most common one where this company operates and manages the income-generating commercial properties and thus the common form of income here is rent.

What I really like about REIT is that we will get steady dividend income as well as the since the properties value increases there might be a possibility of your money also increases i.e. steady capital appreciation. And as I said earlier as a small investor I am not in real estates but using REIT I can diversify my investment on that front too along with that it is liquid that means you can sell whenever you want and don't have to wait for the buyer like a normal real estate happens.

Now the risk, the risk is adjusted to the market and thus since the market ups and downs happen the REIT share price also follows the same. The only problem in using REIT is that they cannot give you extraordinary return because they have left with 10% to reinvest in other properties that mean the future prospect is limited.

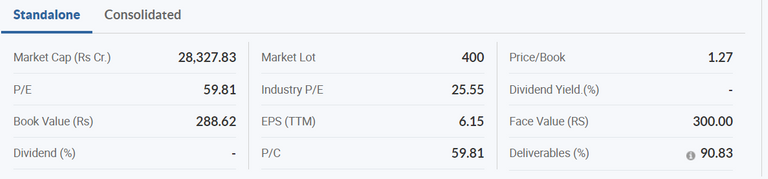

As of now, India has only one REIT and that is Embassy Office Parks REIT Ltd. And Embassy is a big name here in Bangalore, the only problem I see in that stock of having a PR ratio of 52 which is quite high. Though I will track price little more to actually buy it to diversify my investment.

The price is trading at Rs. 367 seems to be a good price to enter given the Face Value is 300.

What do you think, whether to invest in REIT or not?

Your current Rank (139) in the battle Arena of Holybread has granted you an Upvote of 8%