Do you believe it? Can ETC rise to 7000 dollars?

.png)

ETC has always risen staggeredly with the market. The latest wave of rise has happened to coincide with a slight decline in Bitcoin, and the title of "Chariot of Doom" has emerged. ETC has recently stabilized at around US$7, and is far away from its high point of US$46. On the other hand, the forked ETH has long occupied the first position in the public chain. It has risen to US$1,100. According to the current trend, it has reached a new high. Not difficult, and ETC wants to return to the high point of 2017, I am afraid it is a bit difficult.

However, some people predict that, regardless of the present, ETC will exceed $7,000 in the next ten years, and it can become a digital gold-like existence like Bitcoin. Does ETC have this strength? The original prediction is as follows. After reading it, do you think ETC will see $7,000 in ten years?

In the past ten months, the price of Ethereum Classic (ETC) has been between US$4 and US$8. In this article, Etherplan puts forward its latest argument, namely why ETC can exceed $7,000 in the next 10 years.

1. Few systems will win the battle of the blockchain base layer

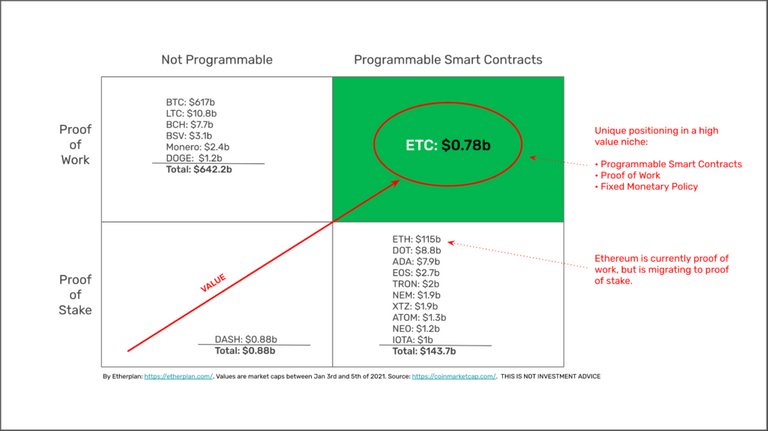

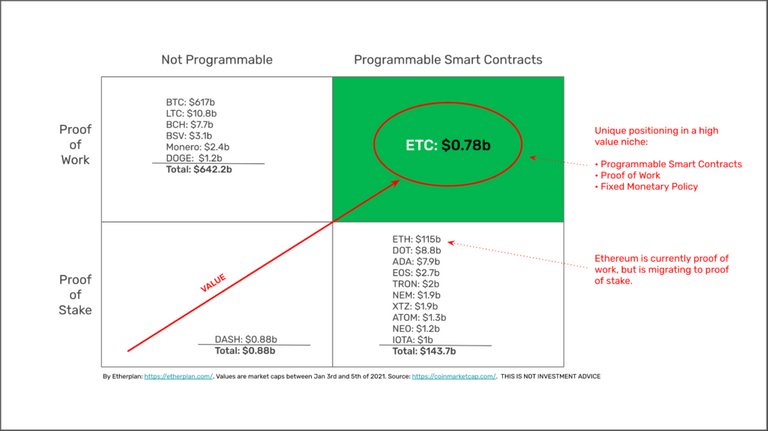

There will be only 3 or 4 chains in the base layer, with market shares of approximately 50%, 25%, 12.5%, and 6.25% (all the rest may be in this 6.25%).

The blockchain industry has gone through 12 years, and it is obvious that the influence of some systems is increasing. At the time of writing, the total market value of Bitcoin and Ethereum accounted for 82% of the total value of cryptocurrencies, with transaction volumes and fees dominating.

In the next 10 years, this trend may continue, ETH will migrate to PoS, which will open the door to dominate ETC.

2. Nakamoto consensus is the safest consensus mechanism

The Nakamoto consensus based on PoW (Proof of Work) will become the basic layer mechanism in the blockchain industry stack because it is orders of magnitude more secure than the PoS mechanism and other consensus mechanisms.

Both Bitcoin and Ethereum are currently Nakamoto consensus blockchains. As mentioned above, as of the time of writing, their total market capitalization is $733 billion, and they dominate the market.

This shows the success and feasibility of the PoW mechanism in the global bottom management and execution of high-value payment, settlement and smart contracts.

3. Ether Classic will be the only smart contract blockchain with top PoW mechanism

Except for the ETH that will be migrated to PoS, ETC is the only secure smart contract blockchain on the base layer.

There is currently no other top smart contract blockchain that uses the PoW-based Nakamoto consensus mechanism, which puts ETC in a unique and extremely valuable niche market.

4. Network reorganization attacks make Ethereum Classic more resilient

ETC has never been hacked, and the 51% attacks it has experienced in history only show that it is working as designed. But ETC has implemented some upgrades and will continue to perform other upgrades to make it more stable. Eventually, with the development of the network, its security model will be able to achieve a security level very similar to that of Bitcoin.

ETC Labs is the core developer team responsible for the network master node software client Core Geth. It successfully implemented an improved index subjective scoring (MESS) function and eliminated reorganization attacks. They also upgraded Thanos and deployed it to the network, thereby adjusting the PoW mechanism so that more miners can participate in the construction of the network.

The ETC cooperative is funded by the managers of Grayscale, the world's largest cryptocurrency asset management company, and the Ethereum Classic Trust. It continues to promote ETC, conducts important research on key improvements, and maintains Hyperledger Besu customers. It has been successfully updated to cooperate with the upgrade of Thanos.

Most notably, IOHK, the co-founder and main supporter of the Cardano blockchain, has reinvested a lot of resources into the Ethereum Classic project. In the past few months, the company updated their ETC Mantis node client to make it fully operational and compliant with the latest ETC upgrades. With the purpose of helping to create a prosperous ecosystem, the new ETC Mantis wallet was launched and a highly secure and simple roadmap was proposed for the entire Ethereum Classic ecosystem.

5. ETC supply has an upper limit

Just like BTC, ETC has mechanical, algorithmic and upper limit, so it is robust and trust minimizes monetary policy.

Just as the supply of BTC will never exceed 21 million and the supply of ETC will never exceed 210 million, the goal of these two cryptocurrencies is to imitate gold or become digital gold.

6. The positioning of Ethereum Classic makes it complementary to Bitcoin at the base layer

As the largest system on the basic layer, BTC has a 50% share, while ETC will rank second with a 25% share because of its high value as a general-purpose computing platform.

Due to its unique positioning in the areas of proof of work, smart contracts, and fixed monetary policy, as well as the "code is law" philosophy, Ethereum will migrate to a PoS mechanism with better performance but low security. ETC has the opportunity and is likely to become an excellent basic layer, highly secure smart contract platform.

7. The base layer will be as valuable as gold

The base layer will be as valuable as gold, with a current market value of approximately US$9.8 trillion and an estimated market value of approximately US$12 trillion in ten years. The price forecast for gold in the next ten years assumes that it will increase at an average expected inflation rate, which is 2.17%.

In recent years, central banks in North America, Europe, and elsewhere have been printing counterfeit banknotes, and this situation may continue for the foreseeable future, so this forecast is likely to prove conservative.

8. ETC may exceed $7,000 in the next ten years

As shown in the table below, if the base layer realizes only 50% of the value of gold in ten years, the BTC market value will reach 3 trillion US dollars, that is, a BTC is about 143,000 US dollars, and the ETC market value is 1.5 trillion US dollars, that is, each ETC is about $7100.

The predicted values of BTC and ETC are calculated on a completely diluted basis, which means that BTC is calculated with a supply of 21 million and ETC is calculated with a supply of 210 million.

BTC and ETC vs. gold in the next ten years

to sum up

As the market shows, even though there are many speculative projects in this industry, few can ultimately gain dominant market share, especially the basic layer. Due to its reasonable design, ETC is expected to become the safest smart contract platform.

Historical reorganization attacks have made it more resilient because it has never been hacked and worked as designed, and the core team has upgraded the network, integrated innovation, and greatly increased their commitment to the project and ecosystem.

As complementary basic layer systems, BTC and ETC will play the role of digital gold. Taking into account factors such as the maturity and success level of the blockchain industry in the past twelve years, the continuous accelerated development of new technologies and global platforms, it is reasonable to expect that ETC will change from the most recent price range (4 USD to USD 8) rose by more than USD 7,000.

Source: Etherplan

Posted Using LeoFinance Beta