DEFI Aggregators Bringing It All Together

Hey Jessinvestors

The world of DeFi is still very much in its formative stages and is still fragmented. There are DeFi platforms on different chains like Ethereum, Binance Smart Chain, EOS, TRON and more; the issue with this is that assets cannot be used as effectively as they should be, especially now that assets are moving across chains.

To make it even more complicated is the fact that on each chain, there are several DeFi services with their own protocols, liquidity pools and native tokens. Every day someone new spins up a clone contract promising high returns.

I am sure that in the bear market, where liquidity is scarce, we'll see many of these DeFi platforms implode, but it doesn't solve the problem of fragmentation.

Many DEFI users tend to use the platform they're staking with or providing liquidity to do their trading, but it doesn't mean they are making the most effective trades. Since trades are made on-chain and liquidity in various pairs can be an issue depending on the size of the buy or sell, there can be more slippage.

If only there were a way to check other exchanges that also have these pairs and see which one can offer me the best exchange.

Well, you can with the help of DEX aggregators.

What Aggregators offer?

Aggregators take your purchase, scan different dex's, liquidity pools and protocols and then offer you the best path to make the trade.

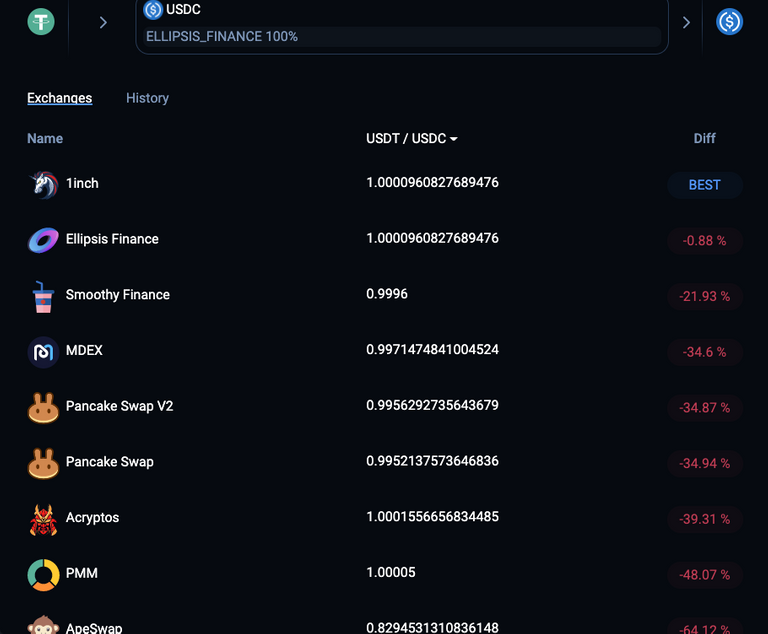

If you look at the screenshot below, you'll see me setting up a swap for USDT for USDC on the Binance Smart chain via 1inch. The DEX aggregator then looks at my purchase and provides me with the exchanges, the slippage and the best path to purchase the asset I want.

1inch trade options

If you’re interested in trying a DEX aggregator, a few of them:

- 1inch Exchange (with the highest trade volume)

- ParaSwap

- Matcha by 0x

- Dex.ag

I think this is only the start, and there will be plenty of aggregators that will look not only to secure Eth and its various side-chains but go cross-chain too.

Aggregators keep market makers competitive

I realise it still requires people to use these services to see their value, but they do offer you more information to make better trade choices. Remember, with DEX"s you're making trades on-chain, and with chains like ETH and BSC, they charge you for failed transactions, so errors tend to punish you.

This gives you even more reason to ensure you use the most efficient path when you do make trades.

I think this is only the beginning, and as more DEX's come on board, more protocols connected, more assets move across chains. We'll see these platforms become more popular and vital in ensuring your trades are as efficient as possible.

This can also help reduce the load of on-chain trades as trades would be executed on the best path, which could be a side chain and use resources more efficiently.

Have your say

What do you good people of HIVE think?

So have at it, my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem, and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta

i really have never knew if that is the use of dex aggregator. I thought it was just the same DEX like pancakeswap and other DEX.

but can it be use for Binance BSC token in 1inch?

Posted Using LeoFinance Beta

Yes you can use any token that's listed on the supported DEX's on both Ethereum and BSC, so you can login to 1inch with your metamask and then select the chain and coin you want to trade it it will offer you possible trade paths to make

Posted Using LeoFinance Beta

This was much waited concept in crypto world. Just like we use insurance portal or aggregators to compare different offering and benefits similarly we can compare different option to trade crypto on different platforms/chains.

This is a very good progress.

Thanks for sharing 👍

!luv 1

Exactly, instant comparisons of versions is going to be bring down a lot of prices for things in crypto as users can figure out the best place to buy and sell should they wish to trade on these markets

Posted Using LeoFinance Beta

I didn't know about the aggregators. Do you know if the Metamask swap function is using one of these aggregators? I think they choose the cheapest exchange and fee for you according to what I saw online but I have never tested it.

Posted Using LeoFinance Beta

I don't think its using aggregates yet as far as I know it was using UNiswap for ETH and pancake for BSC since they have the deepest liquidity but I can't be sure so don't hold me on it.

Posted Using LeoFinance Beta

That's a great move forward. Some centralized crypto platforms already offer aggregation options for best price discovery. But this is even more needed in the DEX'es world right now.

Posted Using LeoFinance Beta

It's also way too fragmented so price discovery is there but the process was highly inefficient, what would be cool too is seeing defi protocols start to connect directly with others to reduce that arbitrage and make it easier for spot traders to get good deals

Posted Using LeoFinance Beta

I messed around a bit with 1inch in the past, but I didn't really have a ton of luck with it. I think I even owned some of their gas token at one point. It didn't really seem to impact the fees like I thought it would. I decided to go a different direction.

Posted Using LeoFinance Beta

What would you say was the cost-saving on the gas token? less than 2% I haven't tried it yet myself. What route are you going for now?

Posted Using LeoFinance Beta

I moved pretty much everything over to the BSC and then I am doing the WAX side of things. That has been doing really well for me. I can't remember the cost savings. It might have been maybe $10 difference on gas. So instead of $45 the tx would have been $35. That was when prices were higher than they are now.

Posted Using LeoFinance Beta

The main question here - is this data valid or modified?

I don’t understand, they just pulling the spot prices on different protocols they not calling the data in their own chain or servers as far as I can see

Posted Using LeoFinance Beta

Yes, this could be problematic, because every DeFi pair in the farm doesn't pull the average of the currencies from the different exchanges, and if this is the case then the rest is also questionable ... at least that's my understanding of how prices are supposed to be formed ... but anyway ... the new data ...the new opportunity ... etc ... 😎

I’m not too sure since most of defi are spot exchanges so for now what I see is just trying to match your order with the place that has the best liquidity pair available!

I think if DEXs would have order books too then these aggregators would make it really easy to arbitrage on the fly

Posted Using LeoFinance Beta

This is an interesting topic to dive deeper into and understand how it can or does affect risk and ROI.

Thanks

Posted Using LeoFinance Beta

What I’m thinking is the more interoperability and routes in and of coins means a lot of these projects are building the downfall of shit coins

A lot of shit coin holders have a buffer because people don’t bother to dump because who wants to sign up to a rando exchange now with dex’s and aggregators it makes it easier for liquidity to come in if you are doing something cool

But more importantly capital flows out will be fast and vicious as a free market should be, in fact I see the success of aggregators leading to the downfall of a lot of projects but in a good way for the overall ecosystem

Posted Using LeoFinance Beta