SUSHI & UNI Tussle War Is Still On!

Do you remember SushiSwap, the first Uniswap fork?

A little over 3 months back, it had created a lot of waves in the AMM industry. It became the inspiration for so many me-too Uniswap forks that cropped up in no time. Uniswap too had to respond by launching its own UNI token and by giving it away with what was one of the biggest airdrop in crypto industry.

But then, Chef Nomi incident happened and SUSHI prices plummeted like anything. Although the anonymous Sushi Chef returned all the $14M worth tokens it had stolen, SUSHI prices couldn't recover much and lost all the momentum it had.

But SUSHI is a rare currency which has a lot of steam and like phoenix, it has the capability to rise from ashes.

The community activity in the aftermath of Chef Nomi incident, the contribution & innovative thinking of talented developers and business collaborations has proved that Sushiswap has got all the right ingredients in place. It's how a fork is done right! Forking out doesn't mean copy-pasting an open sourced code but building upon that codebase by making that fork unique in terms of features and design ...the way Sushiswap did!

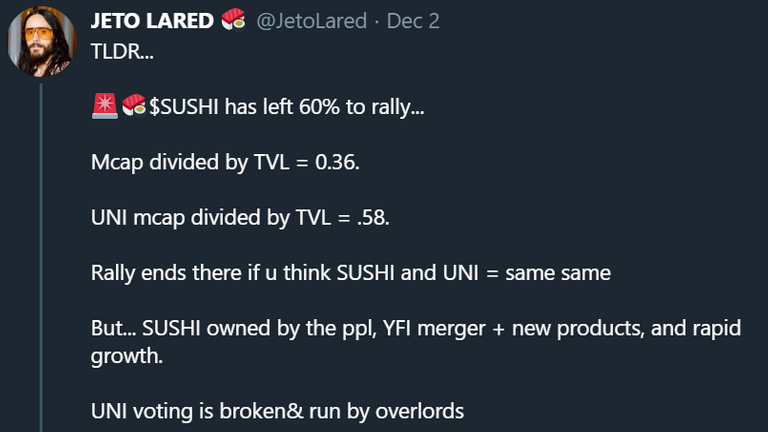

Today, if we compare Sushiswap & Uniswap AMMs, we see that Uniswap has about 1.65b TVL but Sushiswap isn't far behind with about 90m TVL on its platform. The prices of UNI around $4 are almost double of SUSHI at the moment. But if you look at the tokenomics, UNI has a Total Supply of 1b and current circulating supply of about 250m i.e. about 1b market cap. In comparison, SUSHI has only about 125m in circulating supply out of a Total Supply of just about 158m i.e. a market cap of $250M only.

And this is when Sushiswap is doing a lot of amazing things than just an AMM. Sushishwap has recently released its new design and logo. BentoBox lending script is already being audited and gonna release soon. Recent collaboration with Yearn Finance is going to add a completely new dimension. Aside that Deriswap Options are on the anvil.

For me, SUSHI (xSUSHI) regularly earns some more SUSHI as a dividend, a share of 0.05% of total platform trading fee. My SLP also generates a good APY and now Sushiswap has also come up with joint incentive programs from projects for providing liquidity. Called Onsen, Joint Liquidity Mining contract (wrapped Masterchef contract) will make that possible for projects to offer their tokens as incentives alongside SUSHI. Some are already doing that!

...And I just heard BADGER is being airdropped to all SUSHI governance participants. BADGER is currently priced at $6.3 per token. Let's see how much I get it. 🙂

Oh boy, there is a lot to talk about SUSHI. Looks like I get carried away by it. But all these doesn't mean I'm berating UNI. UNI is going to do amazing things too. Recent on-chain integration of Uniswap by Aave's v2 is an amazing feast for UNI holders.

I do hold a good portion of UNI in my portfolio. But recently, worth of my SUSHI holdings has outdone UNI's and I just wanted to say that SUSHI below $2 is a steal today!

So if you're researching to invest in something, consider SUSHI too. Who knows, what's in the future for SUSHI! But I see, a lot is happening there. What's your opinion on it?

https://twitter.com/Bhattg18/status/1334883710550720512

Just read this post on WhaleShare!

Appreciate you reading it. Thanks!