😱 How a potential fraud from Wirecard (Payment Company) might put an end to most CryptoCards? 😱

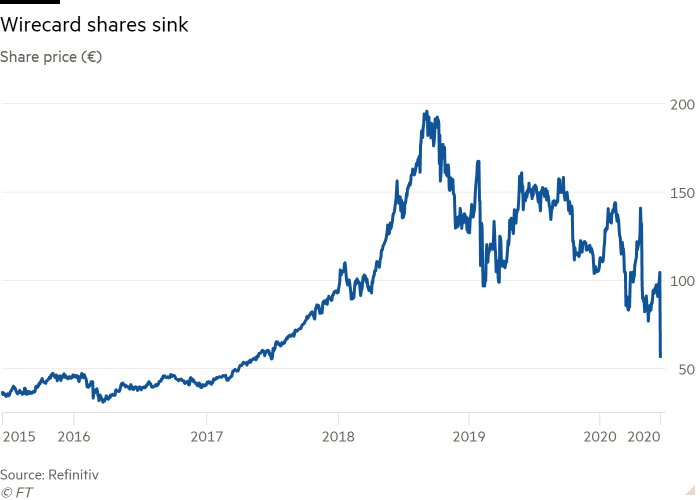

Today, Wirecard's shares are under pressure after the German payments group said €1.9bn of cash was missing and that “spurious cash balances” might have been provided to its auditor by a third party.

Ernst & Young told them that there were indications a trustee of Wirecard bank accounts had attempted “to deceive the auditor”, deepening the crisis at a group long seen as a great hope for Germany’s tech sector.

This is NOT a surprise if you ask anyone working in finance, this group has been known and attacked by activist funds for its opacity and misbehavior.

What is new is that the Bafin (German regulator) has been consistently backing Wirecard against allegations. Which was always kind of a mistery to me as it is not their job to do so.

Wirecard's Share Price

Crypto.com’s popular debit cards are issued by WireCard, which could prove to be a problem for the company.

While it is unlikely that user funds are directly threatened, the hole in the reserves could result in service disruptions on cards issued by WireCard. Cointelegraph reached out to Crypto.com for a comment, but did not immediately receive a response.

However, Crypto.com is not the only provider that could be affected by this.

The company is currently the debit card issuer for Wirex, TenX and CryptoPay.

Coinbase Card would probably be unaffected

As Coinbase became a principal Visa issuer in Februaryit meabs the company is at the same level asWireCard and PaySafe.

Coinbase has has not yet directly issued its own debit card, this news could accelerate their need to do so. In case things go south with Wirecard and other cryptocard providers.

I hope most Cryptocard projects will find a new way to secure their link to the FIAT financial system.

We all remember too well how the sudden collapse of WaveCrest left all crypto credit card companies without a working product.

➡️ Publish0x

➡️ UpTrennd

➡️ Minds

➡️ Hive

➡️ Twitter

➡️ Facebook

➡️ Be paid daily to browse with Brave Internet Browser

➡️ A secure and easy wallet to use: Atomic Wallet

Proud member of:

Helps us by delegating to @hodlcommunity

Make a good APR Curation by following our HIVE trail here

Thanks for the info. Without people like you sharing, I would never know things like this

This is why God put me on this beautiful earth 🌍 😄

I concluded a basic problem from this consequence.That is, the centralization of projects. We have 3 different projects working with the same institution. Now, they all are in trouble. I'm a fan of crypto.com but I reconsider investing more on the project just because of this suspicious things happening about Credit cards. I'm pretty sure that there are hundreds of people who will reconsider investing in MCO or other projects

Indeed and I have no proof but all these marketing events to give BTC or Cryptos at half price seem crazy expensive to me !

Where does their money 💰 comes from ?

Thanks for this news!

Is it the reason why MCO prices ae falling these days?

Not sure but definitely it could put a little pressure. In the end MCO and Crypto.com did not do anything wrong. Just were with the wrong partner.

And nothing shows that their cards would not work because of Wirecard's current situation 😃