Sushiswap surpassed $3b in TVL today. Is $SUSHI a better investment than $UNI?

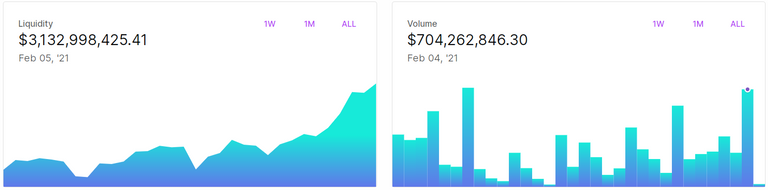

For some days, Total Liquidity Locked (TVL) on Sushiswap platform was hovering just below the $3 billion mark. Finally, it has surpassed this mark today for the first time. Total volume was over $700m yesterday and over $600m in last 24 hours:

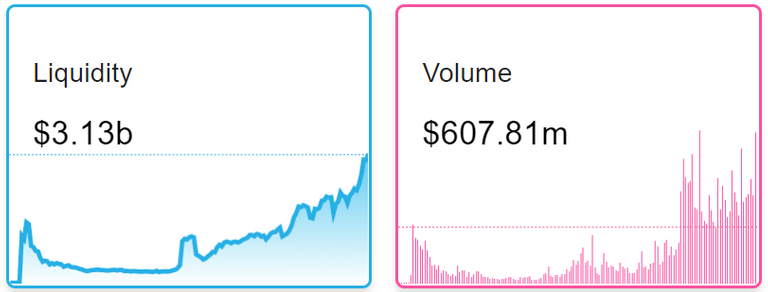

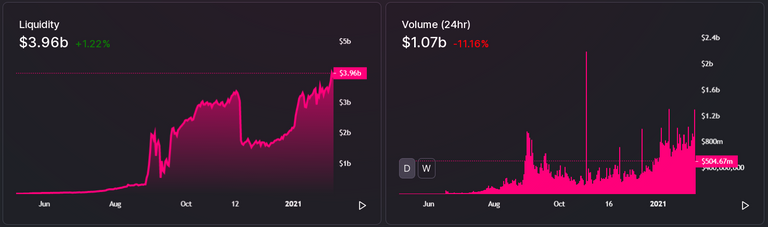

If we compare these to the AMM market leader Uniswap, its figures with about $4b in TVL and over a billion dollar in daily volume may look better to most people. But there is much more to see than just these charts.

While Uniswap has achieved this in over 2 years, Sushiswap isn't even 6 months old. 3 months back it had less than $250m in TVL and the price of token had reached a low of $0.49. But within 3 months, it has posted over 3300% rise to $16.60.

Uniswap's performance is more or less been stable in past 5 months but its token value has soared about 21 times from $1.03 to over $21. I guess this is in anticipation of its much awaited version-3. But I've been waiting for it since last November and don't hear much about it.

Although Uniswap has tried to decentralize its platform by launching its governance token UNI, I feel it's work culture is still not very open and transparent. I mean, I don't get much update on their roadmap and the work being done for it. Also, only 3 proposals were created out of which only one succeeded.

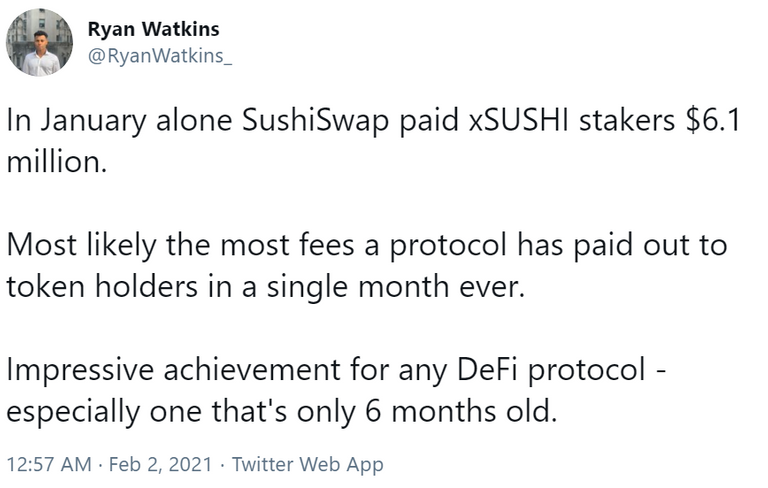

UNI token is just a governance token and doesn't earn you anything. On the other hand, $SUSHI is not only a governance token but also earn a percentage of total protocol fee. Last month itself, Sushiswap paid $6.1 million to $SUSHI stakers in the Sushibar. This is probably the highest fee a crypto protocol has ever paid in a single month. Ryan Watkins of Messari who authored the article

Valuing SushiSwap - The Grassroots Decentralized Exchange tweeted:

$UNI has a circulating token supply of 288m as compared to only 127m $SUSHI.

Total supply of $UNI is 1 billion whereas $SUSHI has a hard cap of $250 million.

I don't mean to say that UNI won't grow from here but I see far greater potential in SUSHI. With so much active development and user friendliness, I feel it's still very undervalued. Bentobox vaults with flash loan feature is about to launch this week and next week it will launch lending solutions too. I'm more excited about derivative trading. Sushiswap is going to launch options and futures too which will increase its volume manifold. They are also working on a plan to double the token holders' income which will further increase the token worth and market price. Second layer integration is also on the cards along with other integrations like Polkadot / Moonbeam and RUNE (already there). Recently they also introduced MISO (Minimal Initial SushiSwap Offering) - a launchpad for new projects.

So basically, Sushiswap won't be seen as a competitor of Uniswap but it is evolving into quite a different project now and I'm more optimistic on SUSHI than ever.

Of course, UNI is a great investment and has delivered me a good return so far. But I'm thinking to sell all my UNI today ...HODLing is tough beyond a point, you know!

I wanted to hodl it until v3 launch but I think the price has already taken that into consideration mostly. When UNI became a top 13 coin, I wanted to wait until it gets into top 10 list. But last week DOGE pushed it a rank below and now AAVE has pushed it down another rank. Thanks to celebrity investor Mark Cuban! In his AMA on Reddit, he revealed his crypto portfolio which had SUSHI and AAVE ...both went parabolic soon after!

For now, Uniswap's market cap of about $6b looks good enough to me. Though in the short term it can grow to $10b, I'd better put my bet on SUSHI at this stage.

To be clear, I ain't investing in any of these coins at this time. These are just my thoughts as I need to sell some coins today and was thinking on what to sell SUSHI or UNI. I'm just thinking out loud here.

Excuse me!