𝐁𝐞𝐬𝐭 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐀𝐝𝐯𝐢𝐜𝐞 𝐄𝐯𝐞𝐫 - ℙ𝕒𝕣𝕥 𝟝 𝕋𝕙𝕖 𝔽𝕚𝕟𝕒𝕝 ℙ𝕚𝕖𝕔𝕖 𝕠𝕗 𝔸𝕕𝕧𝕚𝕔𝕖

These last couple of weeks I have been making time to give some of you the best financial advice ever.

Last week I went all out and gave you some real financial advice. As In what to do with the money you have left after repaying your debt.

So if you are ready to get healthier, and wealthier and you are willing to invest, invest some time in the previous chapters that will help you become free of debt.

Best Financial Advice Ever (Improving Health & Wealth) - Part 1

BitcoinBaby - The Best Financial Advice You Ever Get Part 2

𝐁𝐞𝐬𝐭 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐀𝐝𝐯𝐢𝐜𝐞 𝐄𝐯𝐞𝐫 (in under 5 minutes) - Part 3

𝐁𝐞𝐬𝐭 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐀𝐝𝐯𝐢𝐜𝐞 𝐄𝐯𝐞𝐫 - Part 4 - From No Money To Mo Money

The previous chapters were about getting rid of debt & what to do when your debt is finally dwindling.

But in this last chapter I want to focus on three things:

- Good Debt vs Bad Debt

- How I would spread my risk

- Changing the consumer mindset

Bad debt vs good debt

Now I have mentioned debt a lot, and mostly very negatively, while debt is not always a bad thing. While writing I came across this Post:The Loan Repayment Method of Mine by @arunava.

He/She or they (why are things so complex nowadays) mentions:

Loans are a fundamental thing of our day-to-day Indian Life as the majority of people here in India are from the Middle Class and we are a developing nation which means a lot of people are looking to upscale their lives and a majority of them have either a Home Loan or a Car Loan in their everyday life.

I think the majority of today´s world considers itself middle class. Many of them are indeed driven by the wish to upscale their everyday life. That drive is laid upon them by the world around them, pushing consumerism up on them. And many succumb

to that pusher.

The story continues:

Even though a Loan is something that we should stay away from as much as possible, it is very much a necessary evil in our road to Upscaling our lives.

The previous quote mentioned home and car loans, while here it sounds like the loan might be used in a broader sense.

That´s where things get cluttered. A home loan is risky but indeed could very well be a good investment. Lending money for a car when you have no other means of transportation from and to work might be a necessary evil in order to make money....but that is often where the good debt ends and the bad debt starts.

I am saying this because I accidentally took a Loan that had a penalty for prepaying, even though the loan amount is quite minimal since there is no pre-payment I am unable to clear my loan and have to wait one more year to clean my entire loan.

It´s hard to imagine this loan being for a car or house. But the fact that lending money is made so easy to so many is proof that society will do everything to seduce you into believing you are middle class and need to upgrade your lifestyle using money that you have not earned yet.

Finally I would like to add that Having no Loan is always the best option in my mind.

I do not fully agree with this last bit, lending money to buy a house can be a very interesting loan even if you could buy the house without lending.

Good Debt

Say you pay 5% interest annually on your mortgage; with the current inflation that means you are hardly paying interest while your house increases in value at the same pace that inflation decreases the value of money.

That house would be a hedge against inflation, not making a profit, but also not losing money.

Now the money that you did not use to buy the house can be invested into a more profitable project. Something that makes you 6 or 7% a year. 2% above inflation and 2% more than the interest you pay on your house loan...a loan you did not need but is making you money because of a good investment.

Practice what you preach!

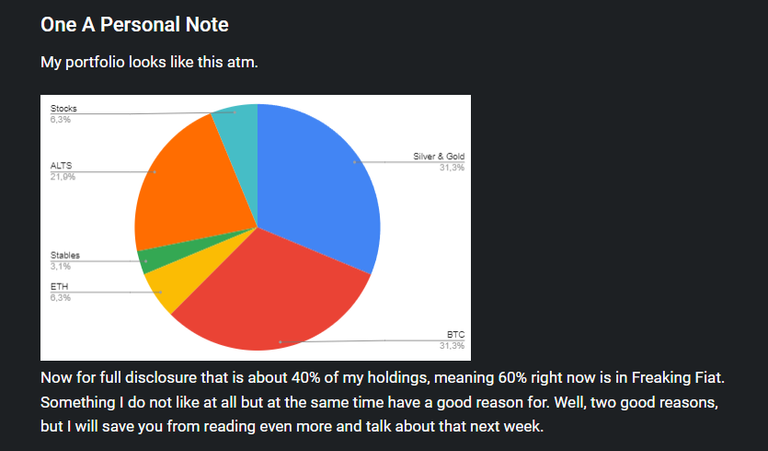

Last week I told you that I had a dirty little secret. That I contrary to what I preached held 60% of my net worth in fiat:

Two Good Reasons

First of all, I like to spread my risk and have quite a bit of dry powder.

But this dry powder is meant to be used for the most risky investment of all...bricks and mortar.

Real estate

Real estate seems like a great investment but it actually is just as good as gold. It´s a hedge against inflation and only makes you money if you can make money from the property before selling.

Hence if you rent it out, and the rent covers a mortgage and the maintenance then you don´t make a dime. If that is not the case you probably break even over time, and that bit of real estate will be nothing more than a hedge against inflation.

Or if you go and live there yourself and can ensure that when maintenance, mortgage & taxes are included your monthly payments are less than renting a similar place.

Because if the amount you repay on that mortgage yearly is not far from what you could have saved by renting a similar place. That money could have been invested better, than in becoming an owner of a reliability like a house.

Buying into bricks & mortar is not as ideal as it seems. Then whywhy would I want to invest in real estate?

Well, for one it's harder to steal a house than a bar of gold you keep in that house.

Never seen someone rug a house.....

It´s not a big money maker but it´s a pretty safe & solid investment, a good hedge, and the right house in the right place will increase your everyday happiness and therefore improve your wealth and health.

That is why I am holding 60% in fiat for now, because I can´t risk temporarily losing a lot while a buying opportunity can come knocking every minute.

Full Disclosure

That is how I would invest my current capital, approx 60% in a very safe investment like a house.

DCA a bit into a stock portfolio monthly.

Hold 10-15% in silver & gold and and 15% in a risk assets.

Let it go from there without managing the percentages too much....just let it grow organically.

Guess I am still pretty conservative when it comes to investing the money I am willing to lose.

At the same time losing your investment is the biggest risk to your debt-free life.

Because those who risk and lose tend to take bigger risks to make up for the loss, and that creates a mix of emotion, risk, and reward. That Dear Reader is a toxic cocktail that sets you up to fail.

In a well diversified portfolio a loss can be absorbed, in a not so well diversified portfolio a loss can be fatal. And it´s human nature to make up for that loss. Don´t.

Be patient. You have money coming in, find a new project, DYOR, and buy into that....slowly.

For a lack of better words, I quote @misieq79m

I’ll say that at the beginning the loss of the first investment, even a large one, is not the worst at all, But the worst thing that pulls us deeper and deeper into this quagmire is looking for another opportunity and trying to recover the loss and wanting to take revenge and that’s the main problem.

Don´t Get Emotional

Don't look to recover, find a new opportunity. Ignore the fact that you are human and just follow the pattern and take a loss.

That is why; the riskier the investment the more important it is to timely sell. Have an exit plan, follow the market, and if you get to the threshold set your stop-loss.

The less risky stuff can keep compounding, but you want to take your risk out of high-risk assets on time, to put them into low-risk assets till the time is right and vice versa.

Sell your XRP after they won the first round, and move that profit into gold. Then when there is blood on Bitcoin Street buy back in and wait till the next bull arrives....

Although we might have seen the last bull...but I think there is one more before mass adoption and price stabilization meaning less volatility, less risk, and less rewards.

Okay, I have been mansplaining my choice for far too long. It took up so much virtual real estate on this post that I started to doubt if I should even start on point 3.

Point 3 was the mindset I mentioned 6 minutes ago, remember? Nope, I thought so. So let´s conclude this story as the prologue to the mindset chapter. Which supposedly will be the final final chapter.

In that final chapter, I will explain how to change your mindset and approach to life in order to spend less and invest more.

Thank goodness you made it till the end Pees, Love and I am out of here!

[Source Pic](All pictures are by Meme, MyI & AI unless source is listed)

Some good advice and things to consider there. I would probably also put student debt in the bad bucket tbh. In the book The Fiat Standard, it mentions those richest in our society are able to leverage debt in the debasing fiat currency whilst buying hard assets. The strongest currencies half in value roughly every 7 years, therefore buying a home makes sense if you will stay somewhere long term, as in real terms, each 7 years the real value of the debt should half. The big question is, will Bitcoin "Fix This" by demonetising real estate as it is doing to Gold and Silver at the moment?

I have picked this post on behalf of the @OurPick project which will be highlighted in the next post!

Buying a home still is so tricky, it requires the right mix in my mind. On the other hand I am not too big on risk assets hence a home at a reasonable mortgage is better than renting at least here I pay the same but interest, taxes and maintenance are still less than the monthly rent. So at least I hedge a bit.

But I am still having a hard time owning too many hard assets in this uncertain world, I really like BTC and bringing it wherever I go. Thanks for picking my advice!

Yay! 🤗

Your content has been boosted with Ecency Points, by @whywhy.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more