Best Financial Advice Ever (Improving Health & Wealth) - Part 1

Winners focus on the next play not the last play.

Winners will lose more than the losers, but they learn.

In the long run, they earn more than any scary pants loser, who did not go for it, ever will.

The above is awesome if not the best financial advice ever, and I could not believe nobody ever told me this.

Maybe they did not tell me because they did not want to share the secret to becoming wealthy.

And maybe just maybe, they told me but I did not hear it, because I had nothing to invest.

If I had known..... well that´s water under the bridge, isn´t it?

I am not going to cry over spilled money. I had a great life and I decided to do things differently. But some days I wish I would have learned some of these lessons earlier on.

Because the second best piece of financial advice I found too late is you can not start too early with investing.

Investing Generates Health & Wealth

The earlier in life you start investing and compounding the better and yes I am late to the party because nobody told me so.

But since I started investing I have been doing & feeling better.

Remember last week, when I told you about my identity crisis. It was about how I turned from a trader into an investor, now you can take that crisis part with a pinch of salt.

The funny thing is that in life I made a similar transition. And till I wrote that & this article I wasn´t even aware.

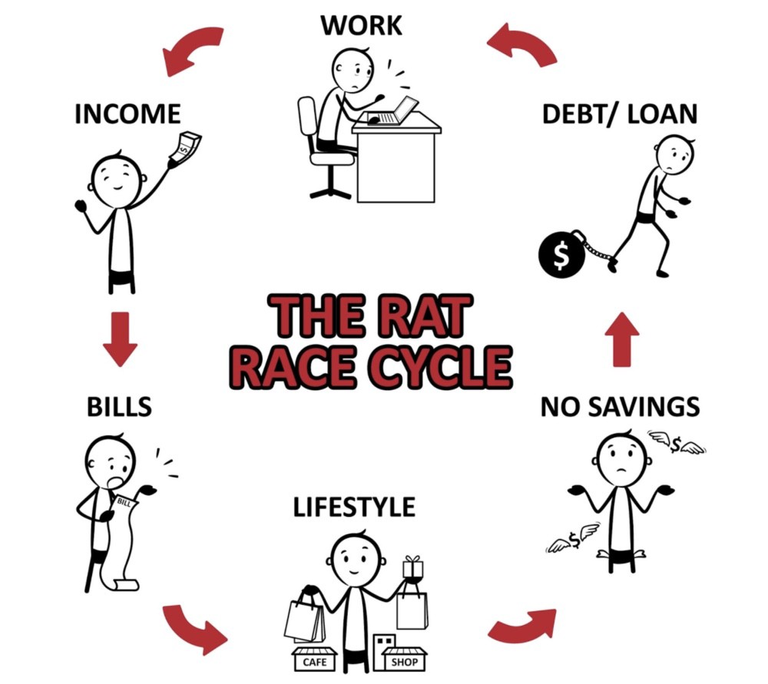

In my daily life, I used to be a trader. Trading my time for money, and putting that money back into this thing called life. That obliged me to keep doing the same thing over and over again.

I was a prisoner of the rat race cycle

The Rat Race Cycle

I worked hard and the time I was left with I used to spend on spending. I spent the little bit of profit I had made, and then some.

And that and then some generated debt, meaning I had less and less money to spend during those moments I was not trading my time for money.

Having less and less gives stress.

Stress will make you spend more and then some.

So your lack of money drives you to spend more as you are trying to buy away your stress.

The Quick Fix

There is a very easy solution to fix this, get rid of the stress.

How?

By getting rid of the root cause.

What is the Root Cause?

That´s you. Now I am not saying to kill yourself. It would get rid of the stress but I guess it would not really be ethical.

The Root Cause

The root cause of your stress is your being unhappy and overspending to temporarily feel better. Or in earlier stages, you overspending and being unhappy about it.

Now I am sure there are a million reasons and excuses to be overspending and there is only one reason to stop it.

That one reason is;

Increasing your happiness.

How do you boost your happiness?

By increasing your wealth. And keep in mind that wealth is not only your financial net worth.

Your real wealth is the Love & Health kind of Wealth.

And by improving your financial wealth you will increase all three!

Now doesn´t that sound freaking awesome and illogical?

Well, it´s not they go hand in hand very nicely.

The Not-So-Quick Solution

First of all, stress is like cancer, it spreads. Not only inside of you making you sick (health), but also mentally. And by doing so it affects you and you affect your surroundings (love).

People around you with lower stress levels will not feel attracted to you when your stress levels increase.

Slowly they will distance themselves from you. These can be friends, colleagues, family, or just people you meet in the bar.

The worst part: You will attract new people.

New People that have higher stress levels than you do. They will feel comfortable with your stress levels and at the same time, you will surround yourself with people to point at and say: "Hey they are worse off than I am."

Trapped in a Downward Spiral

Now some might enjoy that downward spiral but in general you want to break that unhealthy routine of increasing debt and increasing stress.

To do so it takes two first steps:

Look at yourself in the mirror and tell yourself that you want to change.

Cashbook, It´s that thingy all those (f)influencers preach; Write down all your debts, write down all your costs, write down all your income.

That will be a scary thing because hell you know that it´s not gonna add up. This thing is more unbalanced than the Pisa Tower.

But to start feeling better you need to know where that money shouldn´t go.

Where are you spending your money on?

Or better said where should you start to spend less money on?

That is gonna be quite a list and I want to share a lot of suggestions so I guess it will take a Part II to cover that all within your attention span.

But I will list the most important one; To get less debt you need more debt.

Get rid of debt

The worst debt is one that most of those in debt have. And if you have a lot of credit cards you are really f´ed!

You will use them all, and overdraw them all month after month to fill one gap by creating another gap.

And those are expensive gaps, because those guys are no Dire Straits they do not do Money For Nothing.

So STOP

Cancel all your credit cards!

Oh you can´t because you still have a debt;

Depending on how deep you are in the debt hole you have two options.

Option 1: For those that are still able the best way to get rid of your credit card debt is by getting yourself into more debt. Get a loan from your bank that covers your total credit card debt.

Even with the current interest rates you will pay 15-25% less interest over that loan than you did over the outstanding balance on your credit card.

That will save you 1500 on a 10K debt every year.

Option 2: For those who can not get a loan at their bank you are going to have a hard time. Because you will need to cut your cards into pieces and never look back. But keep looking for someone who will give you a loan for that overdrawn credit card balance against lower interest rates.

For every other outstanding type of debt make a payment plan with the company you own money.

To make a payment plan you need to know income and spending.

Right now you are spending more than have and that needs to change, otherwise no payment plan. Without a payment plan, you don´t get rid of debt and you will never be able to get healthier, wealthier, and invest.

So next week some tricks to find the hidden cash you need to come up with a payment plan.

That doesn´t sound too motivating I know, but keep your eye on the prize and at this light at the end of the debt tunnel:

Once those debts are paid you do not have to find money to invest. All that money you used to get rid of your debts can now be used to invest, without having to change anything.

More Light

This is not a sprint. Getting Healthy & Wealthy is going to take time.

And however much you are going to hate following these suggestions at the start, it will get better and you probably even will start to enjoy these budgeting tasks a year from now.

BitcoinBaby From Rags To Riches

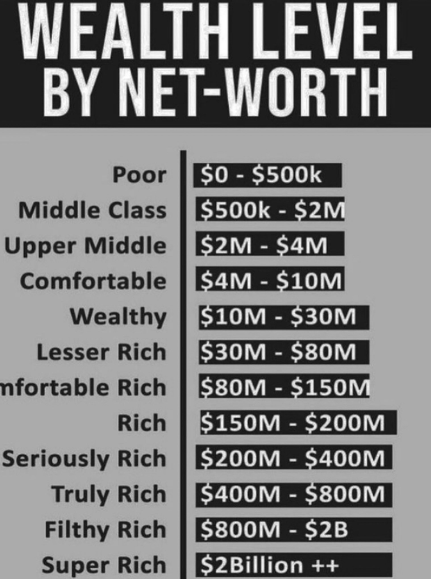

Really, I am speaking from experience. I have been there I have done it and I got healthier and wealthier. However according to this list, I am still poor.

But I was beyond poor in the past, with a negative Net Worth of $15.000.

Then I followed my own advice, got rid of my ex-wife then I looked in the mirror and I said no more debt.

That was step one and I got that bank loan to pay for my credit cards. That was the first step I took on this long journey from trading my time to pay for my debt to investing my time to creating wealth.

Next week I will share my tips, give you an update on how far I came from that negative $ 15,000 net worth and how long it took for me to feel healthier and actually be wealthier.

Bottom Line

Being poor might not be a choice, being in debt is a choice.

I am very curious to hear if you or how you dealt with your struggle with debt or still struggle, so drop a comment and let me know....please!

Thank goodness you made it to the end. Pees, Love, and I am out of here!

[Source Pic](All pictures are by Meme, MyI & AI unless source is listed)

Posted Using LeoFinance Alpha

Those are some great tips, it is worth getting rid of all consumer debt if possible. Getting debt for hard assets can be good though, although at current interest rates, maybe not so much yet.

Current rates are killing although they say this is normal and the last 10 years were just abnormal. But indeed that is a kind of debt that sometimes makes sense but CC debt is never a good idea

I cannot explain how this post have helped changed my mindset. I would waiting to read more of your content related to this wealth creation issues that most people are facing.

Nice, next week will be a great little follow up but the mindset change is really the most important

So you got so rich by Crypto you do not have to work a regular job, anymore?!

;) Just kidding! Really liked your approach of just changing perspective instead of "fleeing the regular job".

As for the rich scale I think (hope!) this only counts for the US ;)

Otherwise you need to include all your future social security claims, as well. Might be complicated, though... :D

!LOLZ I think it´s a very generic scale and maybe I will stay poor for a lifetime, but as I no longer stress because of debt its a much healthier life.

A regular job isn´t bad, as long as you get something out of investing your time. You need profit, not to break even. Because compounding that profit is what makes you feel so much wealthier

lolztoken.com

They’re calling it a BO-VINE.

Credit: reddit

@jdike, I sent you an $LOLZ on behalf of whywhy

(1/1)

ENTER @WIN.HIVE'S DAILY DRAW AND WIN HIVE!

A long time ago I bought a little bit of NVIDIA stock and AMD stock. I ended up selling them not long after I bought them. Like a couple years. If I had held onto them, it probably would have been the smarter move. I wouldn't be rich, but I just should have had more faith in where they were heading. I still have my Apple stock though, so that is a good thing!

It´s so hard to have faith but like I said at the start of the post Winners lose more than losers, but they eventually get better at winning-

And your Apple Stock proves that point, and as long as you sold with a profit and invested that in the next thing you still are in the game.

Yeah, I had a mutual fund that I got out of and I should have stayed in it as well. I'm not complaining though, my portfolio is pretty impressive for someone of my age I think. Especially these days when everyone is all about living a lifestyle versus saving.

I am still working very hard on mine, and I sometimes need to look back and remind myself where I am coming from. Remember I only got out of debt 3 years ago (almost) and what I accomplished in those 3 years already. I mean from owning nothing to owning silver, stocks, crypto and an apartment with a decent mortgage really isn't bad for a baby that just got started.

That is really awesome. My wife and I had some significant debt when we first got together. Something like $25K to $50K in shared debt. We created a plan, got a balance transfer loan for our credit cards and within three years of the five year loan we were paid off. Then the last bull market eliminated the rest of our debt besides our mortgage until just recently when I had to take out a loan for our new (to us) vehicle. I understand how big of a burden debt can be. There are still weeks where things get tight and I get that knot in my stomach.

Yeah no debt probably made your life so much better

And the same here when it comes to things getting tight....

I know it´s because I want to set aside a bit each month but still staying with my budget every month is hard. Although it was much harder before because now I know that if an unexpected bill comes in I can pay it. Before any unexpected bill meant more debt that caused more stress etc etc

I'm pretty lucky that most of my investments I can set aside before taxes. They take it right out of my check before I even get it, so I don't even miss it. I'd like to get to the point where when I get a raise, I just move that into investments as long as I have what I need to live on.

Seriously that is what I did, exactly that! We made it without the raise so lets use (90%) o fit to invest & set aside.

That's smart. We got a little lax with our spending once our debt was gone. Now that we have a loan again we need to pull it back in and buckle down again.

Oh man, I'm in for a treat then! You know what we lost in the past, but on top of that, we made so many FOMO mistakes losing so much. I'd like to say we paid for the experience. But looking back on Splinterlands for example, I wish I could have seen what this was going to be in the future, we'd be loaded from that alone. Sold all, as I could not see it happen, lol I had no faith.

Paid a lot for that lesson but I definitely feel more comfortable the way things are going now than jumping in every new project hoping for the best. Still need to make a plan for the next run though.

!PIMP

You must be killin' it out here!

@thisismylife just slapped you with 10.000 PIMP, @whywhy.

You earned 10.000 PIMP for the strong hand.

They're getting a workout and slapped 3/3 possible people today.

Read about some PIMP Shit or Look for the PIMP District

A plan for the next run, you have about 125 days to come up with that. But I will post about it maybe it helps.

I lost about $300 just because a transaction was stuck on Metamask. Other than that I made several mistakes but overall I am still 3.5K in profit at this bottom of the bear market.

Tomorrow part 2 of this story and I had so much to say that there will even be a part 3. But SPOILER ALRT my networth went up from -25K to ahh just read that tomorrow.

How is the fam? My mom will be coming over in 2 weeks, Kyrian got a work permit for the USA, and Yaelle will be 26 this Saturday. Can you even remember being 26 !LOLZ

lolztoken.com

Mediocrates

Credit: reddit

@thisismylife, I sent you an $LOLZ on behalf of whywhy

(1/1)

ENTER @WIN.HIVE'S DAILY DRAW AND WIN HIVE!