𝐁𝐞𝐬𝐭 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐀𝐝𝐯𝐢𝐜𝐞 𝐄𝐯𝐞𝐫 -𝕋𝕚𝕡𝕤 & 𝕋𝕣𝕚𝕔𝕜𝕤 𝕋𝕠 𝔾𝕖𝕥 𝕎𝕖𝕒𝕝𝕥𝕙𝕚𝕖𝕣

Okay I promise, this is the end, my only friend The End.

No More Chapters added to this story, once I press Publish.

That means I have one more chance to make a change.

One more chance to hopefully help someone.

One more chance to turn my mistakes into a life-changing improvement for someone else, maybe for you Dear Reader.

I started with one chapter, but thoughts and ideas kept coming and so did the awesome comments of some of you inspiring me to keep going.

Now I am not here to milk this series, it just happened.

It Just happened

Me messing up my finances just happened, and that is probably how it feels for most of us.

Feels, because maybe it happened because you did not plan it? Maybe unconsciously you let it happen.

I am not pointing fingers, but I did come to one important conclusion over time. I let it happen.

If I had known better, planned better, and set my mind to it, it would not have happened as it did.

As I mentioned last week, there is one more thing to discuss:

In Best Financial Advice Ever (Improving Health & Wealth) - Part 1 I showed you about that Downward Spiral the world wants you to get caught up in....the debt trap.

A trap I fell for at a very young age. Nobody warned me or gave me the advice to start investing instead of spending at an early age.

Part 2 explained a bit more in deep how wealth will improve your healthBitcoinBaby - The Best Financial Advice You Ever Get Part 2 and the importance of a plan.

Then I figured that if you are not making time to fix your financials you probably would not make time to read my advice, and so I created 𝐁𝐞𝐬𝐭 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐀𝐝𝐯𝐢𝐜𝐞 𝐄𝐯𝐞𝐫 (in under 5 minutes) - Part 3.

Then we got into the part that seems fun when you are in debt, but actually is just as difficult but not as stressful, and I started to share my ideas on investing in 𝐁𝐞𝐬𝐭 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐀𝐝𝐯𝐢𝐜𝐞 𝐄𝐯𝐞𝐫 - Part 4 - From No Money To Mo Money.

And last week I took a look at my own investments 𝐁𝐞𝐬𝐭 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐀𝐝𝐯𝐢𝐜𝐞 𝐄𝐯𝐞𝐫 - ℙ𝕒𝕣𝕥 𝟝 𝕋𝕙𝕖 𝔽𝕚𝕟𝕒𝕝 ℙ𝕚𝕖𝕔𝕖 𝕠𝕗 𝔸𝕕𝕧𝕚𝕔𝕖, and the weird thing was I saw something I did not really notice before. But more about that in the epilogue of this story, because this chapter is all about changing the mindset.

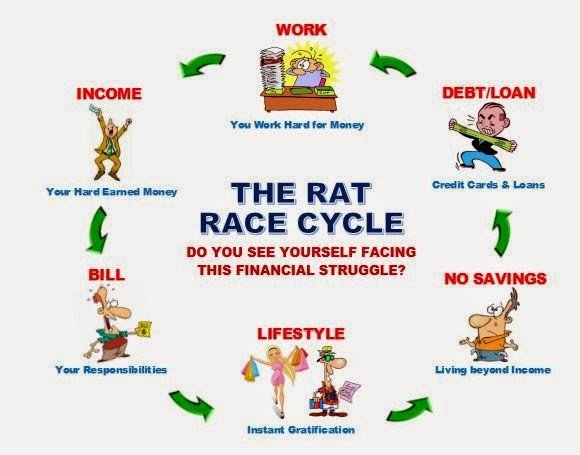

Escapisme Drives Your Debt

The Mindset, it gets you into the debt mess but it´s also what gets you out of it.

If you did not realize, did not plan you risk spending more than you have. Once you spend too much for too long the stress you feel sucks, I know.

And like many in debt, I tried to escape it.... by spending.

Nights out, trips, holidays, video games, binging series, booze; I did whatever it took to not think about my debt.

And it works, the less you think about it the more it grows.

It keeps growing and I kept escaping by not thinking about it.

Till I had a life-changing experience and flipped the switch.

That is the only way; You need to flip that switch.

Look at yourself in that dirty bathroom mirror and say: "I am not gonna take it anymore."

"I AM NOT GONNA PAY FOR THESE F´ERS ANYMORE!"

Now once you are there. Once you are really ready to change. Once you are truly fed up with your own financial mess there are a lot of tips in the previous chapters that will help you become free of debt.

The Mindset

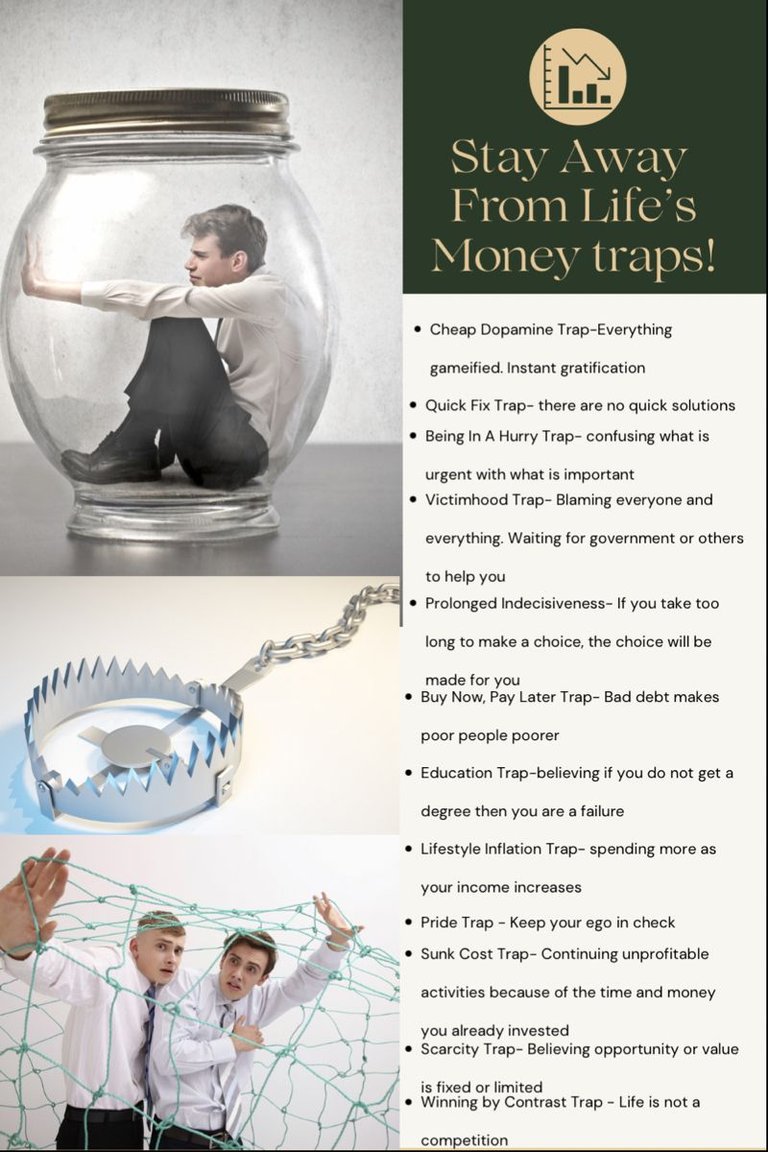

The thing is that it´s so bloody hard to get to that point. One of the reasons that it is so hard is that most of us have been brainwashed and no that is not a conspiracy, it´s real.

People nowadays actually believe they need holidays and shopping to release their stress.

It has gotten so bad that in some countries people think they NEED to go on a holiday, that is a human right. I am not joking:

Amsterdam, April 16, 2023 – The government must ensure that Dutch people can go on holiday. At least, that is the opinion of 21 percent of Dutch people who were recently interviewed for a large holiday survey commissioned by Booking.com. They believe that a holiday is such a great right that the government should step in if you don't have enough money to pay for a trip.

The government is not yet stepping in, but many people who can not afford it believe that it's a right and therefore will go on holiday to relax. And it works!

Until you come back home to more debt and more stress afterward. Now this is a real-life example that might make you cringe and smile at the same time but we all do it in one way or another.

Because, another killer brainwash move was combining Holidays and Shopping sprees; X-mas.

I probably sound like Scrooge but: Come On, can´t you see the writing on the wall?

Christmas was created by Coca-Cola in order to sell and make you buy.

This whole world is set up in a way to make you believe you are missing out if you don´t buy the latest iPhone and do not go on a 3-week holiday.

You Don´t Need A Lot To Get Rid Of Debt

Lift that veil and see through the fog! See how they are trying to keep you trapped.

You are lied to! You are made to believe that spending improves your life, that lifestyle is important, that owning more makes you happier.

Owning more only increases your clutter, decreases your storage room, and increases the cost and effort when you want to move.

Take a long hard look at what you really need, what you really use, and which of those things you use truly increase your happiness.

On A Personal Note

When I was in debt I did not go on a Holiday for over three years, and once things got a little better I went on a 4 day trip because that was what I had saved up for. The trip was lovely, but definitely not mandatory. It was worth spending the money I saved up, but not spending money I did not have.

You need to put your finances on a strict diet, it´s no fun but it will become fun.

Financial Diet

When I divorced my Ex I let her keep the car, it was not even a talking point it was revenge. I knew that car would cost her a lot over time, and it did. Now it also did not make sense to split it, because how to drive half a car?

For me, the decision was easy as public transport could take me everywhere if I put in a bit of effort. Nowadays not having a car makes me money. Instead of paying for it, someone pays me for renting my parking place. Which pays over a month of mortgage a year.

No Car?

Yes, I am not kidding, I have been living without a car for 7 years now. Till now I do not need a car. That means the cost/benefit ratio is zero. I can walk or bike everywhere, there is a subway, and there are busses.

Hence a car would only cost me money and it costs a lot. Yes, it makes life easy, and yes it gives you freedom. But that freedom is very limited when you don´t have the money to enjoy it:

Car Cost Monthly?

Insurance: $80

Fuel: $100

Parking: $40

Taxes: $25

Depreciation: $100

Unnecessary trips: $50

This is a very conservative estimate as I have based it on an average taken from the cost per continent.

But It does mean that owning a car anywhere in the world will cost at least $300 to $400 a month, not taking into account the parking and speeding tickets.

And it´s unhealthy....coming back to wealth generates health!

That is the mindset:

A car shows your lifestyle, it´s convenient, it gives you freedom. But what does it do for you financially? How often do you really take it for a spin just for fun? How many rides really required that car, and how many days did it just sit there in your parking lot?

I needed to change my mindset, from lifestyle and comfort to: What does it cost me? What does it get me, and is that really where I want my money to go to?

OOPS

I did well with the car but I completely F´ed up on the shopping at first, because the shop was so near I went almost every day. I spend over 50% more back then, than I do today on shopping.

Shopping is all about location, location, location

If you need to drive to 3 different shops to get the cheapest products Don´t. You spend time, fuel, parking fees, and get exposed three times to the impulse buying seduction tactics.

But walking to the shop next to your place every day is also not the best option. It again comes down to that one thing:

The Plan

When it comes to financials you need a plan, you need to plan, even for shopping. Like I said in Chapter 2, make that list and stick to it once a week. And you can do shopping for 2 people and a dog, for a week, on a bike I do it everyday week.

Delivering them to your home is also a great cheap option, or walking to the shop and taking an Uber back. That is still cheaper than owning a car in most cases.

Another great way to save on groceries is to visit the market, it´s fresh & cheap hence generating wealth & health and they do not have any seduction tactics other than offering good products for a good price.

The cheapest is relative

I myself don´t shop at the cheapest store but at the closest.

WhyWhy?

It has a wonderful system 2 for 1 or 70% of on the 2nd product. That saving goes into a cheque that you get every two months and for me that almost always means one week of free food. 1/8 is 12.5% discount on my total shopping which then makes it the cheapest (and free shopping is just such an awesome feeling).

Of course, I will stick to my list, but when it´s 2 for 1 I buy for (if the expiration date allows it). These 2-for-1 offers allow me to buy expensive coffee for a normal price.

Invest in a Freezer

I also invested in a good freezer, allowing me to buy bread and meat that has a 40% discount due to the date and freeze my leftovers.

Other ways to cut down on Spending

Insurances: I know I mentioned them before but this is just a reminder we are all over-insured. More on that in chapter 2

Negotiate:

Negotiate with service providers for better rates on utilities, insurance, and other recurring expenses. More on that in chapter 2

Subscriptions;

Stop paying for your health! You can get healthier by not going to the Gym, because that Gym is a money-eating monster.

Gym is not just a subscription, it´s transportation, it makes you thirsty and those power puff drinks come at a cost. On top of that, you want to look good in the gym to be noticed by that girl/boy or just for your Instagram. So it´s not just the Gym it´s a lot more.

Now that you are gonna use the car less do you really still need the gym?

Walking, biking, and not going to the gym generate wealth and keep you healthy.

And it´s not just that Gym subscription:

Amazing Amazon

How about Disney, Netflix, and HBO while you only need Prime, because Prime makes you money.

Without a car, Amazon is awesome as (big) things get delivered, and you can also stop paying for Spotify, as they have Amazon Music.

Now without those subscriptions, you watch less TV and as you no longer spend time traveling to a Gym it is gonna allow you so much time to just walk!

Walking is awesome, it will make you healthier, wealthier, and happier. It´s free and shows you much more than you get to see from that treadmill in that gym that is surrounded by mirrors.

Walking more and less TV means you can also get rid of Netflix and HBO.

And you can even get more money out of Amazon;

As soon as I receive something scratched, a loose screw, or broken within a year I contact the vendor and they always provide a solution, you get a percentage back or the product for free.

And if it´s bought through Amazon,their guarantee is so easy, one email explaining what is broken and they will send you the product again and pick up the old one without you having to leave your house.

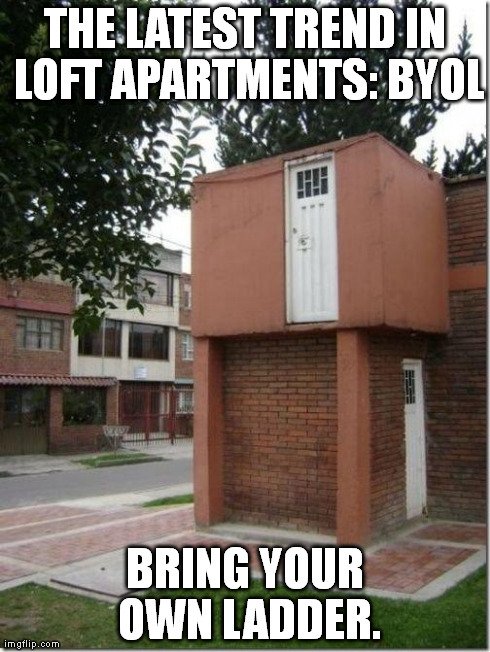

BYOL

Work from home as much as possible, you can save some on your wardrobe, and on commuting. If you are still an obligated office slave, at least BYOL!

Bring Your Own Lunch, don´t buy it or go out with colleagues you are there to make money, not waste it. Also, think BYOS (Bring Your Own Snacks) because those vending machines need to make a buck, and that will be your buck if you don´t BYOS.

Now I tried bringing my own coffee but....better see if you can bring your own machine to the office or have everybody and the boss chip in for one.

Ban Brands

Never ever tell me that you buy a brand because you pay for quality. Research what is quality and then you will see that the brandless stuff is often a lot cheaper.

Impulse Buying

Talked about this one too much already. Bottom Line: Donñt take your kids grocery shopping, don´t go to multiple shops, put some treats on your shopping list so you can stick to it. If you can't get rid of those kids, or have a hard time sticking to the list order your groceries.

Know When To Buy

Don´t do your Xmas or Birthday shopping a week in advance. Buy stuff months in advance when there is a sale or Black Friday and always compare prices to see if you get a real or a fake deal.

Maintenance

The first thing most people in debt save money on is maintenance, house, car, and health. Regular maintenance of home, car, and other expensive assets can prevent costly repairs or replacements in the long run.

Education:

Invest time in learning about personal finance, budgeting, and investing to make informed decisions. This way you can invest the money you now spend on paying off debt in the best possible way once you are debt-free. And if you look around you can get most education for free using blogs, YouTube vids, etc.

The Not So Social Life

This one is a bit hard for some and an easy one for others.

They say humans are social beings, I myself not so much so cutting down on sociallifing was easy.

But for the more social creatures among us, you can still be part of the in-crowd. You can even do birthdays. The trick is getting rid of the shame and being open about your life. Talk about your finances so you do not have to feel bad not getting the kid of your girlfriend's brother-in-law an expensive gift.

Don´t Stop Being Dutch

The Dutch are always praised for being cheap, and they are but there is good and bad cheap. I hate the "you can only have one cookie cheap." But I love to save where I can:

- Reusing simple things like tin foil & sandwich bags

- Buying second-hand games, toys, and clothes

Better for you and for a healthier world. Talking about a healthier world if you buy appliances check the energy usage and then calculate the savings vs the cost of a more energy-efficient appliance.

And of course, turn off the light, don´t open the fridge twice if you can do it at once, shorter showers and an extra sweater. Typical Dutch savings that will help you get into that how to make a profit from life mindset.

Change management on your mindset

Getting into the make-money mindset takes time and requires you to change.

Still, life should remain enjoyable, so you do not need to go all Spartan on yourself.

Aim at reducing your spending with gradual adjustments and lifestyle changes. Going cold Turkey on your spending is impossible for most people, but it gets easier when you start enjoying saving money.

It's essential to strike a balance between saving money and enjoying your life, so make sure to have realistic goals, a feasible plan, and a bit of patience.

Budget Coach?

If you are not able to do it all by yourself ask for help, and get rid of the shame. Family, friends, partners, many have been where you are now.

And if that is not enough, spend some money to reduce spending and get a Budget Coach. If you need that someone looking over your shoulder that is not too close. Get one, because you need to spend a little money to make a lot of money.

On A Personal Note

On that note, I kept you all for much too long spreading experience and advice on how to get your financial life in better shape by getting wealthier & healthier. Next week I will write a little personal story on how I got into and out of debt as a sort of epilogue.

If you enjoyed this well-meant advice or have some advice or experience you like to share leave me a comment I would love to hear from you!

Thank goodness you made it till the end Pees, Love and I am out of here!

[Source Pic](All pictures are by Meme, MyI & AI unless source is listed)

I think you are the Mr Wolf to fix problems with your financial advices. Great series and some super tips here. Not driving is a real big one that can save a fortune!

I have picked this post on behalf of the @OurPick project which will be highlighted in the next post!

The ideas kept coming, and with experience to link it to it was a fun series to write, and hopefully helpful..... and ehh I am lost on the Mr Wolf reference but I feel stupid askin !LOLZ thanks for the support!

lolztoken.com

But that’s a whisk I’m willing to take.

Credit: reddit

@mypathtofire, I sent you an $LOLZ on behalf of whywhy

(1/1)

Keep up the great work! Mr Wolf is legendary I think!

Damn I totally forgot about that scene, guess I am getting old but feeling honored by the title you gave me!

Well, this was a mega-post with dozens of pieces of advice applicable to many...

I was lucky enough that my parents educated me to save... I remember well when my mom opened my first savings account when I was just 8-9 years old... I remember the piggy bank (which was really a piggy 😃) that I got from my uncle, where I was adding coins whenever I could... The irony in that was that all that money was worthless as we had hyperinflation, but the customs of savings stayed...

I can proudly say that for most of my life, I was debt-free and I'm trying to educate my son in the same way... You can spend ONLY what you earn, and ONLY what you can afford to pay the maintenance... What you said about owning a bigger house, a bigger car... I see many people having some expensive car that is "fixed" by duct tape!

Leisure is needed... and I wouldn't say that we shouldn't have vacations, occasional visits to the cinema, go out sometimes with friends... We should do all that if we can afford it with our income... If not, well, it can wait the next year, or when we have OUR money to pay it...

Thanks for the tips!

That is exactly it, leisure is fine if you can afford it.

My parents did the same I had a Vault piggybank, but they did not explain me the risk of debt. The cost of debt, or the benefits from smart investing, I think they thought I was a kid and did not care.

My kid is very aware of his spending, but due to the divorce I was not there to explain to him the risks of debt. I did explain to him how I got out of it, and I recently wrote him an update telling him about the risks.... I hope I did better than my parents, he surely does better than I did as I was in debt to my brother and some friends at 16