Who recovered the most since the latest DeFi Peak? BSC vs ETH

This post will look at how both ecosystem have recovered since the market drop of the past month. We will try to compare which ecosystem recovered the most TVL and where they both seem to be going.

The result was honestly quite surprising.

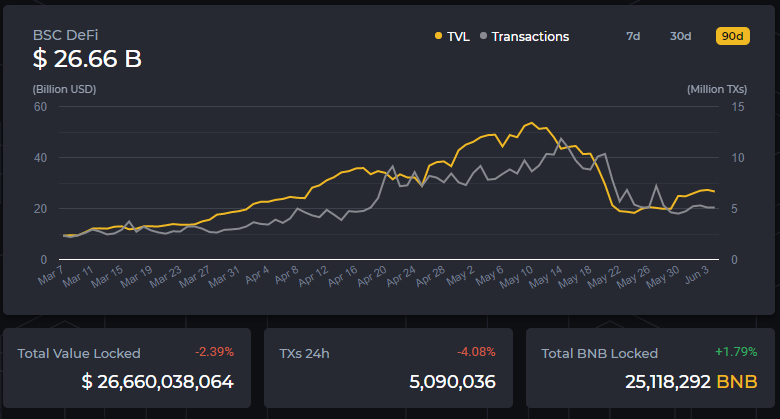

DeFi on Binance Smart Chain

BSC Highest TVL $53.6bn on May, 10th

Today's TVL: $26.66bn

Today's versus Peak: 49.7%

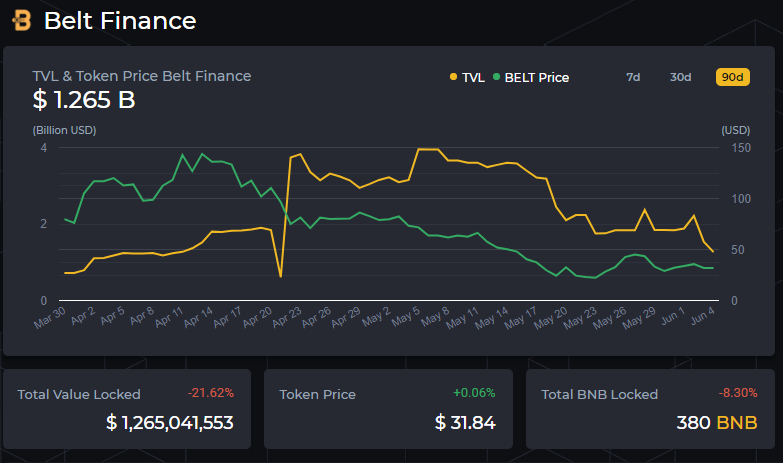

Top 5 DeFi Projects on Binance Smart Chain

I am quite surprised to see that Belt Finance is still in the Top 5 in terms of TVL following its recent hack.

I guess they managed the compensation in a nice way to reassure their community and investors. Well, looking at the numbers they still lost 50% of their previous TVL.

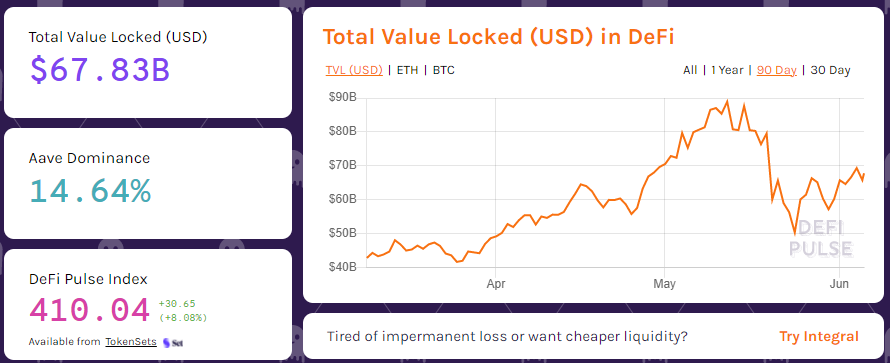

DeFi on Ethereum Smart Chain

ETH Highest TVL $89bn on May, 12th

Today's TVL: $67.83bn

Today's versus Peak: 76.21%

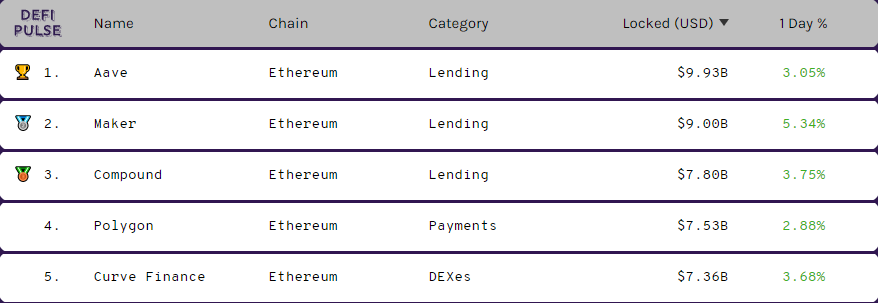

Top 5 DeFi Projects on Ethereum Smart Chain

Surprising conclusion

Before looking at these numbers, I thought Binance Smart Chain TVL bounced back stronger than Ethereum, but as we saw this is not the case at all.

Ethereum was also helped a lot by the rise of Polygon (previously named $MATIC) as it brought some new assets and allowed Ethereum users to pay less fees.

At the moment the gwei is very low and tx costs between 2-8$ which has not been seen for months. I would even say these levels have not been so low since pre-defi.

Ethereum through its vibrant ecosystem and community seems to be holding very well. When you think about institutional investors backing it up more and more and the fact that it is one of the only decentralized "smart chain" out there. It seems Ethereum continues to have a promising future.

Did Binance Smart Chain / Polkadot / Tron / EOS / AVAX miss another opportunity to become the "Ethereum Killer'?

➡️ Leofinance

➡️ Youtube

➡️ Odysee

➡️ Twitter

➡️ Publish0x

➡️ Den.Social

➡️ Torum

➡️ Minds

➡️ Spotify

➡️ Be paid daily to browse with Brave Internet Browser

➡️ Invest and Trade on Binance and get a % of fees back

Posted Using LeoFinance Beta

Ethereum users may have a lot of sunk cost. It is costly to do any action within Ethereum without spending a lot. On the other hand Ethereum is the more decentralized blockchain. That is extremely important to a lot of people.

Posted Using LeoFinance Beta

Hello there @vimukthi,

I agree with the sunk costs when fees where c.50$ to do anything.

As they came down to the lowest in years, people still did not move their assets, quite the opposite, people pulled more into ETH DeFi.

Concerning, the 2nd point I believe it is why it will always be hard to compete with ETH. This is the most decentralized AND innovative chains. Basically all the other ones are copying.

Posted Using LeoFinance Beta

Let's not forget the largest DAPP development ecosystem.

!PIZZA

@vlemon! I sent you a slice of $PIZZA on behalf of @vimukthi.

Learn more about $PIZZA Token at hive.pizza (3/10)

I wish to know more about these token on top 5 DEFI list.

Check Defipulse and defistation, they explain some of the uses of these coins.

Posted Using LeoFinance Beta

Thank you.

I wouldn't be surprised if Binance smart chain outperforms and Ethereum. Ethereum is currently a blockchain that has financial transactions that cost a lot. In my opinion, Ethereum is currently unusable.

It changed a lot and this is my point in this post.

A tx costs now 5-7$, still high but it should be getting lower and lower in the future.

So if you think that tx on ETH are let's say only 2/2.5x more than on BSC, does binance smart chain have a future? Big question.

Posted Using LeoFinance Beta

Personally I think BSC should be doing better but I think ETH 2.0 will reduce fees. The only issue I see there is that the miners might start mining less since they were in it for the money.

Posted Using LeoFinance Beta

I was still thinking about this post ... This is the biggest challenge of the moment, Binance against Ethereum, Champeng Chao against Vitalik Buterinww