Investors (as myself) are flowing into Money Market and Bond Funds!

Hi HODLers, Hiveans and Lions,

What happened over the past month? Back in July, it seemed like the Stock Market was back roaring and we were heading to new highs. 15 Days later, less people are convinced that the market will go up.

What has changed?

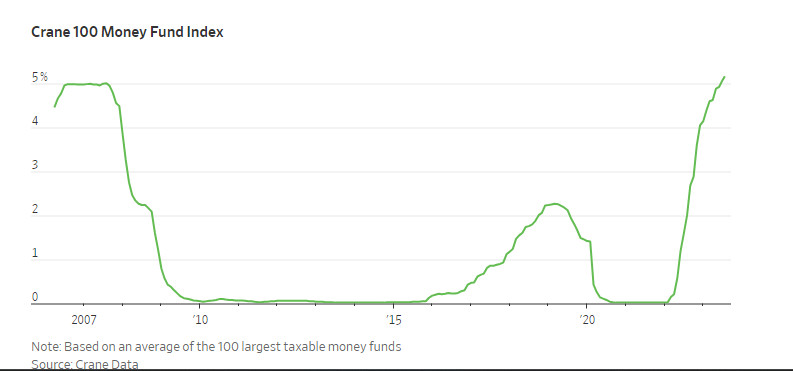

5% interest rates! I keep repeating it but this is THE game changer. I am quite a young investor and should be fully invested in stocks but for the 1st time over the past 4-6months, I am contributing my bi-monthly retirement contributions to... BONDS! Half in High Yield Bonds and half in Investment Grade Bonds with a long duration (average around 7-8 years).

This is the first time in my 10 years investing that I was considering bonds as my main investment and I pulled the trigger. 5-6% almost risk-free is a no-brainer in my opinion and I am just trying to get my hands on the most cash possible to lock these rates!

Apparently I am not alone doing this and if this intensifies, maybe the stock market is in trouble! The US Government needs more investors to take the place of long time US Treasuries Buyers who are selling/not buying anymore such as China or Saudi Arabia.

I know that rates are still rising, but I believe we are close to the top. I also think equities are for the most part overvalued and the economy is in trouble in most places (Europe, China...) and even if US is holding for now, they can't hold the world economy by themselves.

And you? What are you doing at the moment?

Stay safe out there,

Previous Articles

Finally voted for @Leofinance's proposals for the "Everything App"!

Betting against "Zombies" companies and waiting for the "BIG" one!

Posted Using LeoFinance Alpha

I agree it’s a good time for bonds. !WINE

Did you pull the trigger yet? If I have you $100k, which portion would you allocate to bonds or money market funds?