🗞 Daily Crypto News, February, 25th💰

Welcome to the Daily Crypto News: A complete News Review, Coin Calendar and Analysis. Enjoy!

🗞 Market Wrap: Bitcoin Stabilizes Around $49K After Two Extremely Volatile Trading Days

Bitcoin has reversed its biggest two-day loss since March 2020, as prices returned to as high as above $51,000 on Wednesday after the derivatives market calmed down from an over-leveraged condition.

- Bitcoin (BTC) trading around $49,119.46 as of 21:00 UTC (4 p.m. ET). Gaining 3.17% over the previous 24 hours.

- Bitcoin’s 24-hour range: $47,032.52-$51,445.67 (CoinDesk 20)

- BTC trades below its 10-hour and 50-hour averages on the hourly chart, a bearish signal for market technicians.

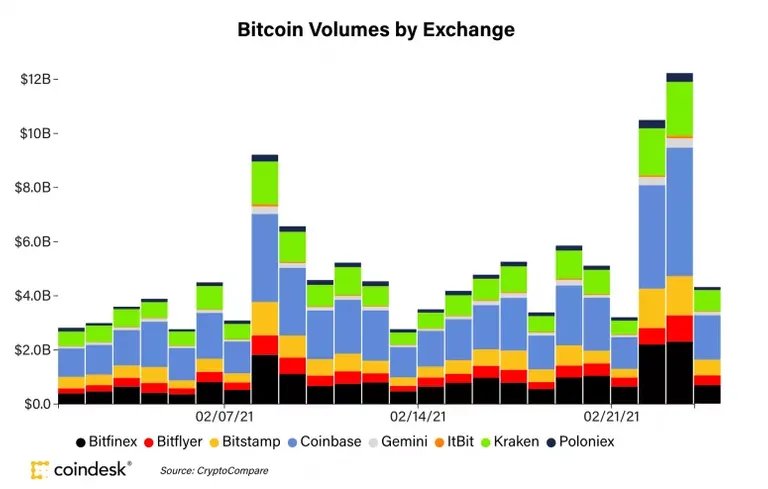

Trading volumes on major exchanges have subsided following a furious level of activity in the past two days, with some $20 billion changing hands Monday and Tuesday on eight major exchanges tracked by CoinDesk. By late Wednesday, volume had registered just $4 billion.

Ether reverses losses from early sell-off

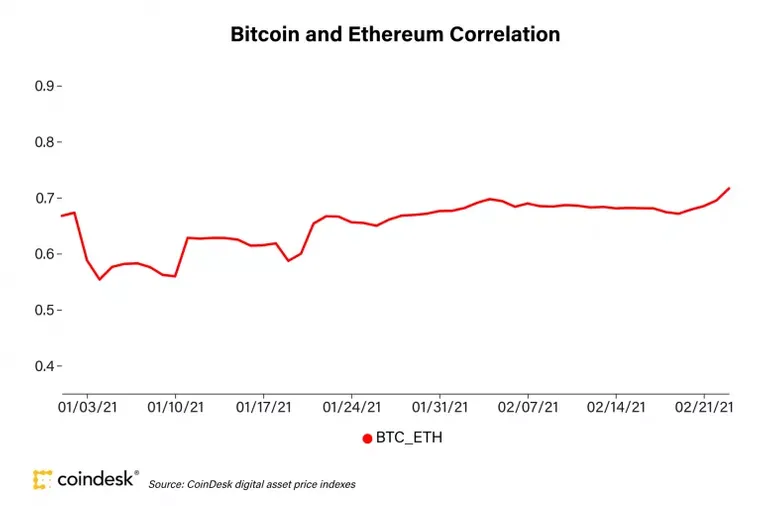

Ether continues to trade in sync with bitcoin and the correlation between the two cryptocurrencies has strengthened since Friday.

🗞 As Visa and Mastercard raise fees, merchants may look to crypto

Credit card providers charge merchants a cut of the payments they accept, called interchange fees or swipe fees. With two major card providers aiming to elevate rates, could crypto become an alternative?

“Visa Inc. and Mastercard Inc. are planning to raise swipe fees for some types of credit-card purchases in April,” the Wall Street Journal reported on Wednesday, adding:

“Though invisible to consumers, they [interchange fees] are glaring to merchants, which often end up paying fees of about 2% of their customers’ credit-card purchases. The fees are set by the card networks, such as Visa and Mastercard. Merchants pay them to the banks that issue the cards.”

🗞 Grayscale’s Bitcoin Trust Is Trading at a Discount. Should Investors Worry?

- Grayscale's Bitcoin Trust is trading at a discount for the first time in years.

- Some analysts are concerned it's a bad thing for the market.

- Others aren't so worried. Here's why.

Shares in Grayscale’s $32 billion Bitcoin Trust are trading at a discount to the price of Bitcoin for the first time in over five years.

Some analysts are concerned that this could depress the price of Bitcoin. If this trend continues, the worry is that Grayscale might stop buying up Bitcoin. And as one of the biggest Bitcoin buyers, a lapse in demand could sink its price.

Darius Sit, CIO of QCP Capital, said there’s nothing to worry about. “Most ETFs trade at discount to NAV,” he said. “It’s not a big deal.”

The catch is that Grayscale will issue these shares in GBTC in about six months. So, in six months, the lending desk could get that GBTC, which they expect to trade at a premium, and use the money to buy back the Bitcoin for a profit.

So when the premium drops, that’s just trading desks cashing out their premiums, he said. “GBTC trading at a discount to the price of Bitcoin doesn’t necessarily indicate bearish outflows,” he said.

🗞 New York Is Done With Tether. Will Other States Follow?

- Tether and Bitfinex settled with the New York Attorney General's office.

- Other states and jurisdictions may be watching how they handle disclosures mandated in the settlement.

On Tuesday, iFinex, the parent company of cryptocurrency exchange Bitfinex and stablecoin issuer Tether, settled a two-year-old investigation brought by the New York State Attorney General.

While the company is publicly celebrating that its stablecoin and exchange can move past this episode, legal experts say iFinex could remain under scrutiny from other state attorneys general and the Department of Justice.

🗞 Daily Crypto Calendar, February, 25th💰

- IRISnet (IRIS)

"#IRISnet Mainnet 1.0 Upgrade is about to happen on Feb. 25"

- Auction (AUCTION)

At 2021-02-25 06:00 AM (UTC), Binance will open trading for the AUCTION/BTC and AUCTION/BUSD pairs.

- Unibright (UBT)

"Whitepaper release; 25th of February 2021"

- Huobi Token (HT), JUST Stablecoin (USDJ), TRON (TRX)

Polonidex delists some BTC, ETH, WBTC, WETH, HT, LTC, USDT, TRX, and USDJ pairs.

- Drep (DREP)

"The founders of DREP will host an #AMA in DREP community at 9AM (UTC) on February 25, 2021."

- 🗞 Daily Crypto News & Video, February, 24th💰

- 🗞 Daily Crypto News & Video, February, 23rd💰

- 🗞 Daily Crypto News & Video, February, 22nd💰

- 🗞 Daily Crypto News & Video, February, 21st💰

- 🗞 Daily Crypto News & Video, February, 20th💰

➡️ Youtube

➡️ LBRY

➡️ Twitter

➡️ Hive

➡️ Publish0x

➡️ Den.Social

➡️ Torum

➡️ UpTrennd

➡️ Read.cash

➡️ Spotify

➡️ Be paid daily to browse with Brave Internet Browser

➡️ A secure and easy wallet to use: Atomic Wallet

➡️ Invest and Trade on Binance and get a % of fees back

➡️ Check out my video on Unstoppable Domains and get 10$ off a 40$ domain purchase

➡️ Get 25$ free by ordering a free Visa Card on Crypto.com using this link or using this code qs4ha45pvh

Helps us by delegating to @hodlcommunity

That's a million dollar question - but if they follow then the entire crypto market is going to be affected for sure. Let's see how it plays out.

Posted Using LeoFinance Beta

I am not even sure as it seems they had some kind of backing.

In the end we would switch to another stablecoin but this wouldnt make the market blow up imho

Posted Using LeoFinance Beta