Fednow Services - Just One of the Many Usecases of Hive

The FedNow Story

The United States Federal Reserve has launched the long awaited FedNow Service on Thursday. FedNow is created to modernize America's payment system, making it possible for Americans to send and receive cash in instantly. FedNow is deployed for depository institutions in the United States, and is scalable to allow the institutions to build products on top of the FedNow platform.

The idea of FedNow has been on the research bunker for about a decade, finally launching out as a system that could eventually mean businesses and consumers will be able to enjoy near instant access to payments (including paychecks) and money moved between financial accounts.

The launch of FedNow is widely considered a "good news for American consumers and our economy," according to Sen. Chris Van Hollen. While many are previewing with a Digital currency eye, it is clear that FedNow is not a digital currency or a replacement for the U.S. dollar but is intended to act similarly to other money transfer apps.

Some banks are already pilot running the new system and would make the service available for customers immediately. Ahead of this development, The Clearing House, which is a consortium of the nation’s largest banks, including JPMorgan and Bank of America had rolled out its own high speed money transfer system, known as the Real Time Payments Network (RTP). RTP recorded about $26 billion in the first quarter, which is a minor 0.13% compared to the $19.7 trillion sent over the nation’s dominant Automated Clearing House (ACH), which takes between one to three business days to move money.

Americans use ACH typically to pay recurring bills, paycheck deposits and loans. FedNow is a relief for Small banks, that have been reluctant to sign on to the big-bank-controlled RTP system. FedNow is expected to revolutionalise banking and cash flow in the U.S. but under the eagle eyes of Fed Reserve. FedNow would open up the banking system for more private entrance since the system would allow for products to be built on it. A new wave of Fintech is opening up in the U.S. economy but one only wonders why it wouldn't favour digital currency transactions.

Like FedNow, Like Hive

In the web3 world, there is a scalable technology that one of its multifaceted fintech services is the FedNow. Yes, Hive blockchain had long been programmed to serve instant payment solutions without boundaries and limits. Just like FedNow, several communities can leverage the Hive blockchain technology to build products that would allow users to send and receive $HIVE crypto as well as other tokens within 3 seconds. That is super fast, anyone would agree! This transactions are made possible by peer to peer communcation which dissolves the need for intermediary services.

Hive... Feeless, Fast and Scalable

Beyond offering users a super fast service of funds transfer, Hive blockchain technology allows for feeless transfers too. A user can send as much as $1 million worth of $HIVE (presently about 2.7 million $HIVE only) to another user without spending a dime as transfer fees. That is an impossibility on FedNow.

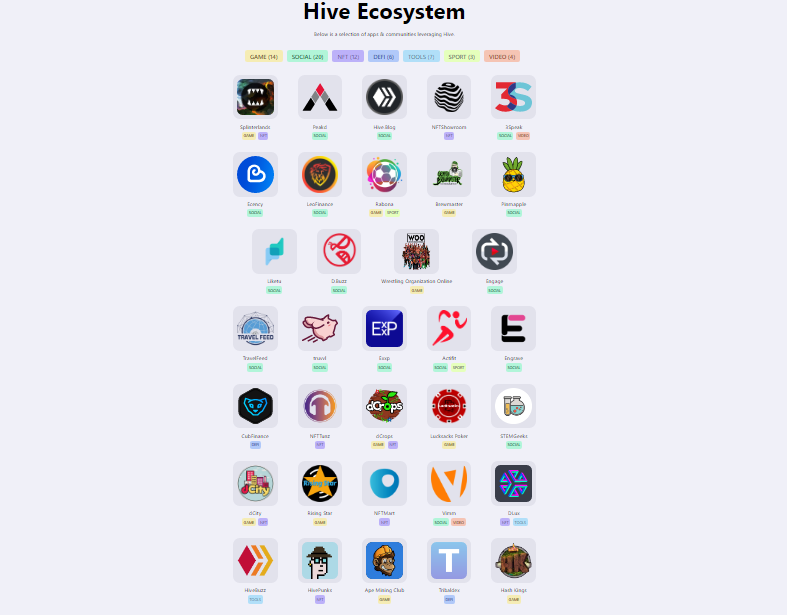

Like FedNow, the scalability of Hive blockchain infrastructure is very robust. There is always room for more dapps and communities to hop in and create as much products as they can to offer an array of services and even transact products.

Hive... A Growing Ecosystem

Building a community and a product on Hive attracts no extra cost if the team has the necessary skill sets required. Getting new users to onboard the new product is also as free as and can be done in less than 1 minute with the LeoInfra feature in place by LeoFinance.

The Hive ecosystem is always growing in a never ending stretch. Some communities have become so large that they are even housing some many other communities within it. Today, @LeoFinance community has built a community feature that now brings many other communities on Hive together for microblogging and on-chain conversations. The @Splinterlands ecosystem on the other hand is robustly growing to cover many other gaming applications within.

While is is clearly stated that FedNow is not a digital currency system, we are keenly watching how easy it would be for banks to build their products on top of the FedNow Infrastructure as well as how FinTechs would be able to maximize this new phase of money management in the U.S. economy.

FedNow and Hive are on two different worlds with no basis for comparison but worthy of notice as we await the feedback from the first set of FedNow user banks and individuals.

On a last note, it would not be far reaching to think that crypto technology's is the inspiration for FedNow. I wish the US Fed success on this launch but also hope that many that seek to draw the best from financial systems would think web3.

Let's Connect

Hive: https://leofinance.io/@uyobong

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using LeoFinance Alpha

https://leofinance.io/threads/uyobong/re-uyobong-mj5zp8h1

The rewards earned on this comment will go directly to the people ( uyobong ) sharing the post on LeoThreads,LikeTu,dBuzz.

I think bitcoin was the inspiration to Fednow. I imagine this will mean hundreds of millions will get paid faster. I hope it is more private than bitcoin or Hive though!

Click on the badge to view your board.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts:

Click on the badge to view your board.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts:

Click on the badge to view your board.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts:

Click on the badge to view your board.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts:

Click on the badge to view your board.

Thank you to our sponsors. Please consider supporting them.

Check out our last posts: