MANTRA the DeFi Ecosystem where Trust & Compliance are part of the DNA

What is Mantra ?

The literal meaning of a MANTRA is a chant which people use to repeat and invoke higher powers to grant them their wishes.

In a lot of ways MANTRA the DeFi ecosystem is also like that.

One important focus area of the MANTRA Ecosystem is its focus of development of Web 3.0 dapps.

One of its main thrusts is to help developers by providing them with the tools and environment to build apps that would be

- Regulated,

- Compliant and

- Permissioned applications

This is the most striking thing that catches ones attention when we visit its site

https://www.mantrachain.io/

Deep dive into the MANTRA ecosystem

Looking deeper we we MANTRA is made up of

- MANTRA Finance

- MANTRA Chain

- MANTRA Nodes &

- MANTRA DAO

MANTRA Finance

The MANTRA Finance focuses on providing DeFi ecosystem that would offer a

Trusted & Compliant DeFi Ecosystem to enable security of the highest order.

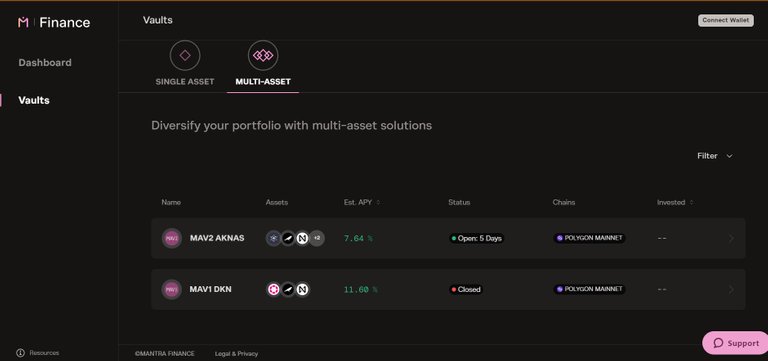

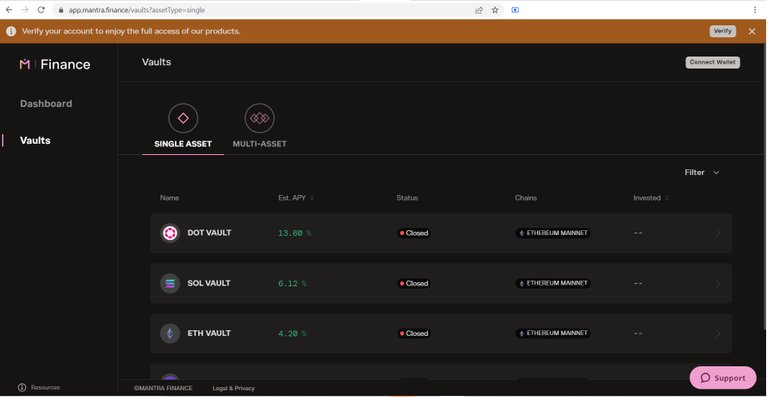

The MANTRA Finance platform provides Vault's that are single asset as well as multiple asset vaults that lets a user earn with a secure platform that provides institutional level security.

MANTRA Finance provides an interesting single and multiple vault feature.

Let is explore the Multiple asset vault feature of MANTRA finance

How the Multiple asset Vaults work?

A user deposits USDT and earns an yield on the deposited amount.

The deposited USDT gets the user an set of predefined interoperable cryptos. This way the USDT deposited is giving the user exposure to ATOM, KSM, NEAR, ADA & SOL.

This exposure is managed by a single wallet without having to manage individual blockchain wallets.

The Vaults operates for a fixed number of days. When the vault period expires the user would be able to withdraw the USDT.

This way a users deposited USDT would earn him rewards on five different assets.

There would be a 10% validator commission fee that would be deducted from the reward amount.

Thus the amount paid to the user would be.

The Principal Amount + rewards earned on the 5 different assets - 10% validator commission on the rewards.

The platform is KYC enabled which means anyone interacting with MANTRA Chain has to undergo a mandatory KYC.

KYC compliance for a DeFi platform ?

This may seem odd however this step is implemented to ensure the safety of the user funds.

A DeFi platform on a blockchain would mean that every wallet on the blockchain is visible and trackable.

Thus in the case of a hack the blockchain address can be tracked however the big question is who does the address belong to?

Why do we even need regulated apps and dapps ?

The KYC process ensures that each wallet address is mapped to a real world person.

This way it is possible to track every blockchain address and the associated transaction with a real person.

This enhances the security of the DeFi system.

The MANTRA Chain

Vising https://www.mantrachain.io/ one is greeted with an elegant design and a welcoming text "Permissionless Chain for Permissioned Applications" that makes one thing what it is all about.

This opening phrase emphasizes its focus on proving the tools to Web 3.0 developers to build regulated permissioned and compliant Web 3.0 apps and dapps. More information can be fount in its litepaper here

Mantra is a chain for the present and the future

Web 3.0 is the present and the future of social media. In a Web 3.0 environment users get rewarded when their content is liked by other users.

Those developers who are involved in building for Web 3.0 can leverage Mantra's Web 3.0 yield engine. Doing so would help them use the Mantra chains yield engine to reward the Web 3.0 users.

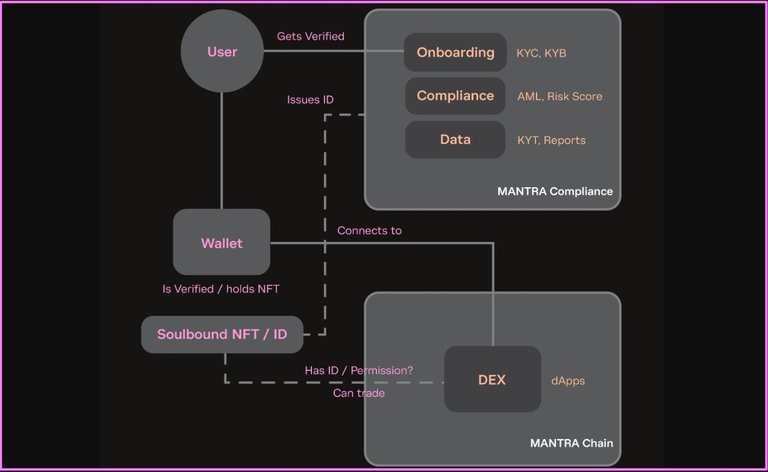

MANTRA Chain provides the tools to implement a DID (Decentralized Identification ) system.

The process includes

KYC- Know your customer

KYB - Know your Business

KYT - Know Your Transaction protocols

- Wallet verification

- Risk assessment & reporting

- AML or sanctions screenings

These protocols and services can be incorporated by the developers in their development work.

MTS or the MANTRA token service

As part of the SDK, the MTS lets developers create native tokens for the projects which can be created, issued as well as distributed as per the Tokenomics.

Multiple benefits of building using the Mantra chain

There are multiple benefits of using the Mantra Ecosystem

- The decentralized apps or dApps can work across Multiple chains

- Mantra offers a vertically integrated ecosystem

- It enables building of dAPPs on CosmWasm. CosmWasm is a smartcontract platform that incorporates a couple of features like security, interoperatibility as well as performance

- Leverage the benefits of IBC compatibility. As Mantra is build with cosmos SDK it means any token launched on the Mantra chain can operate on a various blockchains.

- With Mantra chain implementation also means fast cross chain transactions across some of the largest layer one networks.

Currently the Crypto and the blockchain world works in isolation with the physical world. Assets in the physical world have no correlation or way of coming onto the blockchain.

The Mantra chain is designed with the intent to get Real World Assets or RWA's on to the blockchain as regulated assets. With this functionality anyone would be able to bring real world assets on to the blockchain.

What is a digital asset ?

If a person designs a logo for a company on his computer that logo is a digital asset. If a person scans a document and keeps it in a digital format on his digital device that is a digital asset too.

However with the launch of blockchains and crypto way back in 2009 the digital asset got a new definition.

Thus now a digital asset is used to create value by way of tokenization on a blockchain.

Mantra is a chain for the present and the future.

Let us try to understand this with an example. Jack has a big ancestral house that is quite old. He discovered that his house has a piece of history associated with it.

So he plans to renovate it and turn it into a museum.

For this he needs the money.

One way is to go to the bank and take a loan. The bank would keep the papers of his house and in return give him a loan. This keeps his business idea a local one as he can only reach out to the banks in his city that would be in a position to entertain him for the purpose of loan.

Based on the terms of offer from the bank his options are limited and the terms are decided and dictated by the bank.

While he is considering the bank's offer there is something brewing around him in the crypto universe.

The crypto universe is a land of opportunities and possibilities as we know it.

Alternatively he can turn to the world of crypto and blockchain.

What if he can create a business model where he is willing to raise the money in the crypto space.

A case in point The Mantra Chain comes to his rescue.

For this use case Jack could use the Mantra Chain and tokenize his house or a part of it.

With this idea a certain number of tokens are generated that represent the house he wants to tokenize.

With the money that gets raised from the sale of tokens he can carry out the repairs and renovation an turn his heritage house into a museum.

The profit that is generated from the ticket sales of the museum is shared by the token holders who had invested in Jack's house tokens that were created with the intent to renovate Jack's house.

This all looks doable with the help of the Mantra Chain.

Thus if Jack or to use the MANTRA Chain. He could create native tokens that represent a part of his house.

Moreover in compliance with the law of the land he could sell the tokens to only those people who are whitelisted to buy these tokens.

There are a lot of MANTRA Chain features that Jack can incorporate to build an efficient and functional business model.

Selected key features can be incorporated into Products designed over the Mantra ecosystem.

Use cases of the Mantra chain that any business can incorporate

- Real world assets can be tokenized and mapped to the Mantra blockchain as Mantra assets

- Decentralized ID's (DID's) or Soulbound NFT's can be implemented using the Mantra blockchain

- Using fiat to buy crypto or fiat on ramping as well as off ramping can be implemented using the Mantra ecosystem

- Ease of integration of a project using the MANTRA Token Service SDK

- Incorporating compliance into a project using the Mantra compliance feature

- Use of Mantra decentralized exchange or Native DEX

- Use of Interoperable by way of the Cosmos IBC

- Yield engine utilization of the Mantra ecosystem

- Mantras launchpad can be used as a Capital Formation platform.

The MANTRA Nodes

The MANTRA Nodes are an essential part that provides the stability & functionality to the OMniverse.

Any one can stake their tokens to the MANTRA Node with ease and by doing so they provide strength to the MANTRA ecosystem.

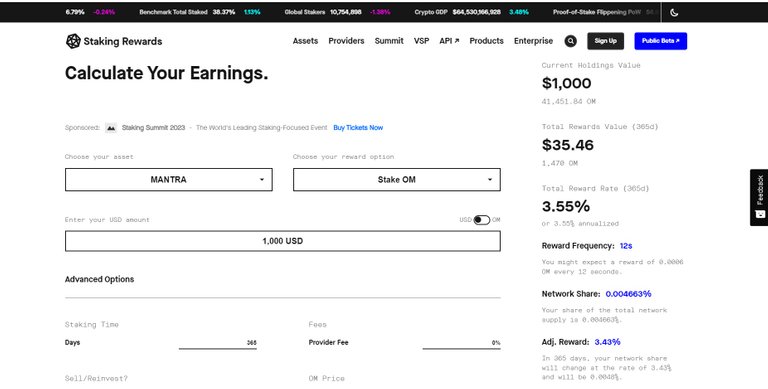

This can also be a viable investment strategy as by way of staking a user can earn staking rewards.

The staking rewards can be calculated by using the calculator here

MANTRA DAO

MANTRA is a community centric project. To incorporate a decentralized, transparent governance ecosystem the project has a DAO in place.

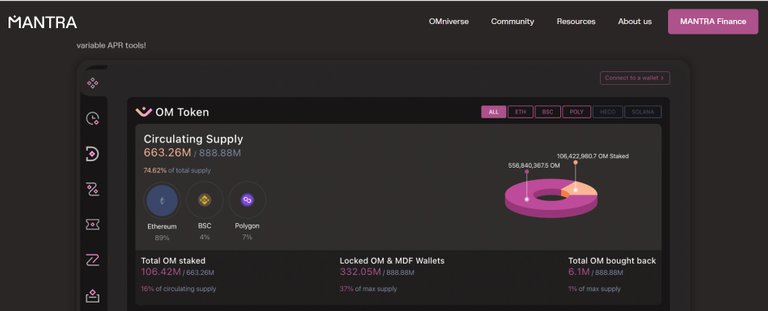

OM is the governance token of the MANTRA OMniverse. There are many uses of the OM tokens such as

- Voting for proposals

- Staking

- DAO token access etc.

Final thoughts

MANTRA is a vertically integrated ecosystem

that focuses on the ability of building regulated dapps in the Cosmos ecosystem.

There are a number of blockchain, and DeFi systems however MANTRA is all about creating a secure system that is compliant by design.

By using MANTRA's infrastructure for development the developers can focus on the development using the tools of the MANTRA toolset and ecosystem.

While the developers deal with incorporating the functionality of the project the compliance can set to get implemented as a part of the MANTRA tools.

For the end user it deploys a KYC compliant DeFi ecosystem where a user can deposit his stable coins and earn from the fund deployment across five different chains tokens.

For More information about the Mantra Chain feel free to conntect with the project team via their social media handles

Posted Using LeoFinance Alpha

https://leofinance.io/threads/thetimetravelerz/re-thetimetravelerz-2puhqaft4

The rewards earned on this comment will go directly to the people ( thetimetravelerz ) sharing the post on LeoThreads,LikeTu,dBuzz.