The Demand For Oil Will Keep Growing

Many are questioning where the demand for oil is going to be in both the near and long-term.

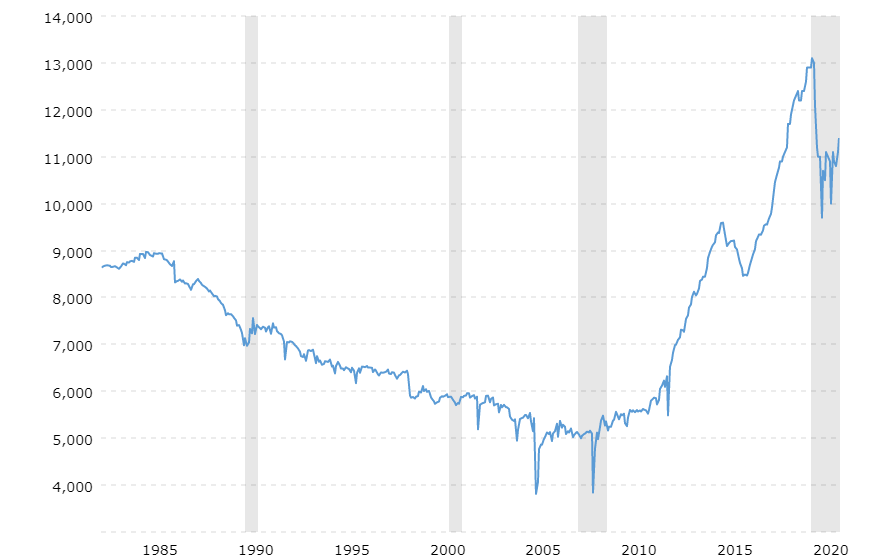

This is coupled with a supply issue since the production of oil was pulled back. In the United States, the drop off since the kickoff of COVID is enormous.

Source

As we can see, the U.S. is still producing about 2 million barrels less than it was in the Spring of last year. This pulls a lot of supply off the market. Of course, we see this across the world.

This is what led the massive run up in prices over the last year. The fact that pricing fell off a cliff (going negative on the futures market) set off a major bull run. This was coincided with an enormous drop off in rig counts.

Renewable Energy

Many feel that oil is done. The believe is that renewable energy is going to crush demand. After all, we are seeing the amount of electric vehicles growing by leaps and bounds.

Logic says this is going to put a dent in oil usage. The problem is that oil is used a lot more than just fuel for vehicles. It also provides a lot of energy for the electrical grid.

While renewable energy usage is also jumping it is not keeping pace. This is going to keep the demand for oil higher than many are thinking.

This from the EIA:

Global electricity demand is growing faster than aggregate renewables capacity, meaning that more fossil fuels will be required to meet the increasing needs, warns the International Energy Agency (IEA). The IEA sees 2021 power consumption rising by 5% year-on-year, followed by another 4% increment in 2022.

So while we are seeing some incredible growth rates with renewable energy, the overall electricity demand, globally, is far exceeding that.

Ironically, this will only increase as electric vehicles are adopted. Hence, the more EVs sold, the more oil that will be needed, at least in the medium term. This is counter-intuitive but it is where we stand.

Oil Supply

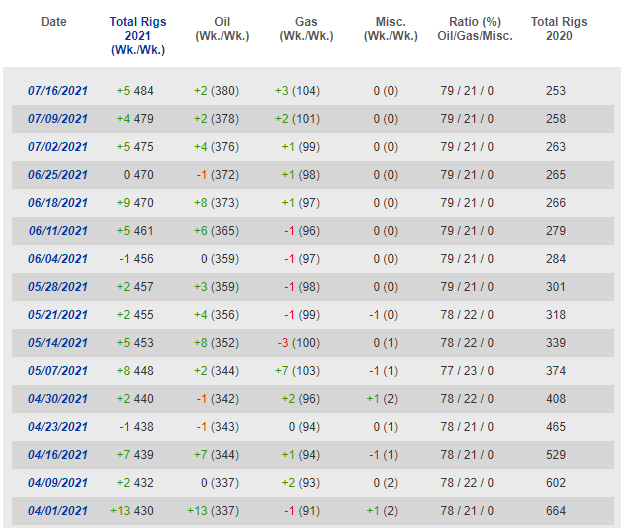

The supply of oil fell off a cliff during COVID. Rig counts dropped liked a brick, still far below levels at the start of 2020. Those numbers were a major pullback from the start of 2019.

If we think back to the way things were 18 months ago, we were dealing with a glut of oil. There was a great deal more supply than demand, causing the companies to cut back their capital expenditures. This is where the cyclical nature of commodities is evident.

The rig count tells a great deal of the story. While that rebounded of late, it is still far below the levels near the start of the pandemic.

Here is the Baker-Hughes rig count chart:

As we can see, we are near double where we were a year ago. However, this is still down a great deal from the 700+ from the end of March 2020.

Less rigs simply means there is less oil being produced. We have the same situation in fracking. Both show that the oil companies are hesitant to increase their drilling capacity a great deal in the near term. In fact, many of the well being drilled were previously opened. Hence the amount of oil from each well is down compared to a new well.

All of this means supply will be tight for a while. Even with demand decreased due to the fact that more people are working from home and commuting in many major cities is seriously diminished, the glut will remain a distant memory.

Market Tug-o-War

The markets will likely remain in a tussle with the bulls and bears fighting it out. Obviously, markets are subject to rumors and being impacted by them.

Each day we hear a lot more about OPEC which is going to push moves, both up and down.

We can expect the rig count to keep increasing, especially if OPEC does decide to pump more. The Americans are not going to want to lose market share. However, the moves of OPEC are far from certain at this point.

There is also the continual rhetoric about the end of oil. This will keep hitting the headlines. However, as noted earlier, more electric vehicles will cause a higher demand for fossil fuels since that is how it is generated globally at the moment.

Thus, we can expect the balancing of the long and near term with the markets. If the global economy does slow, this could have a big impact on demand.

It will take a while for this to sort itself out. Nevertheless, we can count on the demand for oil to keep growing throughout the rest of this decade. The renewables will keep increasing although that could, in a roundabout way, feed into fossil fuel demand.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

https://twitter.com/taskmaster4450/status/1416571477953060865

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

-Hence, the more EVs sold, the more oil that will be needed, at least in the medium term

Presumably more EVs mean fewer gas powered vehicles so are you saying the electricity used by an electric car consumes more oil than the gas used by an equivalent gas vehicle?

The problem I see is that Biden and his administration is doing anything about the prices. Until the pressure mounts more in society, I can't see them being proactive in dropping prices so I expect prices to still go up for a while.

Posted Using LeoFinance Beta

Most non-renewable electric is from coal or natural gas, at least here in the US.

(source)

With a glut of nat. gas from fracking, I don't see oil being the go to to match electric demand. As electric cars become the norm rather than a novelty I expect oil demand will tank. I put it at about 5 years out based on the current uptake of electric cars.

Oil is barely used for electrical energy production and it is very unlikely that this usage will increase. Oil prices will live and die based on use in transportation.