Leofinance Needs To Follow The Eurodollar System

If Leofinance wants to be successful as a Web 3.0 platform, it should follow the Eurodollar System. This is imperative for all to understand.

Before getting started, I will state that we are awaiting some infrastructure. For that reason, this is an article meant to stimulate the mental exercise of where things need to head in the future. It is not, per se, a call to head there now.

That said, we see Leofinance starting to excel in the area of social media. The long -form content is genre specific. The microblogging is now added and that is open to any topic. We are told that shorts will be incorporated, added another valuable medium (video) to the platform. This will also follow as a part of threads.

Here we see a solid foundation forming. We are now to the point where covering the social media bases is forming. Another 6 months and we should be there.

What about the financial aspect? After all, what is Web 3.0 without finance? Here is where infrastructure is crucial. However, after that, it is a necessary part to build out.

The Eurodollar System

Anyone who follows me knows that I spent a lot of time studying the offshore lending system, also known as the Eurodollar System. This is something is overlooked by most, omitting a key component to how our financial and monetary networks truly operate.

It is also the road map for cryptocurrency. Unfortunately, most do not realize this.

The Eurodollar system, these days, has nothing to do with the US dollar. We see the only tie is to the unit of account. There was a time when eurodollars were a claim on US banknotes but no longer. After all, physical currency has too many problems associated with it.

People think governments are in control of money. This is categorically untrue in the majority of the cases. Not only is 80% of the global currency under fractional reserve banking, it also overlooks the entire Eurodollar system.

We also have something that is outside the scope of central banks. As Alan Greenspan said in the June 2000 FOMC meeting, finding money was becoming a "dubious" proposition. In other words, the Fed can't even identify is since the banks created so many different forms.

Essentially, the Eurodollar System is one of lending, borrowing, remittance, collateralization, and cross-border payments, all operating outside the reach of governments and central banks. It is fully decentralized among the participants with anyone being able to participate in the same manner. That said, it is a closed system only open to banks.

What they create is private, reserve-less bank money.

Cryptocurrency is the same, just removing the banks.

Think Like A Banker

When it comes to the second aspect of Web 3.0, it is crucial for us to start thinking like bankers. That might stick in the craw to some but the bottom line is you best understand their thinking.

Bankers know money. This is something that cannot be stressed enough. Others think they know money yet do not. After all, find me a gold bug who can explain the Eurodollar system and how bilateral agreements operate in comparison to the repo market and what impact that has on global geo-politics.

Think I am making this up. The answer is why sanctions tend not to work since the participants, i.e. banks, are not really concerned with SWIFT, BIS or the Fed.

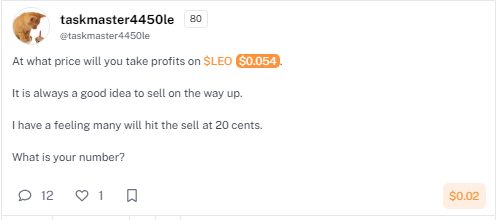

Here is a thread I sent out earlier:

The answer should be: NEVER.

Wait. Doesn't it say it is always a good idea to sell on the way up?

It does if there is no other choice. However, the goal of Leofinance should be to ensure that LEO holders never sell.

Sell is what average people do. Bankers do something different. Instead of sell, they collateralize. If something has value and they are optimistic it will continue, then why sell? The way to accomplish this is to use the asset for a loan so that you get paid yet still own the asset.

Do you see how that is different?

How would you like to be able to take your LEO, at 30 cents, and put that up against a loan at 70%. Lets say you have $3,000, you can pull out $2,100. Now you have liquidity to invest elsewhere. Imagine being able to do that, swapping into HBD, and putting $2,100 in savings earning 20%.

This is what bankers do. The Eurodollar system is one predicated upon the capacity of the balance sheets. Each person on Leo needs to look at his or her balance sheet and how to expand it. As the capacity of the collective gets larger, the entire system grows.

Another interesting thing happens when people collateralize: there is no sell pressure.

If our Lion to the $3000 worth of LEO and sold it, that could put downward pressure on the price of the token. By putting it up against a loan, no sale takes place. The asset is used for further economic (financial) expansion without selling the asset.

Do you see the opportunity that can be presented?

Imagine being able to use this for options, synthetic assets, interest rate swaps, or other derivatives. Consider for a moment being able to use your LEO as collateral for a wrapped version of bitcoin.

This is banking 101. For the past 70 years, the international financial system has been operating in this manner. Ironically, they did it for the most part outside the view of everyone.

It is the path forward for cryptocurrency. Withint its own world, it is the way Leofinance should be thinking.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Alpha

Just thinking about what will happen if there will be increasing demand for the LEO token. Where will they get it if holders will refuse to sell? Expand the token supply?

Refuse? How long one is going to refuse to sell? Raise the prise, and always there will appear someone who wants to sell. Not many, not enough? Raise the price more!

Yeah, a higher price will invite sellers. However, I am thinking of a hypothetical future scenario in relation to what TM said about collateralizing one's LEO assets:

Because not everyone is going to hold. There are always sellers. If you own your house, you can collateralize that for loans. Yet how many people sell their houses.

Posted Using LeoFinance Alpha

Got it. I thought there is another alternative if such an ideal scenario of LEO holders will happen.

Some will do that certainly. But not everyone does. Even insurance companies and banks do end up selling assets at times.

Perhaps the situation varies, that's why.

As price goes up more sellers are brought into the market. However, if the supply is short on the market, then price goes up in USD (or whatever currency it is prices in-swap.hive).

That is the variable that keeps moving.

Posted Using LeoFinance Alpha

Yes, that's the reality of the pricing mechanism of the market economy.

Besides loans, are there other ways to collateralize our Hive and Hive Engine assets? I'm still trying to wrap my head around the deceptively simple concept of the eurodollar system which has neither euros nor dollars.

I want to ask questions, but I don't understand enough to be able to formulate any others yet.

Just think of putting up a diamond ring as collateral for a car. There is no dollars or currency involved other than the unit of account.

The Eurodollar system is like that on steroids. Same is true when you swap Hive for $LEO. It simply spent decades building an entire financial system around this concept.

Crypto is at a much earlier point in time but the road map is there.

Posted Using LeoFinance Alpha

That example I understand. Thanks for providing it.

How do we make the successor system accessible to people? The eurodollar system, to this day, is set up by banks for banks. It looks as if we wouldn't be able to participate immediately since we need to have assets to begin with.

My concern is for people who have 0.000 and are trying to acquire enough assets to be able to enter whatever is modeled after the eurodollar system.

As long as cash and cryptocurrency are still accessible, that's not a concern. Should the day come when cash it outlawed and decentralized cryptocurrency is banned in favor of CBDCs, then people without assets would be locked out.

https://leofinance.io/threads/rzc24-nftbbg/re-rzc24-nftbbg-2ucvprg5y

The rewards earned on this comment will go directly to the people ( rzc24-nftbbg ) sharing the post on LeoThreads,LikeTu,dBuzz.

I hope this idea can be brought to fruition before the bull run and everyone starts rushing to sell. Interesting insights Tasky