LeoDex And The Impact Upon LEO

How much of an impact can LeoDex have on the price of $LEO?

This is something that has many wondering. Understanding the potential implications could lead us to grasp why there is so much excitement surrounding this addition.

We are starting to get some numbers filtering out that we can work with. This, combined with some data from existing exchanges could give us insight into how things could go.

So let us dive right in.

The Impact of LeoDex On LEO

To start, we have to mentioned one major point.

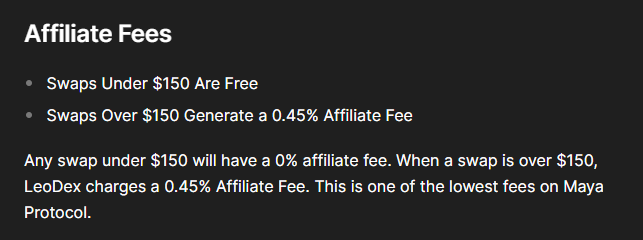

The fees of LeoDex are as follows:

We were told that the fees are going to be used for permanent liquidity. This means that LEO along with CACAO will be purchased in equal amounts and submitted into the pool on Maya.

For example, if there is $1,000 in revenue, we have $500 of each purchased and placed in the pool. This means, at the time of addition, $1,000 was added.

Fairly straightforward stuff.

The major question is how much volume can pass through this DEX. Here is where we get into some guesswork.

To be honest, it is impossible to know how well this does. What we do see, immediately, is LeoDex has one of of the lowest affiliate fees on Maya.

Also, the UI is very intuitive. Ease of use is something that is presented. With the input-output design, users will have no issues utilizing this. What this means is that one coin or token is input to sell and what is desired to receive is selected. Everything else is handled on the back end.

Ease of use is crucial. Also, for those who are connecting using the xDEFI wallet, there is simplicity there also.

The Potential market.

When analyzing this, we have both internal and external users. By internal, I am referring to those within Hive.

There is a major need for this service. Many have few easy ways to buy or sell Hive coins. The ecosystem is basically an island in this regard. For example, Binance is not operating in the US and the largest exchange, Coinbase, does not handle HIVE (or HBD).

LeoDex solves this.

We also have the ability to move in and out of Hive-Engine tokens. This could also be something that helps to generate revenue although it is likely that much of this is below the $150 minimum.

As an aside, that is a nice addition. By allowing smaller amounts to be swapped without a fee, we can see the attraction.

Here is a list of the 24 hour transactions for HIVE according to CoinGecko.

There was over $4 million worth of HIVE traded during this time. As we can see, Binance takes a large portion of the activity.

Can LeoDex capture a portion of this? I think that is logical. To achieve 2.5%, not an astronomical amount, we are looking at $100K. That is $450 in fees generated.

Of course, this is only one coin. There is also the trading of anything related to Hive (eventually) for any listed on Maya. This could include BTC, LTC, ETH, along with the top stablecoins. There is also going to be integration with ThorChain(by Maya) which will allow access to aLL that is on there.

We have to keep in mind that LeoDex is an exchange. This is no different than Uniswap in that regard. That means that we are not limited to only dealing with HIVE based transactions. LEO is the bridge in and out Hive yet other swaps can take place.

For example, LeoDex can be used to swap BTC for ETH (or vice versa). This is no different than what people do on Binance or Coinbase.

LeoDex Fees

How much potential is there really?

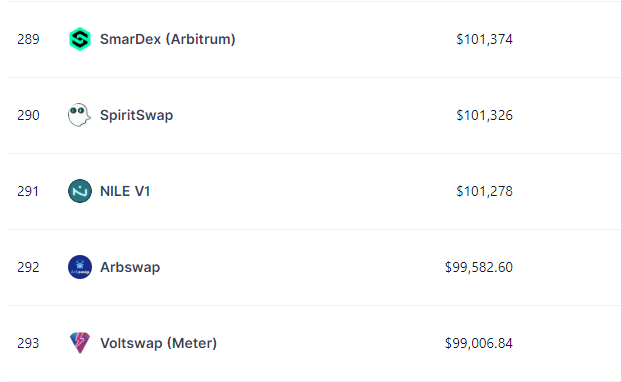

The best way I can figure to make an approximation is to look at other decentralized exchanges. Again, I will use CoinGecko for the numbers.

We will go with the target if $100K per day, in volume, a total that produced $450.

Looking at the list, here is what we come up with.

As we can see, we are not dealing with household names within the crypto world. This is where I would place the first major target.

If we do this daily, the revenue from fees to purchase LEO and CACAO would be $13.5K for the month. That is $6.75K buy pressure on LEO.

This does not seem unrealistic. A DEX doing only $100K in volume is nothing. Right now, Maya is still developing some major pieces which will likely enhance the future prospects of LeoDex. In addition to THORchain integration there are going to be steaming swaps added.

Through LeoDex, people on Hive can connect to whatever cryptocurrency they want and, ultimately get into fiat through a centralized exchange. This is something that was difficult for many.

We will see how things unfold over the next two months. That will give us some key insight. The first task is to fill the liquidity pools. This will enable for larger trades.

It all compounds. We will see if LeoDex provides a breakthrough.

Posted Using InLeo Alpha

The lower fees compared to others was already good, but making transactions free for those under 150 is great. Since it is still new it might be hard to get outside users on the onset, but if Hive accounts use it, that can get the ball rolling.

I have used it and I think the interface is simple and clean. But do you think Hivers will use it?

I think gradually, the higher users have begin to make proper use of the interface to interact with it and I believe it will increases as day goes by