Capital Flow Into The US At An Increasing Rate

Once again, never believe the mainstream financial media.

Week after week, the financial channels bring people on espousing one point of view or another. They talk about crash and how things are going to collapse. Often, the Fed is used as the scapegoat as to why things will happen. Then we have the political narratives, aLL which cloud things even further since neither side even know what the truth is.

How many YouTube videos are out there talking about how the US stock market is going to crash? They will point to interest rates, the economy, or whatever nonsense fits the rhetoric.

That said, once we leave the Truman Show environment, we can see clearly what is going on.

Capital Flow Tells Much of the Story

Answer me this:

When was the last time an "expert" on one of these financial segments discussed the idea of international capital flow and the impact upon markets?

I will be honest, I don't pay much attention to the noise they put out but I am going to guess it is a while. This is not something discussed.

Yet, capital flow is the core basis for much of what takes place. People seem to understand this within sectors, what the "experts" called rotation plays. When it comes to the big question, they punt.

For this reason, let us uncover what is taking place.

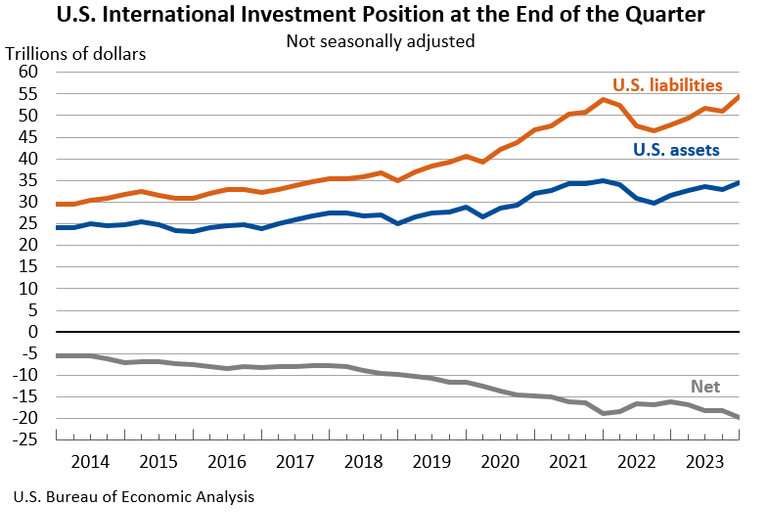

Here is a chart that tells much of the story. It is the net international position of the United States, Notice how both assets and liabilities were going down, post-COVID, and then started to move back up in early 2022. What happened at that time?

Russia invaded Ukraine.

This is an important point to the story.

To get the numerical breakdown, here is what we see.

In the 4th quarter of 2023, the NIIP position, decreases by $1.66 trillion. This means the liabilities increased more than assets.

Another way of looking at this is the liabilities are US assets held by foreigners while assets are the opposite. Hence, when the liabilities increase at a rate outpacing the assets, it means capital is flowing into the United States.

As we can also see, for the year, we were looking at a $3.6 trillion jump.

Safe Haven

How many times have we heard the United States is going to collapse? The market will crash? BRICS will kill the US dollar?

Nonsense.

Look at the data. What happens when things turn ugly? Money seeks safety.

Here is where Putin enters the picture. Since he started the conflict with Ukraine, things are escalating. We are seeing things drag on, which puts the threat of the hardliners on the table. At the same time, the warmongers within the US Government are intent, it appears, on starting World War 3. Nobody is talking about peace.

What is money to do?

Are the wealthy in the EU going to keep their money there? Not a chance. Japan had somewhat of a surge post-COVID like the rest of the world, only to resume their multi-decade trend. China is in rough shape although their flow is hindered due to capital controls.

Where is this money going?

According to the BEA, at least $1.6 trillion of it found its way into the United States in the most recent quarter (the reporting is always a quarter behind).

Do you want to know why the Dow is at an all time high? No, it has nothing to do with the Biden economy. It is summed up here. The Dow is reflective of international capital flows, mostly through major institutions. This is not small cap type stuff.

We also see why the US is always the last one to go down the drain. When the talk turns to BRICS and other theories, simply watch the capital flow. Are trillions going to flood into China with its capital controls or South Africa when things are going south?

Do they even turn to the yuan? We hear a lot about China dumping US Treasuries, a sign the US is losing its place at the helm.

If that is the case, why do we see this with the yuan?

The USD is at a 10 year high against the yuan. A likely scenario, considering all the USD denominated debt China has is that the Treasuries are sold, in part, to help prop up the currency. Of course, hat certainly doesn't fit the narrative.

Sadly, the facts rarely do. Capital flow can tell us a great deal of the story. When the world is going to hell, the one thing we can count on is the run to US Dollar denominated assets.

Posted Using InLeo Alpha

I think many still consider the US as the biggest superpower. Russia messed their position up with what they've done. China is showing weakness with their housing market and economic problems. In times of uncertainty or for people wanting security, the US is still the best choice for investment.

The US has been the only superpower post WW2 although China is working on changing.

To be a super power requires more than just a strong military. It also requires a powerful economy, strong education system, advanced banking, lots of natural resources, manufacturing, technology, and a legal environment conducive to business.

While the US has its challenges, it was the only one that excelled in those areas.

I agree. Post pandemic, a lot of the other countries faced challenges while the US just moved sideways.

Yeah.

The US has the advantage that it is still considered by many to be the safe haven, hence money flows in when things go to crap globally. This provides a great deal of insulation.

so do u think we will have a financial crisis in the upcoming future?

Of course we will. That is part of the business cycle. Nothing goes in one direction.

China is already in the middle of a massive financial and economic crisis.

o.o but when US has one then thats when world falls apart for a certain time