Another Famed Investor Talks About Bitcoin Ban

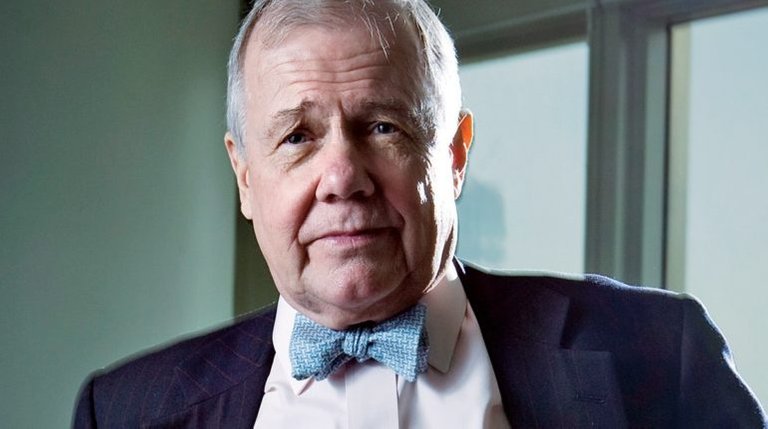

The fossils are out in full force it seems. While not as certain as Ray Dalio, Jim Rogers is in the same camp.

Source

He seems to believe that governments, especially the United States, could ban Bitcoin. The one caveat he adds is that if it becomes a threat as a currency.

In other words, if it starts to threaten the USD, then the government will take action.

This is something that is really interesting and quite useless. In my view, Bitcoin will not end up going after the US Dollar. Instead, it will be targeting gold, something that is already on track for.

If Bitcoin ever becomes a viable currency, not a trading vehicle, but a viable currency, they can outlaw it.

What I find very intriguing is that he is looking at things in terms of Bitcoin, and nothing else. This is very telling to me and makes me wonder of the regulators as well as others in government think this way.

My stance is that if the USD or any other fiat currency is threatened, it will be by other tokens, not Bitcoin. In fact, we are seeing how transactions are already being handled by the Stablecoins.

Thus, the focus upon Bitcoin in this arena is pretty useless.

Of course, like the last decade, Bitcoin took the attention, got the arrows fired at it, while the rest of the industry expands under in its shadow.

Source

By this point, the resiliency of Bitcoin is well documented. After more than a decade in the open ready for attack, there are few ways to take the network down. It is easy to see how it keeps expanding further out. While governments are trying to figure out what to do about all this, the network continues to grow.

Thus, with each passing day, the ability to take down Bitcoin decreases.

Viewed from this angle, we can see how this entire situation is a Trojan Horse. That is what is baffling to people such as Rogers. He does not see what is taking place, hidden in plain sight.

The threat to the United States Dollar is not direct. As stated, this will not likely come from Bitcoin. As for the other coin and tokens, this is a different game than what they are thinking.

This is not a financial challenge. That is not where the battle is being fought. Instead, this is one that depends upon technology. That is the real key. Cryptocurrency's threat is not in that it is an alternate form of currency to take on fiat. Rather, the biggie is the fact that these are decentralized systems moving us towards the networked economy.

As a straightforward financial tool, I agree, Bitcoin and the others pose little threat, at this time, to fiat. The reason this is stems from the fact that cryptocurrency is not looking to take over the economy where fiat reigns supreme.

Instead, cryptocurrency is designed to develop networked economies that remove many of the traditional institutions (including governments).

Netflix did not beat Blockbuster by renting more DVDs. The same was true for Amazon. THey did not open more stores than everyone else.

Thus, we can see how disruption changes the arena that the game is in.

I believe this is the case with cryptocurrency. A currency like the USD and the crypto industry are not in the same ballpark.

That is why it seems guys like Rogers do not get it. They simply are in the wrong zip code.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta

many have tried to ban Bitcoin but no succeeded in doing so

Cryptocurrency is the future. The earlier they accept it, the better for them

Posted Using LeoFinance Beta

Their track record does seem lacking, that is for sure.

Posted Using LeoFinance Beta

You're right. It's whack-a-mole, except every time you bop one, another 3 holes appear.

Posted Using LeoFinance Beta

That's the beauty of cryptocurrency the more you try to stop it the more it will flourish

Yeah. Coingecko has 6,000+ tokens listed: CMC has over 9,000.

We will likely see double those numbers in a year.

Posted Using LeoFinance Beta

The FUD never ends with these guys. It's never ceases to amaze me how normally very intelligent individuals can have such a narrow-minded vision of bitcoin and cryptocurrencies in general. Look at the technology you morons!

Or, more likely, they are trying to keep it from running away so they can keep accumulating. That might be giving them too much credit though...

Posted Using LeoFinance Beta

I don't think they are narrow minded they might have invested their capital in it as well but want to stop others so they can store their money in banks and of course they will profit from it

I like your point of view.

I think they have invested in Cryptocurrency.

They just want to stop others.

They are only interested in what will profit them

Posted Using LeoFinance Beta

I think that a natural defense mechanism called LAZY and their stubbornness, which prevents such people from learning cryptocurrency, is of great importance here.

Posted Using LeoFinance Beta

Are they really intelligent?

Does it take genius to become wealthy in a rigged game when you know how it is rigged and you are able to latch onto the ones rigging it?

Rogers was partners with Soros. I dont think he had to really struggle looking at charts to see what was going on.

Posted Using LeoFinance Beta

I can definitely see ETH, BTC and the others living with the current fiat system. And I tend to agree with you that it will be the new cryptos that will disrupt the market. But I do think the Defi related networks on ETH and BSC tends to disrupt the existing banking system so are you saying that only the original networks for trading is accepted by the bankers? Anything else would be a threat?

Posted Using LeoFinance Beta

Anything can be a threat. All threats are a figment of the imagination of a particular person. The threat can be seen even in a teddy bear (for example, it can be a place where millions of COVID viruses accumulate)

Posted Using LeoFinance Beta

I think they want to focus on Bitcoin because that's where the majority of the money is and while it wouldn't kill of crypto, it would set it back for time. Maybe they are just wanting to buy time for the moment

Posted Using LeoFinance Beta

Interesting information. There will always be people who will be against it. No matter what, they like to be against. This example is very similar to such people.

Link to vote for @cranium as a witness

Posted Using LeoFinance Beta

The US government and the Fed are much less concerned about BTC supplanting the dollar than some of these people. The world is full of assets of every description. Bitcoin and the rest of the crypto assets are among them. In the eyes of the US government, cryptocurrencies are property, not money.

I think the current financial system will adopt blockchain technology and many currently existing cryptoassets and make them part of the system. Bitcoin, for example, is rock solid as a settlement layer for very large transfers.

This video, for example, is very enlightening in this respect:

Posted Using LeoFinance Beta

Yes they do have that view now that it is property.

That can turn at anytime. I think the fact that Bitcoin has zero chance of replacing the USD is going to help keep the USG at bay.

However, as others start to arise, that could really awaken them.

Posted Using LeoFinance Beta

Central banks seem to be much more concerned about stablecoins than Bitcoin. Stablecoins have both the stability and also throughput depending on protocol to replace fiat. They cab be pegged to any assets and currencies or any basket thereof.

Thanks for providing me a topic for a new post that I just wrote, by the way.

Posted Using LeoFinance Beta

I would say that is a valid concern on their part. Stablecoins are the big threat to the use of fiat currency especially the USD.

Coins that massive go up and down in price are not going to be good use cases for transacting.

Posted Using LeoFinance Beta

What the widespread use of stablecoins could do, at least in theory, is undermine the effectiveness of the monetary policy tools at the disposal of central banks. But I wonder how effective their tools are even now apart from the ability to provide liquidity to prevent outright collapse.

Posted Using LeoFinance Beta

Let them talk, they are the “old fashion“ trades. They don't kown really anything about crypto!

Posted Using LeoFinance Beta

There are mix reviews by different governments around the world.

Some a re considering a ban on Crypto and some are actually flourishing it and started incorporating it in their system.

Time will tell what the big giants want.

I think the governments are torn and they do not know really what to do.

Is this an opportunity or a threat? That is what they are asking themselves. And I dont believe they truly know the answer.

Posted Using LeoFinance Beta

Well said and i really liked the Netflix and Amazon analogies... No doubt about it, we are in the middle of a paradigm shift. We are the early adopters and will be rewarded.

I agree with this completely. However, we have a responsibility to keep moving things forward. This will not happen on its own.

We need to keep growing the numbers, all of them, financial and otherwise. People are really what is going to make it insurmountable for those who seek to destroy what is being built.

Posted Using LeoFinance Beta

Yes, absolutely, we've got to keep the momentum now and help the new arrivals find their feet and keep building. Onwards and upwards long term, with the occasional inevitable crypto dip..

Yep, this guy is not even on the same zipcode. It is more likely that stellar lumens overtakes fiat while Bitcoin becomes digital gold, and Ethereum destroys the bond market and other finantial instruments that are better done with smart contracts.

A death by a thousand cuts, that is.

That is all true.

We are nicking away at them. That is how they are lulled to sleep.

When the killer dapp appears, then it will be game over because that will move so quickly they cant stop it.

Posted Using LeoFinance Beta

At some point in the adoption cycle, shutting down crypto will mean shutting down entire economies, as too many businesses will be dependent on them. Hopefully that comes long before Bitcoin is seen as a threat to fiat.