The Strong APR Of Staked HIVE (Over 12%)

There is a lot made of the yields earning in cryptocurrency by staking. This is something that added a dimension to the speculation approach favored by so many.

While it did not eliminate that, it is a supplement to what people are doing. For example, while waiting for their favorite coin or token to moon, they can earn a bit more by receiving some yield.

It is not a bad way to approach things.

Ethereum Make News

The most notable coin to do this was Ethereum. When they switched from Proof-of-Work (PoW) to Proof-of-Stake (PoS), the ability to stake was presented to holders. This pays out at a 4% yield.

This got the attention of people like Raoul Pal. While he is purely a speculator and doesn't really go for yield. he did see the value in the opportunity that Ethereum is presenting.

Understanding how there is a huge market for fixed income instruments only enhances the appeal. Many can receive a bit of a return in addition to the price moves made by the market.

Over time, the yield decreases as more ETH is staked. Nevertheless, when compared to the rates on most fixed income assets over the past decade, this is still rather strong.

The Return on HIVE

We are seeing something emerging with Hive that blows this away. We often focus upon the stablecoin and the 20% APR that the Hive Backed Dollar (HBD) is paying.

However, the other base layer coin is offering something that really stands out.

When $HIVE is power up (creating Hive Power) we see something interest emerging.

To start, there is an adjustment paid to HP wallets for inflation. This decreases over time as the coin is disinflationary.

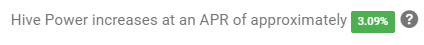

According to PeakD, here is the rate (as of 24 hours ago):

It is now paying 3.09% on an annual basis. This is a bit below what some other opportunities are paying.

However, this is just one aspect to the equation. There is also a more active approach which cannot be overlooked.

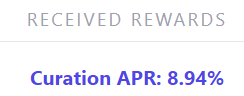

Using Hivestats, this is what the curation APR was on my account:

We see a return of 8.94%. That put the total return for Hive Power over 12%.

In the world of finance, this is outstanding no matter how you break it down.

Granted, there is some activity required. To garner the curation return, the button on the mouse has to be pressed at least 10 times each day.

That said, a 12% return will really enhance an account over time.

Overlooked Gem

Some of us believe that Hive is an overlooked gem in the cryptocurrency world. It is a forgotten animal while people focus upon the shinier objects that are out there.

In the meantime, building takes place. One of the keys, on an individual level, is to keep active. The idea of each account being a business due to monetization is something often espoused.

How many assets out there can provide a 12% yield? Even in cryptocurrency where the returns are known to exceed traditional finance (or TradFi), we do not commonly see this. Yet this Hive, we can count roughly forecast the return based upon the change in the inflation rate over the rest of the decade.

Of course, we are leaving speculation out of the discussion. I operate under the presumption this network will get more valuable over time. As it does, that will eventually be reflected in the price of the value capture token by the market.

Again, while we wait for the mooning, it is nice to keep filling our bags a bit more.

Compounding Effect

There is no doubt that Hive offers an opportunity to compound our returns. We can easily see how the APR turns into an APY as time passes.

The payouts are not in liquid $HIVE. Rather, one receives Hive Power for the inflation adjustment as well as curation. This means we are garnering a return on the coins that were distributed as part of the earlier return.

None of this discussion includes post payouts or layer 2 tokens. We are simply dealing with curation and inflation adjustment. Yet, with just those two, we see a 12% return.

Of course, when we factor in other possibilities, we see how even greater returns can be garnered. Those require having a belief in some of the Layer 2 projects. Nevertheless, those opportunities exist also.

logo by @st8z

Posted Using LeoFinance Alpha

Very useful info @taskmaster4450 - I especially like the idea of having a clear number of actions to shoot for each day, though my question may be a bit too literal...:

Do mouse presses simply mean 10< upvotes on other people's posts per day, without comments or content creation?

!CTP

The 10 mouse clicks are voting at 100%, 10 times a day. This will use up most of the voting power.

Of course, many vote more than that, using a much lower percentage. I give out over 100 votes each day if I had to guess.

I see! That's good to know. On days like today when I'm offline for long periods, it'll be good to have a "ten upvotes @ 100% each" daily target to shoot for as a way to get something done. Thanks.

Always try to use your voting power.

I believe a lot in the future of Hive. I believe this creation and inflation adjustments and the possibility of a twelve percent return is already something most of us never expected. Hopefully, it's going to come pretty soon.

It isnt totally passive. One does have to curate content.

Considerin the price of HIVE will go above $1, %12 annual yield would be just great!

Thanks for the useful information.

Well the percentage is based upon Hive, without regard to price in fiat.

Yes, but suppose the price of HIVE is $2. %12 yearly interest rate for something equal to $2

The rate is based upon amount of $HIVE. It has nothing to do with the price in USD or any other currency.

1,000 HP at 12% means 120 HP added over a year.

Same whether the price is 30 cents or $30. Of course, the return in USD would be much different with the speculation.

Because this post is about Apr, in this case passive earnings, I have a question to you.

What in your opinion makes someone inside the same tokenomics, choose 12% (Hive) instead of 20% (HBD)? What are your financial arguments to not put all in HBD?

Much different products.

With HIVE, one has the speculation aspect. The price of Hive could go from 30 cents to 90 cents. Then the APR is much greater. It also provides more influence for curating and voting on governance.

With HBD, you are looking strictly at yield. The fixed income market is huge so not to diminish that.

It simply is a matter what people prefer. Many buy stocks while others prefer bonds.

Thanks for the response 👍

It seems that plenty of people are just curating and probably automating it. You can get a nice return from that and if $HIVE does go up then you do even better. As I'm traveling and less active online I've automated more of my votes and my curation earnings are much the same. I could make a little more via $HBD savings, but I like to benefit others too. Curation spreads more wealth.

That is true. Autovoting does make it a passive return situation.

As for you doing it, I know this is a temporary measure as you tend to manually curate when you have time.

That said, if one buys a bunch of $HIVE and autocurates, I guess that is needed too.

A lot of different ways to attract people.

Could the 12% “yield” and 20% on HBD the reason why HIVE price is lagging?

Like creating too many shares without increasing the value.

Crypto space doesn’t like “inflation”. Meanwhile people receiving this inflation could be selling for income without enough demand.

Certainly there could be some selling. However, the comparison between HBD and HIVE is not valid. Actually, to create large amount of HBD requires conversion of HIVE. So that can actually flip it to deflationary.

As for value, I do agree. But value is consistently being build whether the market realizes it or not. Consider what took place just in the last 18 months regarding a lot of projects.

Over things get overlooked in the bear since the majority are simply negative about all prices.

That is why I mentioned it being a gem that is undiscovered by many. The activity actually feeds into the value of both HIVE and HBD.

Well, building and staying active is the goal man. But the question here is you made mention of people focusing on the 20% APR the HBD is providing. Those that mean focusing on $HIVE staking might have an effect on it? Okay......... Yeah, people tend to keep HIVE in liquid to wait for a push up, they fail to understand the power of yield earning and the effect it has on the price of the actual coin.

There's this pure truth that people need to know, no one will ever build the tokens for us. We have the power to attract them by building. At this stage I discovered most people don't understand the effect of staking coin. It tend to aquire more energy.

So, what we need to preach more is the power of staking. Explaining the effect of staking HBD and HIVE(hp)

Well people have their own preferences.

We know that, in addition to return, there are advantages to Hive Power. This helps to distribute the influence.

Plus do not overlook the speculation side of $HIVE. HBD is not going to move from 98 cents to $3 (at least we hope it doesnt).

But $HIVE could go from 30 cents to 90s cents. That is where people have choices.

Yeah, there's preference. You should also know these proclivity is due to lack of understanding, so preaching more about it and explaining how it work do make a difference. Then if they tend to do....... We'll know it's a matter of fondness but as it stands there's need for them to know

Yeah, that's true

https://leofinance.io/threads/josedam/re-josedam-28s12uvxg

The rewards earned on this comment will go directly to the people ( josedam ) sharing the post on LeoThreads,LikeTu,dBuzz.

there's also some nice opportunities to delegate your HP for even higher APR's

Great post. 12% per year is a good return.

True, the price does not stand still. On the one hand, this is a risk, on the other - an opportunity.

Thank you for this message. I hope you will stay informed about the news from the 2nd level projects