The Problem With Asset Back Currency And Why HBD Could Be Different

The Hive Backed Dollar (HBD) has a chance to stand out from the rest of the cryptocurrency world.

Over the past 18 months, we discussed what it takes for a currency to be successful. It is something that few evidently consider since most seem to believe in the idea of asset backed currencies. We will get into why this is ineffective in a bit.

We recently had a couple different articles discussing this currency. Both focused upon different aspect of what is can do, one financial and the other dealing with commerce. While both are applicable, the contrast does show the spread in thinking.

Nevertheless, in this article we will discuss why HBD could be different and truly stand out from the rest of cryptocurrency.

Asset Backed Currency

For some reason, many believe that a currency has to be backed by something else to be valuable.

Most recently, we saw the idea of the BRICs forming a gold-backed currency to compete with the US dollar. Even if this were a success, it could be destroyed in about a year.

The problem with asset backed currencies is where the value resides. If the value is on the asset, what good is the currency? Ultimately, that is what people want.

Obviously we could point to the medium of exchange. Yet in a world with thousands of cryptocurrency and hundreds of fiat currencies, there are plenty of currencies that fill this role.

Harkening back to the gold idea, we already have this lesson in history. Charles de Gaulle taught us this in the 1960s when he sent ships to NY Harbor to pick up the gold. Since the dollar was backed by gold, each could be redeemed for the precious metal.

This illustrates the problem with asset backed currencies. When the backing (or reserve) is what provides the value, that is the point of vulnerability.

Hence, the BRIC idea could be killed by the US simply accepting payment in the new currency for its exports. It would be a one way system, feeding "BRICcoin" into the US. After about a year and a couple trillion dollars worth of transactions, the US simply goes to the different banks holding the gold and redeems it.

It is no different with cryptocurrency. When the value of a stablecoin is on the reserve, whether it is US Treasuries, other crypto, or an algorithm, the result is the same.

What Gives A Currency Value

Here is where we will uncover the point that is missed on most everyone, but most notably the gold lovers and people immersed in cryptocurrency.

A currencies does not get its value from a reserve. Instead,what provides value to a currency is the economic productivity generated by that currency.

Read that again. It is the economic productivity tied to the currency that gives it the value. This is why the US dollar is worth more than the Venezuelan bolivar or Mexican peso. It has nothing to do with oil, gold, or the faith and credit of the US government.

So, from this perspective, we see the immediate flaw in HBD.

This is an algorithmic stablecoin that can be converted for $1 worth of $HIVE. Here we see the backing and the quandary.

As long as the value for HBD is on the other coin, it will be flawed.

It is the path most other stablecoins are taking.

The Circular Economy Developed By Hivesucre

Much of this, including the images, comes form this article by @demotruk. It is suggested that you give it a read before going any further.

The entire premise of this article is to provide utility to HBD. It is summed up by the concept of the circular economy. Essentially, we are looking at building value on HBD so that people desire the currency without worrying about what is backing it. In other words, $HIVE does not enter the thinking.

We see so much attention in cryptocurrency paid to HODLing and getting people not to sell a currency. This is where use case enters.

For all the discussion of market mechanisms, few are discussing the idea of a currency being tied up because of the utility tied to it. This is rarely mentioned for something that is used as a medium of exchange.

In short, the idea is that people HBD simply because they use it to pay for goods and services. They are not doing it for speculation purposes, hoping the price skyrockets. There is no interest in hunting yield although there are a few who might take part in the savings. Ultimately, it comes down to keeping the money since it is used as payments.

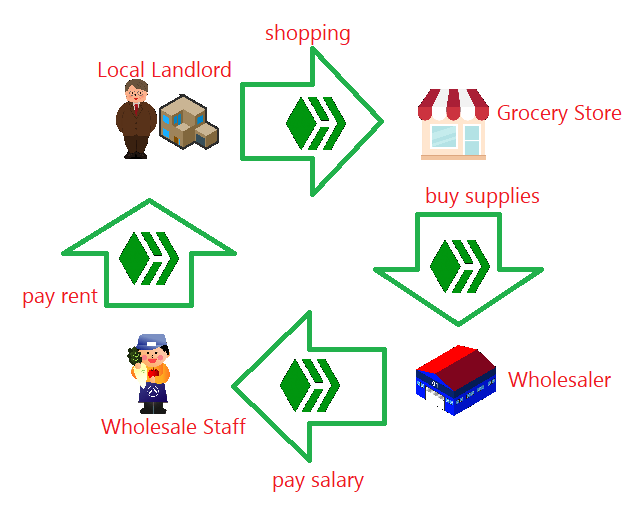

The first image describes the basic concept of a circular economy and how a currency will flow. Notice how there are no "leaks" in the system. People are not looking to utilize an exchange to switch into something else. Goods and services are purchased at every layer of the system.

This image shows what is established in Sucre according to the author of the article. We can see there is a difference at the moment yet a foundation is in place.

In this situation, there is still an issue. While first level operations are taking place in HBD, the next step is usually conversion to the local currency. The reason is merchants have to pay their suppliers in bolivar.

Thus, we have retail transactions happening in HBD with businesses accepting it. However, the wholesalers are still operating in the local currency.

Nevertheless, the progress here is amazing. We are looking at the basis for a circular economy forming. That means that HBD flows into the area and does not leave. It keeps circulating throughout the different participants. Suddenly, the impact to the region is not based upon market price of the asset but the velocity which the currency is flowing.

This is how economic productivity is generated.

Remember, money was created to facilitate trade as opposed of depending upon the barter system. HBD can help this.

Financial Purchases

We would be remiss if we did an article about HBD without mention another area of purchase: financial products.

When discussing the utility of a currency, most focus upon the commercial aspect. The challenge is the numbers are much bigger in the financial arena.

The key for HBD is to have the coin utilized as payment for financial services and assets. This is something that has to be developed on the second layer. When HBD is used to purchase bonds, derivatives, or as payment for on loans, then we see things move to another level.

At present, DAI is doing some of this which is an advantage. The challenge is the transaction fees that comes with it. Even now, Ethereum is around $20 per transaction.

With Hive, any transaction is based upon resource credits. Thus, there is no direct fees. This is the golden nugget for this currency.

The actions of this in Sucre would be enhanced by the development of a financial network built around HBD.

So while others are trying to figure out how to back their stablecoins, Hive can create a commercial and financial system with HBD as the medium of exchange.

As that grows, the utility for the currency explodes. It is also what could make HBD stand out from the rest.

logo by @st8z

Posted Using LeoFinance Alpha

The more I learn about HBD, the more I'm coming around to it. I don't think I would ever allocate a huge percentage of capital there but it's proven itself to be robust within the overall Hive economy.

Excellent work brother.

To be honest I am not a fan of algorithmic stable coins. In fact, I insist others not keep money in algorithmic stablecoins. Besides many people feel afraid of holding assets in algorithmic stablecoins after the TerraUSD (UST). But I know HBD is different from it and for that reason, I believe in it even if I am not a fan of algorithmic stablecoins. You have shared everything with details and it's very helpful to understand and it also shows why HBD is better than other algorithmic stablecoins.

The key aspect of HBD seems as to me that it is so nicely co-ordinated with just $1 of Hive.

That means crisis out of currency reserves or value loss is controlled by it.

Many of the people have the same question that what gives currency the value with which we operate in our activities. I think, by reading this article, the doubts will be cleared.

👍

I keep increasing my position in HBD because I love to have an interest payment of 20%. It is a risk I am willing to take, but I will never put 100% into it.