What is PWR?

Hello SPIers, today we talk about HIVE Power Ventures, ticker PWR. This is still a new token/project on HIVE. SPI is invested so let's look into it so I can show you why I invested us into it.

What is HIVE Power Ventures - PWR?

I think HIVE Power Ventures is the Project and PWR is the first token in the same way SPinvest is the project and we have SPI, EDS and DAB under it. This means there might be more tokens released under it in the future. At it bones this is a delegate HP to get a token project. All the received HP is used for curation via proxy and most of the HIVE earned from curation is powered up.

Hive Power Ventures ($PWR) is an HIVE derivative semi-backed by Hive(softly-pegged) whose long-term purpose is the maximum possible accumulation of Hive Power and future influence in the Hive ecosystem.

Today we are focusing on PWR the token. Like EDS, this is a 100% HIVE-only project, each token is soft pegged to 1 HIVE and liquidity is offered via AMA on BeeSwap. Soft pegged means they aim to keep the price at 1 HIVE, this might sound like they are trying to pull the wool over your eyes but they are not and they can maintain peg easy. Its one of those, the longer the project runs, the better it gets. You might be thinking, thats the way it should work but most defi is the other way around starting good and getting worse.

The token had no presale, no team mintage, no operator mint, no nothing. People have to mint new tokens so PWR started on day 1 with a 0 mint. There are currently 2 ways to mint PWR. Here are the tokenomics and ways to get PWR.

Tokenomics:

Initial Supply: 1000-5000

Max Supply: 1.000.000 (1 million)

1 - Delegate HP to @empo.voter and receive PWR each day

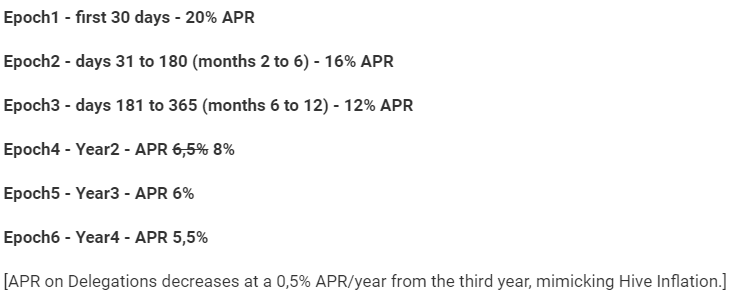

Simple enough and easy to understand. The APY for delegating HP drops over time with there being 5 drops/Epochs in total. It started at 20% (Epoch 1) and will drop to 5.5% (Epoch 6) after 3 full years are complete. We are currently on Epoch 2. Here is a post/copy from the launch post showing how they will do this.

The token was released around 5 and a half months ago so currently the delegating APY is 16% and will soon drop down to 12% for 6 months. Even 12% is still good, its better than curating yourself, better than leo.voter and better than leasing on Dlease.

2 - Provide liquidity to the PWR/HIVE LP on Beeswap

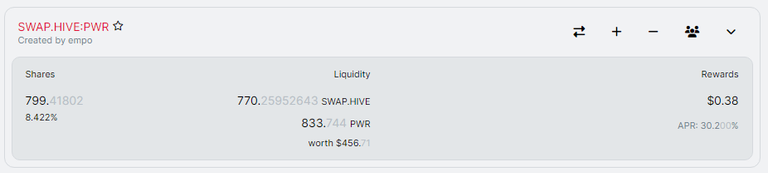

PWR can be matched with HIVE to create an LP token and then staked on Beeswap to earn PWR rewards. Currently, the APY is 30.2% which is very high. The APY is not set so it can go up and down. It started low at under 5% and has increased since then but I would be not be shocked to see it drop either. It all depends on daily volume really. The higher the trading volume, the higher the APY.

They offer liquidity through an AMA which is great, this helps to maintain peg as liquidity gets deeper. This is always very important to me an an investor. Can is cash it all out easy? And with PWR, yes you can. You might need to take a 5-15% hit but you can cash it all out quickly. Providing liquidity is currently the only use case for PWR.

1 & 2 - Do Both

The best play, you would delegate HP to get PWR for free and stack it. After you have a nice pile, match it off with HIVE and add it to the liquidity pool. If you dont have liquid HIVE, you could also convert half your PWR stack into HIVE to create the LP token.

Long term, holding the PWR/HIVE LP token and earning an APY by staking it to the liquidity pool is the best play. Delegate HP to get PWR while delegation APY is high and build a nice LP position. By the time the delegation APY is down to low single digits, you'll have built and be earning a nice APY from your LP position. Then you sit on it, collect your daily HIVE and PWR dividends and wait for the hardcap.

What is the point of building a stack of PWR?

Let's cut the fat and get to the point here, they will start to pay out a HIVE dividend 1 year after launch so in just over 6 months time. I have no idea what the APY will be but i do see its game plan and I can see growth built in.

How?

We know that curation will earn around 8% and we can see in the epochs above that from the start of year 4, the delegation APY drops down to 6%. This means for the first few years, PWR mintage will be higher than the amount of HIVE they earn from curation rewards. This results in less HP in their account compared to PWR tokens in circulation and this project will be underpeg on paper for a few years. From year 4 onwards, curation rewards will overtake PWR mintage and HP growth will start to accelerate against PWR circulation and after a few more years, the project will be overpegged.

Its a little similar to EDS. The distribution is different, very different but the end result is the same. Both have small hardcaps, both are all 100% HIVE and both aim for a token to HIVE peg. We know when we have a hardcap and it's 100% HIVE, it can't really fail under a capable and ethical operator.

Its distribution is..., If EDS were white, PWR is black. EDS is currently over-pegged because it sold EDS miners that mint out EDS slowly at a set amount over a long time. This let EDS power up a large amount of HIVE, much more than circulating tokens. PWR is currently under-pegged because it's minting out its tokens faster than it can earn HIVE to peg them (hence the soft peg). Over time as PWR mintage drops, they will earn more HIVE than they are minting and gain peg and then gain overpeg. With PWR, as mintage is declining, earnings are increasing.

SPI's Investment

We delegated 40-45k HP in the beginning, sold the PWR rewards for the first few weeks to get some swap.HIVE and then added to the LP for 5-6 weeks. I have since pulled back the delegation to 15k cause I was wrecking the peg from selling a large amount each week in 1 go. Our LP on Beeswap is currently worth $450.

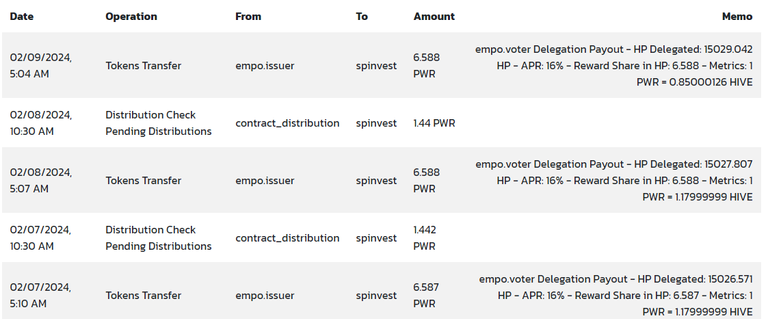

And we earn around 6.5 PWR a day from our 15k HP delegation. My guess is PWR received from "contract_distibtion" is LP rewards. So we're earning about 56 PWR a week.

My plan for SPI is to build its LP holding, maybe try to double it to $1000, sit on it, earn the rewards and wait for dividends to arrive. After this happens, I'll plan the next move.

This will be a good long-term hold. The thing thats really great with PWR and what makes it so attractive you trade it through an AMA meaning you have instant liquidity. This is why SPI does not hold any large amount of any hive-engine token. For SPI, this is the perfect project. Liquidity, check. Roadmap that is sustainable long term, check. 100% HIVE based, check. Reputable operator, check. See, perfect. It'll never make us rich but it'll be very hard to lose money as well if we hold long enough.

Final Thoughts

It really nice to see a project like this pop up. I moan about "why dont others set up tokens and build the ecosystem, its so easy" so seeing a new token thats not bullshit is great. Im a little biased cause SPI is invested but it really does look like a great long-term hold. Alot will depend on the PWR dividend APY but I'd take a guess that it'll be under 8% because curation rewards are around 8%.

I know from reading the launch post the curation rewards will be powered down. A large percentage will be powered up, i assume in another account, another percentage will be used to buy PWR and add to the liquidity pool and the last percentage will go toward PWR and/or HIVE dividends for PWR token holders. They have not specified %'s yet.

I would advise them to use the HP they own from powering down curation rewards for leasing and not curation because they can earn a higher yield from it.

BTW, when I say they, I mean @empoderat. This is the operator. Some might remember a token called SEED that was about for a while, this was a past project of his. He wrapped it up cleanly and everyone got paid fair which speaks volumes about his character and how he does business. SEED was a complicated idea, it was very high-risk, high-reward and was based around crypto angel investing but it had very good fundamentals and he built up core HIVE investments mostly before going into risky ones. The problem with it was, that it was hard to value the token because it's hard to value something thats not been released and traded. I think because PWR is 100% on HIVE, this project will be much better for him and easier to maintain. Hopefully, we'll see Empodert shine a little brighter with this token. Props for releasing a 2nd token after wrapping one up as well. Thats what we love to see, a serial project guy or gal.

To sum up, if you have a few years to wait, could be an ok idea to delegate some HP to this and stack some PWR tokens before its mintage rate declines over the next 14? years to 0%. Use the PWR to get into the LP and build up a stack there as well. In time, if the project keeps on track and stays active, it could be a nice earner and become passive income. I have no idea how they plan to reward providing liquidity after all 1 million are minted but this could be alot of things. Could be swap.HIVE are he could create a new token called PWRv2 and continue on as is. The projects deffo has legs.

ps, The PWR token's liquidity is not connected to its HP balance meaning it can be underpeg in real terms for a long time and still trade at peg on Beeswap. When im talking about earning more than mintage and being over or over peg, im talking about if the token were being backed by actual HIVE and hard pegged, no the trading price if that makes sense.

SSUK Score of 7 out of 10

Thats a good score, better than 95% of other HE tokens easy. and as time marches on and the project matures, this score will increase. It's a 7 today because it's early days and it has a long way to go before its earnings and the amount they power up overtake PWR circulating supply. Fundamentally, the model is sound, growth is built in over time and the operator seems to be an honest person.

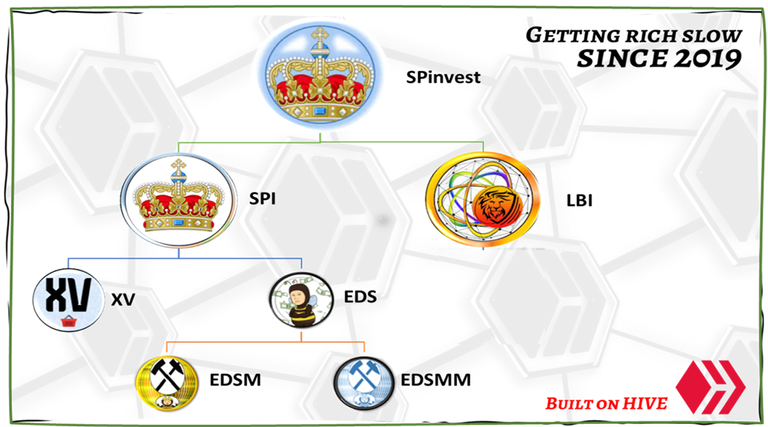

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS miners | @eddie-earner | EDSM |

| EDS mini miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, and fund stats and find out more about SPinvest in our discord server

I know @empoderat and he is a great investor and a long term Hiver.

He has my full support in this project.

!pimp

You must be killin' it out here!

@tbnfl4sun just slapped you with 5.000 PIMP, @spinvest.

You earned 5.000 PIMP for the strong hand.

They're getting a workout and slapped 2/2 possible people today.

Read about some PIMP Shit or Look for the PIMP District

sounds interesting!

!BBH

!ALIVE

@spinvest! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @ sylmarill. (4/20)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power (2x 50 HP) and Alive Power (2x 500 AP) delegations (4 weeks), and Ecency Points (4x 50 EP), in our chat every day.

@spinvest! Your Content Is Awesome so I just sent 1 $BBH (Bitcoin Backed Hive) to your account on behalf of @sylmarill. (6/50)

Yes, @spinvest ...

... it would be hard to overstate the importance of this.

As a savvy investor and steady content contributor on these topics, I would imagine you have written a post (or two) about why this is not the case with the tokens in the table at the end of your post. I'd welcome a link to it, if so.

Overall, apparently I agree with your assessment. I am "next in line" behind Spinvest, on the Richlist. 🫡

Wow, I certainly wasn't expecting this post and I'm so glad you visualised it this way.

Some details:

I have several ongoing dilemmas with dividends that I have not yet solved/decided.

I'll probably ask you for your opinion and how you would do in a few months if I haven't come to any conclusions yet (I hope you don't mind).

And I probably won't do so for the time being, I think it is important to keep the project flexible to changes that I think may be necessary.

All HP received from the healing account to the hold account is delegated to other projects that give a higher % Vs curating.

Cheers!

Yeah, I think long-term and can see good potential in PWR. SPI IS selling some off each week but as the delegation APY drops, that will change and I'll start stacking.

Dividends are always a pain in the ass to think out. You want them to be good so people invest for the "passive" income but at the same time, you'd rather compound it all to snowball faster 😆 Sure, hit me up anytime, you have me on Discord.

Thanks for checking out the post and glad you dont disapprove. BTW, 7/10 is pretty good. I'd mark EDS the same 7/10 to be honest cause it's on the same path as you are with PWR, EDS is just a few years ahead with 2 out of 20 years done, your 0.5 done out of 14ish years. It's near the same thing, EDS is built out more but you have a liquidity pool so...pretty even on paper.

Look forward to making some $ together 🚀

Just today got to know about this project. Sounds interesting, will share to friends as well.

!PGM !PIMP

!PIZZA

Well shit @balvinder294, this post is older than 7 Days days.

Please try PIMPin' a different post.

(We will not send this error message for 24 hours).

Read about some PIMP Shit or Look for the PIMP District

$PIZZA slices delivered:

@balvinder294(1/5) tipped @spinvest