What is Margin Trading? & SPI's 5x ETH Margin Trade

Hello SPIers, today we learn about margin trading basics and take a look at a recent position I've got SPI involved with.

Before we get started, margin trading and using leverage in any form is super high risk. I would advise to never put more than 1% of your net worth (excluding pensions and property, your house is not an investment but thats a different post.) into any form of leverage trading.

What is Leverage?

Trading with leverage means you get much more exposure to the market than the amount you have deposited. Trading leverage is a double-edged sword because losses are magnified the same as potential gains. You can get wrecked quickly if the market turns against you and if there's a flash crash.

There are many types of investments that use leverage like currencies, CFDs, futures, spread betting and margin trading. Today we will be looking at margin trading with leverage.

What is Margin Trading?

This is borrowing money from a broker are exchange to allow the investor to buy more than they have deposited. The investor is buying the actual asset and not buying a contract/paper asset.

An investor will deposit funds to their margin account and decide what they want to invest in. After they have decided, they have the option to trade for either spot or at leverage. Leverage will be shown as 2x, 3x, 5x, 10x, etc.

If the investor deposits $1000 and selects 5x, they can borrow $4000 and have a $5000 position. The money borrowed is subject to interest. If the investment drops 20% to a value of $4000 (the borrowed amount), the broker/exchange will liquidate your position and you lose your $1000.

A simple rule is to divide 100 by the leverage and thats what percent your position can drop before you can liquidated. 2x would get liquidated after a 50% drop and 10x would after a 10% drop. The higher the leverage the higher the risk of getting liquidated.

On the flip side, the price of your investment could double and be worth $10,000. To exit, you would liquidate the position, pay back the $4000 plus interest ($10-$50 for a few months) and the remaining $6000 is yours. That's a $5000 profit on top of your $1000 investment from your investment doubling in price.

Another advantage of margin trading is when the price of your investment pumps, you can sell off any amount and use it to pay off your loan. Using our example, the investor could sell off $4000 of ETH and use that to repay the loan and that would be left with $6000 worth of ETH.

Protect your Position at all times

All good exchanges will have some sort of auto-top option and my advice would be to use it. We're told to not hold funds on exchanges but to use their services, you have to. Sticking with our example of doing a 5x trade with $1000, I would recommend having at least the same amount sitting in your holding wallet so $1000 in this case. You might think of this as dead money and it kinda is but essentially, this would be your security against a big correction or flash crash. We never remember the last flash crash but they happen and they wreck alot of people.

The higher the leverage the more you should have in reserve, if trading 10x for $1000, you should have $3000-5000 in reserve because the risk is higher. Always have auto top-up selected, ensure your wallet is funded and never "borrow" from it. Thats a rookie mistake cause you'll never pay it back.

Always Protect Your Position

SPI's 5X ETH Trade

Ok, now all the explaining and boring stuff is done, let's take a look and see what SPI is doing. I've been doing margin trading from my personal account for a few years already and I've already paid the cost to learn so thats a nice saving for SPI 🤣

First off, im using Binance. I've been using Binance since 2017 and never had a problem yet so they are my go-to. I've been waiting for a correction and when i seen this happen with ETH. I was watching a few tokens but ETH had the hardest dump, the #3 dump was 7.2% and that was my signal to jump onto the horse.

Sadly it did dump 1 more time but c'est la vie, its all good now.

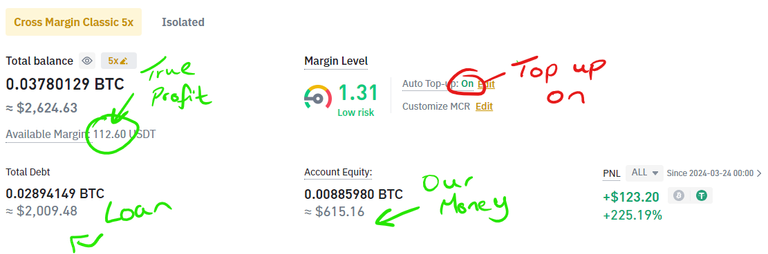

I deposited $500 USDT into the margin trading account and kept $500 more in the spot/holding wallet to be called upon if a liquidation event comes up. I went to the ETH trading page, selected margin trading and picked 5x because I was feeling good about the trade. I had planned to do 3x but ETH was down 20% in total from its recent run to $4000 and it just did not feel it would drop another 20%.

At the time, ETH's price was $3350 and I worked out our liquidation price at 5x to be $2680. I think thats more likely we'll not see $2700 ETH again than we will so I take the 5x trade. From the deposited 500 USDT, I was able to borrow another 2000 USDT (@16% APR) and get us a $2500 ETH position.

You can see we took a dip after we bought in and then it went sideways for 5-6 days before it pumped again around 8th-9th a few days back. Now we are in profit and sitting pretty.

We have built up $9.63 in interest so far so it's looking like around $9 per week. You can see above the "true profit" number showing as 112 USDT, this is the amount of free equity we have in our wallet. We could open another 112 USDT ETH position and compound our gains or you can take out a new trade with different conditions on a different crypto. This can really boast profits to the moon but it's risky as hell and it's not something I'll be taking advantage of for SPI. We could also compound $20 of our profit in and it would be much less risky but I feel thats a getaway trade that leads you to take more risk further down the road. I thought I'd just explain that because "account equality" is not the same as equality you can use from profits for further investing.

When Exit?

Sheet, no idea to be honest. How high can ETH go? It went to nearly $5000 last cycle so it's possible it could double that this cycle to $10,000. I'd say we jump off the horse at around $7000 which is double our buy-in and exit with $5000. If that takes 1 year to happen, we'll have built up $460 in interest we left with $4540 and we take away our initial investment for $500 to leave a true profit of $4040.

That would result in us getting a 9x return on an investment that did 2x.

Thats the Post

There you go, SPI has ventured out into a new investing style. This is 1 off for now but when the overall crypto market is so predictable, its hard to resist the free money. We know crypto is going to pump for the next 18 months, we have no idea what days or weeks but it'll pump. We know that crypto will dump in 2026 opening the doors to shorting positions. 2027 = sideways (take the year off) 2028/2029 = Pumping again.

I hope I have explained things ok and if you are a complete newbie to leverage trading, the post made sense. Let me know what you think.

Getting Rich Slowly from June 2019

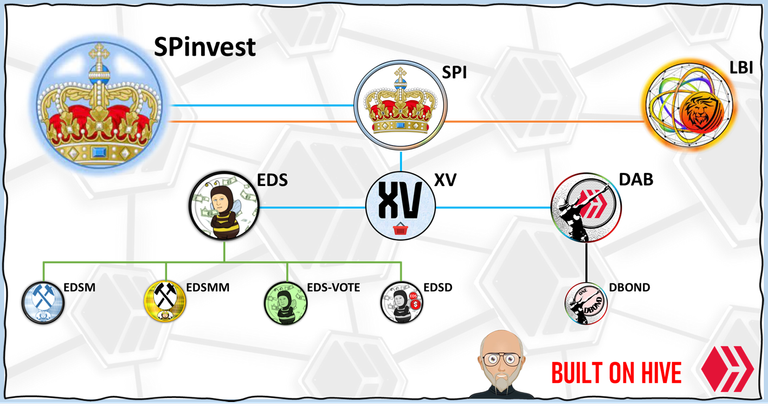

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS miners | @eddie-earner | EDSM |

| EDS mini miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, and fund stats and find out more about SPinvest in our discord server

Thanks for the informative share. !LOLZ

lolztoken.com

Because it cantelope.

Credit: reddit

@spinvest, I sent you an $LOLZ on behalf of fjworld

(4/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

Your welcome, hope you learned a little bit if you dont know about this type of trading

It was a good refresher. Back in the day I did have a margin account to trade some stocks. And I still use some form of leveraging in my investment and business strategies. !PGM