Take the Quiz and find out which Investor type you are

Hello SPIer's. Today we look at 3 types of investors and into how you should go through all 3 types (1 at a time) through different stages of your life. There's a quiz you can take to see which type of investor you are.

The 3 types of Investors

- Conservative

- Balanced

- Aggressive

Ideally, we should be all of these types of investors as we move through life and. When we are young we can take risks because we have lots of years to make up for losses, when we are middle-aged, we need to slow down some and when we are near retirement age, we need to take as little risk as possible and be planning for income investments.

Under 40 years old

When you are younger, you should be aggressive and invest with a long-term POV to let compounding work its magic for you. You dont need to diversify as much and can cherry-pick and go 20% on 1 investment are even be invested into 1 investment class. At this stage, you trying to build and more risk can be taken. If you lose a bunch, you have time to make it back.

Over 40 and under 60 years old

This is when you are most likely over the halfway mark and the ideal time to become more balanced. Start investing in index funds, bonds (if they are decent) are even real estate if you've done well during your aggressive years. You are still investing long-term but your risk should be spread out more into more predictable investments that have a time-proven history. At this stage, your trying to split your eggs into things that will stand the test of time.

Over 60

The end goal and retirement if you started out young in your 20's. By this stage, you could be super conservative and I think the goal would be to have investments that earn enough to pay for your chosen lifestyle while compounding 4% back into your investments to cover future inflation.

The classic is that it has $1 million in the SP500 thats has averaged 9% the past few decades. Remove 5% from your SP500 1 time each year and let the let ride. You'll have a 50k-a-year income that increases by 4% per year which is higher than the normal wage increase each year.

I say classic because these days, you need $3 million invested to make a comfortable family life factoring in having to pay taxes. You might have a property that you bought while younger that is now paid off and earning you rental income or you might have a large basket of the top-yielding dividend stocks.

Most People

Most people are 1 type of investor their whole life and this is not a bad thing. I mean do what you know and more years of experience should yield better results. Some people dont like risk, period. Others dont mind short term risks but only if they believe it'll come good in time and a few of us complete degens with 0% risk awareness.

We are what we are and we are creators of habit, so...what are you?

Question 1: Buying Shoes

You go to a shoe store to buy a pair of shoes you’ve been eyeing for a while. Your friend tells you he just saw a new pair of limited edition shoes that are selling out fast. The store closes in 5 minutes, and there is no time to try them on. You can’t return the shoes, either. You:

- Get the shoes. Chances are, you’ll like them (3 points)

- Ask your friend to buy them now, and if he likes them, hopefully, you can buy yourself a pair later if they’re still available (2 points)

- Get the shoes you originally wanted – you know they’re good (1 point)

Question 2: Game Show

You’re a contestant on a game show, and just won a brand new laptop. You would:

- Happily take the laptop (1 point)

- Trade it for a chance to win a car or lose everything (3 points)

- Phone your friend – she always gives great advice (2 points)

Question 3: Migrating to New Colony

You’ve been asked to be a part of the first colony at the bottom of the ocean. You have to decide now – you’ll only have a day to pack! You:

- Start packing, and are ready to go an hour early (3 points)

- Agree to go, but only if you can come back whenever you like (2 points)

- Run away like a scared cat, and hide in the closet (1 point)

Question 4: The Weather

The weather forecast says there is a 50/50 chance of rain today. You:

- Get the umbrella, and double check to make sure there are no holes (1 point)

- Go outside into the rain – nobody melts if they get a little drizzle on them! (3 points)

- Look outside to see what other people are doing (2 points)

Question 5: A new Type of Coffee

Final question. You go to a café, and see a new type of coffee on the menu: The ghost. Your usual is still on the menu. You:

- Get the ghost – it could become your new favourite (3 points)

- Go for your usual – better safe than sorry! (1 point)

- Come back tomorrow with your friend, and have her sample it first (2 points)

Okay, time to add up your score. Now, let’s find out what kind of an investor you are!

5-7 Points = Cautious Investor

8-11 Points = Balanced Investor

12-15 Points = Aggressive Investor

Let me know in the comments below what type of investor you are. I took the test personally and I got a score of 13 so im aggressive. The questions are silly but it's all a bit of fun. The quiz was provided for by this website here.

Thanks for taking the time to check out the post, have a great day.

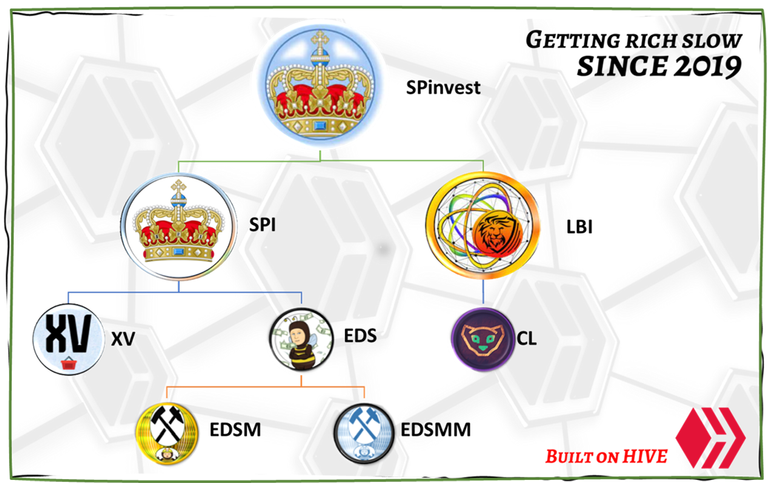

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS mini miners | @eddie-earner | EDSM |

| EDS micro miners | @eddie-earner | EDSMM |

| CUBlife | @lbi-token | CL |

Stay up to date with investments, fund stats and find out more about SPinvest in our discord server

I came out as a balanced investor which was probably true in the past but now I would say I'm very conservative. But then can I call myself conservative if I'm invested in crypto?

Balanced is good.

Depends on the crypto to be honest. I'd personally say if its not BTC or ETH, it might not be around in 5-10 years. Go back each year from 2022 and look at the top 10 cryptos and your mind will be blown to see how many once really great looking investments are now dead. Well, still operating but dead.

Yeah. I was referring to BTC really. It's the only one I DCA into. :-)