SPI's 4-Year Full Crypto Cycle Journey and Lessons Learnt

.Hello SPIers. SPI is now in its 5th year of operation and I'd say we've done a complete crypto cycle. Let's look back and see how the fund has been operating and how the SPI price pegged to HIVE can swing massively depending on where we are in the cycle.

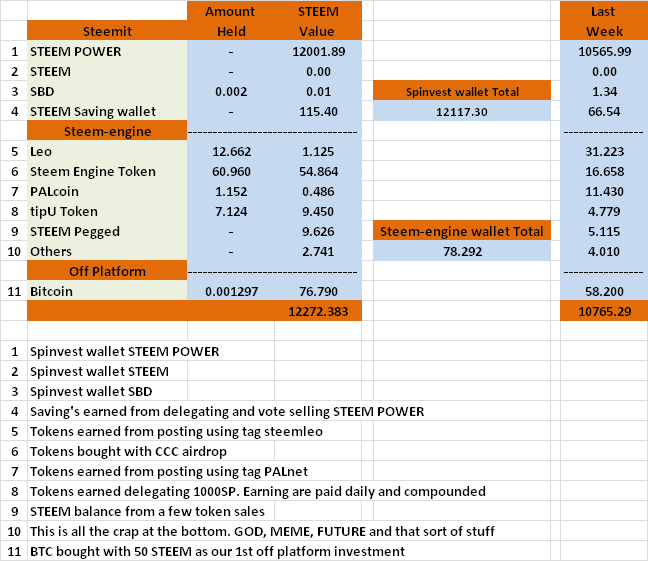

Going back 4 years to 9th Aug 2019

Pretty lucky this was a Weekly report day so thats cool. The fund was only 42 days old at this point. We had 12,000 STEEM POWER and about 250 HIVE worth of hive-engine tokens.

Each SPI token was worth 1.12 STEEM. 12% profit in 42 days, damn! We did get off to a good start but it all started from STEEM POWER. I issued SPI token for 1 HIVE each and powered up all the STEEM. Pretty much everything SPI has built since this time has been funded through either content, HIVE POWER and airdrops.

Look at the amount of BTC we had back then. bahaha. I could not have dreamed about SPI having a full BTC backed then. This was our 1st ever non-HIVE holding. I think this was around $30 worth and it took 5-6 weeks to save up for it through earnings.

Going back 3 years to 9th Aug 2020

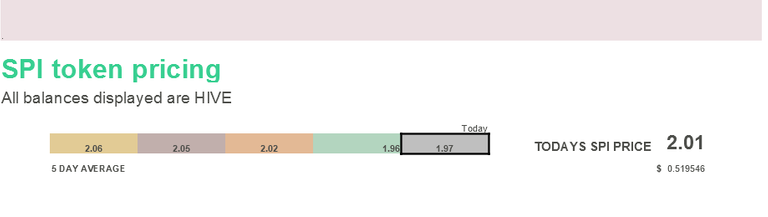

So by this point, we had sold out and issued all 100k SPI tokens and we had already swapped over the HIVE. By now the SPI fund was worth close to 200k HIVE (50k at the time) and each SPI token was 1.97 HIVE.

Things were going really well and because we all received the HIVE airdrop, we were able sell all our STEEM and use those funds to buy 1 BTC and 10k Tether. This is what really helped to boast SPI and it was really a massive blessing from teh crypto gods at the perfect time. The whole moving over to HIVE was like a new start in a way as the SPI token had to minted on HIVE-engine.

The holding report had evolved by this point and i continue to upgrade are make a new holding report each year.

We had also started dividends as well by this point. Before the HIVE airdrop, we had bought our ALPHA and BETA Splinterland pack tokens. We ended up making a killing on those. We actually made a profit in the thousands of percent on both tokens. I think we bought 17 ALPHA tokens for around 350 STEEM and sold half of them after Splinterlands blew up for 900 HIVE each. We still have 5 to this day.

This year was a great year for SPI and its foundations were in place and ready to support sub-projects. Plus the HIVE airdrop which was our gift.

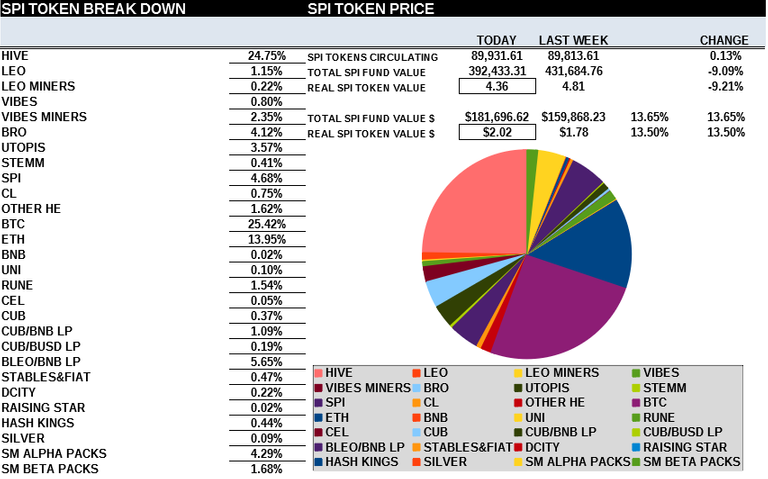

Going back 2 years to 9th Aug 2021

This is when things started to really pop off. We were in full crypto degen stage here. CUBfinance was launched and I was getting us deep into defi in general. The fund was worth close to 400k HIVE ($181k at the time) and each SPI token was worth 4.36 HIVE.

The investments we were holding had increased massively by this point compared to the year before. Lots of new HE tokens, gaming tokens, more crypto like ETH, RUNE, BNB and making a killing from defi so a few LP tokens, we had over $100k in defi LPs at one point.

Damn, I cant hardly remember that table. I never knew I had allocation breakdowns like that in old reports. At a glance, looks like HIVE and BTC were 25% of the fund each. Its very interesting for me to look back as well at this stuff. It will be here forever on the blockchain. Its worth noting that in Jan 2021, the BTC to HIVE ratio was 330k HIVE ($0.12)to 1 BTC ($37.5K).

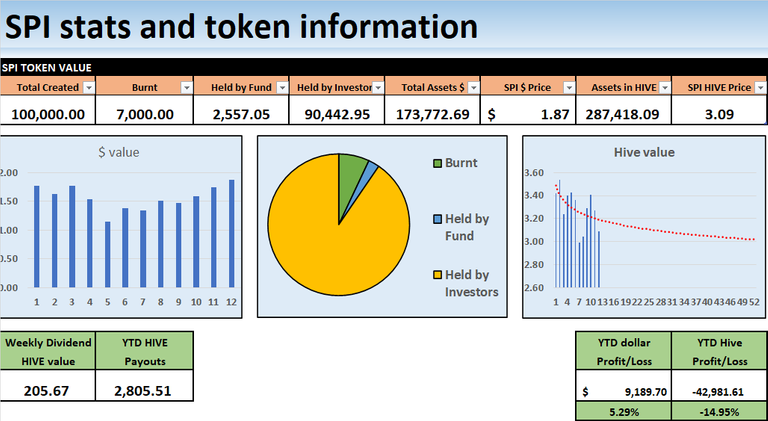

Going back 1 year to 9th Aug 2022

The fund peaked out during this year as it went to just over $500k for a few days whenever HIVE was mooning at over $3 in Nov 2021. Since that point, it was all downhill. By Aug 2022 the fund was $175k with HIVE at $0.62. At this time, we were still involved with defi alot and polyCUB was the thing. Was that only 1 year ago? Feels like pCUB has already been dead for 2 years, lol.

Looking over what we held last year. It looks like I was still heavy into defi but starting to cash out. We had 9500 HBD at this time so I know I had started to cash out. When we consider that HIVE which makes up around 50% of SPI dropped over 90% from top to bottom, we need ok and have never dropped more than 75%. Still a massive loss but in comparison, we come out winners.

It's worth noting that during this year at the end of Nov 2021, the BTC to HIVE ratio was 20k HIVE ($2.87) to 1 BTC ($57.8k).

Between Aug 21 and Aug 22 was a hell of a journey for us. We hit our peaks and slammed into our bottoms. It was a fantastic learning process.

9th August 2023

We are still kicking ass and doing our thing. We have released a few miners and EDS-vote for EDS, released a 2-year crypto basket token and then we've gone 50s with Brofund with DAB. I'll prob not promote that too much from SPI and think it fits Bro's community better. SPI come up with the models and structure and BRO promotes them and shills.

Over the past year, we have pretty much exited completely from defi and we are just waiting now. The top 2 things on the list are converting most all of our HBD into HIVE and trading between BTC and HIVE.

the future...

1/

I would like to get this HIVE for between $0.20-0.25 so it might take a few more months are a year are 18 months to get there. In the meantime, the HBD is doing well earning us almost 200 HBD a month in interest payments.

The goal here would be to convert HBD into HIVE when it's completely bottoming out and people are giving up and losing faith and then convert it back into HBD when the next bullrun comes along for $2 each and do a 8-10x $ ROI. We could in 3 years time have 100k HBD in our wallet earning us 55 HBD a day in interest payments. I'd say dividends would get a boast if we could pull this off.

After i convert the HBD in HIVE, we will need to hold for 6-12 months so ideally i will power it up and delegate it to @eds-vote and then start to power down when HIVE 1st hits $1 again.

The result could be amazing, 20k HBD per year for nothing! (assuming the APY stays as is)

2/

I would like to do something i said i never would. I would like to do something with our BTC which involves not holding only BTC for 6-12 months. During the last cycle, the BTC to HIVE ratio went to 1-300k and then when HIVE peaked out, this dropped all the way down to 1-20k. The potential for something like this to repeat is fairly high when we understand that BTC and HIVE are two very different cats in terms of the power/recognition within crypto and marketcaps. BTC leads the pack while ALT follow and the lower they are ranked the longer it takes to catch up. When BTC had almost doubled from its last ATH in Jan 2021, HIVE was still bottoming out at 12 cents. Most smaller caps tokens were still bottoming out.

Anyways, there is alot of time to plan this but im looking to play it safe and try convert 1 BTC into 200k HIVE if the opportunity ever comes up. The plan here would be to wait for HIVE to moon and convert 100k HIVE into 2 BTC and add the remaining 100k to the SPI HP balance.

The result would be double our BTC and double our HP. Sounds crazy but sometimes doing less it better. We not trying to get max profit here, just a nice 4x is all.

Both of these trades consist of 2 transactions each. 1 out and 1 back in. Its will be months and months before we make the transaction for either of these and time between these 2 transactions will be months apart as while.

Because I have sort of set targets in my head, it makes it easier to pull the trigger when I see them appear on my screen after waiting and planning 2-3 years for it to happen. (I've been waiting over 10 years for a 50-1 silver-to-gold ratio so i can become goldstackeruk, im a patient boy)

The worst case for both cases is we cant trade out and we end up with more HIVE as both trades are converting something into HIVE. Whatever, eds-vote becomes a beast and SPI more than doubles its leasing rewards to boost income.

Round up

What do you think? It's been a crazy ride from the start just over 4 years ago. We've tried so many things not even mentioned above, not even scratched the surface really.

Alot has been learned and this next cycle for us will be much different. I have outlined the top 2 trades I want to do but we must also plan ahead how to preserve the most $ value when the market mooning so we can enter back in at a much higher position. Would be nice to only lose 50% between peak and bottom this cycle but we have to wait and see.

What do you think about SPI future? and is it on the right path? Should be look into something else?

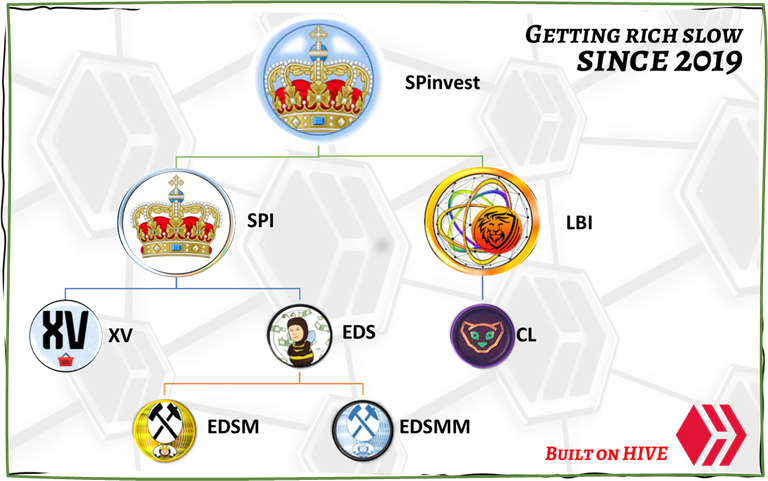

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS mini miners | @eddie-earner | EDSM |

| EDS micro miners | @eddie-earner | EDSMM |

| CUBlife | @lbi-token | CL |

Stay up to date with investments, fund stats and find out more about SPinvest in our discord server

So much has happened in all these years!

After all the leofinance hype that ended in silence and dead projects, I’m happy with the EDS and BRO projects. Dab as well.

Not much is able to beat the steady 20% for HBD though. Which is why most of my funds are there.

Yea man, you can't go wrong with holding HBD earning 20% during the bear market.

SPI, EDS, XV, DBONDS, LBI, CL, BRO, INCOME, all backed by assets so thier prices are liquidation values. Im sure there are more but these the ones i have experience with.

What a wonderful journey it has been! Great to look back and sometimes be surprised how long (or short) ago some things happened. For sure the creation/forking of Hive was one of the milestones, as it was for most of the early Steemit holders who are still on Hive right now.

Keep up the good work!

Thanks,

Yes, the journey is ups and downs and feels like forever to me already. I think this cycle will be much better for us compared to the last one. Many things were learned. If you watched my old weekly update videos from 2020, I said BTC would peak on 09 Dec 2021. I was really close but instead of acting on that prediction, I was waiting on BTC hitting $150k, haha. Sounds funny now but remember everyone was saying BTC was going to go to $250-400k back in 2019.

Yes, lots of news things learnt for sure and this time round, fuck building and investing during 2025. It'll be all about converting and cashing out. 🤑

awesome rundown, stacker. thanks for the detailed breakdown from the fund start to current times and our future outlook. we look forward to seeing what the future has in store for SPI as well as our on and off chain investments. Love the passive income we are creating and growing, especially with the bottoming of HIVE and conversion to HBD. Cheers

Always good to hear from your bro and great to see your keeping up to date.

We're long term but planning out trades years in advance makes so much easier to pull the trigger. Im hoping this time in 4 years we'll be earning a much better dividend because fingers crossed, we are able to preserve a great amount of $ value between the peak and drop.

Thanks for dropping a comment 😁

Thats quite a journey over the years. The forward plans sound about right to me, and align with my own, especially in terms of flipping between HIVE and HBD. Sounds like its on the right track to me.