SPI weekly earning and holdings Report | Year 05 | Week 41

Welcome to the weekly SPI Report

Each Sunday, @spinvest uploads an earnings and holdings report to keep investors up to date with fund performance and news. You can subscribe to these weekly reports in the comments.

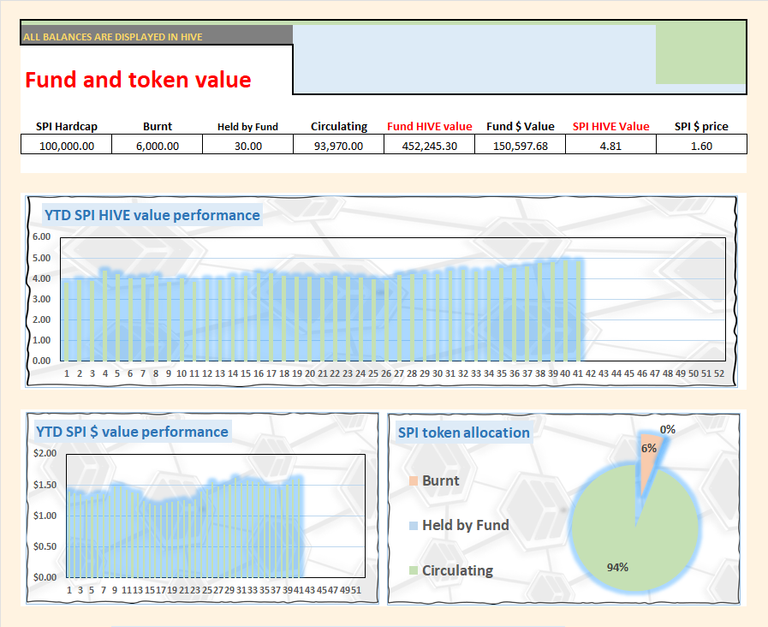

SPI is the flagship growth token for the SPinvest fund. Launched in June 2019. SPI tokens act as both a token of ownership and a governance token. Since launch, we've been able to 7x the HIVE value (including revaluations and token split) and 12x the dollar value of the fund.

We are now in our 5th year of operation and still going strong as we stick to our plan of investing the bulk of our holdings into time-served investments and HODL.

Our motto is = Getting Rich Slow

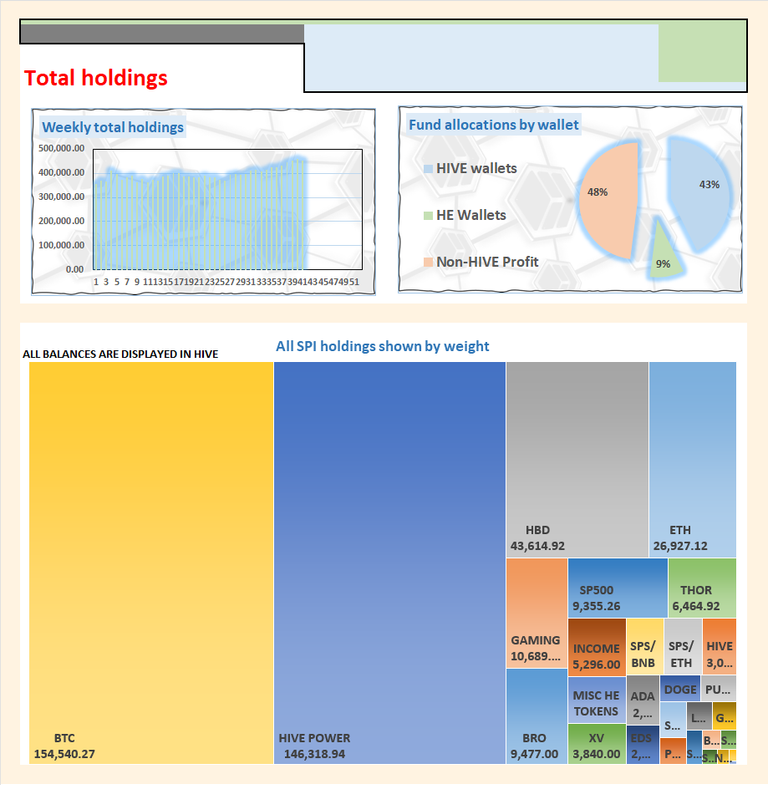

In our expansive portfolio, we are involved in over 30 investments, with a significant portion dedicated to HIVE, BTC, and ETH. We firmly believe in avoiding impulsive actions driven by the fear of missing out or chasing unattainable aspirations. Instead, we rely on tried and tested strategies that have proven to be the most effective and secure.

Our guiding principle is to accumulate wealth steadily, adhering to the philosophy of "Get rich slowly." We employ the power of compounding by consistently reinvesting in sound opportunities to amplify our returns over time.

When considering SPI tokens, it is essential to adopt a long-term perspective, aiming to hold them for a minimum of 3-5 years. Our rationale behind this recommendation lies in the belief that substantial returns require patience and allowing investments to mature organically. By committing to an extended investment horizon, you significantly increase the probability of maximizing your potential gains. This aligns perfectly with our overall investment philosophy and strategy, ensuring sustainable growth and profitability in the long run.

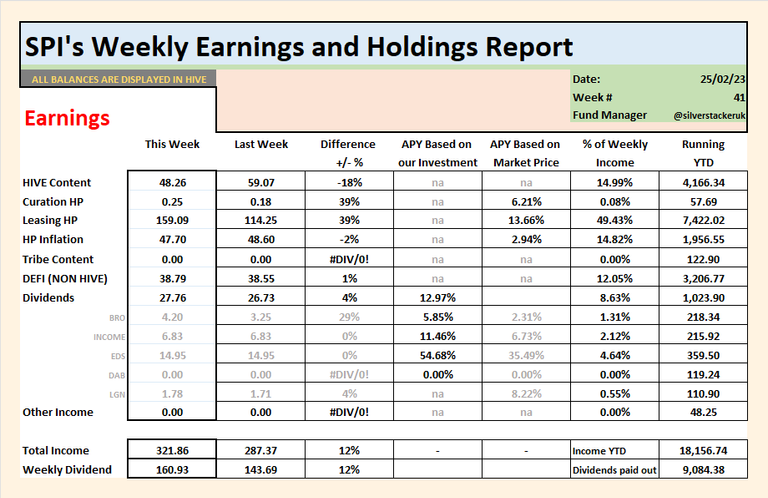

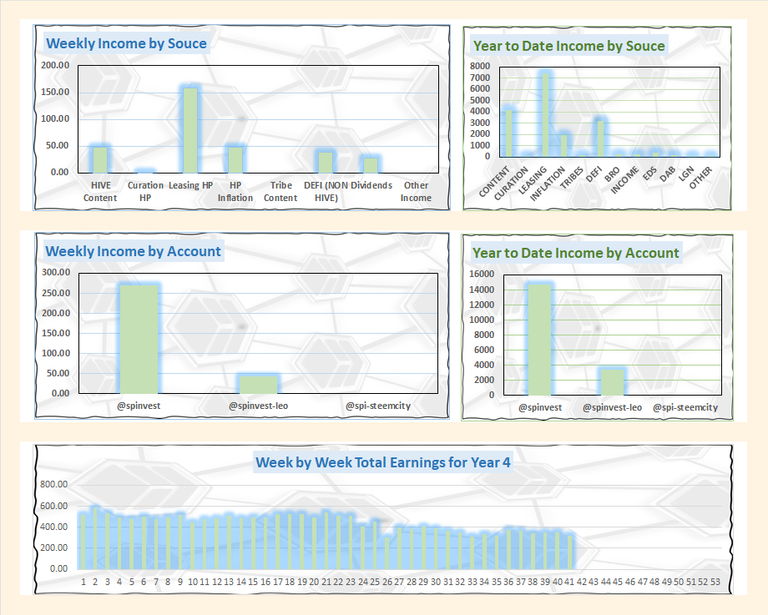

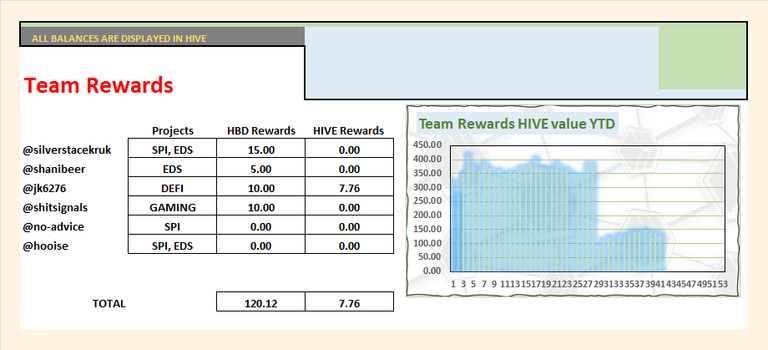

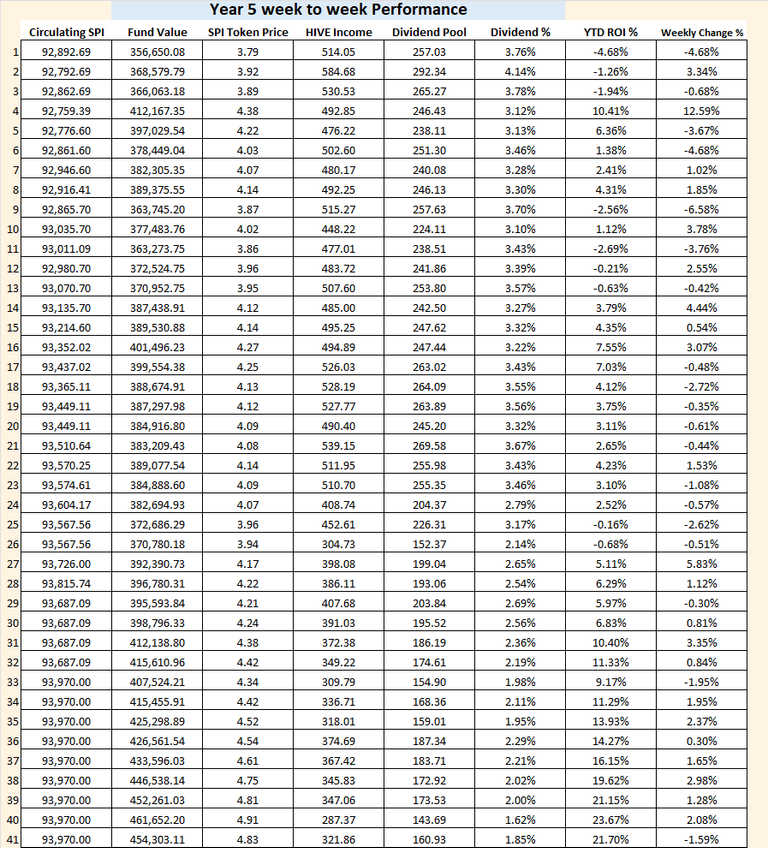

Incomes are up from last week which is good. We never got backpaid from leo.voter even after they said they would be hey, can we be surprised? We delegate to leo.voter to receive the liquid rewards of an advertised 13%. I have been selling PWR rewards from our delegation to @empo.voter each week but from next week, we will start to stack these tokens and build a stash.

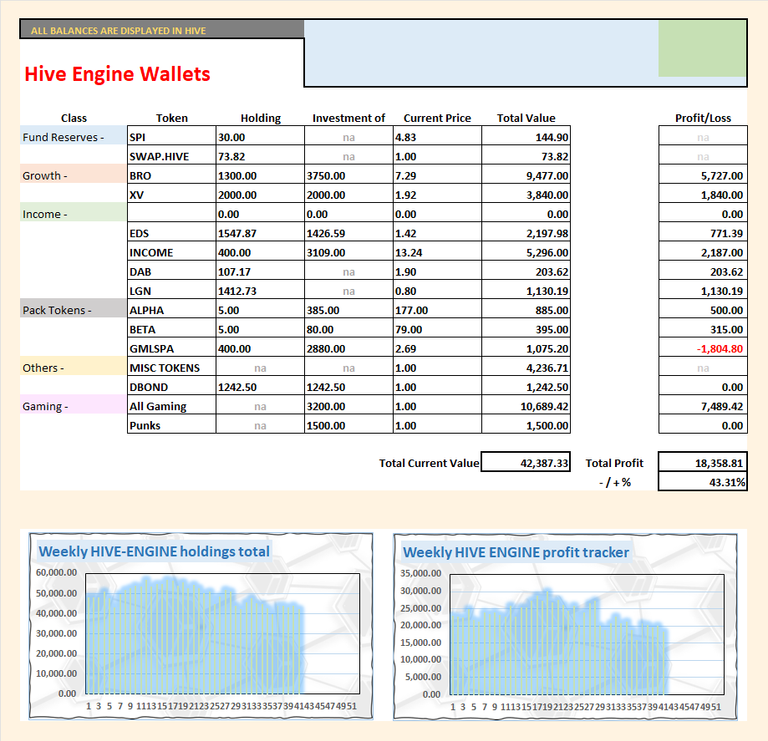

Dividends from tokens we hold have been steady. If you are wondering why the EDS APY is so high, its because we have got some of our EDS from eds-vote rewards and our cost per EDS has declined as a result.

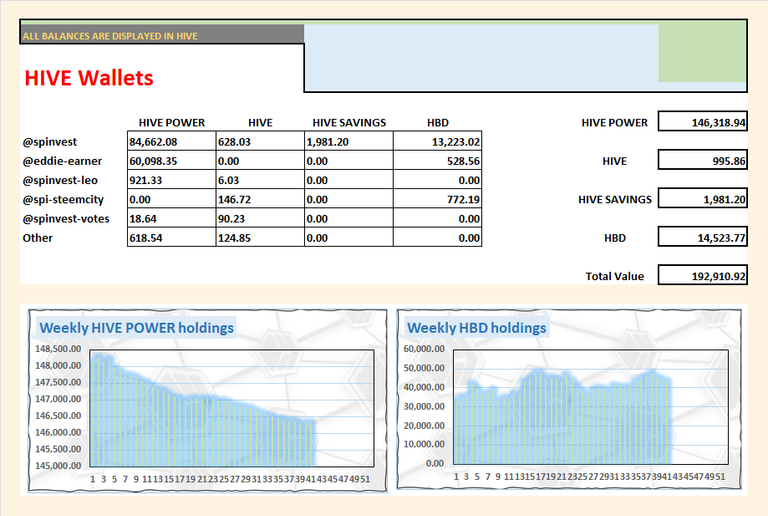

In our HIVE wallets this week, our total HP balance for the next time is about 6 months has gone up. We had an increase of 12 HP and the funny thing is you can actually see the increase in the above chart. When you can see a 12 HP increase on a chart of 146,000 HP, you can understand better how small our range (148k-146k) has been over the past 40 weeks.

With HBD, we received our monthly interest payment and I have withdrawn 2700 HBD. I plan to invest around $2000 into FET tokens and top up our liquid HBD balance. We will have 10,000 HBD remaining and from that, over the coming 3-9 months i will invest another 5000 HBD into non-HIVE cryptos. Earning 20% per year is nice but heading into a bullrun, we can earn 3-10x by holding cryptos. Ideally, we can find some nice 1st cycle tokens that are already in the top 100 at the time of investing. There is lots of new blood in the top 100 and we should have a slice of the action. The 7000 HBD that will used is equal to under 5% of the total fund so nothing crazy.

Gaming tokens have taken a dip this week and lost around 2000 HIVE in value. Gaming holding has been very choppy the past 2-3 months, let's hope something pops off and we can get that back up to over 15,000 again. We have a few extra EDS and no extra DAB because we're waiting on HIVE SQL for that one.

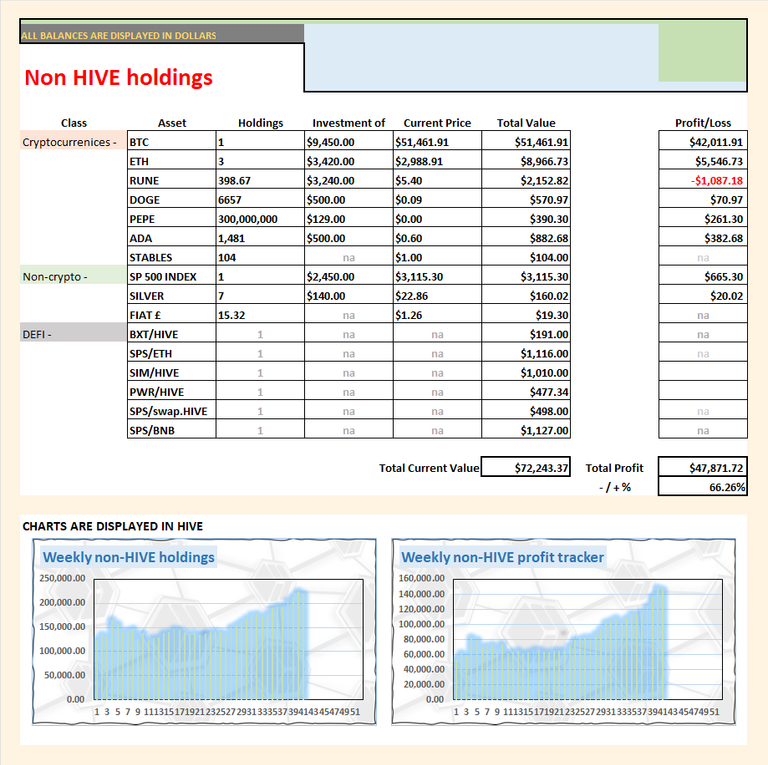

Not much changed in this wallet, pretty much everything is around teh same price as last week.

Sideways week for our non-HIVE holdings, most things went up a little in $ down but HIVE outperformed most this week so they went in $'s but down in HIVE value.

I noticed are SP500 investment is up again this week. We've been holding this for around a year now and it's up over 27%, I think that is very impressive when compared to the DOGE (+14%) and ADA (+76%) we bought at the same time.

This week the BTC > HIVE ratio dropped to 1 BTC > 154k HIVE. BTC has been outperforming HIVE for a long time already we've been expecting this. We're still a way off our 200k to 1 BTC target but we're still halving. I am aware the halving is already priced into BTC but that does not stop the hype and it still pumps in the months after.

As mentioned above in the HIVE wallet part, we will be seeing new additions to our non-HIVE holding soon starting with FET which is an AI token. These tokens will be funded for with HBD and the idea will be to sell most of what we buy at a higher price and convert back into HBD for the next bear market.

HIVE outperformed all our other assets this week so we see a dip in the fund's total HIVE value. We lost 1.6% but YTD we remain in the green to the turn of 21%.

We have 11-12 weeks remaining in the SPI year so it would be nice to either hold are increase our current profit. The next big thing in crypto is the BTC halving which will happen in around 7 weeks and after that, I dont know. I might take a guess and say ETH could moon but people start to speculate on an ETH ETF. SPI should really hold more ETH, we missed it when it was cheap. It's the only gas token that produces a yield (through staking) and is deflationary. We had 10 at one point 😢

Things are going well or to plan anyway. I will release a post this week explaining what FET is as im sure most will not have heard of it yet. Thank you for taking the time to check this weeks report and dividends will go out this evening. Have a great week.

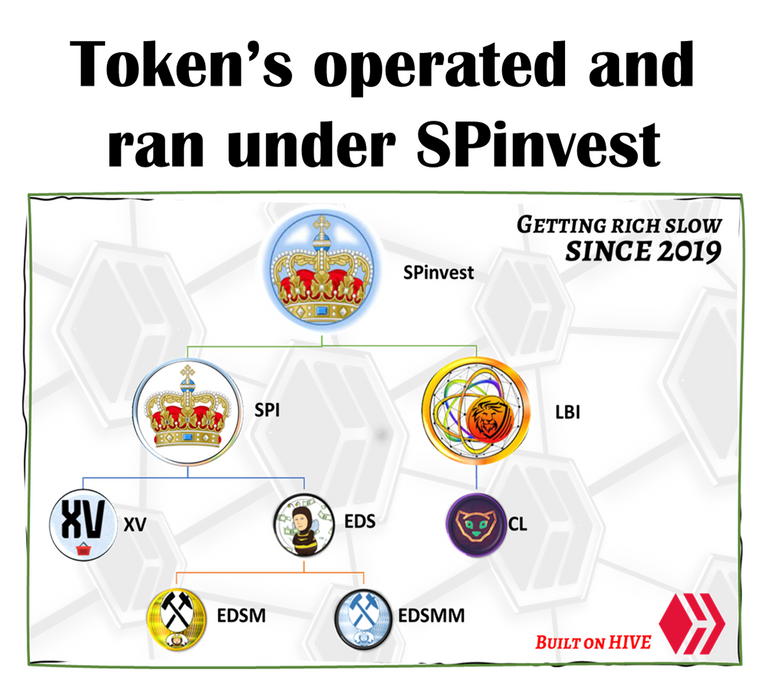

Links to all projects under SPinvest

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS mini miners | @eddie-earner | EDSM |

| EDS micro miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, fund stats and find out more about SPinvest in our discord server

Tag @spinvest to a comment below saying "I wanna Subscribe" and I will tag you in future SPI weekly reports.

Sub List:-

@ericburgoyne, @mikezillo, @shanibeer, @oldmans, @roger5120, @lilolns19, @riandeuk

Great report, thank you for publishing.

I like the idea of investing in an AI token, if that's where the tide is turning, its good to put our cash into that current.

I am not sad that we don't have more ETH, its so expensive to take money out sometimes, it adds a whole new layer to the timing of everything.

I agree, we should take advantage of the bullrun while it's here. We know things are going to bounce, i mean they already are. Fetch.AI is up big but it will moon even more. Probably the best AI sleeping giant along with AGIX. Some other tokens to maybe watch could be OCEAN protocol and I also like AXL.

Great report as always, Cheers BRO