SPI weekly earning and holdings Report | Year 05 | Week 36

Welcome to the weekly SPI Report

Each Sunday, @spinvest uploads an earnings and holdings report to keep investors up to date with fund performance and news. You can subscribe to these weekly reports in the comments.

SPI is the flagship growth token for the SPinvest fund. Launched in June 2019. SPI tokens act as both a token of ownership and a governance token. Since launch, we've been able to 7x the HIVE value (including revaluations and token split) and 12x the dollar value of the fund.

We are now in our 5th year of operation and still going strong as we stick to our plan of investing the bulk of our holdings into time-served investments and HODL.

Our motto is = Getting Rich Slow

In our expansive portfolio, we are involved in over 30 investments, with a significant portion dedicated to HIVE, BTC, and ETH. We firmly believe in avoiding impulsive actions driven by the fear of missing out or chasing unattainable aspirations. Instead, we rely on tried and tested strategies that have proven to be the most effective and secure.

Our guiding principle is to accumulate wealth steadily, adhering to the philosophy of "Get rich slowly." We employ the power of compounding by consistently reinvesting in sound opportunities to amplify our returns over time.

When considering SPI tokens, it is essential to adopt a long-term perspective, aiming to hold them for a minimum of 3-5 years. Our rationale behind this recommendation lies in the belief that substantial returns require patience and allowing investments to mature organically. By committing to an extended investment horizon, you significantly increase the probability of maximizing your potential gains. This aligns perfectly with our overall investment philosophy and strategy, ensuring sustainable growth and profitability in the long run.

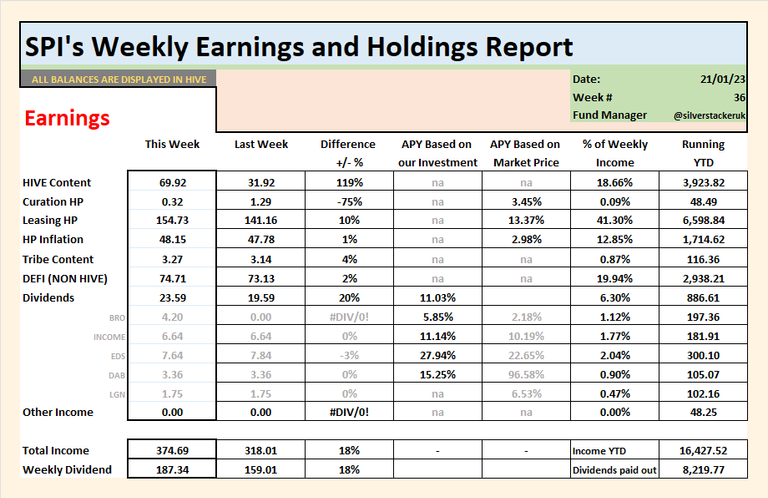

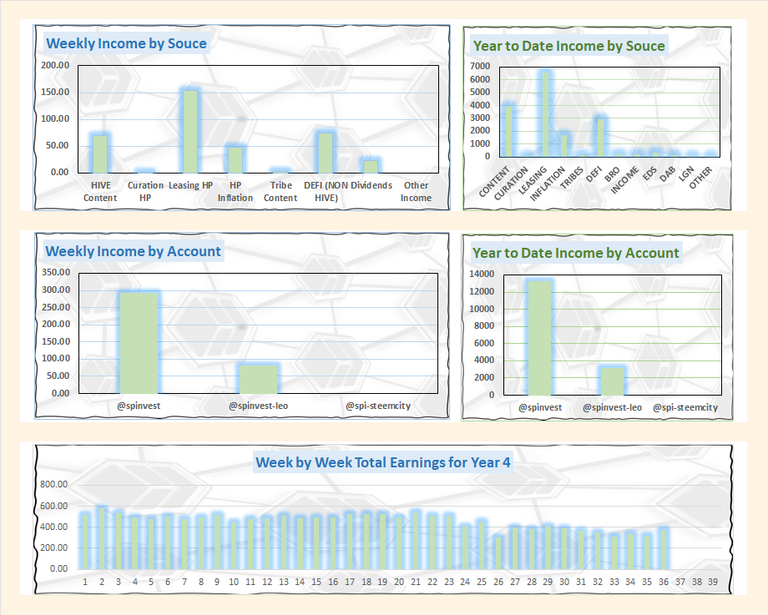

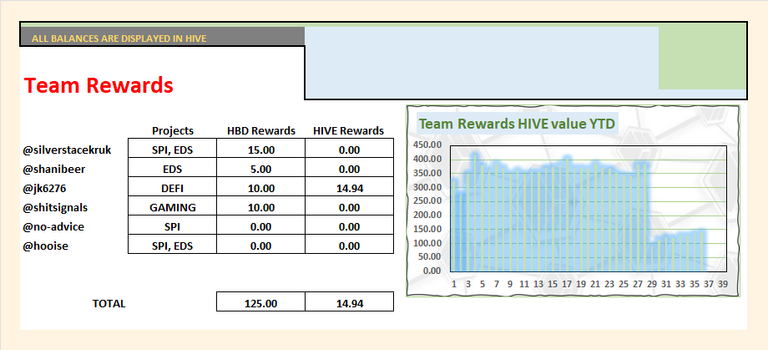

HIVE income this week was been a little higher than in the past few weeks which is nice. The boost in incomes came from content and leasing HP. Each week our incomes came from the same sources, these are always the same but the amounts we earn can go up and down. YTD, we have paid out over 8200 HIVE as dividends. This is not a huge amount but SPI is a growth token and with time, our incomes will increase.

This week we see our HP balances break even which is good because they normally drop a little each week due to the set up over at EDS. I will need to add @dailydab into the above table soon as we're now profiting from it a tiny bit each week and very little helps.

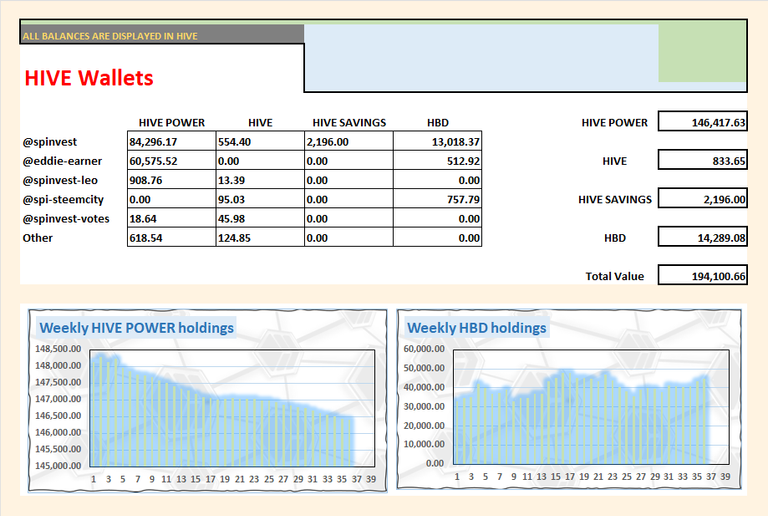

We saw HIVE price decline this past week so our HBD now converts into more HIVE. I'll keep an eye on the price and if HIVE drops to 30 cents, we might convert some HBD into HIVE.

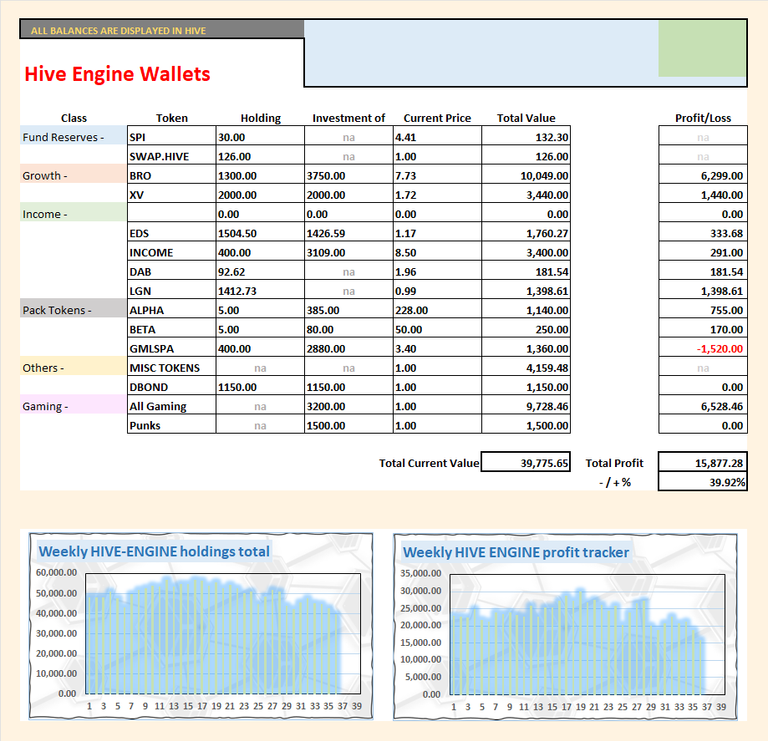

Week by week, we see no changes here and we've no plans to invest into anymore HE tokens. We hold our bag of BRO, INCOME, EDS and DAB for divs and GMLSPA token packs as a gamble. So far our gamble has not been working out and we're about 50% down on it but it's early days and I think Arrgoed will shill this harder into the bullrun cause he loves a good money grab. Gaming this week is no better than last week to be honest, most things in our HE dropped this week. This is de to HIVE dropping HE not being caught up yet.

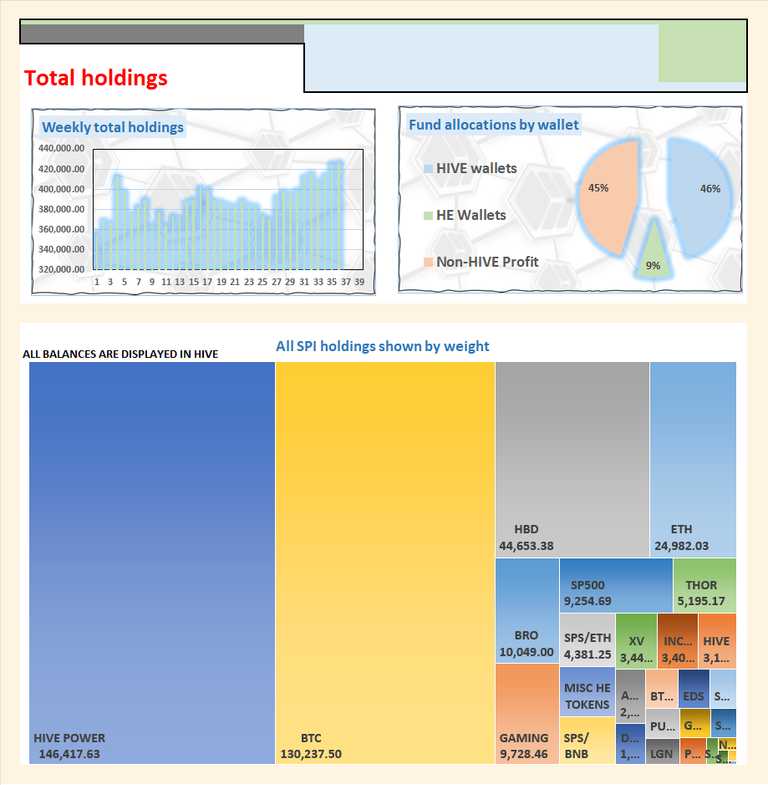

We see no changes with our non-HIVE assets, they are just worth a little more or less compared to last week. Most of the cryptos are down but non-crypto things like silver and the SP500 are up. Our SP500 investment has increased by near 20% in 10 months which is way better than expected. I think normally, the SP500'S growth is 8%. I will need to write a post about our SP500 investment and show how its performed since we bought it.

1 BTC this week gets 130,200 HIVE just as an FYI for those following me on our BTC to HIVE trade.

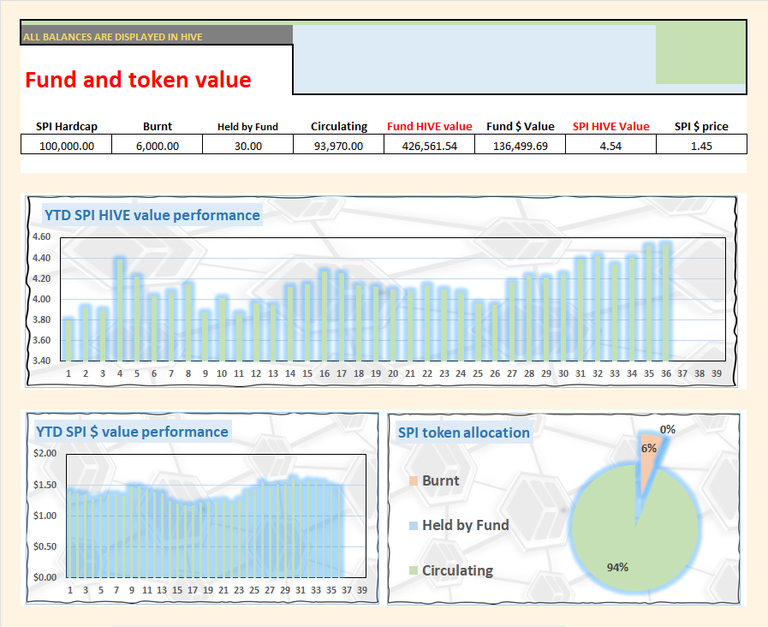

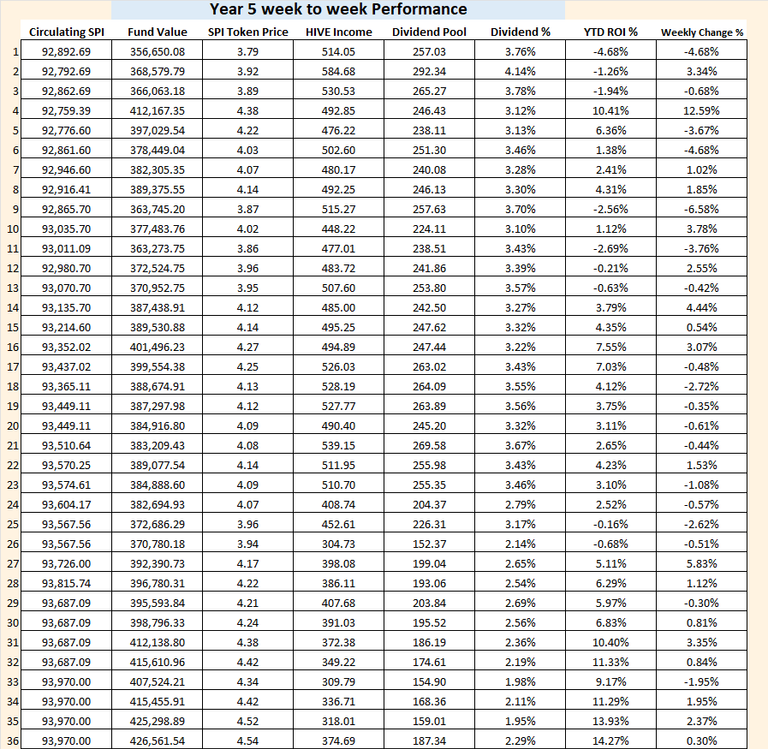

We finished this week pretty much the same as we started it and the fund 0.3% up for the week. With 36 weeks gone, we're around 2/3rds the way through the SPI year and up over 14% so still on target to hit 20% by year-end.

The weekly dividend is not that much at 2.3%. To the untrained eye, this looks bad but it can be explained. The low APY is the result of fund growth outperforming income growth. If the fund earns 500 HIVE a week and pays 250 as a dividend from a fund worth 100k HIVE, the SPI dividend would be 13% APY. If the fund still earns 500 HIVE a week and still pays 250 as a dividend from a fund worth 500k HIVE, the SPI dividend would be 2.6% APY. If HIVE income remains around the same but the fund value increases, the SPI APY drops and the same in reverse.

I know which one I'd prefer and I dont see a low dividend APY as a bad thing if it's low because the fund has increased in value.

In other news, i put us on the preorder list for the next Solana mobile phone they are calling "Chapter 2". The first one sold out a few months back and are trading on eBay are $3000-5000. These phones are loaded with exclusive SOL airdrops and NFTs worth over $2500 at today's prices. I dont think we will see the same success with this 2nd phone as more will be sold, maybe 10x more as there is some hype for them but i dont us losing money on it. The preorder cost was $450 and we'll need to make up the rest when they announce the final price.

They plan to release it first half of 2025 and these will be hard to get. The release might be later, it always is but any time before 2026 is good, this is when SOL fanboys will have the most money and feel the richest. We can either sell it brand new for the maximum price when first released and the hype is at its highest or strip it of whatever airdrops it comes with and use the phone for SPI stuff. I currently hold 2 SPI wallets on my mobile because the platforms are app-only but it would be nice to keep them separate.

If SPI has a mobile number, we could set up a 24/7 customer service helpline and have @shanibeer man the phone (national calls are charged at 1 HIVE per minute, international calls are charged at 2 HIVE per minute, 5 HIVE per TXT message🤣)

As for the markets, i would not be surprised to see top cryptos like BTC, ETH, SOL and ADA going sideways and most other stuff dropping some. I think we'll see 30 cent HIVE but when? 1 week, 20 weeks, no idea. We continue to sit on bags and wait for the moon next year.

People always ask what the SPI dividend APY

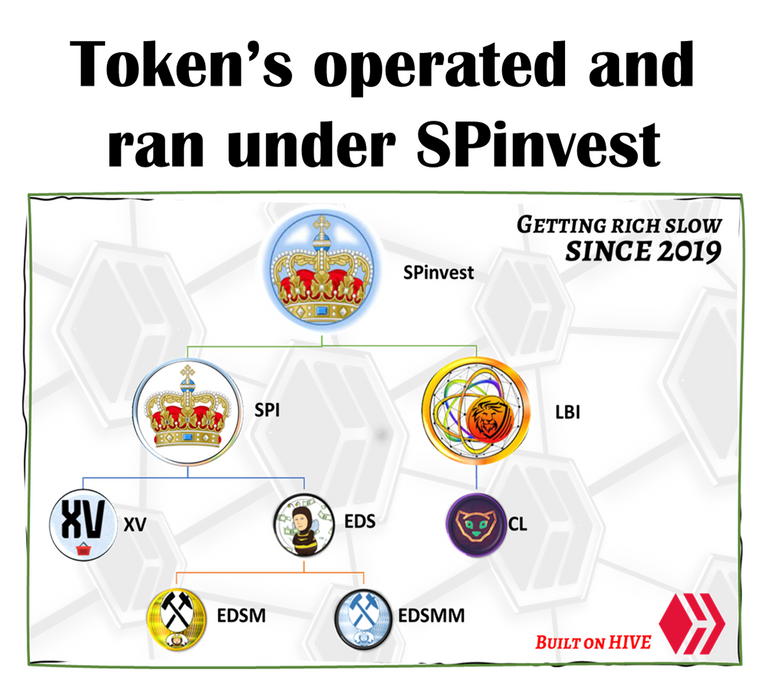

Links to all projects under SPinvest

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS mini miners | @eddie-earner | EDSM |

| EDS micro miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, fund stats and find out more about SPinvest in our discord server

Tag @spinvest to a comment below saying "I wanna Subscribe" and I will tag you in future SPI weekly reports.

Sub List:-

@ericburgoyne, @mikezillo, @shanibeer, @oldmans, @roger5120, @lilolns19, @riandeuk

I'm going to be busy growing Saturday Savers Club to bring in LeoAds revenue.

Can we have 500 LEO staked in the @eddie-earner account please.

count me in

!PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444