SPI weekly earning and holdings Report | Year 05 | Week 29

Welcome to the weekly SPI Report

Each Sunday, @spinvest uploads an earnings and holdings report to keep investors up to date with fund performance and news. You can subscribe to these weekly reports in the comments.

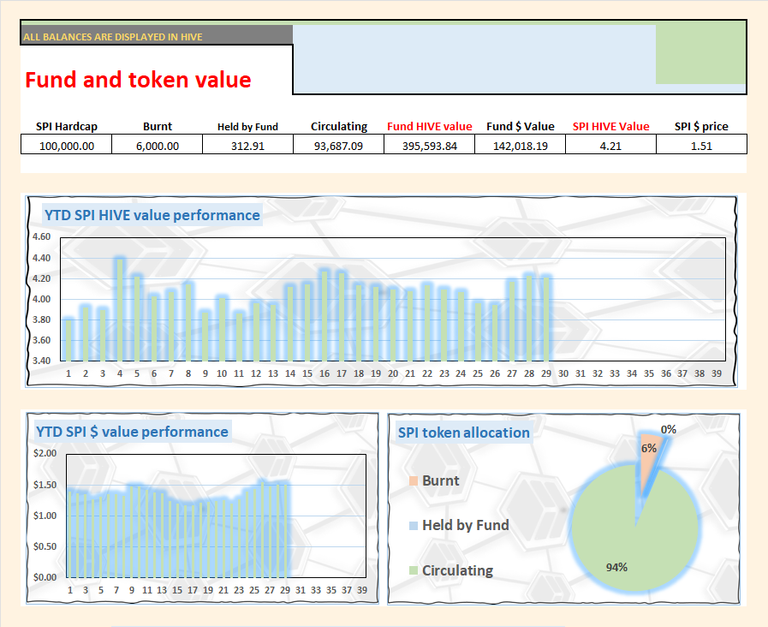

SPI is the flagship growth token for the SPinvest fund. Launched in June 2019. SPI tokens act as both a token of ownership and a governance token. Since launch, we've been able to 7x the HIVE value (including revaluations and token split) and 12x the dollar value of the fund.

We are now in our 5th year of operation and still going strong as we stick to our plan of investing the bulk of our holdings into time-served investments and HODL.

Our motto is = Getting Rich Slow

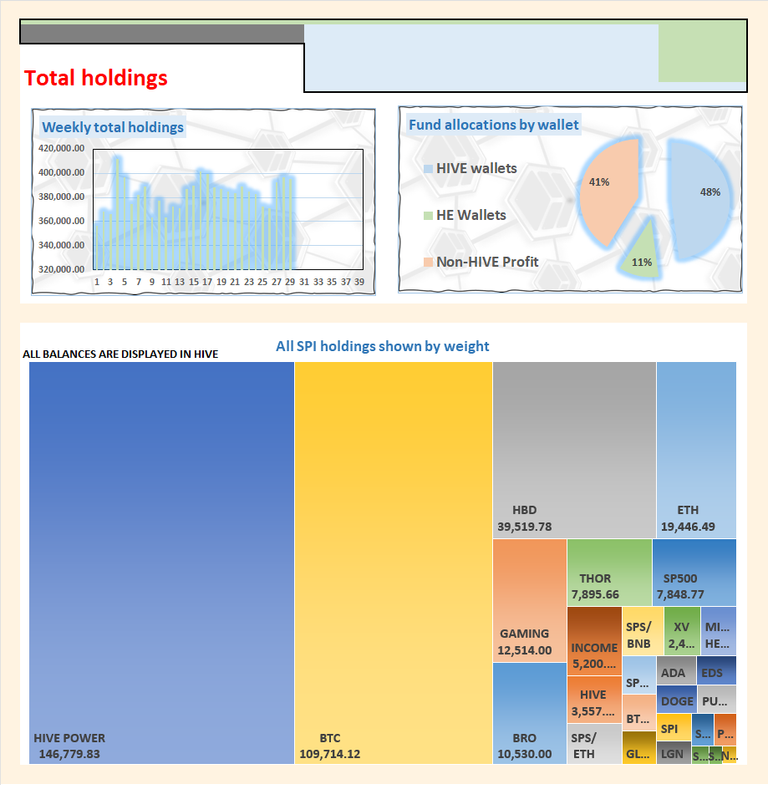

In our expansive portfolio, we are involved in over 30 investments, with a significant portion dedicated to HIVE, BTC, and ETH. We firmly believe in avoiding impulsive actions driven by the fear of missing out or chasing unattainable aspirations. Instead, we rely on tried and tested strategies that have proven to be the most effective and secure.

Our guiding principle is to accumulate wealth steadily, adhering to the philosophy of "Get rich slowly." We employ the power of compounding by consistently reinvesting in sound opportunities to amplify our returns over time.

When considering SPI tokens, it is essential to adopt a long-term perspective, aiming to hold them for a minimum of 3-5 years. Our rationale behind this recommendation lies in the belief that substantial returns require patience and allowing investments to mature organically. By committing to an extended investment horizon, you significantly increase the probability of maximizing your potential gains. This aligns perfectly with our overall investment philosophy and strategy, ensuring sustainable growth and profitability in the long run.

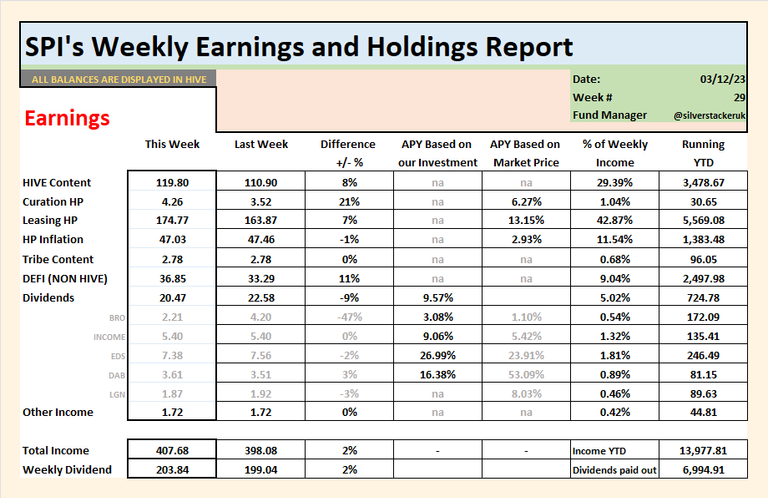

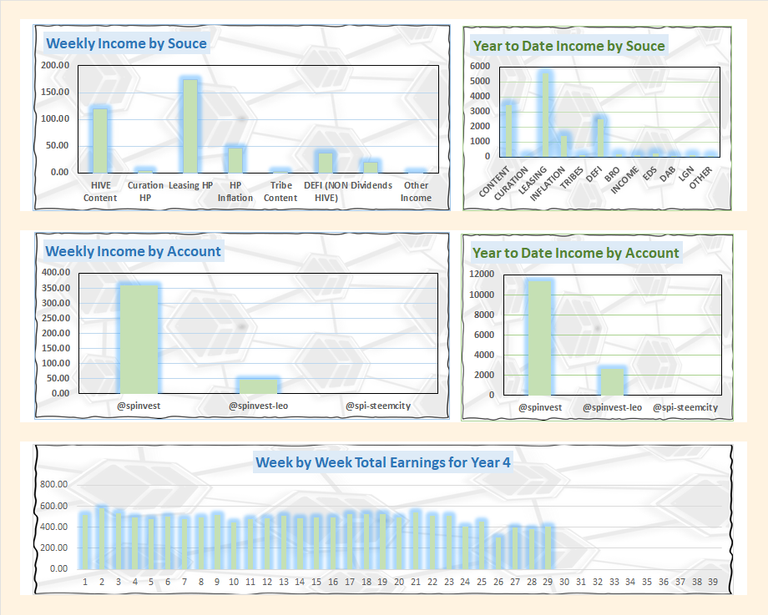

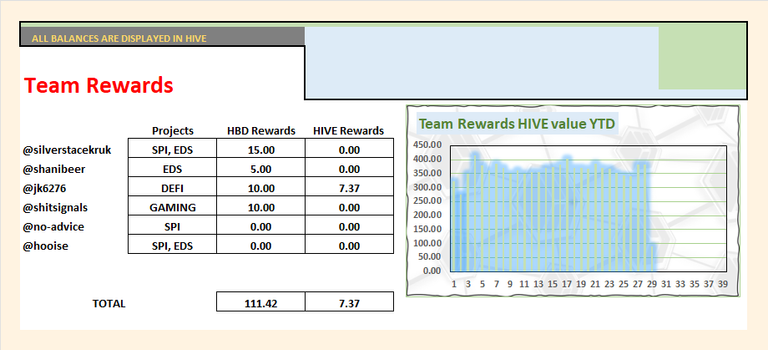

Earning are a little better this week as we posted 7 times last week. From next week we will see a 50% drop in HIVE content reward because of the new SPI team reward structure were we swap from rewarding in SPI tokens to HBD tokens for operators and a 50/50 post rewards split with authors. Because of this you will in "TEAM REWARDS" table below a huge dip in what SPI is paying out. This is because now this only represents HBD paid to operators.

The rest of our incomes have been steady this week, we earned a little more from HP leasing/delegating which was nice.

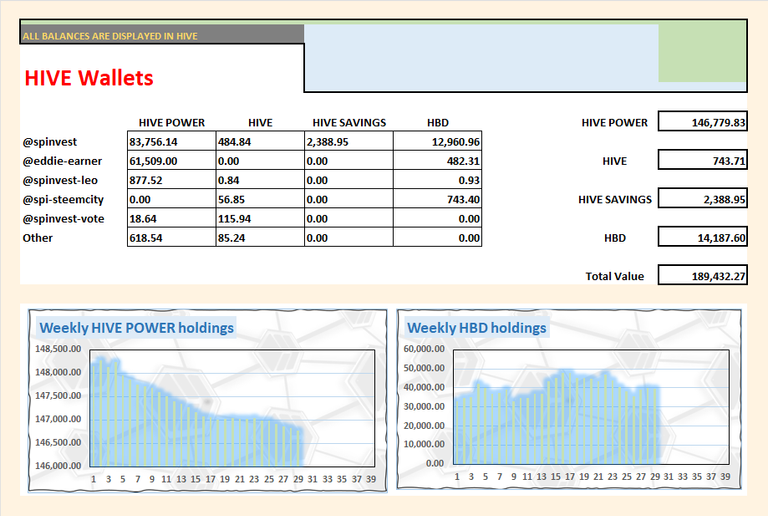

I am annoyed that the HP balance is continuing to decline. I know what its happening and the worst part is it's not going to get better. This decline is directly because of EDS and its model. Each week the project currently mints more EDS then it powers up HIVE and cause EDS are backed by 1 HIVE/HP each, its runs at a loss each week. @eds-vote was doing great things and you can see between weeks 16-25, the decline had levelled off. What happened? You'll laugh but EDS content rewards went down and this is why. EDS content will also be cut in half from next week so it'll dont get better. It will get better but not soon like within the next few months. Ok it, EDS will release a final last token, a HBD token and this again should boast the amount of HIVE it is powering up and make content rewards less of a factor.

The price of HIVE has gone sideways this week and our HBD is worth the same at around 40,000 HIVE. I would take 50,000 HIVE for it, thats $100k when HIVE hits $2 in 2025. I think it will go higher but I dont think we will regret selling at $2 with the plan to buy back in 4x when it drops to 50 cents in 2027 are something.

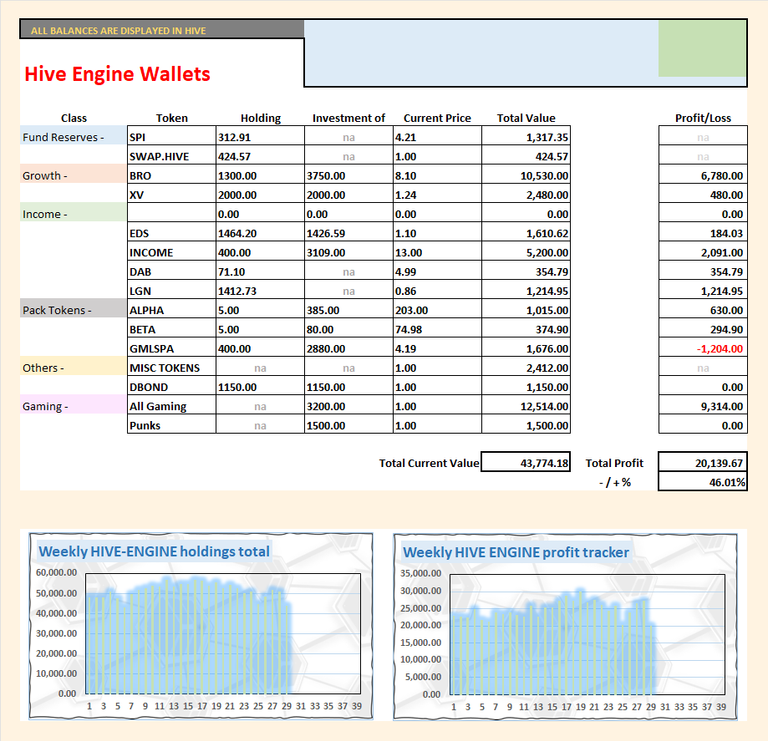

Each week we add some EDS and DAB to the wallet, both of these tokens pay our HIVE incomes. EDS is weekly and DAB is daily. GMLSPA tokens seen a nice jump this week for whatever reason, we bought in at 7.2 HIVE which was undervalued back then. This is the same pattern Splinterlands followed were everything declined to almost nothing before it mooned 100-200x as the bullrun was getting started. If these can do 10% of what Splinterland ALPHA packs did, we could earn a decent 5 figures. If not, hey, we bought them with profits from Splinterlands packs anyway.

Been trying to sell off BRO, not easy because every time I set a sell order tons of mini sellers come over the top and when I compete all I do is kill the price. Selling off a few hundred more at market value might take a few weeks.

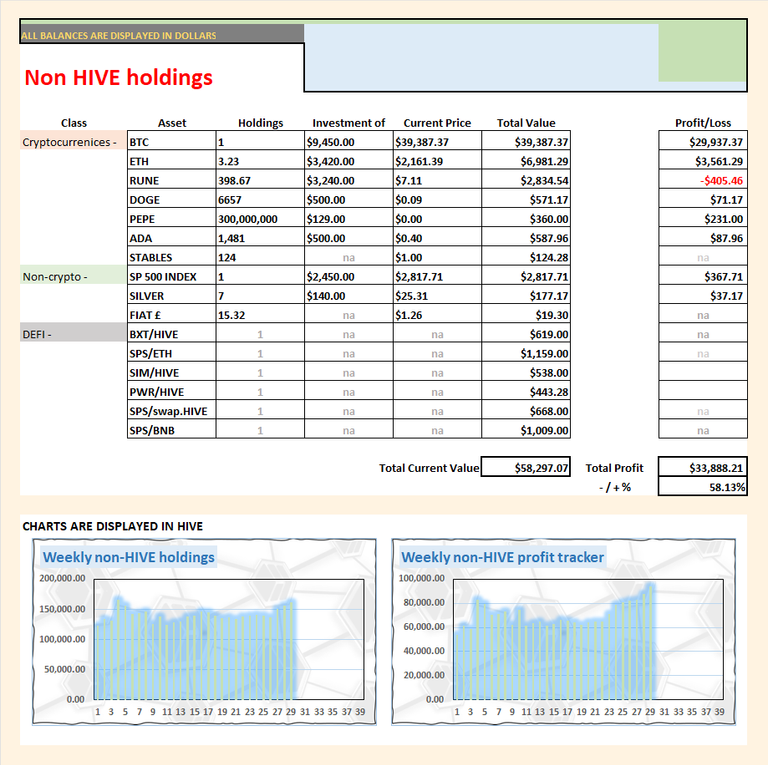

So BTC is mooning, it's so close to hitting $40,000 and momentum is starting to change. Everything is up this week and we are even getting close to breaking even on RUNE which at one point we were minus over $2000 on.

Non-HIVE wallets when converted to HIVE are up all around.

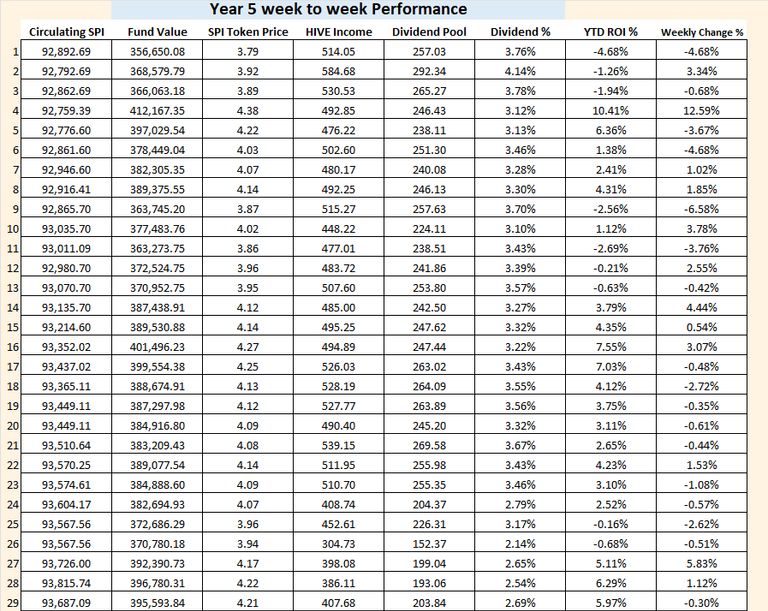

We finish this week pretty much as we did last week. We finish with a loss of 0.3% thats represents a 0.01 HIVE decline in SPI token value. Most of this decline this week came from our gaming account which lost a bunch of value this week for whatever reason. Gaming NFT prices are volatile and we've seen this before, im sure next week things will be back to normal. It's a low liquidity thing really. I also sold off some HE tokens and shipped others the spi-null amount because im bored of adding up pennies each week.

For the past few weeks, I have been writing about the BTC to HIVE ratio and how we plan to take advantage of this when BTC is mooning and ALT tokens are yet to catch up. I expect this to be in late 2024/early 2025.

This week 1 BTC gets 109,700 HIVE which is 3700 more than last week and 6500 more than 2 weeks ago and 15,450 more than 4 weeks ago. You get the idea, as BTC leads the pack and as we head into the next bullrun we will see its dominance increase over HIVE. Last cycle this peaked at 1 BTC to 330k HIVE and 10ish months later when HIVE peaked at over $3.5, this ratio dropped to 1 BTC to 20k HIVE. We aim for 200k HIVE with our 1 BTC.

I had a closer look at our SP500 investment this week and see that we are holding it for 9 months so far and have yielded a 13.5% ROI already which is actually amazing. I mean we dont have a ton invested with $2800 but nice to see that getting 18% APY is really good outside of crypto. It'll probably crash 40% next year but whatever, we ain't selling then.

Thats all for this week, thanks for taking the time to check out the weekly SPI report. Have a great week.

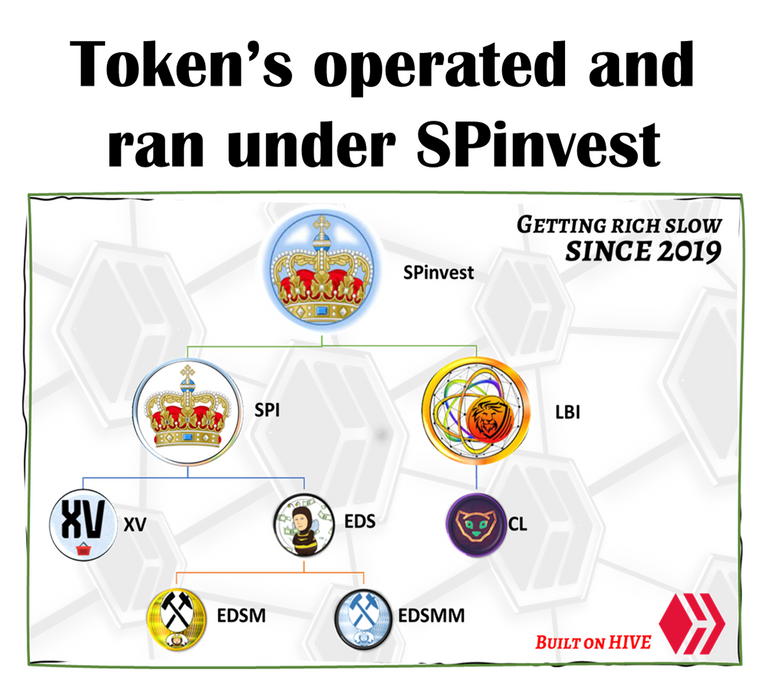

Links to all projects under SPinvest

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS mini miners | @eddie-earner | EDSM |

| EDS micro miners | @eddie-earner | EDSMM |

| CUBlife | @lbi-token | CL |

Stay up to date with investments, fund stats and find out more about SPinvest in our discord server

Tag @spinvest to a comment below saying "I wanna Subscribe" and I will tag you in future SPI weekly reports.

Sub List:-

@ericburgoyne, @mikezillo, @shanibeer, @oldmans, @roger5120, @lilolns19, @riandeuk

count me in

!PGM

!pimp

You must be killin' it out here!

@tbnfl4sun just slapped you with 5.000 PIMP, @spinvest.

You earned 5.000 PIMP for the strong hand.

They're getting a workout and slapped 2/2 possible people today.

Read about some PIMP Shit or Look for the PIMP District