Saving for Retirement - Stock Market Exchange Traded Funds | September 2023

Welcome to this month's ETF Investment Update

Guest author: @hoosie

What is SPI?

SPI tokens are growth investment tokens that pay a weekly dividend. They have been circulating for over 2 years, onSTEEMHIVE. Mostly sold for 1 HIVE, each token today is worth over 4 times its HIVE issue value and 12x its dollar value. On top of that, token holders receive roughly 8% every year from weekly dividends. We raised $13k from issuing SPI tokens which has been used to grow a diverse portfolio of investments, many of which provide streams of passive incomes. SPI tokens are part ownership of all SPinvest tokens, accounts, assets and income. The price of each SPI token is its liquidation value as SPI tokens are 100% backed by holdings. Hardcapped to roughly 94,000, no more can be minted or issued. Adding, hold and compounding has us on the road to major growth and these tokens are still growing in value.

SPI tokens are part ownership in an actively managed fund. We have our hands in over 20 investments with the lion share being HIVE, BTC & ETH. We do not FOMO or chase pipe dreams. Tried and tested works best and is safest. Our motto is "Get rich slowly" and compounding down on sound investments is our game. You should invest in SPI tokens with the mindset of not selling for 3-5 years minimum. Follow @spinvest for weekly holdings and earnings reports.

Introduction

I invest in stock markets through Exchange Traded Funds (ETFs) and Share Funds via Fidelity UK. My investment strategy is for long term gain (5+ years), and I tend to DCA in when I can (but I wouldn't bet my mortgage on it or put my family at financial risk). I invest in ETFs and funds as I like spreading my investment across a basket of shares, as opposed to trying to pick individual shares, which would be too risky for me. I tend to stick to solid funds within the US, UK and Europe, and have a liking for tech funds. I do not day-trade, or look for short term flips. Please take that into account, and always do your own research!

What's Happening This Month

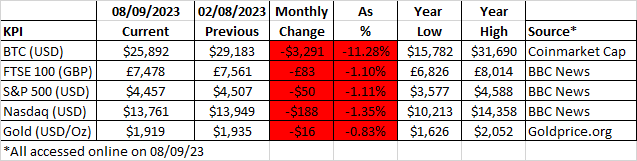

Monthly KPIs

I use a number of Key Performance Indicators to help me gauge how the overall markets are performing and it also helps me to try to understand where money is moving.

Looking at the monthly change columns:

- This month we have red across the board, everything went down, with BTC taking the biggest hit,

- Gold and the stock markets have only seen a small hit in the order of 1% compared to BTC's 11% hit,

- Realistically speaking, it puts crypto at a good buying point if you are in accumulation mode,

- This latter week or so has seen some pretty bad news from a stock market perspective, with the tech trade war hotting up in respect of semiconductors/chips between the US and China, which has affected some tech stocks like Apple, and a reduction in the UK economic outlook forecast (flatter but not going into recession) hitting UK and European stocks,

- The economic news globally did not seem that great, with gas prices also affected by strikes in Australia,

- Add all that up and it hints at further poor market performance over the coming weeks,

- With crypto down, and if the markets go down further, maybe we'll see a small uptick in gold soon.

Recent Trade activity

I was playing around with some of my pension pots during August, and transfered a smaller one into my Fidelity pension pot, giving me some funds to play with. I used those funds to pick up some more of the Schroder UK Listed Equity Income Maximiser (SCKZI), which is a new fund that I started buying into over the last 2-3 months.

For me it has a nice balance of low ongoing management fees (0.26%), nice consistent growth since its inception and quarterly dividends. Its UK focused as well, noting that the majority of my funds are US based and I wanted to diversify a little. I like SCKZI - its probably not the best fund on the market, but for me its a nice all rounder.

I'd bought in at £0.52/unit, and its currently sitting at £0.526/unit - so a tiny gain, but with the markets going down by 1% over the month, I'll happily take a tiny gain.

Monthly Fund Focus

Normally I would pick a fund to focus on for the month and look at it in more detail, but this month I want to stray from that and ponder the merits of income focused funds versus growth focused funds. This has really been playing on my mind over the last so many months, so I thought I'd use this post to sketch out the merits of each to help me decide how to select which funds I'd like to invest it going forward.

Income funds are those which payout dividends to the fund holders on a pro-rata periodic basis, whereas growth funds generally wont payout any dividends to the fund holders and instead reinvest any dividends back into the fund to improve the overall price so that the investors get better growth in the value of their holdings.

When you look through the funds available and sort by growth, you do generally find that growth based funds generally are preforming better in terms of fund price. When I first started investing in funds, I would simply search for high growth funds and invest in those, so I ended up with a portfolio that theoretically would perform well, but gave me very little dividends.

In reality what that meant was that over the last few years where stock market performance has been pretty poor, I have not seen any growth, infact I've chalked up a small loss in value, while having quite poor dividends.

However, I'm starting to change my views, and am thinking of investing a higher percentage going forward, on income funds. With income funds, you will usually get some kind of periodic dividend, even if the overall markets are performing poorly. What I like about getting dividends is that it gives me options. Rather than dividends being auto-reinvested out of my control, I can decide what to do with them, whether to take them out and spend them, or reinvest them into another fund that I'm currently preferring. With dividends I can also cover my monthly fund charges, without having to put money into my investment account.

Also, I've been really enjoying re-investing dividends when I do get them. At the moment my portfolio gives me dividends in most months (except May, August and November). Some months the dividends are quite small, and others are pretty decent, depending on what fund is giving out dividends that month.

Going forward I'd like to be in the position where I get dividends every month. I find it very exciting when dividends come in, especially if there is enough to re-invest. I normally then go on a shopping spree, looking for a nice fund to invest in, at a good price.

It would also be nice to be in a position where my fees are covered each month without me having to dip into my bank account. I do actually earn more in dividends than I'm charged in fees, but I have a complicated account setup , with some of the funds locked away in a pension, from which I cant withdraw the dividends yet because I'm not old enough. So it means I have to cover the fees another way. At the moment I dont quite have enough to do that monthly, but I will slowly reinvest a higher percentage over time in income funds, such that I should shortly be in that position at some point in the not too distant future.

However, I dont think its good to be one way or the other on this. I think the best approach is to have a balance. Thats is, to have enough invested in income funds to cover my fees and give me some spare cash to re-invest or withdraw to spend if needed, with the rest invested in growth funds, which should see good performance over the long term.

At the moment, I'm too heavy into growth funds, so for the near future I will be focusing more on income funds in order to get a better balance.

However, what if I can find funds that provide a balance of both. Well, that brings me back round to to Schroder UK Listed Equity Income Maximiser (SCKZI) - that is exactly what I like about it. It provides quarterly dividends (not as high as some other income funds), and also consistent growth (better then many income funds, although not as good as some growth funds). So its seems to provide the best of both worlds, and thats why I've been investing into it these last few months.

So going forward for the coming months, I will be looking for good income funds, ideally with good growth prospects, until I can get myself into the regular dividend position that I'd like to be in.

Round-up

Its been an interesting month in crypto, and with quite a bit of bad news floating around on the markets, we may see a dip in those over the coming weeks. However, I'm in it for the long term, and I will continue to DCA into good funds when the prices suit. I do believe that we've been having a few bad years considering everything that has gone on and is going on in the world, but long term I'd like to think it can only all go up.

As above, I'll be looking around for more income funds to invest in, and should probably diversify a little further across markets and sectors, as I am a little too heavy into tech.

Heres looking forward to my next dividends so I can invest some more !

Thats my round up for the month.

If you have any advice to share or tips for funds, I'd love to hear about them - and feel free to leave feedback on the post - I'd love to know what you think !!!

All the best @hoosie

Want to know more about SPI tokens and investments ? Check out the latest posts here.

Want to know more about the Saturday Savers Club ? Check out the latest posts here.

Post voted 100% for the hiro.guita project. Keep up the good work.

New manual curation account for Leofinance and Cent